Skynova Accounting

Not complicated or fancy, just plain and easy

- Tailored to the needs of small businesses

- No accounting knowledge required

- Forget books and confusing spreadsheets

- We give you easy double-entry accounting

- Easily swap between cash and accrual basis

- Get a quick overview of owed and paid tax

- Get easy expense tracking and receipt upload

- Transactions are recorded automatically

- Record manual journal entries easily

- Get financial statements fast

- Export all documents as PDF

- Give your accountant remote access

Join thousands of happy customers

Take a look at how our customers feel about Skynova

We strive to make your financial tasks easy

Customize your solution by choosing only the tools you need

- Clutter-free webpage layout

- No unnecessary distractions

- All your data backed up securely

- Get everything in one place

- Add functionality with add-ons

- Full integration between products

No more stacks of dust-gathering books

Nor any spreadsheets full of confusing formulas

Tired of endless nights summing, checking and double checking the balances of the General Ledger? Are you really sure there are no mistakes in any of the formulas on your spreadsheet?

With Skynova, your transactions are automatically recorded into the correct accounts. Even better, all accounting data from the subledgers are transferred into the General Ledger.

No business without income

and no income without invoices

One of the reasons that many small businesses fail is because of cash-flow issues. If you are not able to effectively bill your customers and follow up on the payments, your business' financial health will take a hit.

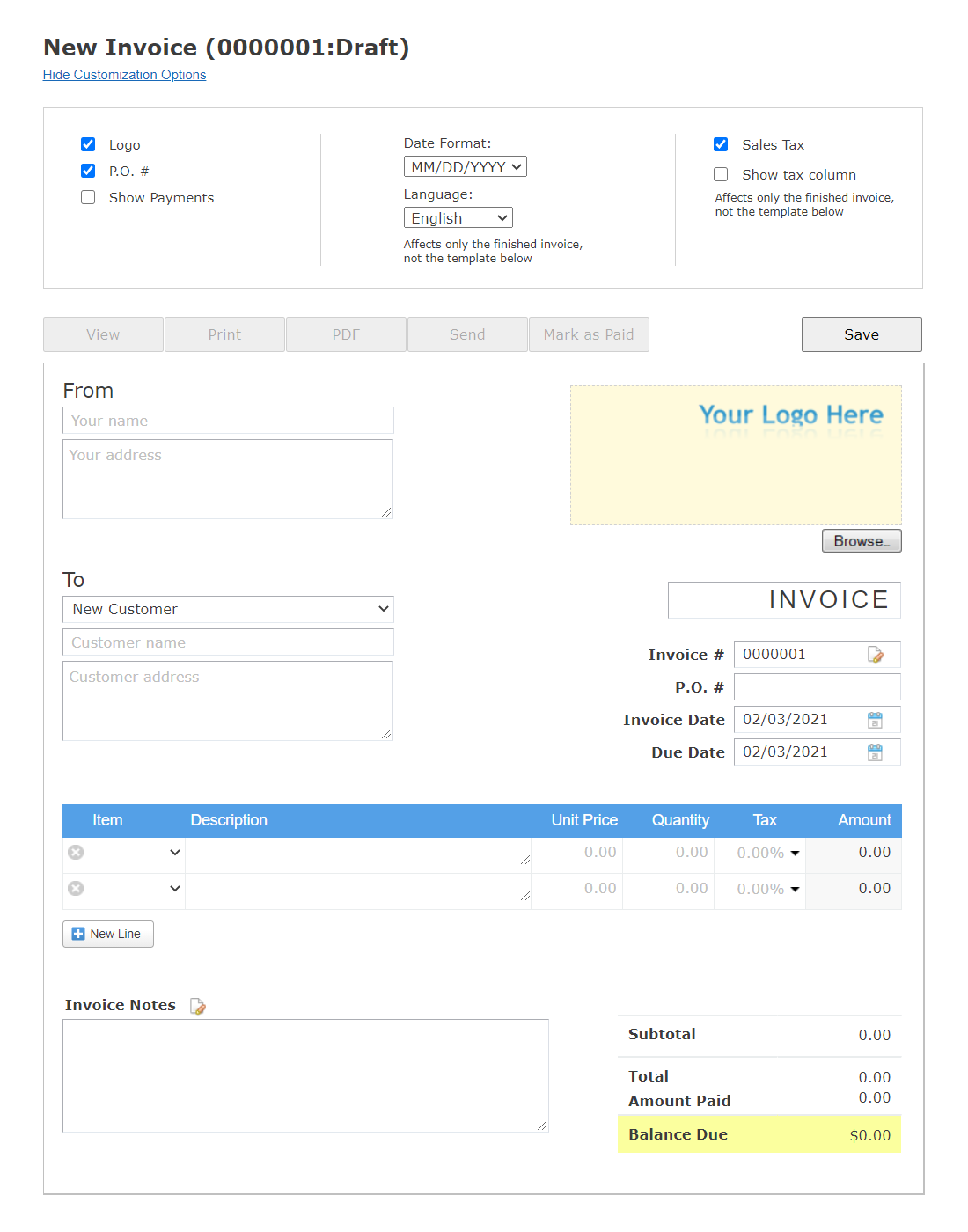

The invoice is a document that informs your customer of what they have purchased and the payment terms of that purchase.

Skynova Accounting lets you invoice your customers easily. Customize the look of your invoices with your own logo and add a personalized note. It will make your business stand out as professional and trustworthy to your customers.

When done, you can send the invoice directly to your customer with a few clicks. No need to log into your email software. You will be able to see when the customer has opened the invoice and when it is paid. It doesn't get any easier than that!

If you want to send it the traditional way, by mail, just print it out with one click.

Automatic recording of income and loss

We give you financial statements in just a few clicks

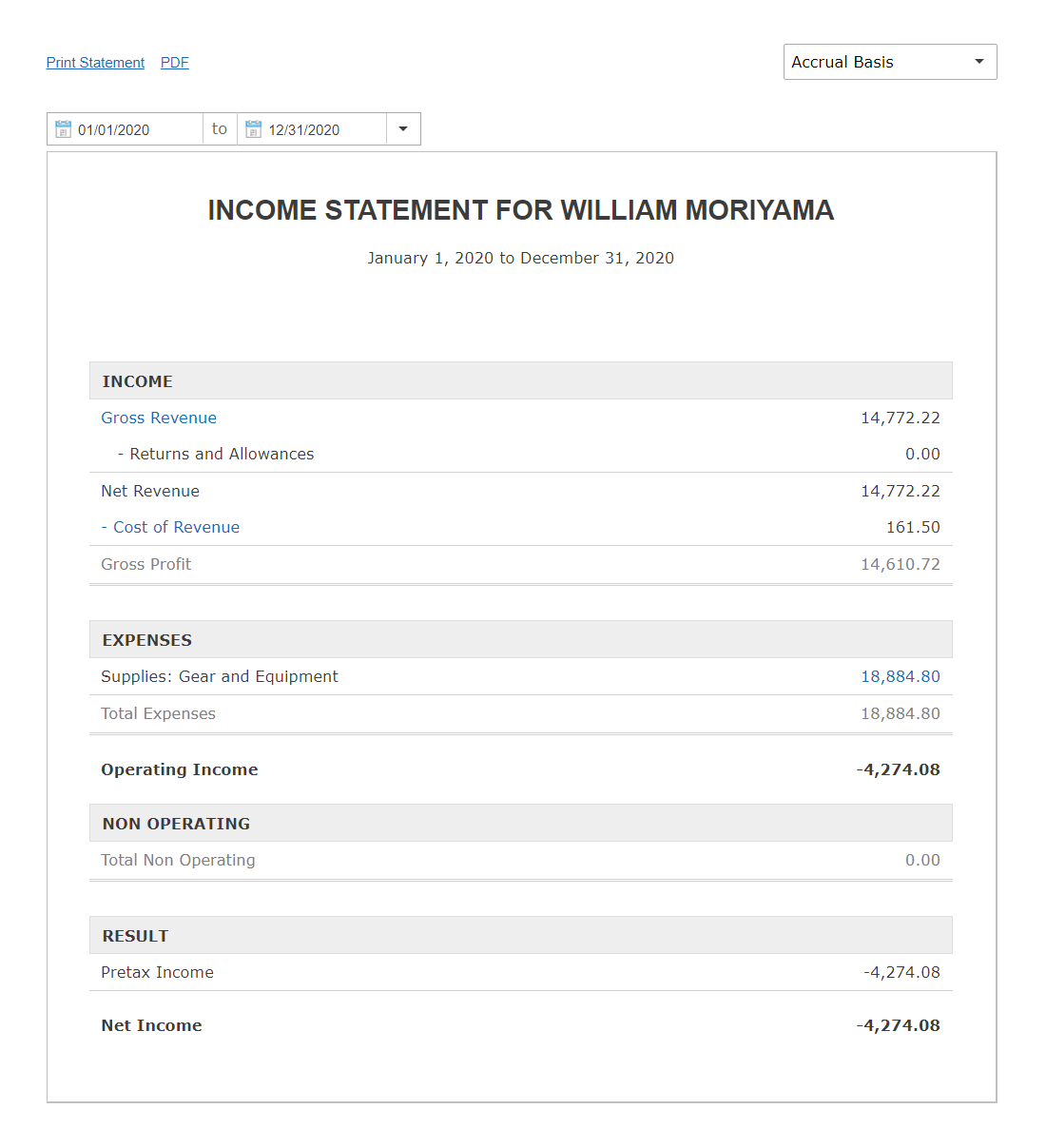

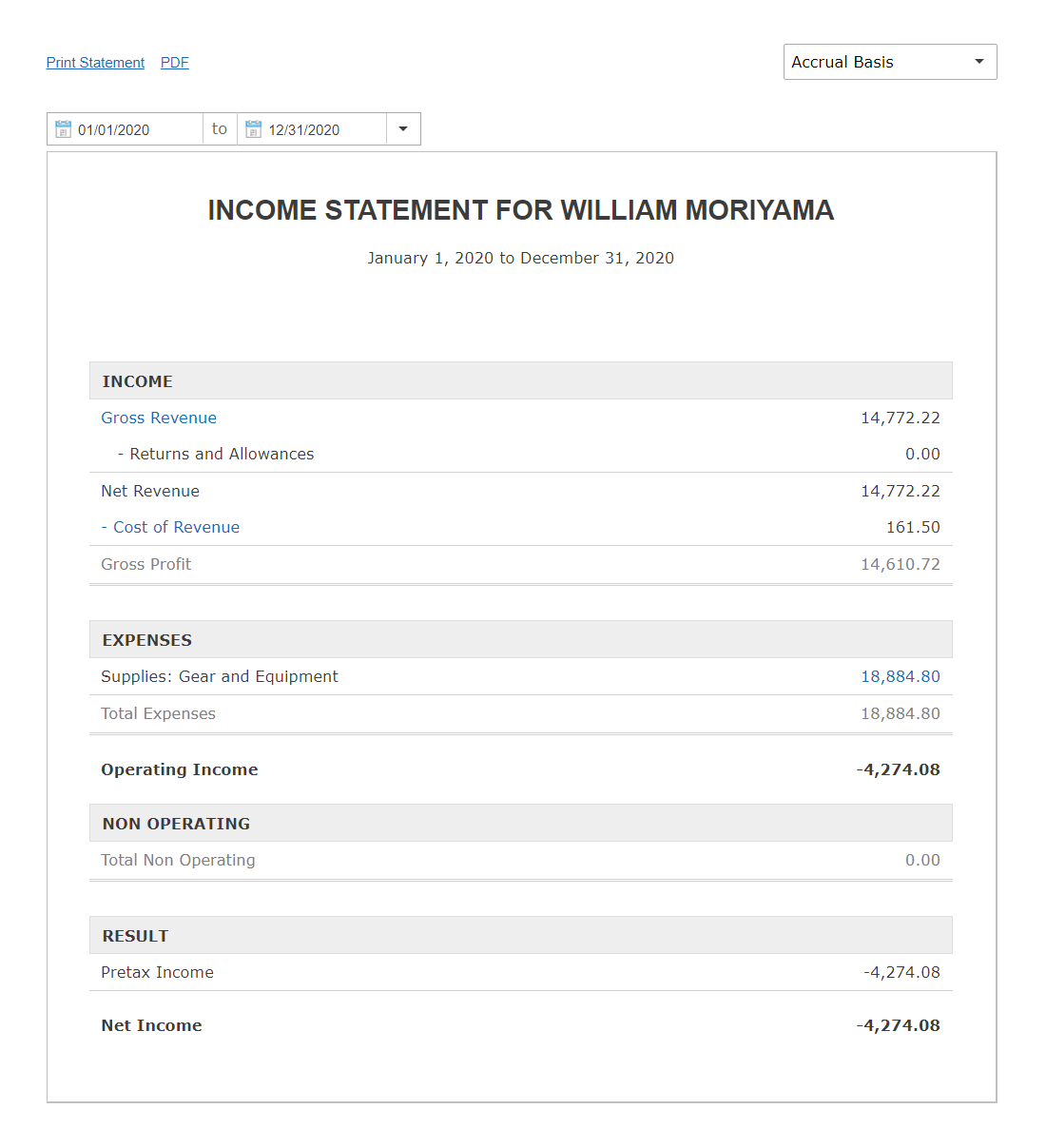

The Income Statement will give you valuable information about the financial health of your business. You will get an overview of where the business is earning and losing money, and whether your business is profitable.

If you are looking for investors to your business, the Income Statement is one of several important documents for convincing them it is a profitable investment.

Skynova Accounting will give you the Income Statement for a chosen period of time in just a few clicks. Select the start and end date and the income and losses are summed up automatically.

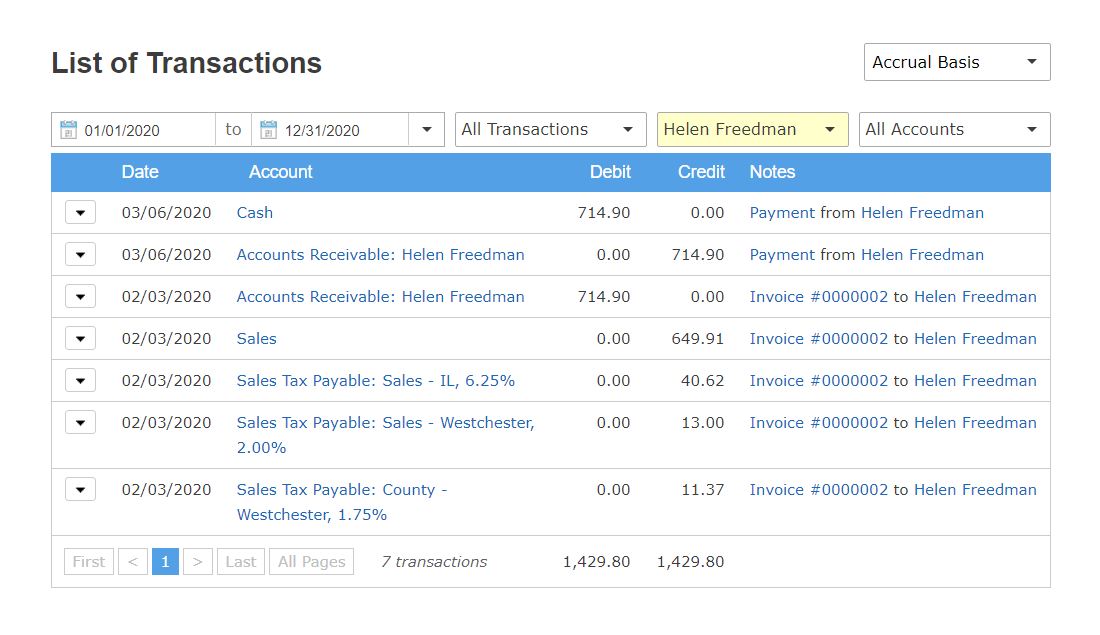

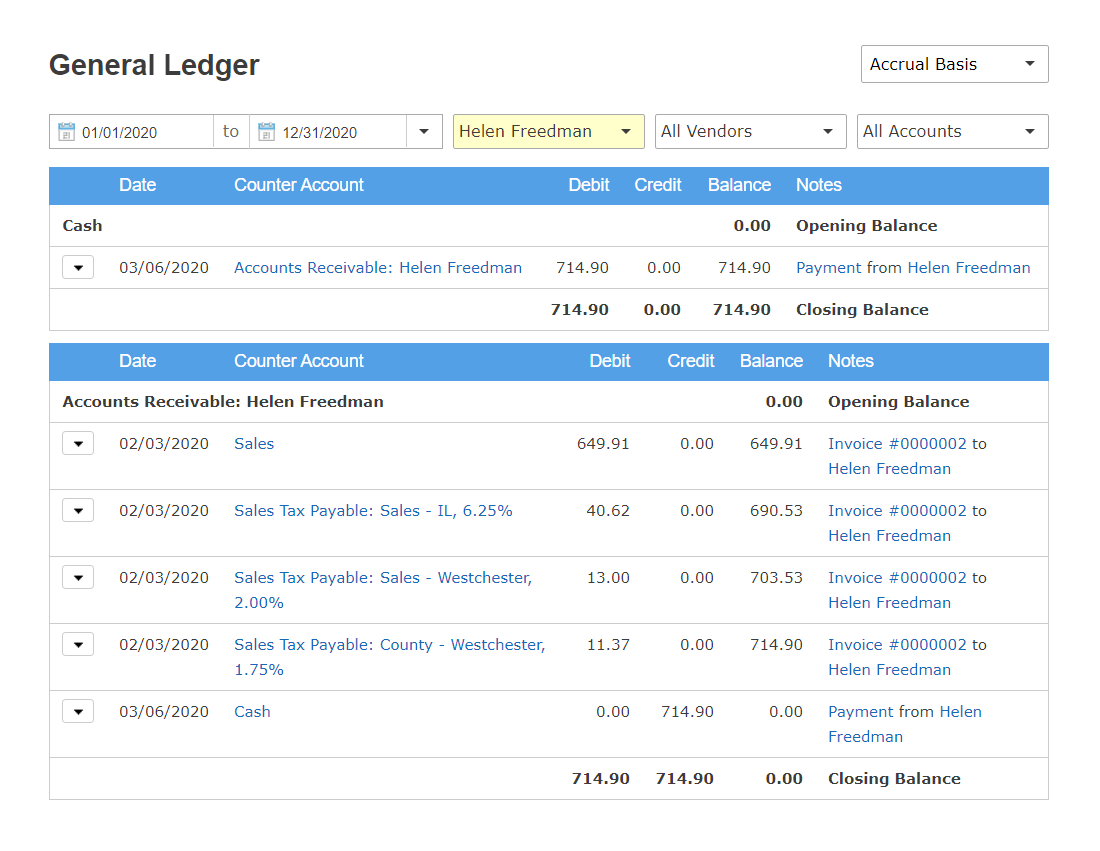

Easy double-entry accounting

We take care of the debits and credits for you

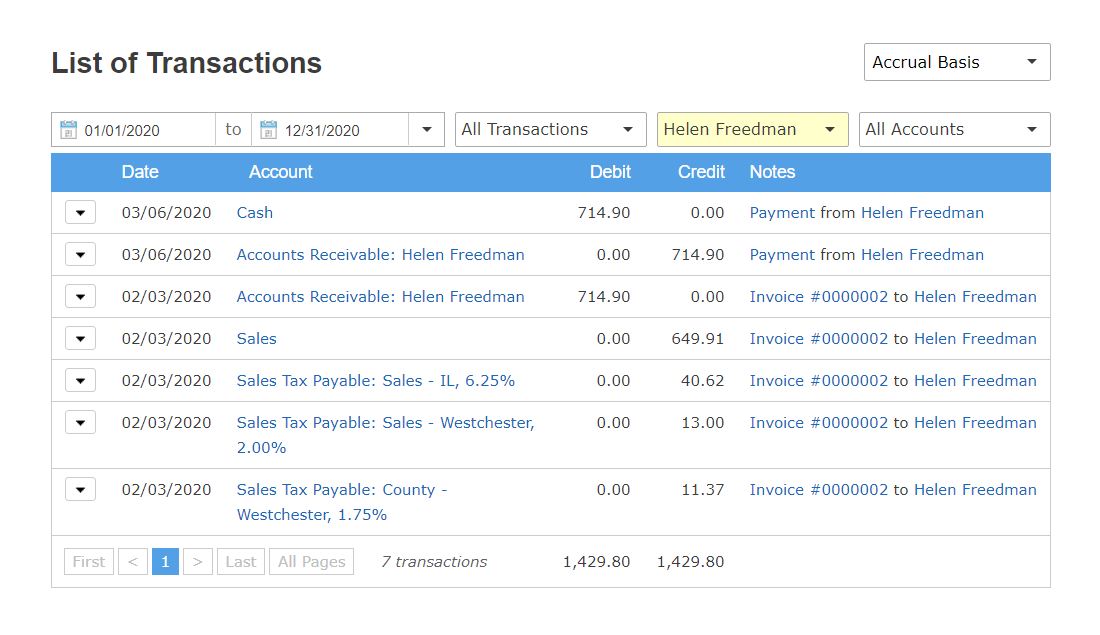

The double-entry system is the core principle of accounting. For every transaction you will have to create a record in at least two accounts of the system; you will add a debit and a credit amount. All expenses will relate to revenue, which makes it easy to calculate profit and loss accurately. Always entering a debit and a balancing credit amount into the accounts also greatly reduces possibilities of errors.

Skynova takes care of the double entries for you. When you create an invoice and send it to your customer, we will add a debit amount to the Accounts Receivable and a credit amount to the Sales account. when your customer pays the invoice, we will add a debit amount to your Cash account and a credit amount to your Accounts Receivable.

Cash or accrual basis?

We make it easy to swap when needed

Cash based accounting will record revenue when cash is received and expenses when cash is paid. Advantages of the cash basis method is that it is easy to see how much cash the business has at a given time and that income tax is not paid until the cash is actually in the bank. The cash basis method is simple and therefore often used by small businesses.

Accrual basis accounting focuses on what revenues are earned and what expenses have incurred. A transaction is recorded when it happens, not at the time of the resulting cash exchange. Accrual based accounting provides a more accurate and long-term picture of the financial health of the business. The accrual basis method will not give the same overview of cash flow, so careful monitoring of cash flow is needed. Also, income tax is paid the year the revenue is recorded, not when cash is received. The accrual basis method is almost always used by businesses handling inventory.

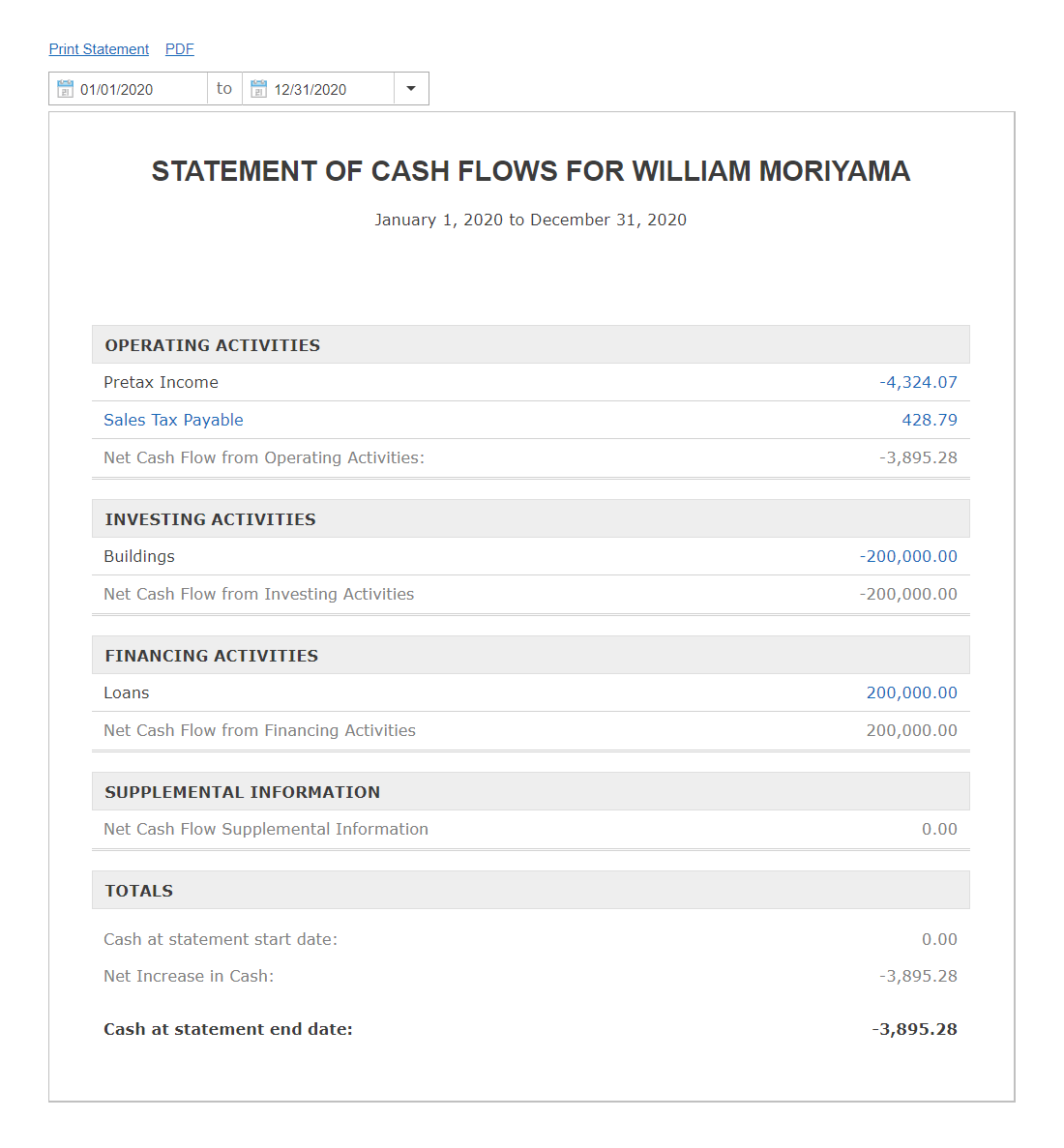

Skynova allows you to easily swap between cash and accrual basis. When using accrual basis accounting, we make it easy for you to monitor the cash flow using the Cash Flow Statement. You will always have a good picture of the financial health of your business.

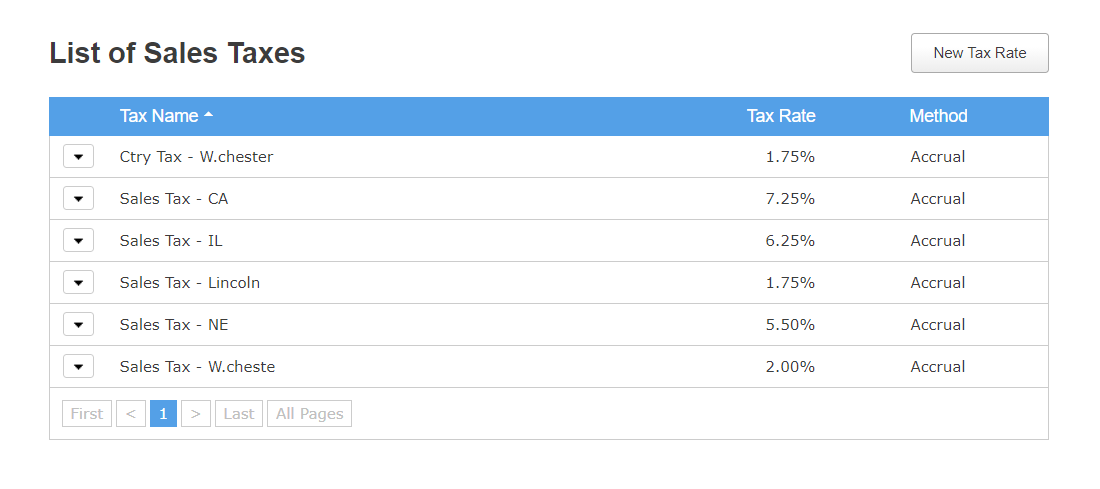

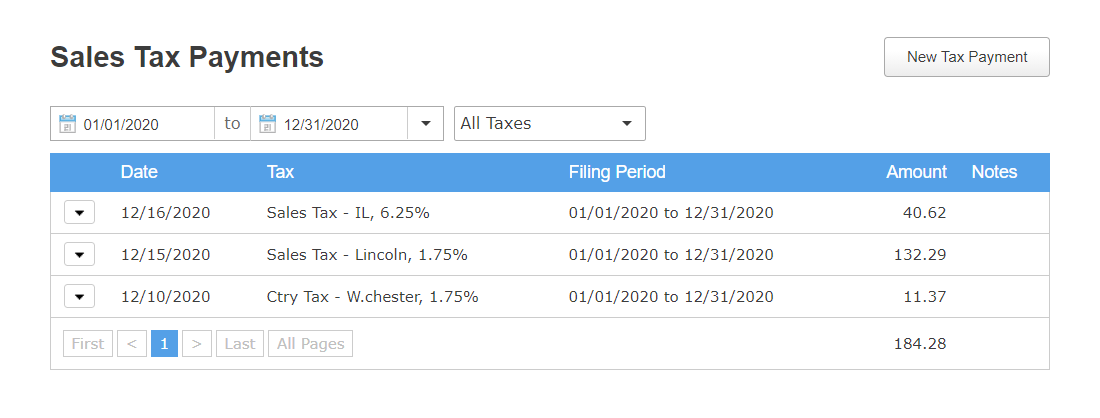

Owed and paid sales taxes

We give you full overview in just a few clicks

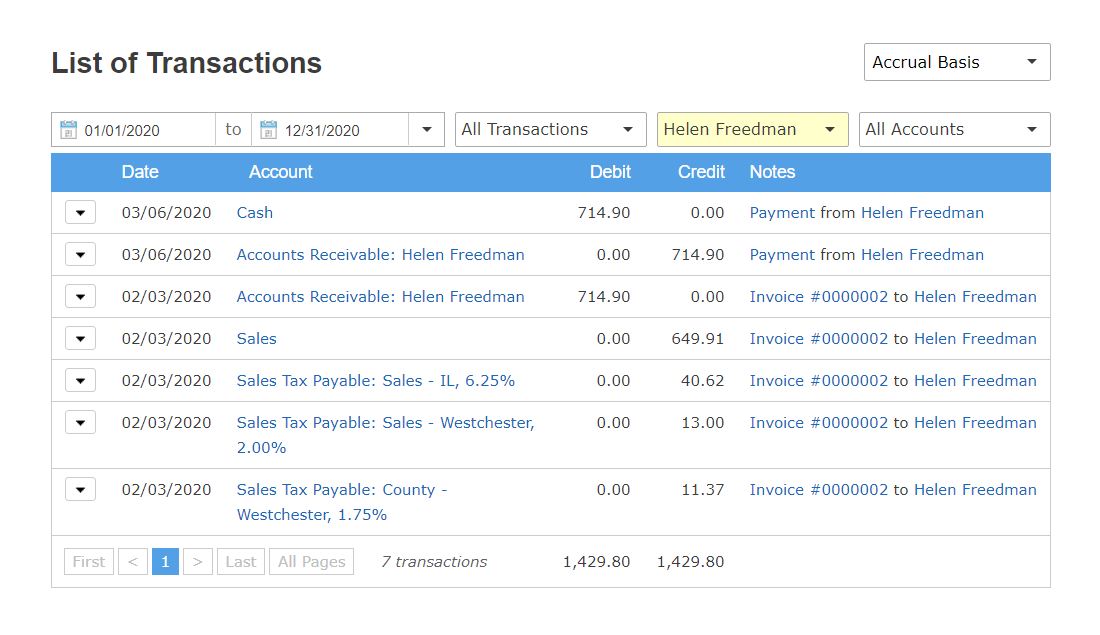

Sales tax procedures depend upon the state in which your business is located. If a state has origin-based sales tax, the sale is considered to take place in that state, meaning you'll have to collect tax for the state in which your business is located. If a state has destination-based sales tax, the sale is considered to take place in the state of the buyer’s location. In this case, you'll have to collect tax for the state in which your buyer is located.

Whether your sale is taking place in an origin- or destination-based state, Skynova provides an easy way to manage sales tax. You can easily specify different sales taxes and apply them to your invoices. In a few clicks you'll have a list of all sales taxes you have specified, the sales tax you owe and/or the sales tax you have already paid.

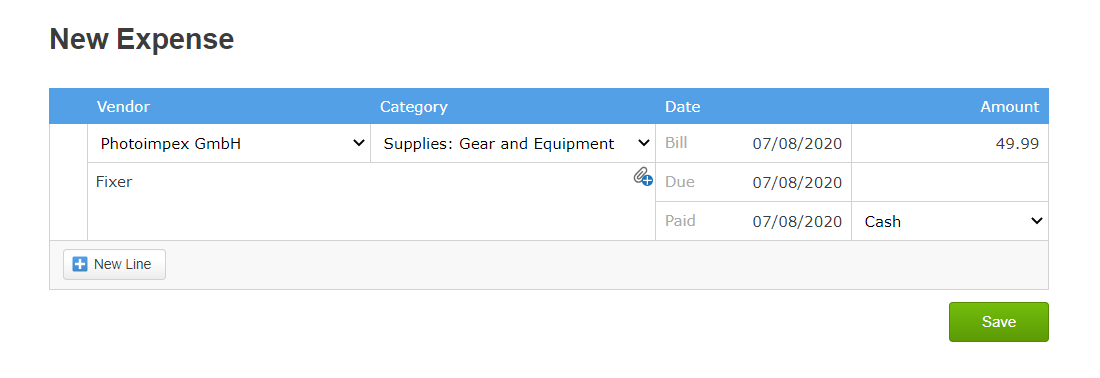

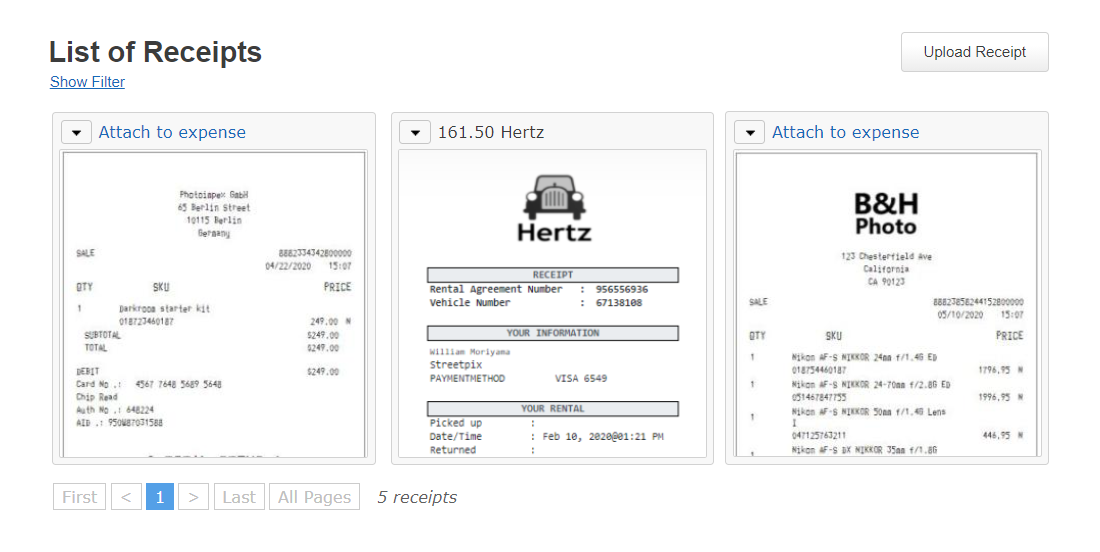

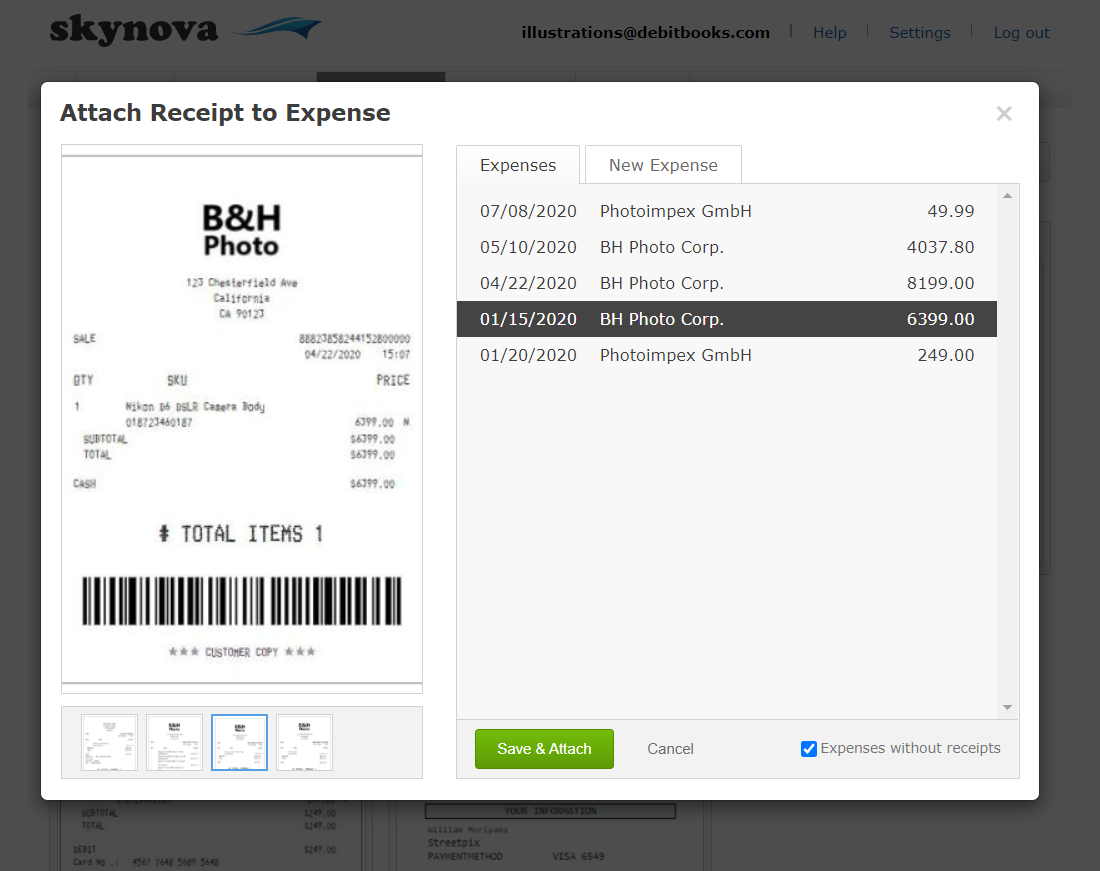

Easy expense tracking with receipt upload

We give you the ability to link receipts with expenses

To be able to manage your business profitably, it is crucial to track your expenses. When all expenses are accounted for, you will be able to see whether you are going to earn or lose money this period.

Skynova makes expense tracking easy. Simply select the vendor and expense category, choose the bill and due dates, add the amount and click Save.

Better yet, all your receipts can be uploaded and linked to the matching expenses in a few clicks. No need for all those shoeboxes anymore!

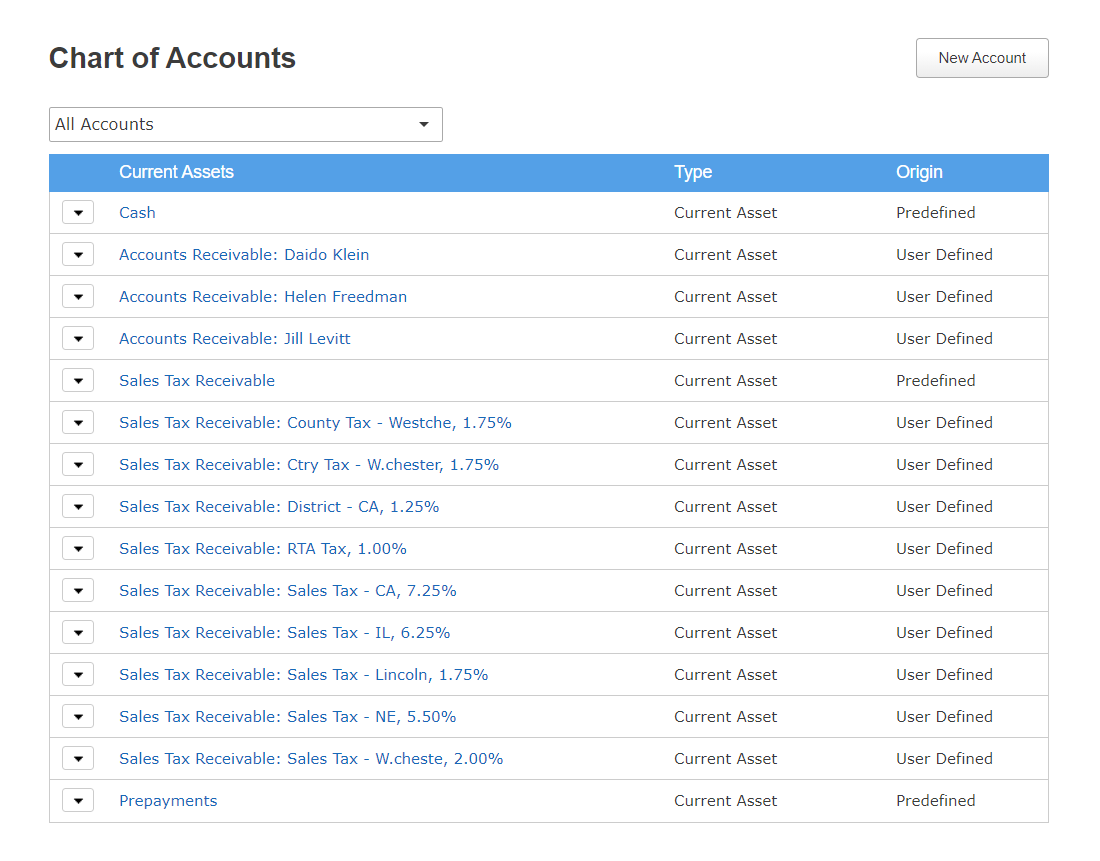

Automatic recording of transactions

We make sure your records are always up-to-date

When doing the bookkeeping, you create a collection of accounts to store the transactions into. This can be done using a physical book or using computer software, like a spreadsheet or specific bookkeeping/accounting software.

When all accounts are defined, you need to do the work of recording every transaction as a debit and credit amount into the correct accounts. At the time of balancing the books, you will need to sum up all the debit and credit amounts in each account and see if they add up.

By using Skynova Accounting, you'll have all the transactions recorded automatically into the correct accounts. We have even prepared a set of general accounts for you to use. If you would rather set them up yourself, you can of course define custom accounts as well.

You can easily filter your transactions for date interval, transaction type, customer, vendor, and account.

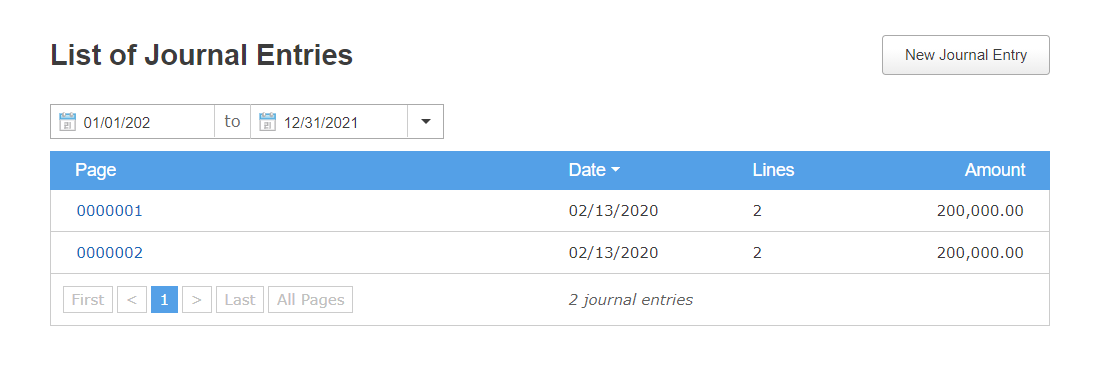

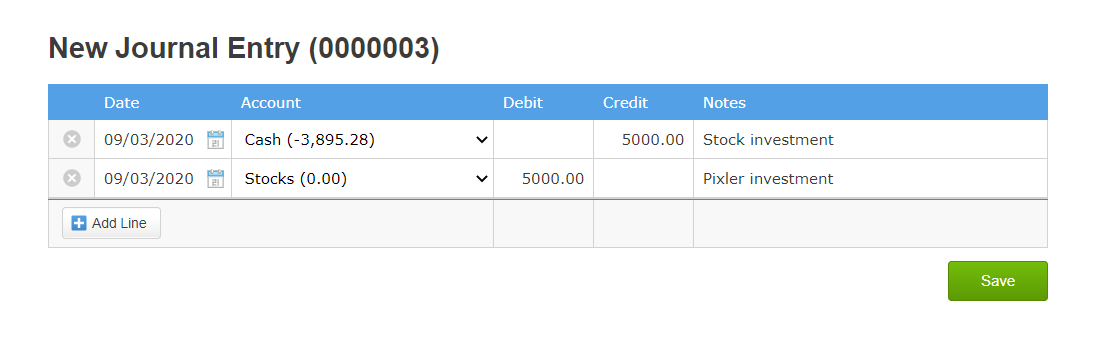

Easily record your manual journal entries

We give you one system for all your transactions

You can use journal entries to record adjustments and special entries. Simply choose the transaction date and account, enter the debit and credit amounts, enter a descriptive note and hit Save.

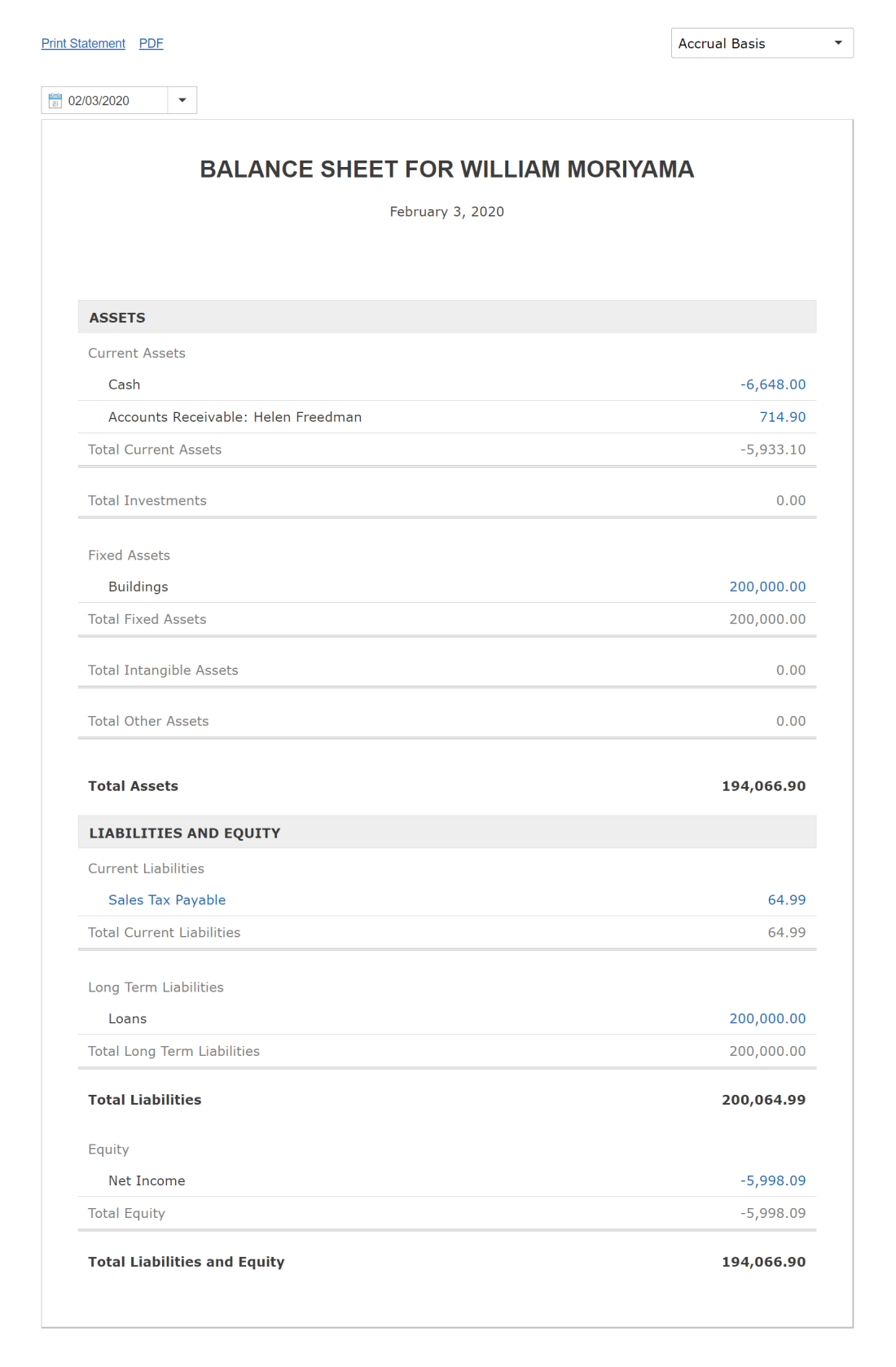

Generate your financial statements quickly

We give you the overview when needed

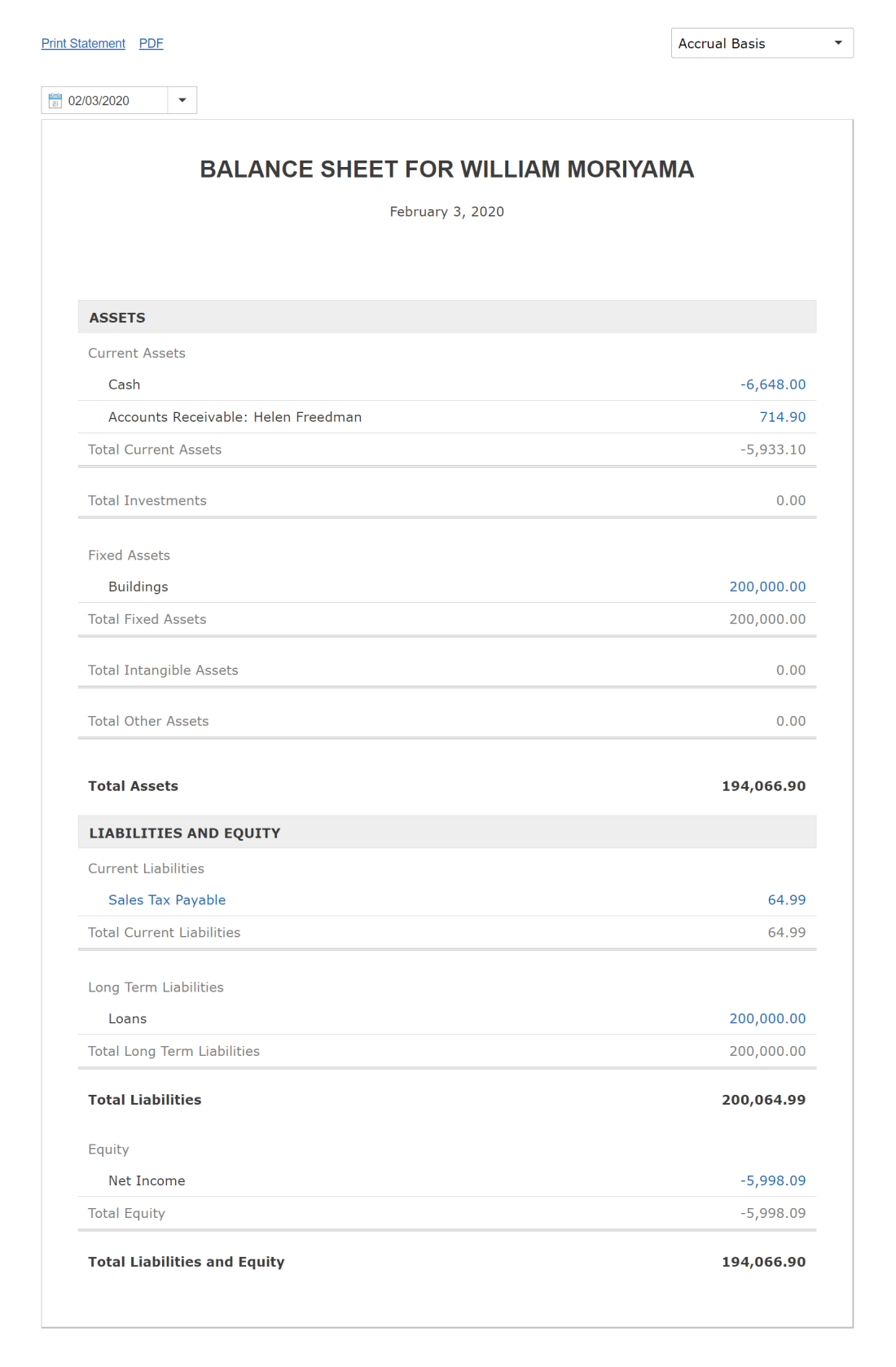

To get a good overview of how your business is doing, you will need to analyze all your recorded transactions. Use the General Ledger as a basis and generate a balance sheet, cash flow statement and an income statement. Based on these reports you will see the financial health of your business and you will be able to make better short- and long-term decisions.

Skynova Accounting will create all these reports for you in an instant. All you have to do is take a look at the numbers and decide how to take your business to the next level.

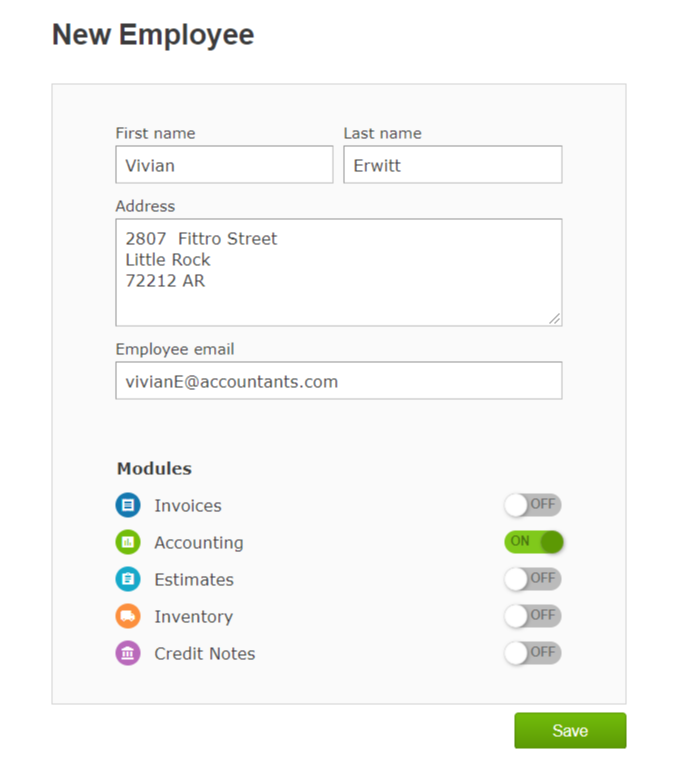

Give your accountant access to the data

No need to bring your financial statements over there anymore

At the end of an accounting period, you'll need to prepare your books and financial statements. Maybe you also have to report the financial performance and position to your external stakeholders.

If you are using an accountant to manage your books, they will need access to all your numbers. Depending on the size of your business, you might need help from an accountant either monthly, quarterly or at the end of the year for closing the books. This can be done in several ways; you can print out your numbers and deliver a physical copy to your accountant, you can download PDFs and send your documents to your accountant by email, or you can give your accountant Employee access to your Skynova account.

Create an Employee login for your accountant, and they will be able to view your numbers and statements immediately!

Export your documents as PDFs

You can also print out hard copies - your choice

There will always be a time where you need to send a document or two, to a third party. Using Skynova Accounting, you can at any time print your documents or export them as PDFs.

| |

Skynova Customer Support Benefits

We are always there to help and guide you

- Friendly and knowledgeable support agents

- Normal response time is less than 1 hour

- Support available 7 days a week

- Support Agents covering all US time zones