Making sure you’re getting paid for the work you do — preferably on time — is one of the most important factors for the success of your business. However, you’re more likely to receive payments on time if you’re also sending your clients accurate and timely invoices. Hence, an effective invoicing system is highly recommended whether you are a freelancer, contractor, or a small business owner.

The invoices you send to clients are legal documents that serve as proof of debt on their part. And until they’re paid, they represent the business’s accounts receivable, which is why they’re integral to your record-keeping and accounting system.

In this guide, we’ll discuss the most frequently asked questions about invoices. Keep reading to learn the different types of invoices and how to easily create them for your business needs.

Frequently Asked Invoicing Questions

What Is an Invoice?

An invoice is a document that records a business transaction between a buyer and a seller. It contains information describing the products sold or services provided, the amount due, the payment terms, the date when it’s expected to be paid, and other pertinent details. When you send an invoice to a client, it serves as proof of debt, where it creates a liability on their part and accounts receivable for you.

Invoices are generally used by businesses that sell products or offer services on credit. To ensure you’re getting paid on time for your work, it’s a good business practice to prepare and send invoices promptly.

How Do I Create an Invoice?

Skynova offers a wide array of products and templates for all your business needs. To create a professional-looking invoice in a matter of minutes, simply input all important information on Skynova’s invoice template. The template is easily customizable.

You can add a corresponding purchase order number, sales taxes, and a company logo if you have one. You can then print your invoice, download a PDF, or send it online. Learn more about creating an invoice here.

How Do I Send an Invoice?

Skynova’s invoice template allows you to send invoices straight to your clients from the software. All you need to do is enter your contact’s email address. You can also choose to be notified when the recipient views the invoice and even have them pay online by credit card.

Another option is to print your invoice or download it as a PDF and provide your client with a physical copy. You can find out more about creating downloadable invoices here.

How Do I Manage Invoices?

If you are still using paper spreadsheets to manage your invoices, you may be missing out. Paper invoices can be misplaced. They’re also time-consuming and difficult to keep track of. It’s time to free yourself from paper and take advantage of electronic invoices.

Easily create and manage your invoices with the help of invoicing software. With Skynova, all invoices are tagged and sorted, which makes them searchable. This means you can check the outstanding balance, the amount paid, and the total of any invoice by using their unique invoice number to search. Learn more about coming up with unique invoice numbers here.

The Basics of Invoicing

When creating an invoice, your goal is to get paid promptly. To that end, you want to send your clients clear and accurate invoices so that they easily understand what they’re paying for, how much they owe, and when to pay.

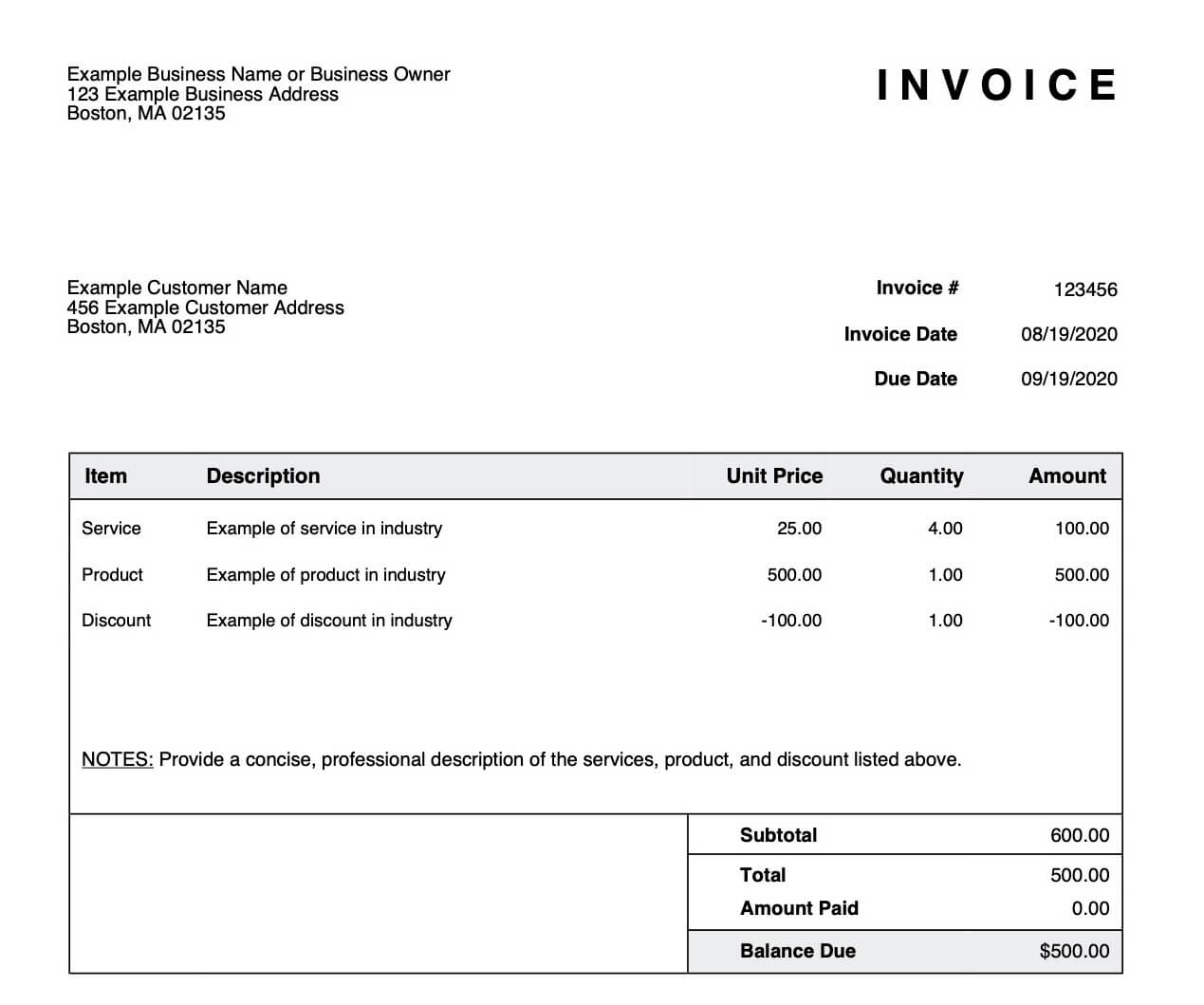

Your invoices should have the following elements:

- Invoice date

- Names and other pertinent information for both parties

- Description of the products delivered or services rendered

- Price and quantities of products or services

- Payment terms

- Due date

- Any deposits received from the client or discounts offered

- Applicable taxes

The Importance of Invoicing

Aside from acquiring clients, a huge part of your success depends on effective invoice management. Your invoicing process can affect your cash flow, accounting, and profits. Most of the time, small businesses struggle to cover their expenses — not due to a lack of sales but because they’re not getting paid on time.

This is an accounts receivable issue that could be solved if you look at your invoicing practices. Maybe you’re not sending invoices promptly. Hence, payments are not coming on time. Perhaps your invoices are unclear, so you require back and forth before the client understands what they’re paying for and how much they owe.

Your invoicing practices should aim to:

- Create accurate invoices for clients

- Send timely invoices

- Make the management of your invoices easy

- Make invoice payment convenient for clients

Consider online invoicing software, like Skynova’s free invoice template. Get paid faster with professional-looking invoices that you can email directly to your clients. You can even get a read-receipt when your client opens the email. So, you can stop guessing whether your invoice was received.

Skynova also offers accounting products that can help you manage your invoices. Simplify your invoicing system. Spend less time doing administrative work and more time growing your business.

Invoicing Types

There are several types of invoices utilized in the business world. But what you’ll use for your business will generally depend on your industry, the payment terms you offer, and how you charge for your products or services. Below are the most common types of invoices for small businesses.

Proposal/Bid Invoices

Generally, a p roposal invoice contains the minimum estimated cost for the products or services the client would like to order or have done. A bid invoice is sent to the client for approval. They’ll decide if they accept the costs appraised on the invoice. Proposal invoices can then be modified to suit both the buyer and seller until they agree on what the client is willing to pay for or what the business can fulfill in exchange for payment.

Interim Invoices

Interim invoices, also called progress invoices, are commonly sent by businesses engaged in large projects that involve multiple payments. Progress invoices are based on an estimate for the project that both parties agreed on. It will cover the percentage of the project that has been delivered up to that point.

Interim invoices are usually sent weekly, monthly, or quarterly. But if you are a freelancer, you may prefer to send your interim invoices after you’ve completed an agreed-on milestone.

Timesheet Invoices

Timesheet invoices are created by businesses or employees paid based on the hours they work. They are commonly used by professionals who bill their clients hourly, such as lawyers, consultants, and mental health professionals.

Recurring Invoices

Recurring invoices are used when a business charges its customers the same amount at regular intervals for ongoing services. It makes the process of invoicing convenient and effective for freelancers and businesses entering long-term contracts with clients.

Recurring invoices are generally adopted by businesses that offer subscriptions or service maintenance packages, such as gyms, golf courses, and freelance digital marketers.

Final Invoices

A final invoice is utilized when a large project that involves interim invoices is completed. The final invoice you send to clients should be comprehensive. You’ll need to include an itemized list of all services provided or products delivered, the total cost of the project, any deposits and payments you’ve received in the interim, and discounts you offer. It should also note the payment terms and payment methods you’ve agreed on for the final payment.

Past-Due Invoices

A past-due invoice is sent by a business to remind clients that their payment due dates have passed. If you’re sending a past-due invoice, it must include all information detailed on the final invoice, including any late fees or interest you charge for late payments. Ensure you have an invoicing system that catches past-due amounts as soon as they happen and send past-due invoices to clients as soon as they miss payment due dates.

What’s the Difference Between Invoices and Purchase Orders?

The main difference between an invoice and a purchase order is who creates them. A purchase order is created by a customer to initiate a business transaction. It includes the quantity of each item they want to purchase, when they expect the goods or services to be completed, and other specifications. The business owner will then confirm the availability of the items or respond with changes.

Both the buyer and seller will issue an approval to confirm the client has all the information on their order and that the business can fulfill the request. When the terms of the purchase order are complete, the seller then creates and sends a sales invoice to the buyer. The invoice will contain details of the services provided or goods delivered, the total cost of the service or goods to the client, and the terms and methods of payment.

How to Create an Invoice

There’s no standard form to create an invoice. And each type of invoice has a specific purpose that you need to consider. Whether you’re making them on paper or online, invoices have basic elements discussed below.

Use a Professional Invoice Template

Get professional-looking invoices with the help of Skynova’s invoice template. If you’re using Microsoft Excel, Word, or paper to create invoices, Skynova’s platform will speed up the process.

You’ll have access to a template that you can edit, print, and download as a PDF. You can also send your invoice to your client’s email with no downloading necessary. And as a bonus, you can track when your client opens your invoice. All of this makes for a faster, smoother process of getting paid.

Include the Right information

Here’s what should be included on your invoice:

- A date the invoice is created: This is important information used to calculate payment terms, especially if you use language like "due in 30 days."

- Client information: Make sure you have the right client’s name, address, contact information, and email address.

- Your information: Make sure clients have your name, company name, address, phone number, and email address.

- Invoice number: This keeps track of your invoices. If you are using Skynova’s invoice software, the invoice number will automatically be generated with your second invoice to ensure it’s unique.

- Line items for products or services provided: Each item should include a brief description, cost, and quantity if applicable.

- Total amount due: The invoice must state the total amount the client is expected to pay. Make sure deposits and discounts are deducted, and sales taxes, if applicable, are added.

- Payment terms and due date: Include the exact date you expect to be paid and add a line to remind the client of your payment terms.

- Payment methods: Make a note of the payment methods you accept — cash, check, debit, or credit cards.

Should I Print Invoices or Send Them Online?

As the world evolves digitally, people and businesses rely more on electronic invoicing. However, your decision to do away with paper documents should involve the needs of your clients and your industry.

The use of invoicing software does have benefits, such as:

- Easy way to file and sort invoices

- Search features offer easy access to documents

- An easier way to track invoices

- Digital storage offers document protection from physical damage

- Reduction of paper use

If you are a small business owner considering a change from paper invoices to invoicing software, Skynova’s platform is built for you. We offer efficiency for your invoicing and accounting needs. Use our free invoice template to make and send invoices that you can print, download, or send directly to your client’s email.

Pros and Cons of Paper Invoicing

Paper documents may take up space and produce clutter, which makes it difficult to find specific ones, but many people still hang on to them because of the security they provide. Clients may also be more inclined to look for and pay a bill if it’s on paper because of the physical reminder.

Although they’re not environmentally friendly, and they can get lost in the mail, paper documents are accessible to everyone. Clients don’t need a computer or smartphone and the knowledge of how to use them. But a faster response time between payment and confirmation could be enough to entice clients to consider online invoices in the future.

Pros and Cons of Online Invoicing

There are many benefits to online invoicing. For businesses, it is cost-efficient because it takes away the handling and processing expense. After all, they don’t need to be physically delivered. Aside from being environmentally friendly, the digital storage solution saves space and time because it allows business owners to quickly look for invoices.

As a business owner, your clients may not have the skills to operate the technology needed to check their receipts and balances. This may also be a reason they may miss a bill payment. There is also the fear of having their personal information compromised. If you are looking to transition your business to online invoicing, you may need to address these concerns.

How to Track Invoices and Cash Flow

Cash flow is the total amount of money you have at your disposal to cover business operating expenses. You have a positive cash flow when you have more money coming in than out. A negative cash flow is when you bring in less money than you need to cover your expenses.

If you’re looking for an efficient way to track your invoices and subsequently manage your cash flow, check out Skynova’s invoice template. You’ll get access to a customizable invoice that you can print, download, and send directly to your client’s inbox. The invoice also features a way to record payments and manage your invoices.

Tips for Tracking Invoices

Whether you’re sending paper invoices or creating them online, tracking your invoices is easier when you follow the best practices for invoicing. Make sure you fill them out accurately and keep them as detailed as you can. You should also send your invoices promptly.

However, you only have so much time to dedicate to tracking your invoices. Simplify the process by using an invoicing software like Skynova. Our invoice template allows you to create invoices and accept credit card payments. It also makes managing your invoices a breeze. You’ll see the total for each invoice, what portion is paid, and how much is still outstanding.

With invoicing software, you’ll also have the option to automate your invoices to be sent promptly and set up alerts to be notified of missed payments.

Tips for Tracking Cashing Flow

To ensure you are on the right course in monitoring your cash flow, you should know your numbers. Track your invoices so that you know how much money is coming in each month. You should also know what portions of your invoices are still outstanding.

To properly manage your cash flow, you should track your business expenses. The first step is to understand and sort your business expenses into categories. Not only will this process prepare you for tax season, but you’ll also have a better grasp of your expenses, which you can then compare against your earnings to determine if you have a positive or negative cash flow.

For an easy-to-manage cash flow tracking system, take a look at Skynova’s accounting software. You’ll not only have all your invoices in one place and be able to organize your expenses by vendor and category, but you’ll also be able to make financial reports, like cash flow statements and income statements.

Tips for Getting Paid

A critical factor in your business’s success is getting paid on time for your hard work. Here are invoicing practices to get your invoices paid on time:

- Send timely invoices, meaning as soon as the products and services are delivered.

- Make sure you are sending accurate and detailed invoices.

- Follow up on missed payments promptly and courteously.

- Present your payment terms early and clearly to clients. Avoid vague language like "Net 15" or "upon receipt" without an explanation.

- Set up payment reminders for clients.

- Have more than one payment method to make it easy for clients to pay.

Create a Customized Invoice With Skynova’s Sales Invoice Templates

Whether you’ve been in business for a while or you’re at the starting point of your venture, Skynova’s platform is built for your billing and accounting needs. We offer free, customizable, professional-looking templates that you can print, download, and send electronically.

Explore Skynova’s software and templates, and start simplifying your administrative tasks. Save time and still get paid on time.