As a small business owner, getting paid on time for your services is crucial. Sometimes, clients don’t seem to understand your struggle and drag their feet when it comes to paying for your services. There might be a perfectly good reason why a client hasn’t paid, or there might not be. Either way, effectively wording your invoice will help increase the likelihood of getting compensated on time.

In this guide, we’ll provide a sample invoice template with effective wording that can help small businesses get paid on time to maintain the cash flow they need to operate.

Professional Invoice Writing Tips

Depending on the nature of your business, there are essential documents, like invoices, that are critical to your business’s bottom line. To get paid on time, not only should your invoice look as professional as possible, but it also needs to communicate several things to your client. While you should always include certain things, like your business information, a great invoice will show your customer how and when to pay you that doesn’t feel too pushy.

Writing an invoice that treads the line between authoritative and warm can be challenging, but it’s one of the best ways to build a strong business relationship with a client. If you have trouble writing professional invoices, below are some pointers for making invoices that strengthen your business.

Use a Professional Invoice Template

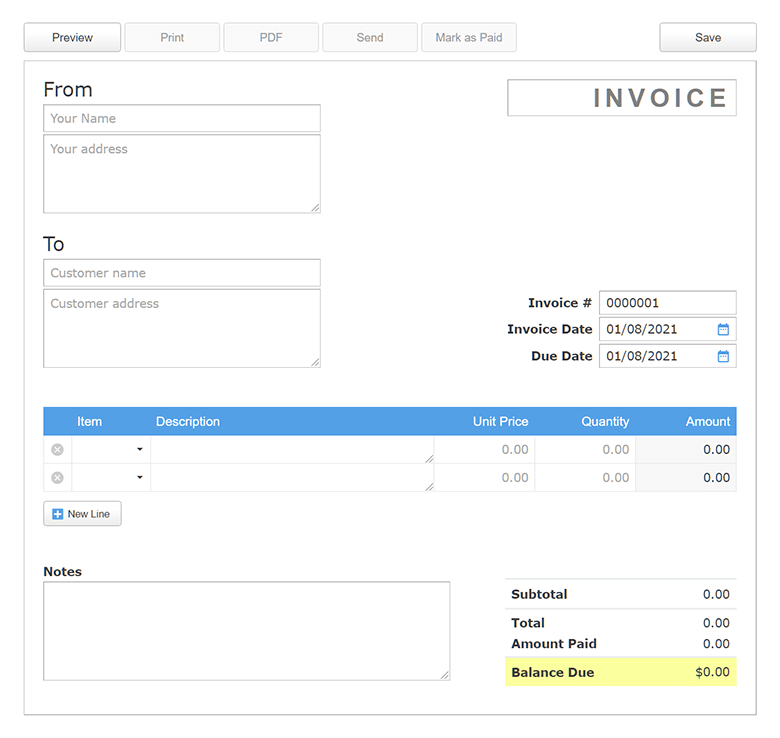

If you’ve been creating your own invoices, you know how hard it can be to get them just right. That’s why Skynova has a free invoice template that can help you put together a professional-looking, quality invoice.

Our template is also fully customizable and printable if your customers need to have a physical copy. You won’t need to rely on programs like Microsoft Word or Excel because our template sets everything up for you, saving you time and money, particularly because you can keep all of your invoices in one place.

Be Concise But Polite

When you’re deciding how to word your invoice, you should resist the urge to use big words and fancy language. You may think that jargon makes you sound more professional, but all it really does is confuse your clients. When you’re invoicing, you want the language in your invoice to be as clear and concise as possible, so there’s no way it can be misconstrued.

This can come into play when you’re listing your services. You want to avoid any language that your client won’t understand. Say you’re a back-end developer contracted to improve the functionality of a corporate website. When listing charges, you won’t want to use terms that only other developers will understand, like "Created APIs using Python to optimize navigation to landing pages." Instead, you might use something like, "Improved access to landing pages."

It’s also important that the language you use is polite. Always remember to use "please," "thank you," and any other words that ingratiate you to your customers. Being polite is a way of communicating your appreciation to a customer. The more a customer feels appreciated, the more likely they are to pay you on time.

Include a Personal Note or Message

You can further make your customers feel valued by adding a personal note to your invoice. A simple "thank you" at the end of the document can really help you appeal to your client. Skynova’s sample invoice template has a "Notes" section that’s perfect for any words of appreciation you’d like to include in your invoice.

You can also use the notes section to include a further explanation for charges you worry a customer might not understand. If you own a construction company, and you’re working on a large job, for example, you may have to contract extra workers or freelancers to help you get it done. The notes section would be a good place to explain any extra labor charges you’d have to pass to your client. You can also explain items you may have a flat rate for.

Make Payment Terms and Methods Clear

You want to make it as easy as possible for your client to pay you. Do you accept cash, credit or debit cards, PayPal, or other methods of payment? In the email with your invoice, make it clear how you expect to be compensated when invoicing.

If you can accept charges online, include a link to where customers can make payments. Many clients really appreciate being able to make online payments or payments over the phone. The easier you make it for them to pay, the less likely they are to procrastinate.

It can also be wise to maximize the number of payment methods you accept, especially if you sell to other businesses. Businesses get used to paying for things a certain way. Accounting departments might even have rules that limit how they’re able to submit payments.

Highlight the Invoice Due Date

Make your invoice due date as clear as you can. There are a lot of different invoice payment terms that can affect your invoice due date. For example, many businesses require payment on a "Net 30" basis. This means that payment is due 30 days after the invoice date.

However, some clients might be confused by the term "Net 30." Instead of filing your invoice to be paid, they might put it aside with the intent to call you and clarify its due date. Inevitably, they get bogged down with their own day-to-day operations, and after 30 days, you still haven’t been paid.

Instead of using an invoice payment term, spell out your due date. Phrases like "Payment due March 31, 2023" are much easier for a customer to understand. You always want to draw attention to your due date and communicate it clearly. You can even go as far as to highlight it if you’re sending a physical copy.

Additional Professional Invoice Tips

While the way you word your invoice is important, there are a lot of other things you can do that will help increase the effectiveness of your invoicing system. Whether you’re trying to get paid faster or build a bond with a client, these tips will give you an edge.

Send Invoices Promptly

Send your invoices right away. Your customers likely have other things going on, and you want them to see your invoice before they forget any details of a project. This will save you the time you might spend having to clarify charges later on.

Of course, there’s also the obvious reason to send your invoices right away. The quicker your customer gets your invoice, the quicker they can pay it. You might worry that sending your invoice this quickly can come off as rude. On the contrary, customers usually appreciate the promptness, as it allows them to file your invoice while still fresh on their minds.

Because Skynova’s invoice template makes creating invoices so fast, it’s easy to create and send them within minutes. We also have invoice software that lets you share invoices over the cloud. You’ll even get notified when your client sees and accepts your invoice.

Get to Know Your Clients

The more comfortable you are with your clients, the easier it will be to tailor your invoices. Clients have various personalities and needs, and you should adjust your approach toward invoicing each one. You might even want to include your phone number so that your client can call to get to know you.

If a client feels like you’re putting in the effort to try to understand them and their needs, they’ll be much more likely to put effort into getting you paid.

Follow Up

If the deadline for your invoice is rapidly approaching, or you’re trying to track down a late payment, you might want to try following up with your client to see what’s going on. Politely notify your client that payment is due and ask them if they need any clarification on the charges or if there’s anything you can do to make it easier for them to pay.

If you try this approach, you should always initially assume that there’s a good reason a client hasn’t paid. If you’re dealing with a company accountant, they may be waiting for the approval of a higher-up before they can pay. Or they might have forgotten about the bill entirely.

Be careful not to come off as accusatory when you follow up. If you do, you might severely damage the relationship between you and your client. You could even lose their future business.

Offer Incentives and Charge Late Fees

Offering incentives for doing business with you can be a great way to encourage repeat customers. You can offer discounts for referrals, new customers, military personnel, or any reason you’d like. You can also include discounts for early payment.

If you choose to charge late fees on any unpaid invoices, make sure you agree on it with your client before doing business. You don’t want to offend anyone by surprising them with extra charges out of the blue.

Track and Manage Invoices With Skynova’s Invoicing Software

Writing a sales invoice can be tricky. It can seem like there are so many things to consider. Not only do you have to remember to include basic invoice information, like your business name, contact information, and an invoice number, but you’ve also got to think about how your payment terms, wording, and invoice design will affect a client’s mood.

Skynova can simplify the process of tracking and managing invoices. Not only can we help you organize your online invoicing system, but we also have templates for every accounting document you need, from estimates and bid proposals to purchase orders. You can also take advantage of a suite of software products to enhance your system further. Let us make your administration easy, so you can worry about bigger things.