Income statements play a key role in helping companies understand how they're performing. An income statement provides company leadership with an overview of the company's revenue and expenses during a specific accounting period. In conjunction with a balance sheet and statement of cash flow, businesses can grasp their financial performance.

Accurate income statements are incredibly important to gauge a company's financial performance. They provide detailed insight into a business's profitability. As a small business owner, creating an income statement can help you understand your company's business activities and be proactive with your finances.

The right accounting software can help you keep detailed records and create an accurate income statement for your business. Skynova offers all-in-one invoicing and accounting software developed with small businesses in mind. In this article, you'll learn about income statements, why they're important, and how you can create an income statement right away.

What Is an Income Statement?

Income statements provide investors and business leaders with an overview of the company's expenses, sales, and net profit over an accounting period. In most cases, an income statement is for three months, year to date, or 12 months.

Income statements, referred to as profit and loss (P&L) statements, give leaders important information about a business's ability to turn a profit. A P&L statement also allows businesses to see areas where they can reduce costs and increase their revenue.

The income statement shows several things, including:

- Operating profit

- Non-operating revenue

- Gains (other income)

- Primary activity expenses (COGS, depreciation, amortization, etc.)

- Secondary activity expenses (e.g., interest expense)

- Losses from non-operating activities

All in all, income statements provide a valuable overview of a business's finances. This information gives investors and business leaders a better understanding of the company's performance.

While income statements provide an overview of your business's financial health, you'll need to understand what that data tells you. To optimize your company's finances and take actions to improve your bottom line, you can analyze your income statement in one of two ways: horizontal analysis and vertical analysis.

The horizontal analysis looks at trends and changes over several periods. This method provides insight into growth patterns and allows individuals to compare changes in financial statements over time. To perform horizontal analysis on an income statement, you'll need to calculate the percentage change for each line item year over year.

On the other hand, a vertical analysis focuses on the relative size of a line item so that you can compare it more easily. To perform a vertical analysis, calculate each line item as a percentage of the revenue. This will result in a "common size" result for the same period of time. Then, you will need to divide each line item by its revenue.

What Is the Difference Between an Income Statement and a Balance Sheet?

Both income statements and balance sheets provide businesses with essential financial information. However, a balance sheet provides a single snapshot of what the company owes and owns. While a balance sheet shows a moment in time, an income statement provides information about a set period of time.

How Do You Create an Income Statement?

As you can see, creating an income statement is a powerful way to see the financial well-being of your business. Skynova's accounting software empowers business owners to automatically create financial reports, such as an income statement. Continue reading to learn how you can make an income statement.

Choose a Reporting Period

Setting a reporting period, often referred to as an accounting period, is an essential part of creating an income statement. This is the period in time that the financial performance of a business is reported and analyzed.

There isn't one set standard of days for a reporting period - instead, a business can choose its reporting period to be for a month, quarterly, semiannually, or annually. By choosing a shorter reporting period, business leaders can analyze their companies' financial performance more regularly.

Create a Trial Balance Report

Trial balances are used to confirm that the debits are equal to credits when accounting. The trial balance report is one of the first steps that businesses must take at the end of an accounting period. The trial balance report helps detect any errors before proceeding in the accounting process.

Once completed, the trial balance report will provide you with all of the balanced figures you will need to create the income statement. Skynova's accounting software simplifies the process of creating a trial balance report, allowing you to move to the next step quickly.

Calculate Revenue

Next, you will need to calculate your business's revenue. The total revenue is the amount of money earned before subtracting expenses. It can include sales and interest and dividends from investments.

Calculating your business's revenue is a critical step in creating your income statement. Luckily, Skynova's all-in-one accounting software helps you efficiently calculate your business revenue.

Add Up the Cost of Goods Sold (COGS)

Once you have calculated the revenue, you will need to add up the cost of goods sold (COGS). The COGS refers to the cost of producing the goods in which your business sells. It should include the cost of direct labor, overhead expenses, and materials directly used to make the product.

It's important to note that the cost of goods sold can include outside costs that affect production, such as the cost of marketing or distributing the product. In short, the COGS helps businesses estimate the company's bottom line. Using our accounting software, you can add up the total COGS when creating your income statement.

Many income statements include the cost of revenue, representing the direct costs associated with the services and/or goods that the company provides. For those in the service industry, the cost of revenue is more popular because it provides a comprehensive record of the costs related to selling a good or service. Unlike the COGS, the cost of revenue doesn't include outside production costs, such as marketing and distribution. Instead, the cost of revenue considers the COGS or the cost of service in addition to any costs necessary to generate the sale.

The cost of revenue includes:

- Cost of labor

- Materials

- Sales discounts

- Commission

Calculate the Gross Margin

Next, you will need to calculate the gross margin. The gross margin is the gross profit (total sales minus the COGS) divided by the total sales. It measures the percentage of a product's cost versus its sale price. The gross margin also plays an important role in indicating to lenders that your business can repay.

Add Up Operating Expenses

In this step in creating an income statement, you will need to put the sales revenue at the top of the income statement and then subtract the COGS and operating expenses. This will provide you with the total operating income. You will need to add up operating expenses, which are the total expenses to run normal business operations.

Total operating expenses often include:

- Payroll

- Marketing

- Insurance

- Equipment

- Research and development

- Rent

- Selling, general, and administrative expenses (SG&A)

Looking at an accurate report of your operating expenses can show you how you can reduce your operating expenses without impacting your business performance. In contrast, a non-operating expense could be expenses that the business accrued unrelated to its core operations. In many cases, a non-operating expense could be the cost of borrowing or interest charges. Sometimes, certified public accountants (CPAs) will remove non-operating expenses to see how the business performs without these expenses.

Calculate Income With Income Taxes

Next, you will need to calculate your income with income taxes. Even though you will not need to provide the percentage rate of taxation on the income statement, you will need this figure to indicate the expense of taxes.

You can calculate the tax expense by multiplying the tax rate (individual or business) by the income (before taxes). It's important to note that income before taxes should factor in the costs of non-deductible items.

Determine Net Income

Before you finalize your income statement, you will need to determine your net income. The net income provides you with a better understanding of your business's profitability, as it provides you with the total profit. To find your net income, you will need to subtract business expenses and operating costs from the business's earnings. Then, deduct the tax from this amount. From there, you will have the net income, which will need to be added to the bottom line.

Finalize Your Income Statement

Lastly, you will need to finalize your income statement. Finalizing your income statement with Skynova's accounting software is easy. Simply ensure that you have a header to indicate that this is an income statement for a specific accounting period and add essential business details. From there, you can save the income statement to your Skynova account, print it, or send it to whoever needs it.

What Is an Example of an Income Statement?

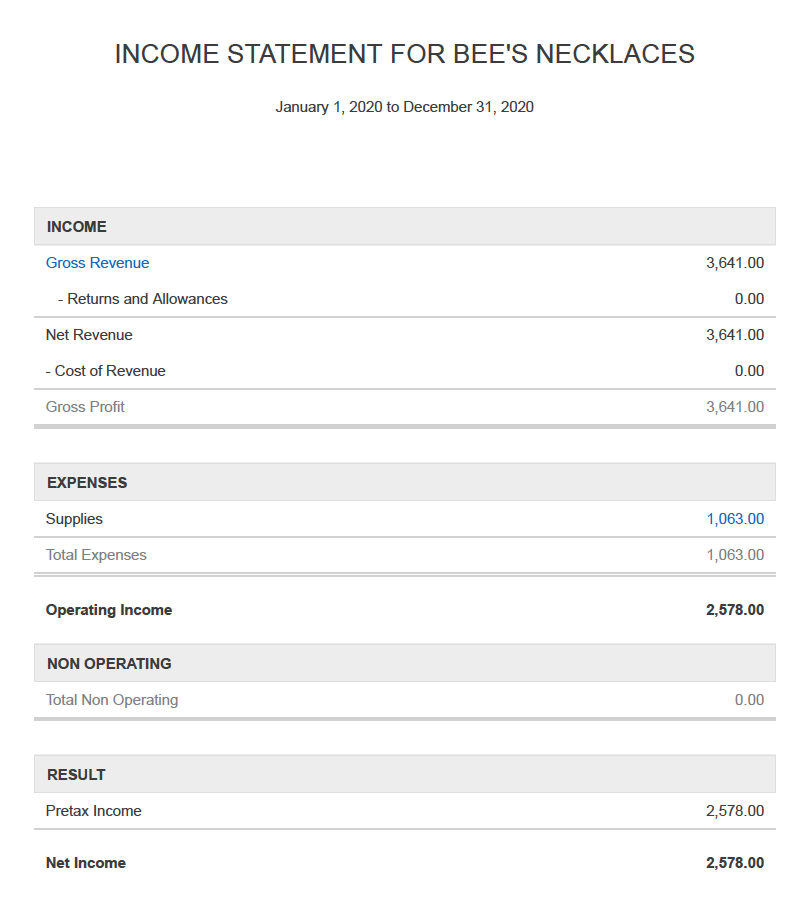

Income statements are important for accounting purposes, regardless of your business's size. In the next section, we provide an example of a single-step income statement.

Example of a Single-Step Income Statement

Smaller companies typically use a single-step income statement instead of a multi-step income statement. It takes a more straightforward approach by adding up a company's total revenue. It subtracts the company's total expenses, resulting in the net income.

Smaller business types that frequently create single-step income statements include partnerships, service companies, and sole proprietorships. In some cases, a large company might create a single-step income statement for financial reporting purposes in addition to a multi-step income statement.

Below is an example of a single-step income statement made using Skynova's accounting software:

Let Skynova Help You Create Your Small Business Income Statements

Income statements can help you better gauge how your business is performing or help you provide essential information to potential investors or shareholders. They provide necessary insight into your business's financial performance during a specified accounting period. All in all, the profit and loss statement, balance sheet, and statement of cash flow are important financial statements.

Skynova's all-in-one accounting software helps small business owners keep accurate records of income, expenses, sales tax, and payments to streamline their accounting process. We have double-entry accounting to ensure that you create complete and accurate records for your business. The all-in-one software quickly generates essential reports so that you can make informed decisions for your business.

Whether you need help with accounting, creating estimates, or sending invoices, Skynova has the right tools for your business. We offer various business templates to help you manage your business's financial accounting needs. No matter what type of business you have, Skynova's tools can help you create professional documents to help you handle the financial aspect of running a business.