|

The term "unicorn" was coined in 2013 by venture capitalist Aileen Lee to emphasize the rarity of a startup company with such high value, which referred to the fact that these companies were valued at $1 billion or more. Their rarity is emphasized by the fact that only around 600 exist in the world, with the United States leading the pack. So how did these rare and valuable startups and the unicorn market itself fare during the pandemic and beyond? The list of unicorns is growing rapidly, with over 180 companies reaching unicorn status in 2021 alone. We analyzed data from various venture capital funding sources and datasets in order to find out more about venture capital activity around the world and looked into the biggest unicorns by country, their valuations, and which industries are becoming hot spots for lucrative startup concepts. Read on to learn about this exciting startup ecosystem.

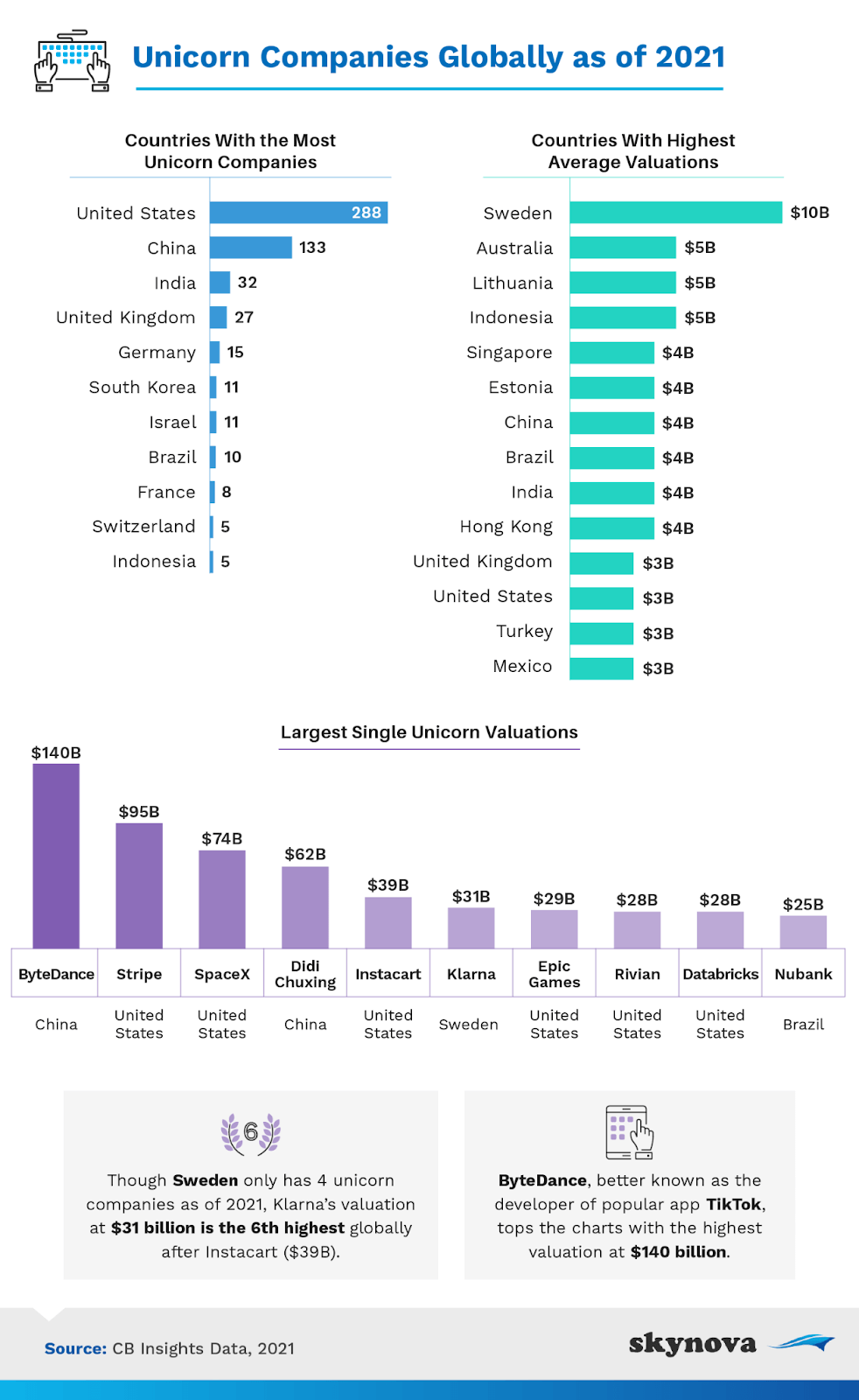

Unicorn companies come from all over the world, with startups ranging from Indonesia to America being valued in the billions every year. According to our data, the United States led the way with 288 unicorns as of 2021, with China having less than half as many, though still a main U.S. competitor compared to the rest of the world in sheer quantity of billion-dollar startups. Interestingly enough, the U.S.’s average value of its unicorns is much less intimidating compared to other countries.

Quantity doesn’t always translate to quality; the U.S. leads the world with the most unicorns, but the average value of American unicorns is less than a third of Sweden’s. Meanwhile, Brazil and India are the only other countries to find themselves in the top ten for both quantity and value.

The U.S. has five of the top ten largest unicorn valuations currently, but China has the No. 1 overall unicorn on earth in ByteDance, valued at $140 billion. Sweden’s average valuation number is certainly helped by the Swedish company Klarna, valued at over $30 billion, and the number six highest valued unicorn worldwide.

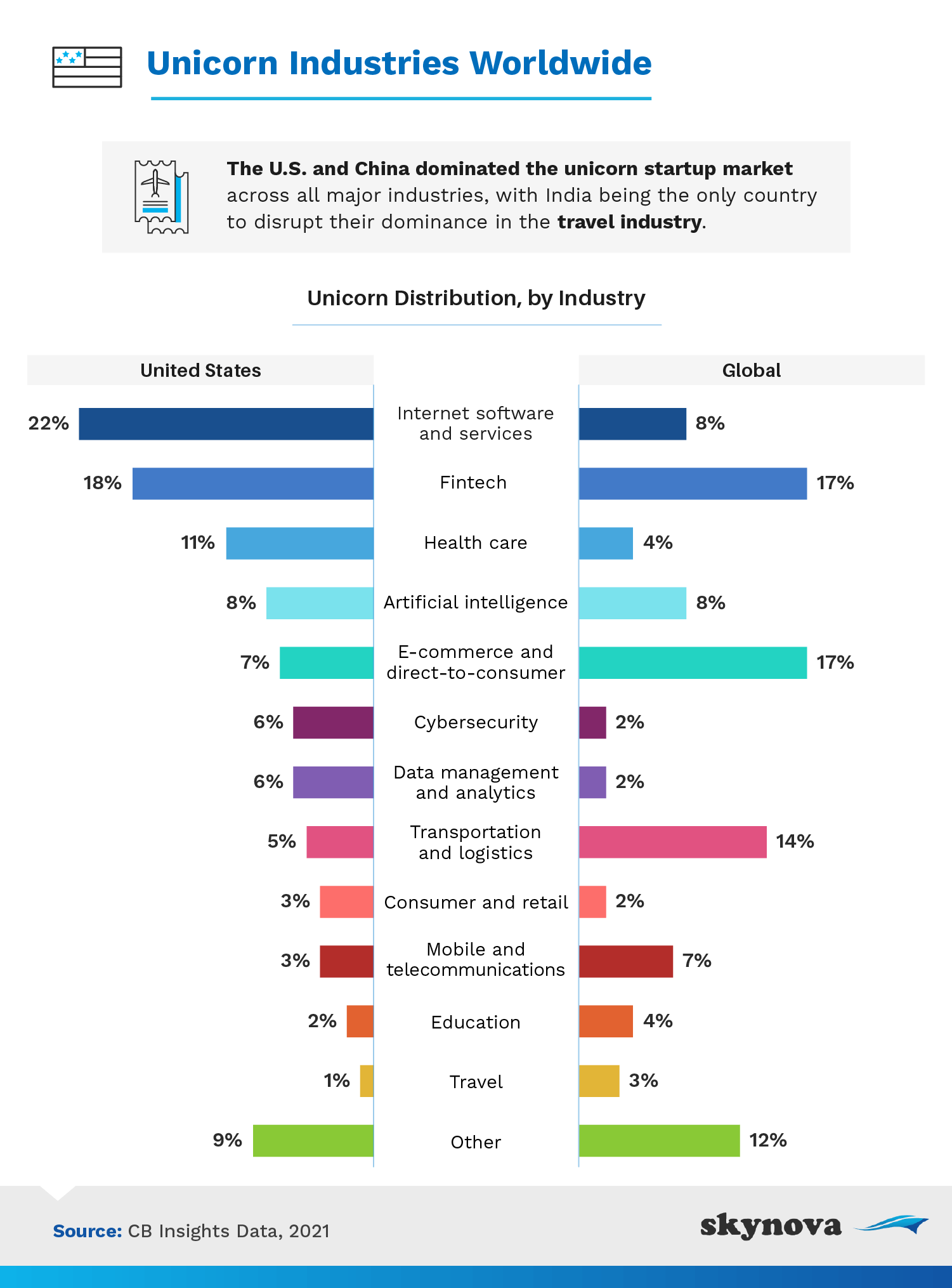

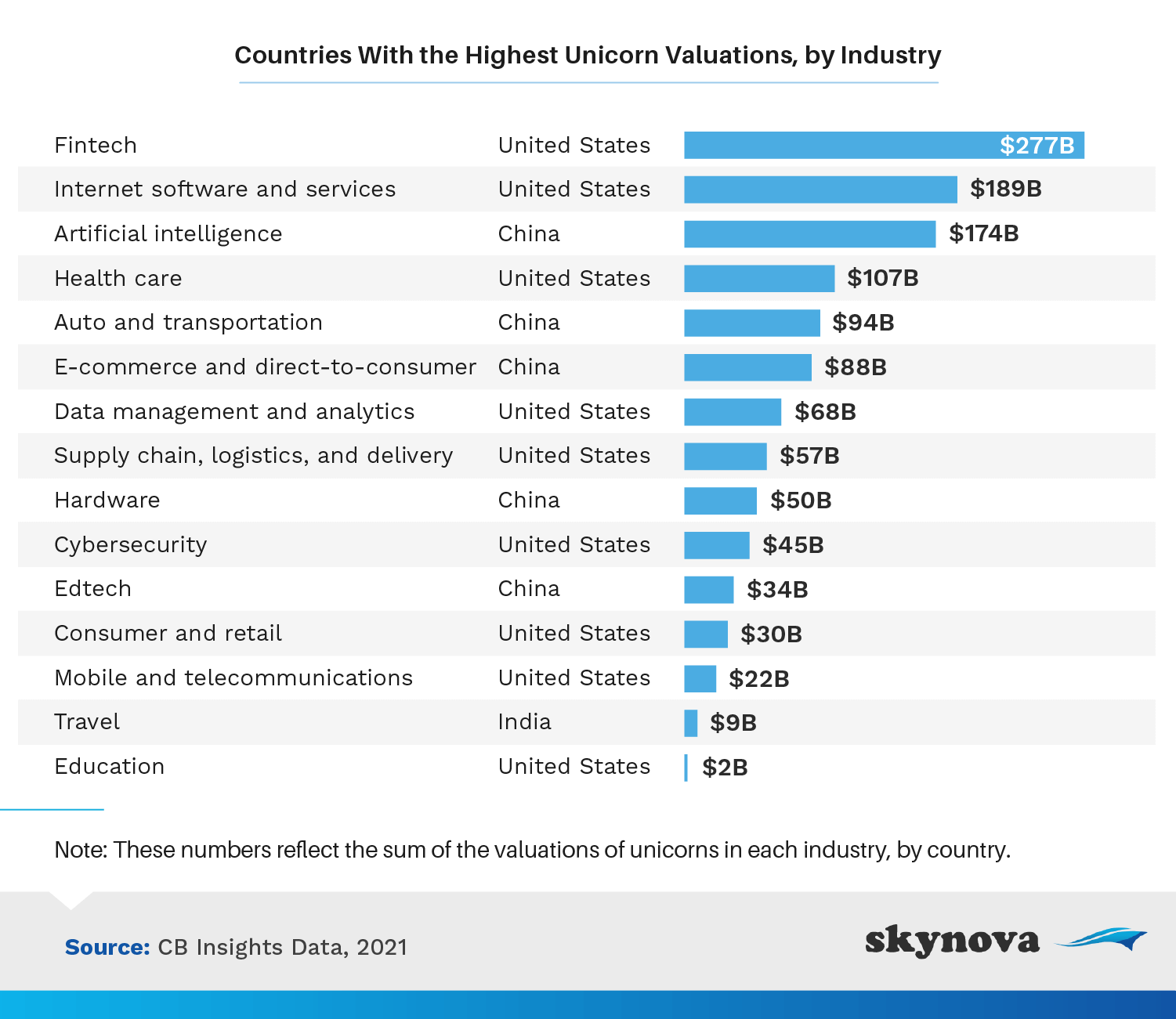

A unicorn is born somewhere in the world roughly every three days. Just like certain parts of the U.S., like Silicon Valley, are known for their bustling and cutting-edge internet startup economies, certain parts of the world are hot spots for specific industries as well. The U.S. leads many of the highest valued industries, like fintech and internet software, but falls behind China in industries like automotive and artificial intelligence. India holds the top spot in the travel industry, which isn’t surprising considering it only accounts for 1% of U.S. unicorns but is more common internationally, according to our research, making up 3% of worldwide startups.

The third most common industry for unicorns in the U.S. is health care, which had a record year in 2020 as seven health care unicorns exited. The health care unicorn landscape will see some major shifts in the near future, as 67% of U.S. health care unicorns are late stage and could possibly exit in the next year or so, chasing lucrative exits from disruptors like 23andMe, since its merger with Richard Branson and the help of his SPAC, a "special purpose acquisition company" designed to help companies go public outside of the lengthy IPO process.

Silicon Valley and the tech boom created some considerable unicorns over the past few years, leading the world in the financial technology and internet software and services industry with unicorns like Stripe and Chime. And while the most common unicorns in the U.S. are from the internet software and services industry, making up 22% of all unicorns, American fintech startups dominate that industry in terms of value.

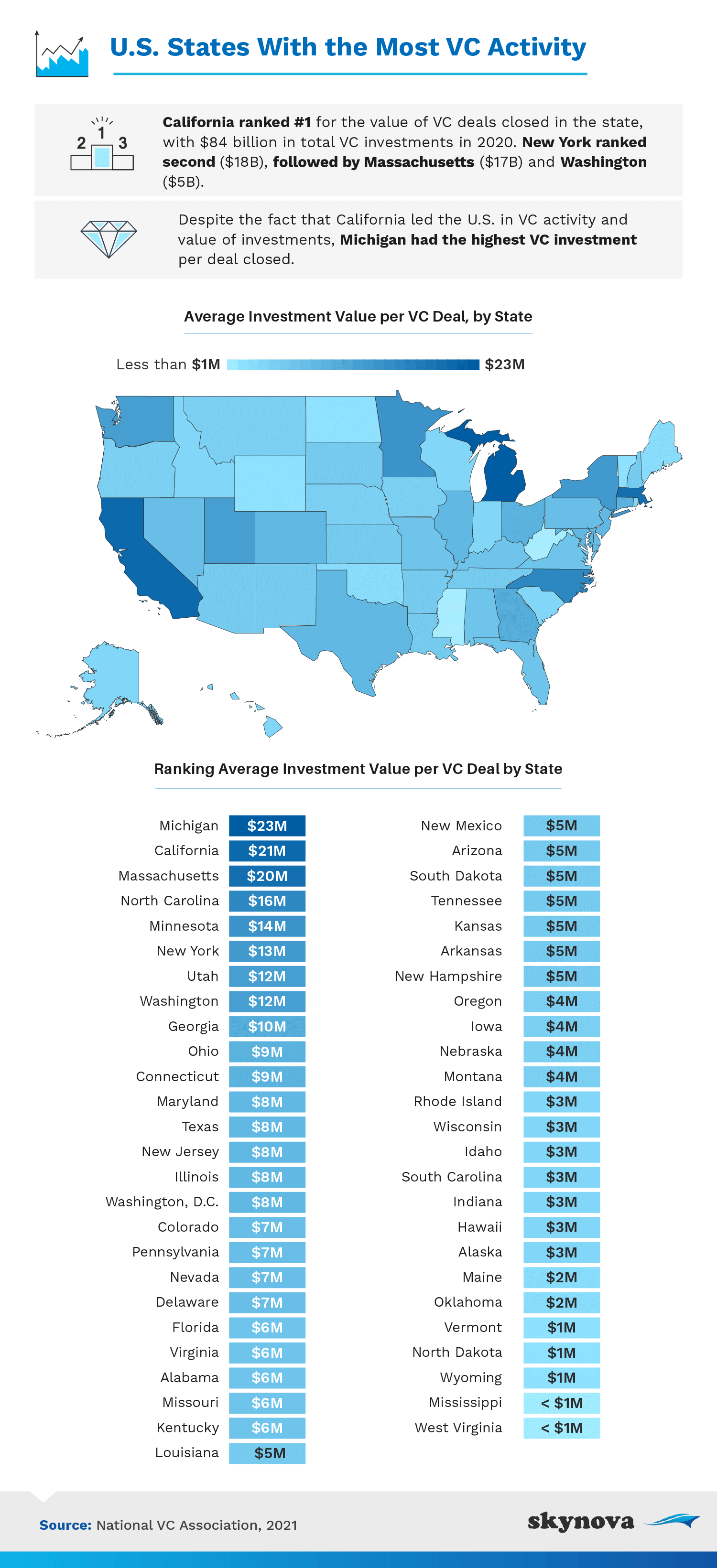

Despite government sanctioned shutdowns of entire industries amid the pandemic of 2020, venture capital assets continued to grow last year against the odds. California continues to lead the way in the total value of VC deals with more than four times the value of the next closest state, New York. But while the state of California has the highest number of investments, it’s Michigan that has the highest average investment value at $23 million. This number was likely helped by huge investments into the automobile manufacturer Rivian, to the tune of $1.2 billion of investments between Ford and Amazon.

Massachusetts also falls just behind New York in total VC investment, but has a more than 50% higher average at $20 million, compared to New York’s $13 million. And while Washington ranks fourth in total value of VC investments into its startups, it ranks seventh (tied with Utah) when you consider the average value of each VC investment.

Though unicorns may be rare, they may be more resilient than we originally thought – recent news highlights a record year of IPOs through a pandemic and much economic uncertainty. The U.S. seems to be continuing its history of leading the tech community, with China right on their heels with exciting companies like ByteDance producing products like TikTok, and considerable activity in the artificial intelligence market. Thousands of deals were closed in the U.S. last year, with California leading the way at nearly 4,000 venture capital deals, so the future of unicorns is certain: Cutting-edge startups from internet, fintech, and health care are going to continue to grow in America, even as the rest of the world puts their VC money into e-commerce and transportation.

Skynova is there for small businesses, providing them with sophisticated online tools to help them stay organized, professional, and competitive. Skynova can help small-business owners send professional invoices, track time sheets, or use more advanced tools for tasks like accounting to make sure they have the resources and time they need to succeed. Skynova also provides in-depth research and data projects covering topics that really matter to business owners, like looking at the latest startup trends, tracking venture capital activity in the United States, and understanding business trends, to see how industries will evolve over the next several years. Visit Skynova.com today for the resources and tools you need to help your business possibly grow into a unicorn.

We analyzed venture capital data from various sources including the National Venture Capital Association Yearbook as well as CB Insights data, which provides market intelligence on investor activities, in order to explore the activities of venture capital and the prevalence of unicorns in America and globally.

We are living in such an exciting time of unicorn startups, so it’s natural to want to share our study with like-minded entrepreneurs or dreamers. We only ask that you share our study for noncommercial purposes, and to link back to our work so we can receive credit.