|

While not everyone understands what the term "inflation" means, this economic concept shows up in many ways throughout our everyday lives. The next time you purchase a carton of milk from the store or fill up your car with gas and think to yourself, "I don't recall this being so expensive," you can thank inflation for that.

We were interested in learning more about people's perceptions of how general costs are rising, including how knowledgeable they are on the subject and how concerned they are about it. We surveyed over 1,000 respondents across the United States, asking them questions about all things inflation: Do they have strong opinions about it? Do they think levels will rise or fall in the short-term future? Would they consider high inflation a good or a bad thing? Read on to find out more!

To what degree do respondents know and think about the concept of inflation?

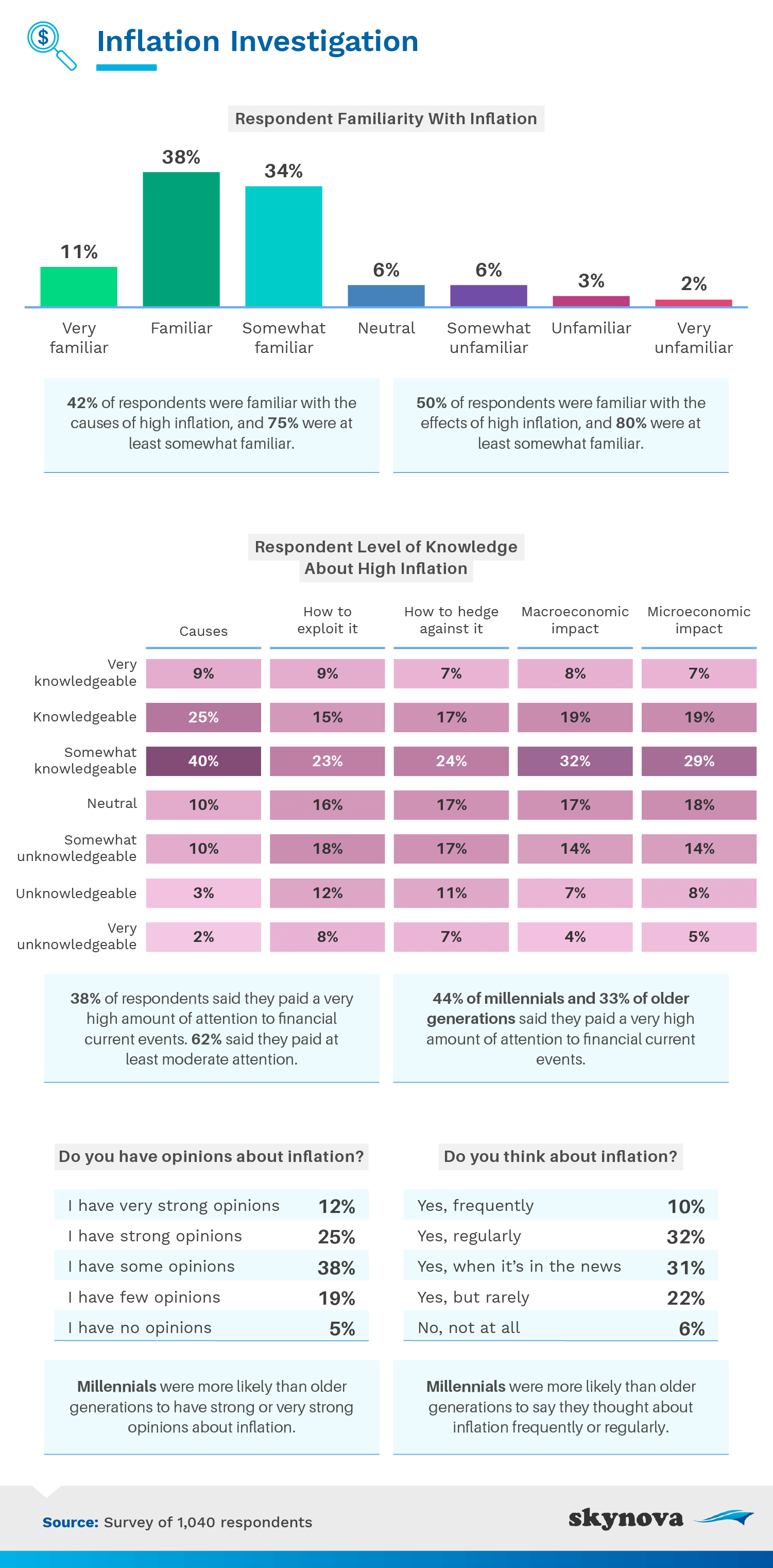

When asked about their understanding of the concept of inflation, nearly three quarters of respondents said they were either familiar or somewhat familiar with it. Also, 42% knew about the causes that can lead to high inflation, and half were well informed about its effects.

There are a number of factors that can inflate an economy. Typically, inflation results from an increase in production costs (cost-pull inflation), a spike in demand for products or services (demand-pull inflation), or an increase in the supply of fiat currency. Here's a cost-pull example: If raw material and/or wage prices increase, demand is unchanged, but the supply of goods declines due to the added costs of production. Therefore, consumers suffer the consequences in the form of higher prices for whatever finished product is presented to them.

Regarding specific inflation-related topics, like how to exploit and hedge against it, the majority of respondents said they were somewhat knowledgeable. Twelve percent were very opinionated on the subject of inflation, but most either had strong, some, or few talking points. Additionally, only 10% frequently thought about inflation, but it still passed through 60% of respondents' minds regularly, or when it was on the news.

Respondents share their opinions on how they think the inflation rate might change in the short term, and address concerns about inflation compared to other life topics.

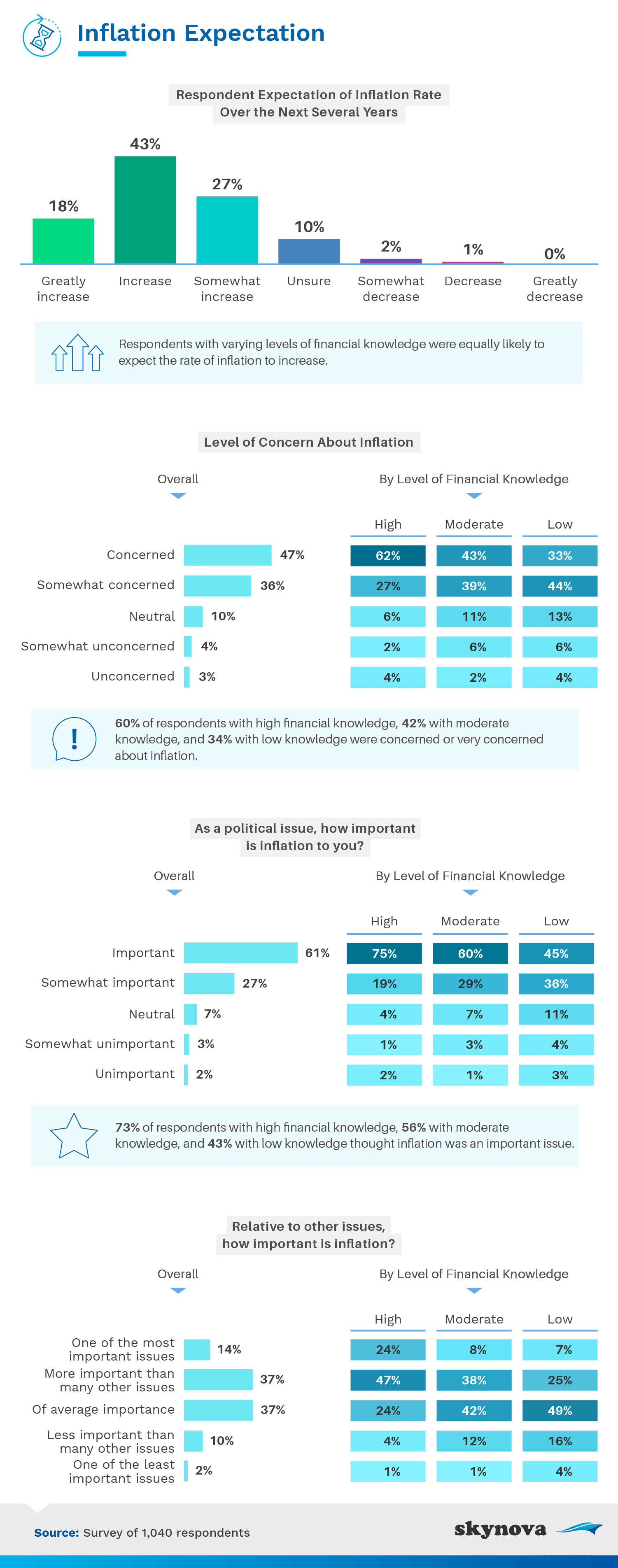

Over the next several years, a quarter of respondents are anticipating inflation to somewhat increase, whereas 43% think a general increase is coming, and 18% think it will skyrocket. According to projections published by the Statista Research Department, the inflation rate will likely increase from now until 2023, then taper off until 2026. Sixty-five percent of respondents either felt concerned or somewhat concerned about the current state of inflation, and their degrees of financial knowledge varied greatly.

As a political issue, people who thought the topic of inflation was either important or very important had a high level of knowledge on the subject. Respondents who labeled it as somewhat important, and those who had no opinion on the matter, were most likely to have a low level of inflation-related knowledge. There weren't many people who thought inflation was unimportant on a political level.

Relative to other issues, approximately half of respondents (most of which were very knowledgeable on the subject) thought that the topic of inflation was either one of the most important or of higher importance than other ones, and 37% (majority low-knowledge) thought it was of average importance.

While high inflation was generally considered a bad thing, that may not be the case for some people. Let's take a closer look at that.

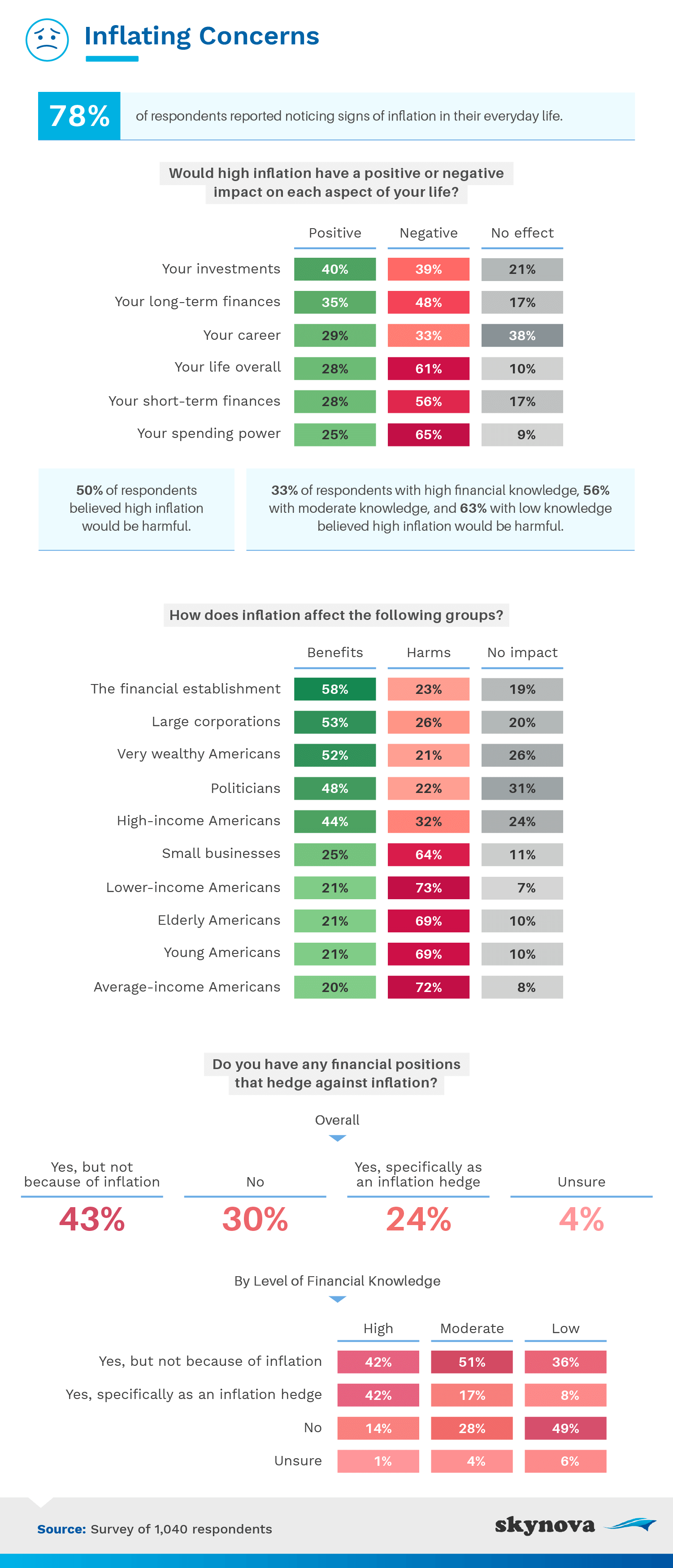

Nearly 80% of respondents said they had dealt with the effects of inflation in their everyday lives. When asked if high inflation was a good or a bad thing, 50% expected it to have negative impacts, and respondents with a higher level of financial knowledge expected it to be harmful. When considering the various aspects of someone's personal life (e.g. investments, career, and finances), the general consensus was that high inflation would create negative consequences for all of them.

Respondents also thought that inflation would be beneficial for society's more privileged groups, such as the financial establishments, large corporations, politicians, and wealthy Americans. On the other hand, people and groups in less fortunate positions (e.g. small businesses, low-income Americans) would suffer if inflation rates continued to rise.

All in all, inflation inequality is magnified by income inequality. For example, as high-income households get richer, firms tend to offer products at lower inflation rates to cater to these particular consumers' preferences. Meanwhile, low-income households deal with higher inflation rates and less variety among low-cost goods, such as off-brand medication and low-cost groceries. Unfortunately, this cycle renders economic mobility fairly inaccessible to lower-income households.

Forty-three percent of respondents claimed they had investment positions that hedged against inflation, but not necessarily due to inflation, whereas 24% had taken actions specifically to hedge against it. Some recommended ways to hedge against inflation include reallocating money into stocks, diversifying internationally, investing in real estate, and purchasing bank loans. Also, regardless of their level of financial knowledge, respondents were more likely to have financial positions unrelated to hedging against inflation in particular.

Most respondents were familiar with the concept of inflation, and based on their knowledge, the majority expected price levels to rise in the short term. Compared to other societal issues like politics, inflation was agreed to be a relatively important topic to consider in all cases.

Lots of respondents also had financial positions hedged against inflation, but not necessarily because of inflation itself. Regardless of their level of financial expertise, this reigned true among the majority of them. Also, while most considered high inflation a bad thing, they believed high rates could actually be beneficial for the wealthier subsects of society. Unfortunately, less privileged citizens are victims of an unfavorable cycle of economic inopportunity. While inflation may seem like a simple concept to grasp, it's anything but.

If you're a small business owner, Skynova's online invoicing system can help you manage your operations with unparalleled efficiency and organization. We also like to produce content that we are passionate about, and hopefully our readers are too. Our pieces will usually take on a business or workplace angle, tying in with another section of society (in this case, the concept of inflation). The articles are built using primary research (i.e. surveys) and secondary research (i.e. statistics, other online resources) to highlight and build on our findings.

For this study, we surveyed 1,040 respondents. Among those respondents, 451 were female, 585 were male, and 4 identified as non-binary. Our average respondent was 40 years old, and respondents ranged in age from 18 to 89. To help ensure data validity, all respondents were required to identify and correctly answer an attention-check question.

In some cases, questions and answers have been rephrased for clarity and brevity. These data rely on self-reporting, and potential issues with self-reported data include, but are not limited to, the following: attribution, exaggeration, telescoping, and selective memory.

There's lots to learn about the concept of inflation and the different ways it can affect us. If you know someone who might be interested in this piece, feel free to share this article with them for noncommercial use only. Also, please provide a link back to the original page so they can access our full findings and methodologies.