|

The concept of a universal basic income has been floating around for roughly half a century, but the specific idea that the government should increase everyone’s earnings is a more recent idea that has gained increased traction over time. With the possibility of universal basic income (UBI) implementation now being a hot topic, we’ve surveyed 1,023 people to get a better idea of how American citizens would react to these monthly government payments.

To begin, surveyees were asked if they support UBI in the first place and were tasked with outlining some of the benefits and downfalls of the program. Also, how small of a payment would people need for it to have a meaningful impact on their life? What payments would they prioritize with their UBI checks? Do respondents think that standards and regulations should be in place in order to qualify for such payments? Read on to learn more about what kind of impact a UBI might have on the country as a whole.

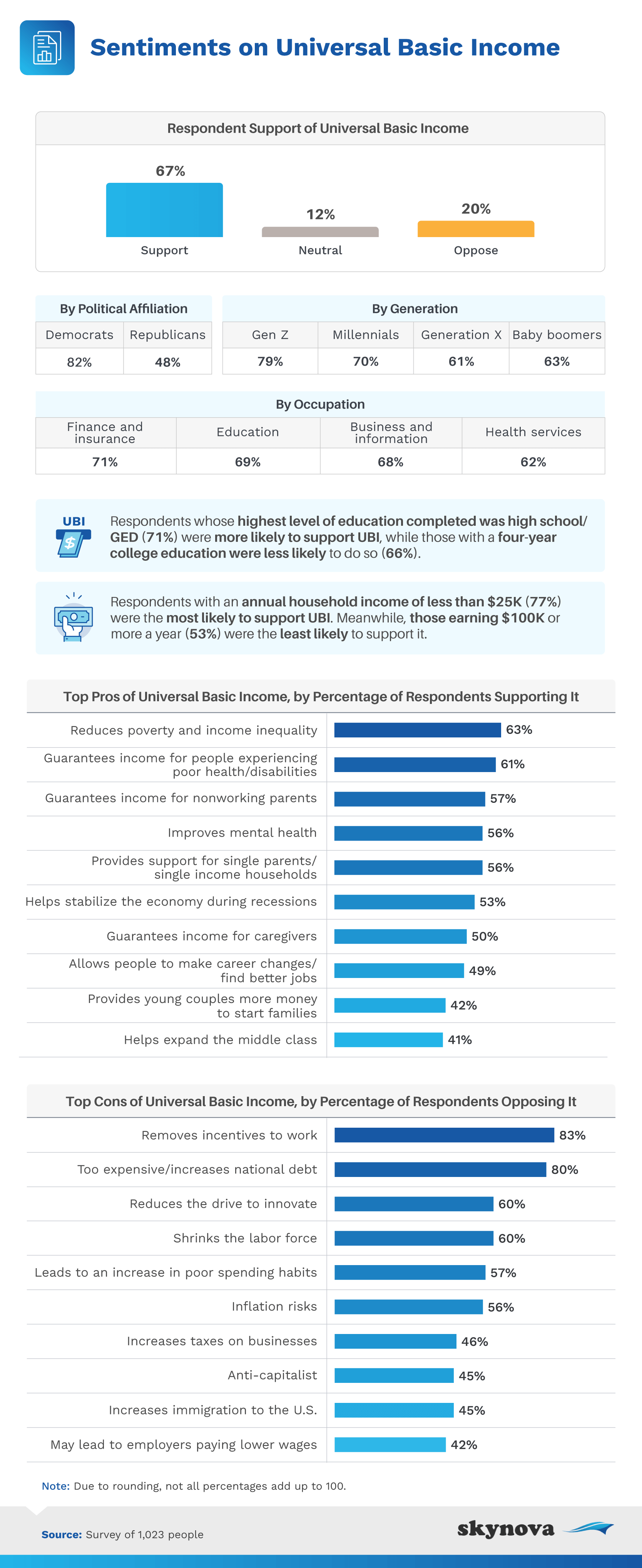

With the idea of UBI becoming an increasingly popular and wanted concept, it’s no surprise that over two-thirds of respondents were in support of its implementation. Neither gender was more in favor of it than the other, but Gen Zers (79%) were much more interested in it than baby boomers (63%). By political affiliation, most Democrats were on board with UBI, but less than half of Republicans wanted it. Regarding occupation, people working in the finance and insurance sector were slightly more in favor of it than others. Also, people with a lower level of education and lower annual income wanted a UBI implemented more than more learned and higher earning individuals.

Naturally, there are pros and cons of going through with a government program such as this one. The top two benefits, according to people who supported UBI’s implementation, are that it’ll reduce poverty and income inequality, in addition to ensuring an income standard for people who are in poor health or have a disability. Building on this, for example, UBI would also allow more flexibility for those who may need to take time off work to care for a loved one.

According to those who oppose UBI, their biggest worries were that it might remove a lot of incentive to work, and the program itself would be too expensive and may increase the national debt. Seeing as implementing a UBI in the U.S. would cost an estimated $3.9 trillion per year, that itself would come with its own set of headaches.

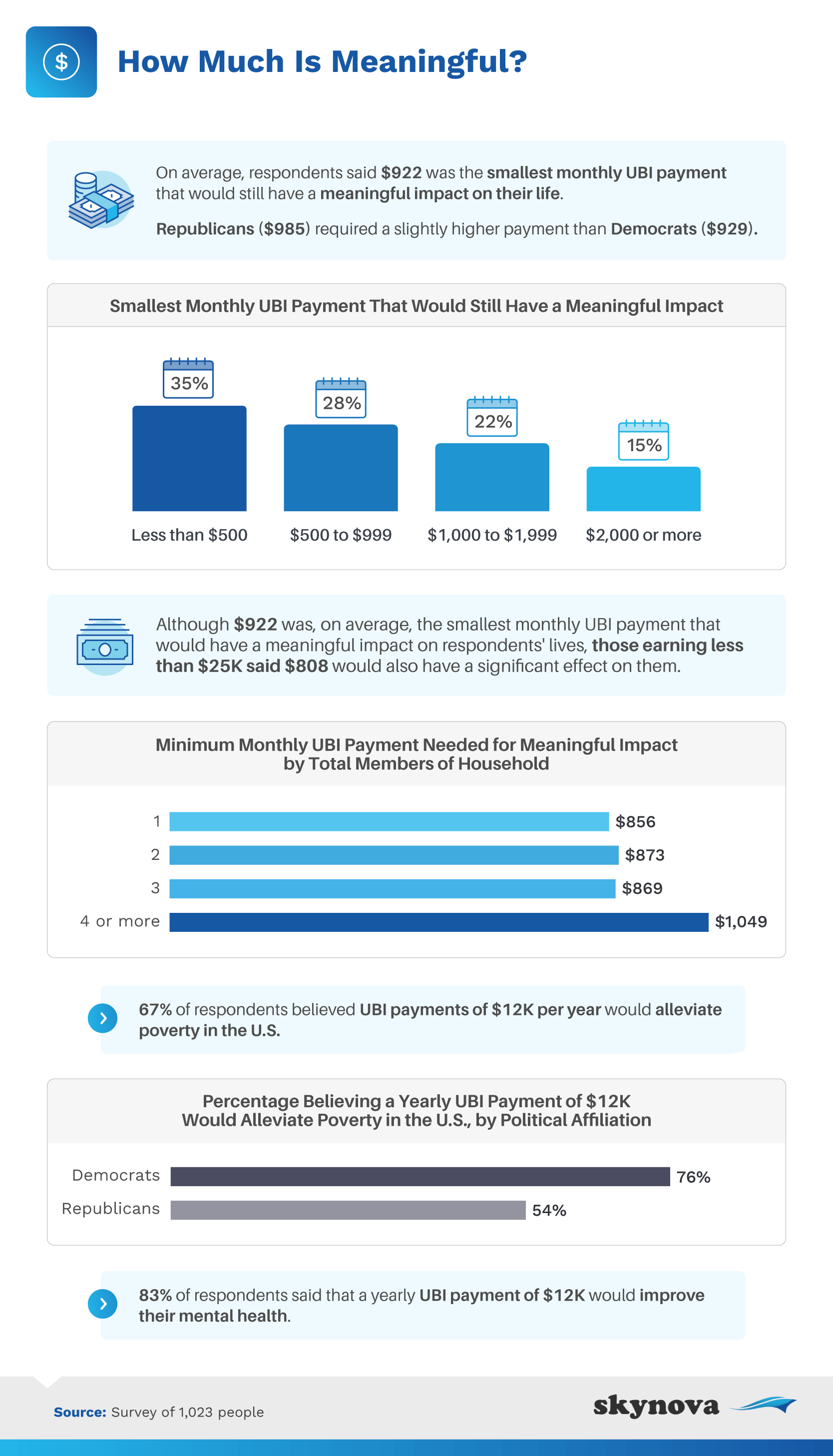

On average, respondents said that a monthly UBI payment of $922 would be the smallest amount that would still make a meaningful impact on their life – Republicans needed a little more money than Democrats to feel this way.

When broken down further, 35% of respondents would’ve been satisfied with less than $500, half would settle for any amount between $500 and $1,000, and 15% needed $2,000 or more to really feel a difference. However, people making less than $25,000 a year considered, on average, a monthly payment of $808 would still have a significant effect on them. By household size, the bigger the family, the more money needed to make an impact – while a single person would appreciate monthly payments of $856, on average, a family of 4 would need $1,049 to feel the effects.

Just over two-thirds of people believed that $12,000 annually in UBI would help alleviate poverty in the U.S. (Democrats more so than Republicans), and 83% said the same amount would benefit their mental health. With the goal of ensuring everyone’s basic needs are met, UBI would naturally lessen the stress levels of many Americans. It would also give people the financial means to leave unfavorable situations, such as an abusive household, and potentially prevent negative childhood experiences (as instances where parents are abusive, either to their kids or to themselves, often stem from poverty and inequality).

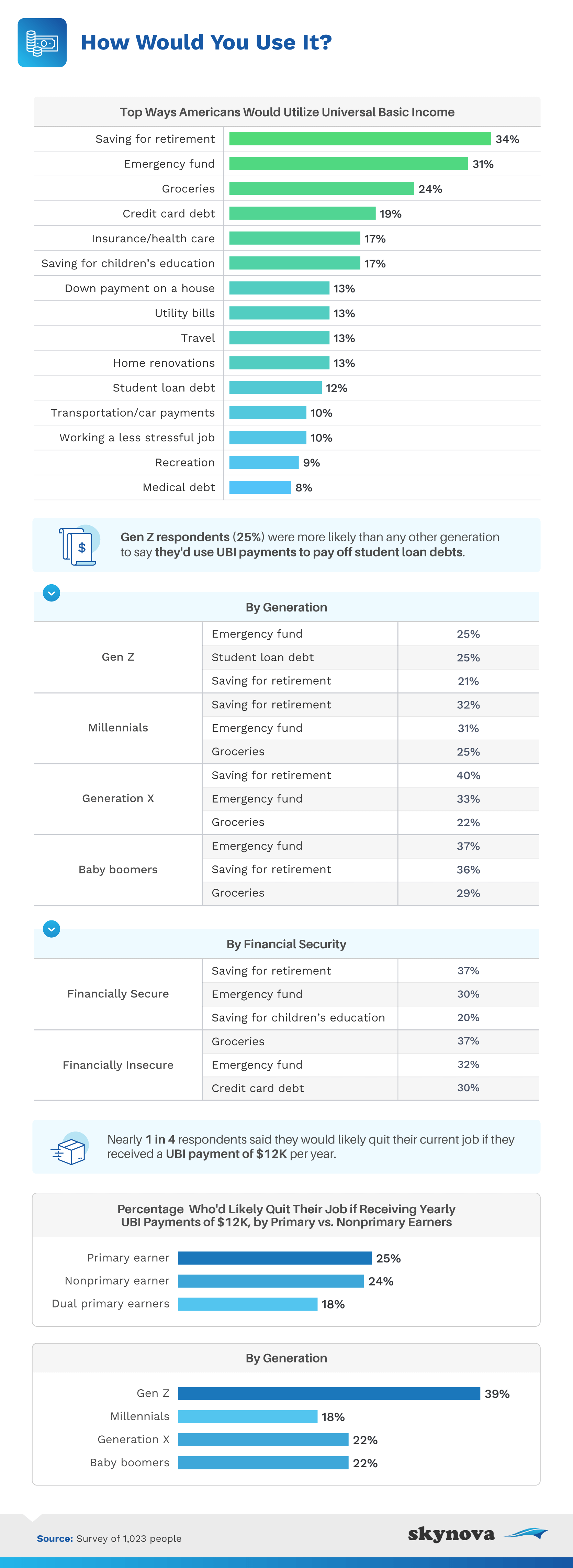

If UBI was to be introduced into Americans’ lives, over a third said they would immediately put their share into a retirement savings plan. Saving up for retirement is important for a number of reasons – for example, it can help cover unexpected medical emergencies (which can become more frequent with age). Also, diversifying your income is safer (instead of relying on a pension, perhaps), and having financial freedom for your loved ones has to feel good too.

Otherwise, 31% of respondents wanted to put their UBI money in an emergency fund, and just under a quarter would put it toward grocery shopping. Education, bills, and leisure were also on peoples’ minds when they were thinking about spending their UBI checks.

Across the generations, the top three avenues people would spend their UBI money would be for retirement savings, emergency funds, and groceries (save for Gen Z who swapped groceries for student loan payments). Regardless of whether people were financially secure or insecure, an emergency fund was a priority for both. Also, nearly a quarter would drop their current job if they were pulling in $12,000 a year in UBI payments. Of those who would be keen to quit, there was no discernable willingness between primary and nonprimary earners. Young people (Gen Z) would be quickest to drop their jobs if they received UBI, compared to older generations. Seeing as the median necessary living wage across the U.S. is $67,690 per year, it makes sense that kids and young adults (who likely have far fewer expenses than their older counterparts) would take this deal.

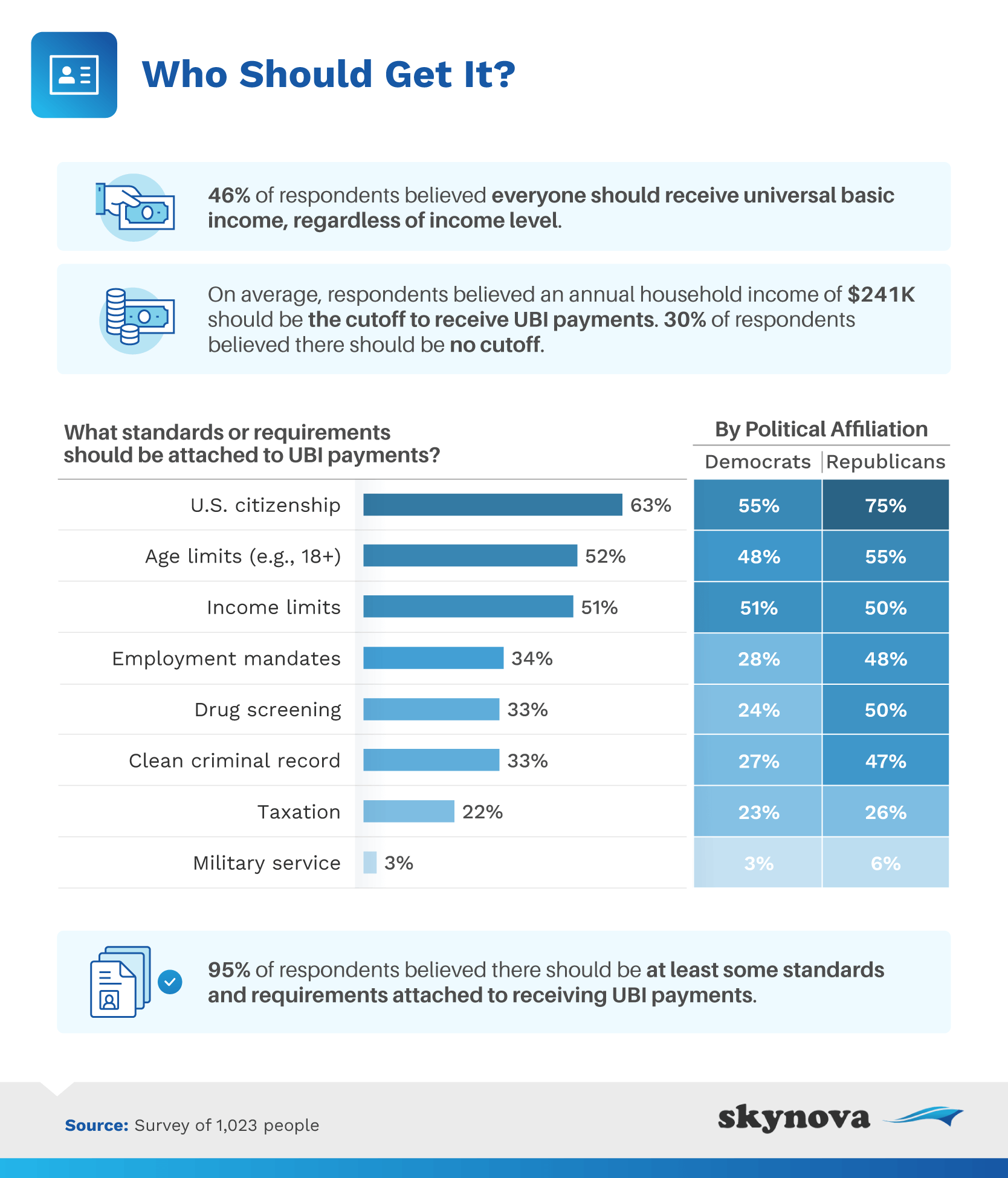

Forty-six percent of respondents believed in spreading the wealth no matter the income level. Of those who weren’t keen on total equality, they believed the cutoff to receive UBI payments should be limited to households making less than $241,000 annually. Seeing as people at that income level are categorized as upper-middle class, most would probably agree that UBI wouldn’t be a necessity for them. That being said, 30% of people said that no cutoff would be necessary.

While a limit is one way to determine who should and should not receive UBI payments, many respondents believed there should be other standards in place to determine who is eligible for them. First and foremost, over 60% agreed that U.S. citizenship should be a requirement – three-quarters of Republicans agreed, and 55% of Democrats did too. More than half of respondents also figured that being a legal adult and indeed having an income limit were necessary prerequisites to benefit from UBI – in fact, 95% of our surveyees agreed that there should be at least some preconditions in place to be eligible for the payments.

The majority of respondents were in favor of a universal basic income, but those who have completed a higher level of education and had high annual income were less enthused about the idea. Pros and cons were also outlined by our surveyees – the main benefit, according to people who wanted UBI implemented, was that it would reduce poverty income inequality. On the other hand, people against UBI were most worried about it removing the incentive to work. People also said they would need a minimum amount from the government for them to feel a meaningful difference in their day-to-day life, and naturally, larger households required more than smaller ones.

If they were to receive UBI payments, respondents would primarily put them away in a retirement savings fund, which can be greatly beneficial in the transition out of a work-filled life. Also, many Gen Zers said they would quit their job if they received payments, which becomes much less of a feasible option the older you get. Lastly, most people agreed that some sort of standards needed to be put in place in order to qualify for UBI payments, like having U.S. citizenship, being a legal adult, and meeting an income limit. As the debate on UBI roars on, we’ll be keeping a close eye to see how and when the trigger might be pulled on it, if ever.

Skynova’s online software modules allow small businesses to efficiently invoice their clients, and manage their other accounting needs with ease. We also love to write about topics that we are passionate about and that you will hopefully enjoy. They usually take on a business or workplace angle and intersect with another aspect of society. We use both primary (i.e., surveys) and secondary sources to outline our points and flesh out our findings.

We surveyed 1,023 people to explore how they currently feel about universal basic income payments. Among them, 52% were men, 46% were women, and 2% identified as nonbinary. For generation breakdowns, the sample sizes were as follows:

For political affiliation breakdowns, the sample sizes were as follows:

For short, open-ended questions, outliers were removed. To help ensure that all respondents took our survey seriously, they were required to identify and correctly answer an attention-check question.

These data rely on self-reporting by the respondents and are only exploratory. Issues with self-reported responses include, but aren’t limited to, exaggeration, selective memory, telescoping, attribution, and bias. All values are based on estimation.

If the country announced that every citizen would be entitled to UBI tomorrow, how would you plan on spending it? Feel free to share this with friends and family to get their take, too. We just ask that you do so for noncommercial use only and to provide a link back to this page for full access to our methodology and findings.