What is a Sales Invoice?

A sales invoice is an accounting document that records a business transaction. As a business owner who provides a service and/or sells products, they're an important part of your bookkeeping and accounting record-keeping system. A sales invoice lists and describes the services you've provided and/or the items you've sold, the total amount due, the payment method or terms, and the due date.

When invoicing a client, it creates an obligation to pay on their part and accounts receivable on your part. It's considered a good business practice to prepare a sales invoice after delivering items or providing services to clients.

What Is a Sales Invoice's Purpose?

The purpose of invoicing is to document a sales order. Once you've provided a service or delivered a product, the sales invoice creates a liability for your client to pay. It also serves as a record of incoming revenue for you. Sales invoices are an essential component of your business's financial statements.

Why Are Sales Invoices Important?

Sales invoices are integral to your business because they serve as proof of your accounts receivable. "Accounts receivable" is an accounting term that refers to the sales you've made but haven't been paid yet. You must have a system to track which invoices are paid or still pending for record-keeping and ensure an efficient cash flow for your business.

For free, customizable invoices that you can download as PDFs and send online to clients, check out Skynova's sales invoice template. You no longer have to create invoicing in Microsoft Excel, Word, or on paper, as Skynova's invoicing software will speed up the process of creating professional invoices. We also offer all-in-one invoicing and accounting for small businesses. Save time and focus on growing your business by having all of your invoicing and accounting documents in one place.

Read on to find out why sales invoices are important for different aspects of your business.

Bookkeeping and Accounting

Having a system to prepare accurate and timely invoices for your sales will make bookkeeping and accounting an easier undertaking. This will allow you to access certain information, such as the unit price or subtotal, when you need it. Sales invoices will also enable you to keep track of your earnings as you get closer to the end of the year.

Tax Obligations

Although you won't have to show your invoices to the government for tax purposes, you still have to produce documentation for your sales. Your sales invoices contain important information that will affect how much you'll pay in income tax and, if applicable, sales tax.

Legal Protection

Make sure you are sending clear and timely sales invoices. Not only will they serve as proof that you've completed your part of the transaction, but they'll also detail the nature of the services rendered or products delivered, the total price to the client, and the payment terms you've agreed on. All of this protects your business from fixing costly disagreements or, worse, paying for the added expense of fraudulent or petty lawsuits.

Marketing and Budgeting

Your sales invoices are not only a source of information to keep track of your accounts receivable and gross sales. They're also invaluable documents where you can learn what products or services you offer are popular or bestsellers. You can then tailor your inventory based on what you sell the most. You can also monitor the time of the year when certain products or services are in demand and create offers to promote the products or services during those peak times.

Sales Invoices vs. Other Order Forms

Sales Invoices vs. Sales Orders

Both forms are used to track sales transactions for accounting purposes. The difference lies in who creates them. A sales order is made by clients to initiate a transaction. It will include a list of products they would like to buy and/or describe services they'd want a business to deliver. On the other hand, sales invoices are created by businesses to ask customers to pay for orders already fulfilled.

Sales Invoices vs. Purchase Orders

When a business receives a client's purchase order, it indicates the start of a sales transaction. The purchase order will contain the client's specifications, such as quantities of items, and when they expect the goods or services to be delivered or completed. As the business owner, you will confirm the availability of the items or the possibility of fulfilling the request.

Your approval of the terms creates a legally binding transaction between you and your client. When you complete the terms of the transaction, you send a sales invoice detailing the work you've done, the amount payable, and when and how you expect the client to pay you.

Sales Invoices vs. Bills

These terms are used alternately for each other, but they don't always mean the same thing. A sales invoice is a legal document that is more personalized, with the inclusion of information about the seller and the buyer. They're also created for products sold or services provided on credit.

Wherein bills are generic. They're also often issued with the objective that they're going to be paid immediately, like in a restaurant. Sales invoices can be considered a specific type of bill, but not all bills are invoices.

How to Create a Sales Invoice

Utilize Skynova's free sales invoice template to create professional invoices in minutes. Below are simple steps to guide you in invoicing clients.

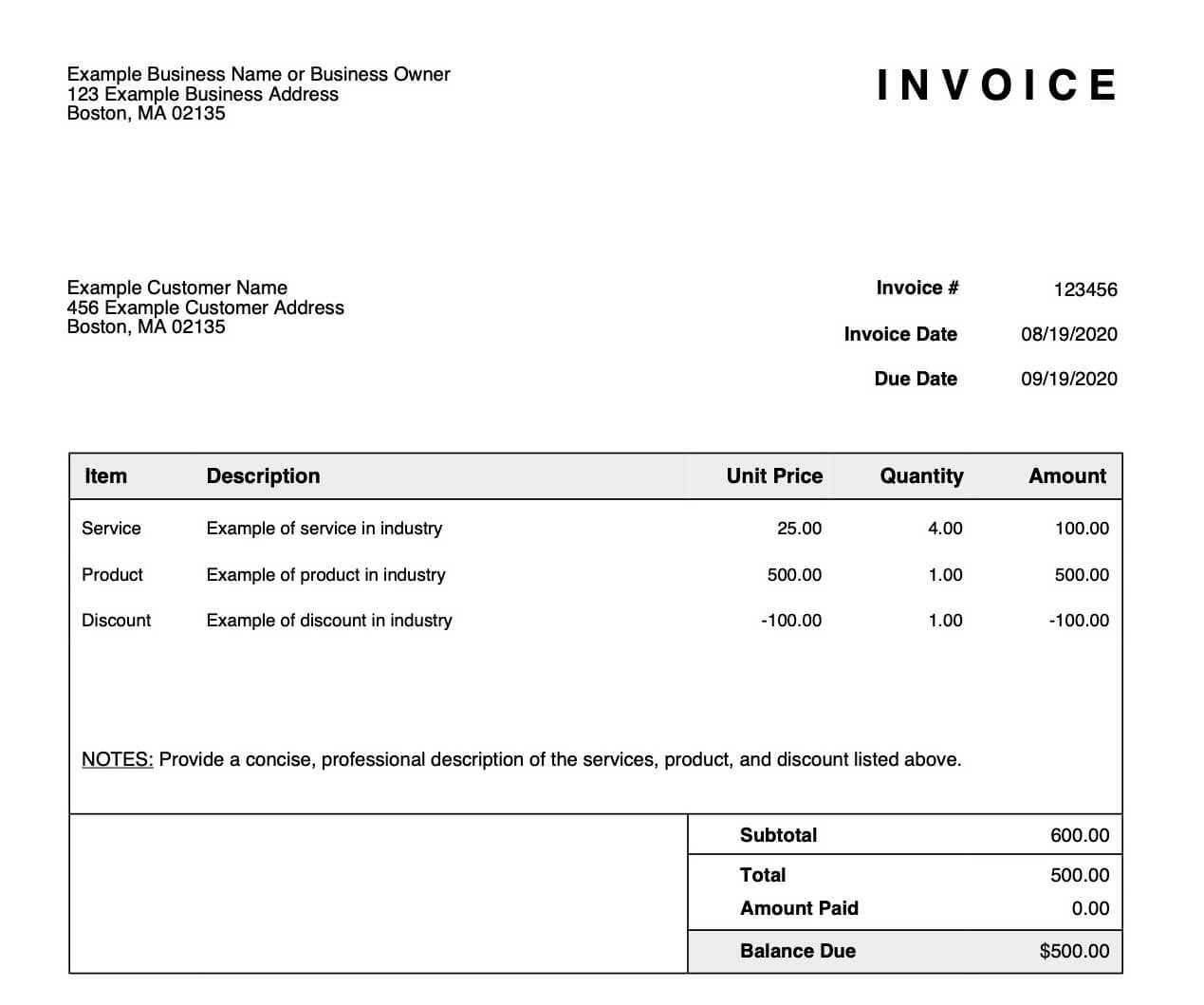

Free Invoice Template Form

1. Contact Information

To begin, input your contact information on the space provided. You can add your company name, your business address, phone number, and email address. With Skynova's sales invoice template, you can also easily include a business logo if you have one. Tick the box for "Logo" under the customizable options and upload your logo onto the form.

You can then type in your client's information in the space below yours. Input their name, address, phone number, and email address. Some companies may have a different contact number or receiving person for invoices, so make sure you have those right before sending your invoice.

2. Invoice Date

Fill in the invoice date, which could be the date you've created the invoice or the date the transaction was completed. The invoice date will give you a starting date if you have payment terms set up. It's also important for bookkeeping purposes.

3. Invoice Number

Invoice numbers are unique numbers assigned to every invoice created. They're used to reference specific sales invoices and track invoices. Invoice numbers are generally sequential, such as #001, #002, and so on. When you create your second invoice, Skynova's sales invoice template will automatically increment from the previous invoice to ensure it's unique. This way, you don't have to continue creating a numbering system or remember where you left off.

4. Due Date and Payment Terms

You can input the payment due date in the space provided. A clearly stated date, like "Sept. 26, 2020," takes the guesswork out of the details. Your clients can make arrangements to pay you if they have a concrete date rather than due dates that can be misunderstood, such as "payment due in 15 days" or "payment due upon receipt."

You can also add a reminder of your agreed-upon payment terms, payment methods (cash, check, credit card), and any late fees you may charge if your client has late payments.

5. Brief Description of Products/Services and Any Additional Information

Your sales invoice should include a detailed list of the products you've delivered or the services you've provided. Add a brief description for each item sold and delivered. Ensure each item on the list has a quantity and a corresponding unit price if applicable. Be as specific and thorough as you can to avoid confusion.

You can also reference other documents you may have exchanged with the client about this sale, such as a purchase order or sales estimate.

6. Total Amount Due

Make sure the sales invoices you send to your clients indicate the total cost with applicable taxes. Your clients will want to see how much they owe without doing mental computation. You should also ensure that any deposits or discounts you agreed on are applied to the total amount due on the invoice.

Create a Sales Invoice With Skynova's Sales Invoice Template

Make sure you're sending clear and professional invoices to your clients. Every communication your clients receive from you represents your business. Present yourself in the best light possible.

Skynova offers a free, customizable invoice template to help you simplify the process of getting paid for your products and services. Skynova's software products also have small business owners in mind. Let us help you with administrative tasks, such as invoicing and accounting. Our software and free templates can save you time, which you can use to focus and grow your business.