|

All-in-one Invoicing and Accounting for Small BusinessGet started in seconds and keep accurate records of your income, expenses, sales tax and payments. 21-day free trial. No credit card required. |

|

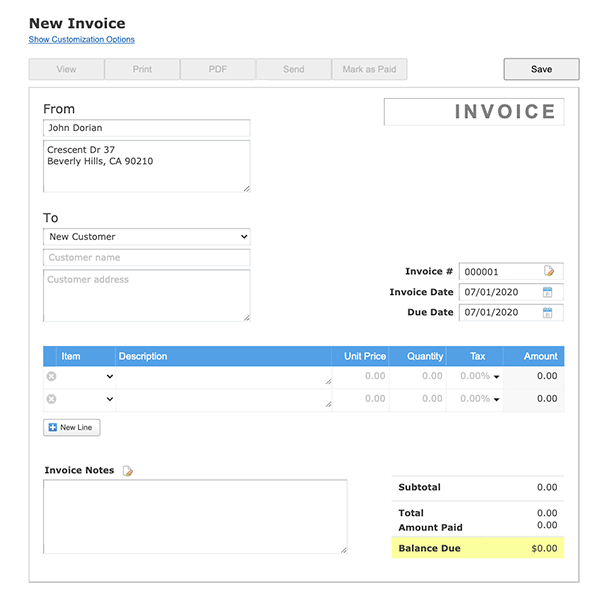

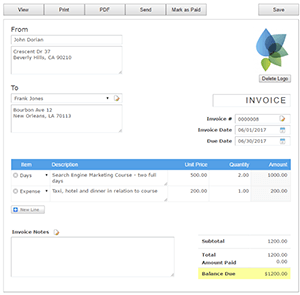

Create your first invoice in seconds and see how easy it is.

Add customizable tax rates to each invoice line (state, city and/or county). Keep accurate records of sales tax collected and paid to your local taxing authority.

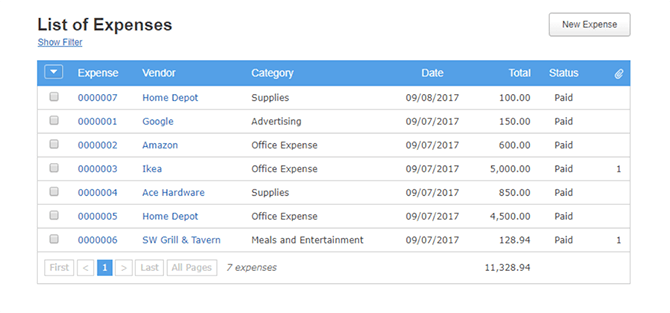

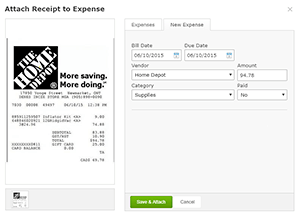

Simplify your payables by uploading expense receipts from vendor bills and other expenses. Stay organized by sorting expense reports by vendor, expense category, or date.

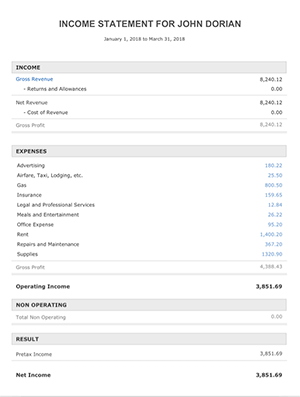

Automatically make financial reports like Income Statement, Balance Sheet and Cash Flow Statement just by creating invoices and uploading expenses.

| | Invoicing | |

| % | Track sales tax | |

| | Track expenses | |

| | Store your receipts | |

| | General ledger | |

| | Journal transactions | |

| Choose between cash/ accrual accounting |

|

| | Ensure accuracy with double-entry accounting |

|

| | Run financial reports | |

| View full feature list | |

To create a free trial account on Skynova, enter your e-mail address and a password below.

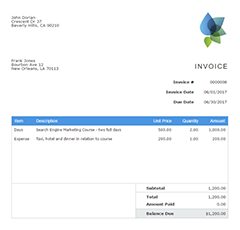

Create and send professional looking invoices in no time. Skynova helps you look professional and get paid with online payments. Other features include 'invoice viewed' notifications, adding custom logos, printing or downloading your invoice, recording payments, and keeping track of open invoices.

With Skynova, you can create a clear record of taxes collected and which authorities you've paid them to.

From office supplies to vendor payments, upload your receipts and keep everything organized. Further, you can bill expenses directly to your customers by adding the expenses to your invoices.

Keep your receipts organized, backed up, and in one place. Simply log into your account and they're available at your fingertips.

Get an accurate view of your company's financial health by viewing real revenues and expenses in a General Ledger.

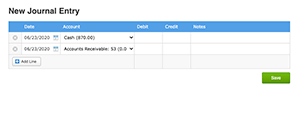

Need to make year-end adjusting entries? Record a cash investment in your business? Accrue interest on a bank loan? We've got you covered with Journal Entries.

Which method of accounting is best for your business? The accrual basis of accounting provides a better picture of a company's profits during an accounting period. Cash basis accounting recognizes revenue and expenses immediately requiring fewer journal entries for creating financial statements.

Double-entry accounting ensures there are two entries for every transaction thereby providing a complete record of financial transactions for your business.

Generate reports like Income Statements, Balance Sheets and Cash Flow anytime you need them. Download and print for your accountant and make better-informed business decisions for the future.

Skynova is designed to be as intuitive as possible, but if you need assistance, our Support Team is always ready to help, 7 days a week.

With over 20,000 positive reviews, our representatives are knowledgeable and will assist with any questions you have.