As a small business owner, you may have pushed invoicing to the back of your mind. However, sending professional invoices is a huge aspect of running a small business. At its core, an invoice helps ensure that you get paid while also helping you better record transactions.

If you forget to send an invoice, you will likely not be paid. That’s why sending an invoice to your client when the service is complete is a major responsibility as a business owner. Not only that, but it can help you appear more professional to your clients.

When you create an invoice, there are a number of things to keep in mind. Apart from the various details that you will need to include, you also need to use an invoice numbering system. It’s essential for every business to have a numbering system for their invoices. And although there aren’t any standards for an invoice numbering system, there are several best practices that we recommend you follow.

What Is an Invoice?

Invoicing is an important aspect of record-keeping for all small businesses. Invoices are used to record transactions for products or services from the provider to the customer. All invoices should specify the items purchased and/or the services provided so that the customer can understand the total amount due. These details explain the costs and lay out the expectations for payment terms. Every invoice should have a due date, making sure that the customer and the business owner know when the payment is due. The due date acts as a time limit and is an important tool for bookkeeping.

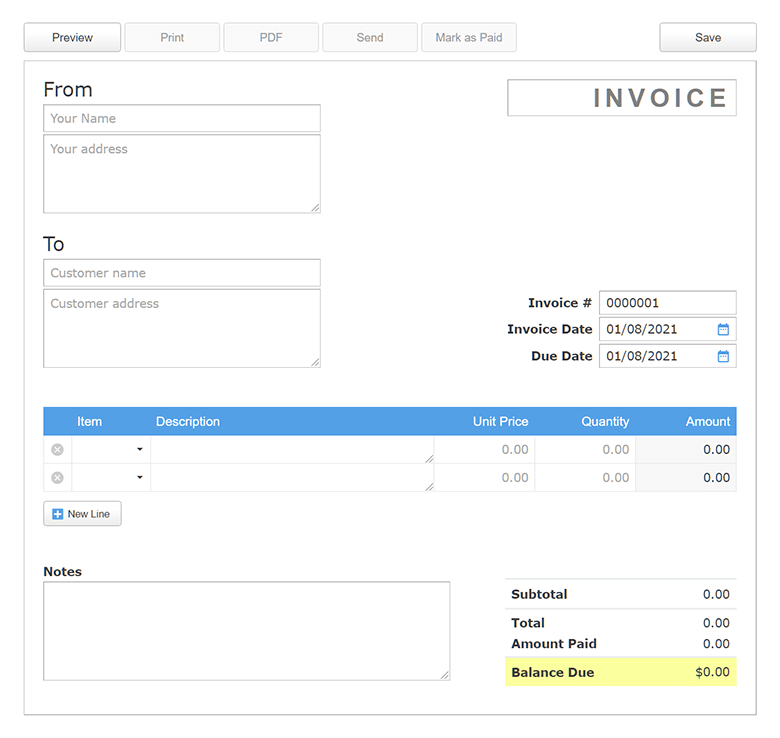

All invoices should include the following information:

- Contact information: You’ll want to include contact information for both you and the customer, including physical addresses, email addresses, phone numbers, and names.

- Line items: Choose a line item that explains the charges in your invoice (inv). For example, if you use Skynova’s invoicing software, you can select "Service," "Hours," "Days," "Product," or "Discount."

- Description: It’s important that every line item in an invoice has a description so that your customer understands what they are being charged for and why.

- Unit Price: Unit price is the cost. For a small business owner who charges an hourly rate of $30, their unit price would be "$30."

- Invoice Date: This is typically the date the invoice is sent out.

- Due Date: This is when the payment is due.

- Notes: The "Notes" section of an invoice provides businesses with additional space to add details to the invoice. These details ensure that customers understand every charge on their invoice, any discounts, and additional information.

In addition to the information listed above, your invoice should also include a unique invoice number. Skynova’s invoice template simplifies the invoicing process, allowing you to focus on properly numbering your invoices and including all pertinent information.

Why Is the Invoice Number Important?

The invoice number is essential for reference within your business and for your customers. This is because the invoice number acts as an identifier. For small businesses, this is especially important, as they can reference the invoices when needed. Additionally, all invoice numbers should be sequential numbers. Sequential numbering ensures that you can reference invoices in chronological order whenever needed.

Do All Invoices Need an Invoice Number?

Every invoice should have an invoice number attached to it. When invoices have unique invoice numbers, it makes it easier to find a particular invoice. This can be particularly important when a customer has a question about a certain invoice. By having unique invoice numbers, you will be able to quickly locate the specific invoice and answer your customers’ questions.

It’s important to have an invoice numbering system, and there are several routes that you can take. How you choose to pick a number sequence for your invoices is completely up to you, but whatever you choose, the numbers should be unique sequential descriptors of your invoice — something that Skynova can automatically take care of for you when you create your second invoice.

Invoice Number Best Practices

As mentioned, you have freedom with which type of invoice numbering system you choose. However, before you begin creating and sending invoices, read the following section about some best practices regarding invoices numbers. These tips should help you create an invoice numbering system that works for your new business for years to come.

Create a Unique System

Above all, you should create a unique numbering system for your invoices. This allows you to quickly locate a particular invoice when needed. This also helps you avoid duplicate charges, which may turn customers away from your services in the future. To begin your numbering system, you can start with any number. Whether you choose to start with "3," "5," or any other number is completely up to you.

Sequential invoice numbering is one way to create unique invoice numbers. When numbering your invoices, you should avoid skipping any numbers in the sequence, as gaps can become confusing. Regardless of the invoice numbering system you choose, the sequence number should always be placed at the end of the invoice number.

Sequentially numbering your invoices is actually very simple when you have the right tool. Skynova’s invoicing template will automatically increment your second invoice number from the previous invoice to ensure it’s unique. You won’t even be able to save your invoice if you’re trying to use a non-unique invoice number.

Implement Alphanumeric Invoice Numbers

Invoicing gives you freedom in terms of numbering. Essentially, you only need to ensure that you have a unique set of sequential figures. This means that you can implement alphanumeric invoice numbers into your system.

An alphanumeric invoice number refers to an invoice number that doesn’t only include numbers. It typically includes letters and other special characters like slashes or dashes. Adding letters and other characters can make it easier to track your invoices.

An example of an alphanumeric invoice number could be A0002, where the "A" stands for a project code specific to your business. You might choose to use several letters to indicate a specific project code, but whatever you choose, make sure it is consistent.

Use a Customizable Invoice Template

Using a free invoice template can simplify the process of creating your next invoice. Using Skynova, you can create and send professional invoices in minutes using our standardized template to ensure that your invoices are consistent and sent out promptly.

Altogether, Skynova’s suite of products helps to improve the administrative processes for small businesses. Particularly, an invoice template makes certain that you include the required information. Additionally, online invoicing with Skynova helps you create professional-looking invoices by maintaining a particular look, consistently numbering your invoices, and tracking payments.

How to Update Invoice Numbers

While using Skynova’s invoice template, you can update an invoice number at any time. If you have an account, simply select the downward arrow next to the invoice that you would like to update. Once you’re on the "Edit Invoice" page, click on the paper and pencil icon to the right of the "Invoice #" box. This will allow you to change the invoice numbering system, which has an automatic default setting. You can also manually update the invoice number by typing a new number into the text box. Don’t forget to "Save" when you’re finished.

Deleted Invoices

Similar to updating the invoice numbering system, it can become confusing if you delete an invoice. Even with a spelling error, a mistake with the invoice number, or any other issue, you should never delete an invoice. Aside from it being confusing to have gaps in your invoice number sequence, it can end up costing you in the long run.

In fact, deleting an invoice can impact the values reflected in your cash flow, which can cause changes in operating assets. Instead, you should issue a credit note. Credit notes are helpful if you need to issue a refund or need to correct any errors. Instead of deleting an invoice, credit notes should be issued to customers so that they know a credit will be applied to their credit card or another account.

Skynova’s credit notes product enables businesses to process credit notes quickly and efficiently. By using credit notes to issue returns or rectify any errors, you ensure that you’re keeping accurate records. For your business to grow to its full potential, you will want to ensure that all of your accounting is done properly, which is why we recommend using Skynova’s accounting software.

Track and Manage Invoices With Skynova’s Invoicing Software

Skynova’s free invoice template streamlines the process of creating a new invoice. When combined with our other software products, accounting tasks are simplified so that you can focus on growing your small business. Whether you have recurring invoices or need to issue credit notes, you can do so with ease using Skynova’s innovative template. All in all, improving your invoicing process helps you better maintain your business’s accounting and get paid faster.