|

Small businesses play an important role in the American economy. Most self-employed workers have faced numerous challenges in recent years due to the Coronavirus pandemic and economic inflation. But despite the issues they've encountered, many small businesses continue to grow and appeal to new customers.

To provide insight into the structure and operation of a successful small business today, we've gathered statistics to help small businesses stay strong in 2023. This information also provides clarity about what the future of small-business ownership may look like for any entrepreneur who's thinking about starting a new venture.

Many new business owners test the market each year, but not every aspiring entrepreneur will stay in business for the long haul. Here are the key statistics regarding how long small businesses last and what percentage of them fail.

To qualify for Small Business Administration (SBA) benefits and various similar federal programs, a business must not exceed the specified revenue or number of employees based on its industry.

While it varies by industry the maximum standard number of employees ranges from 100 to 1,500, and $2.25 million to $47 million in annual receipts. The specific guidelines for qualifying as a small business can be found through the NAICS code or the industry description.

Despite the uncertain economic landscape, many entrepreneurs continue to bring new businesses to market, with 12% of all businesses in the U.S. being less than a year old.

Another 1,419,527 small businesses have experienced long-term success, maintaining operations at least since 1993.

Nearly 214,279 of the American businesses formed in 2022 will likely close their doors after less than one year of operation.

One in two businesses will be able to survive the first year and maintain operations for more than five years after forming.

Among businesses that make it past the five-year milestone, about 70% will remain operational for more than ten years.

The survival rate increases significantly once a business lasts more than 10 years. A few more companies drop off between years 10 and 15, and the remaining business owners represent 25% of individuals who open small businesses.

Eighty-four percent of business owners who have lasted more than fifteen years will celebrate the 20th anniversary of their business's opening.

Over one million new businesses opened in 2022, and 43% of American adults plan to form their own businesses in 2023. Last year, one-third of startups were created by aspiring entrepreneurs doing so for the first time, suggesting we may see some first-timers this year as well.

The largest percentage of U.S. small businesses (nearly 14%) fit into the professional, scientific, and technical services industries. Another 11% are in various other uncategorized business industries, and 10% are in construction.

Only 1 in 10 businesses in the U.S. qualify as a large corporation. The rest meet the SBA's standards for a small business.

Although gross domestic product (GDP) for large businesses is growing faster annually, small businesses continue to report positive GDP increases year after year, generating 44% of economic activity in the U.S.

In 2022, more than 65% of small businesses reported being profitable. Most of them (85%) also expect their business to survive despite the current economy.

Two in three small businesses have made charitable contributions, and 90% of business owners believe it's important for businesses to give back to their communities.

This number is nearly the same as it was in Q3 2022 (65%) and Q2 2022 (66%). But only 27% said the same about the U.S. economy, indicating possible concerns about future economic growth.

Most small-business owners (70%) believe customers expect the ability to complete online transactions.

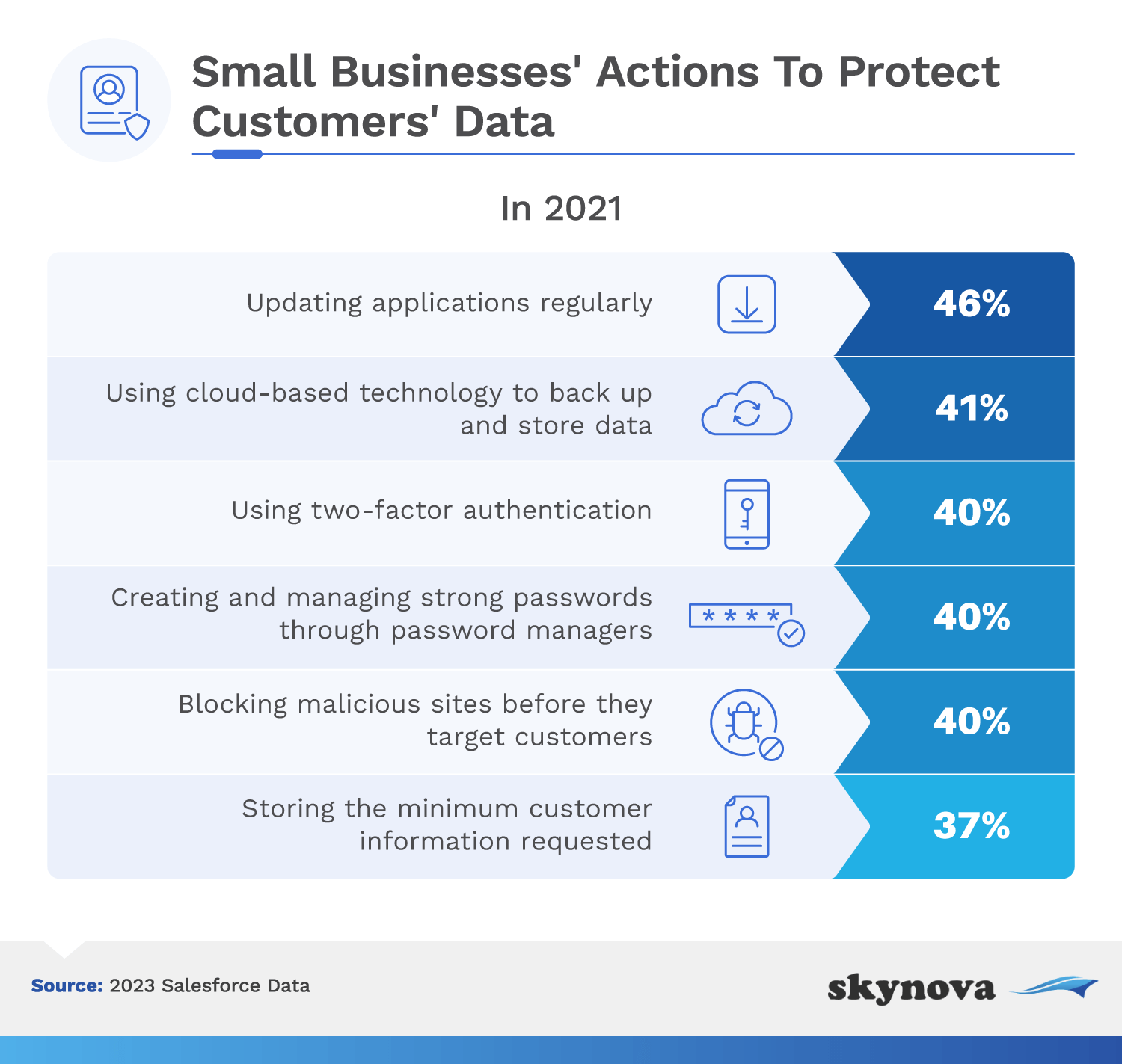

Nearly half of growing small businesses consistently update or improve their applications. Many also back up data in the cloud and/or use two-factor authentication to protect customers' data.

Many jobs were lost after the onset of the COVID-19 pandemic by the second quarter of 2020. But small business job creation is recovering well and has since increased.

2022 saw the highest percentage of this sentiment on record since 2016. Nearly half of small-business owners (48%) reported a revenue increase in 2021, and another 29% noted that their revenue stayed the same.

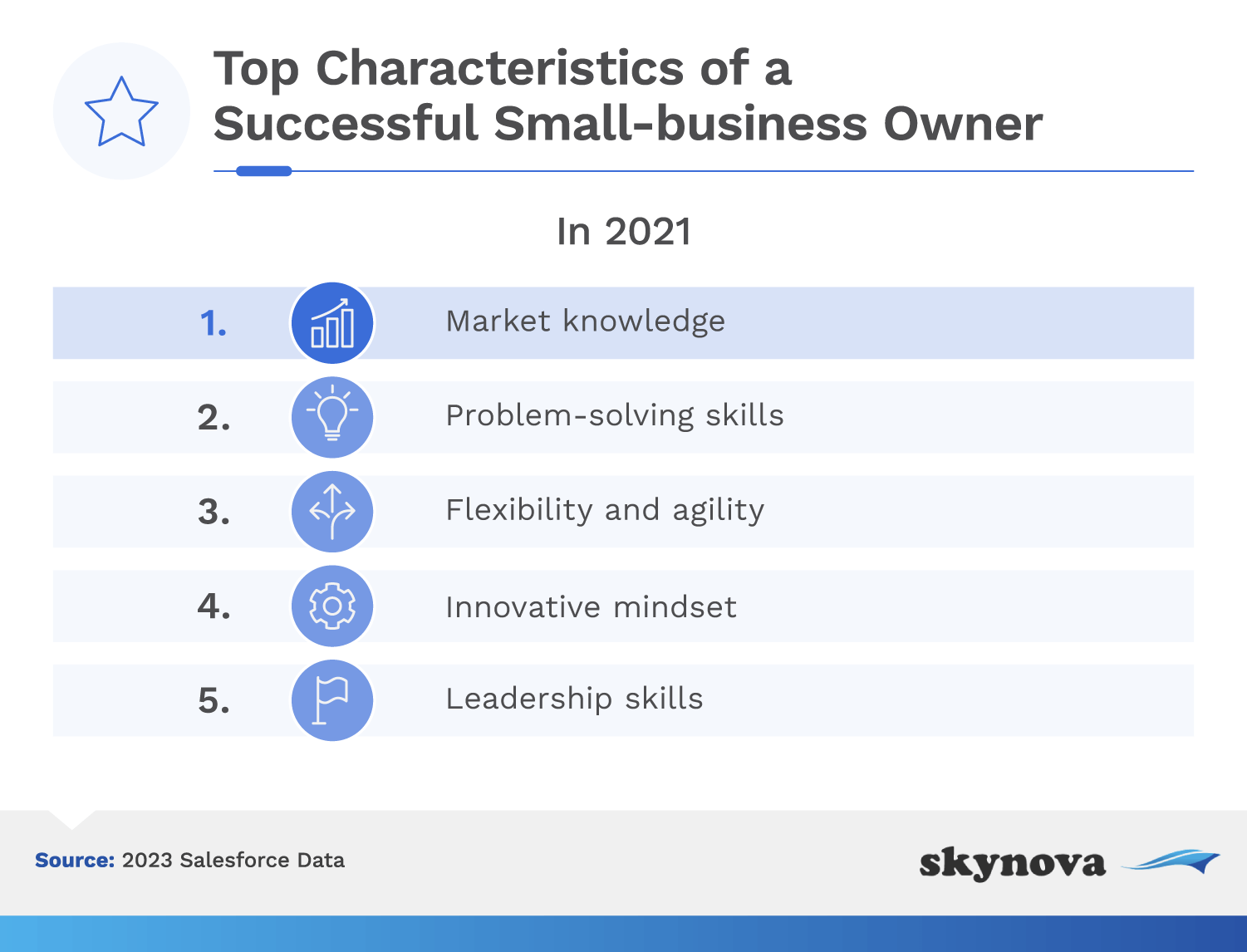

Problem-solving skills ranked second, while flexibility, an innovative mindset, and leadership skills rounded out the top five attributes of successful entrepreneurs.

Other technologies they expect to become more important include 5G, automation, and AI.

Small businesses fail more commonly in some states than others. This may be due to certain laws and tax regulations, or it could be related to a business's market in that particular state. Keep reading to learn about the best (and worst) states for startups.

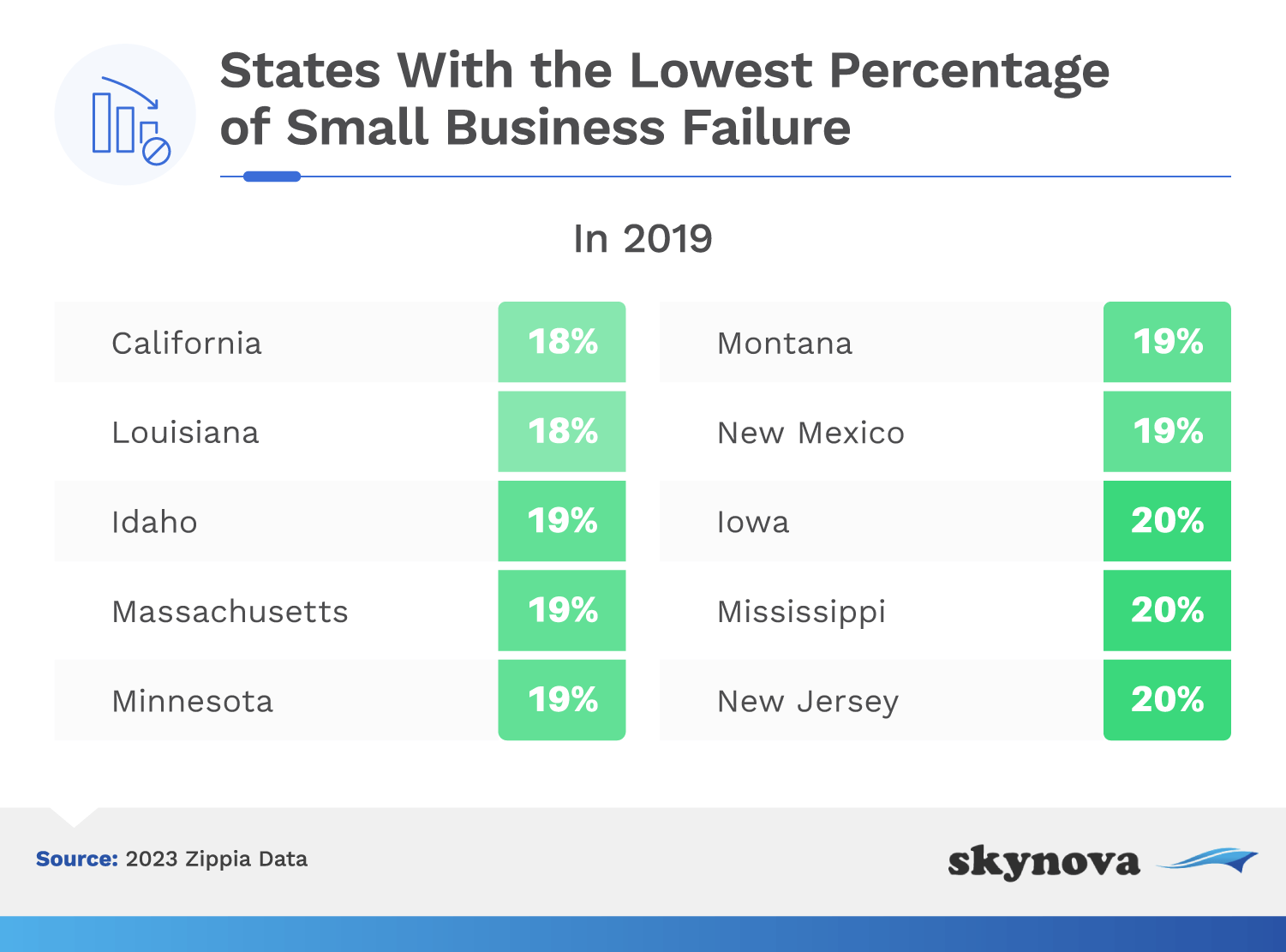

Based on the rates of small business failure in 2019, 82% of small-business owners in California can likely expect some degree of success. Entrepreneurs in Louisiana, Idaho, and Massachusetts are also likely to have high success rates.

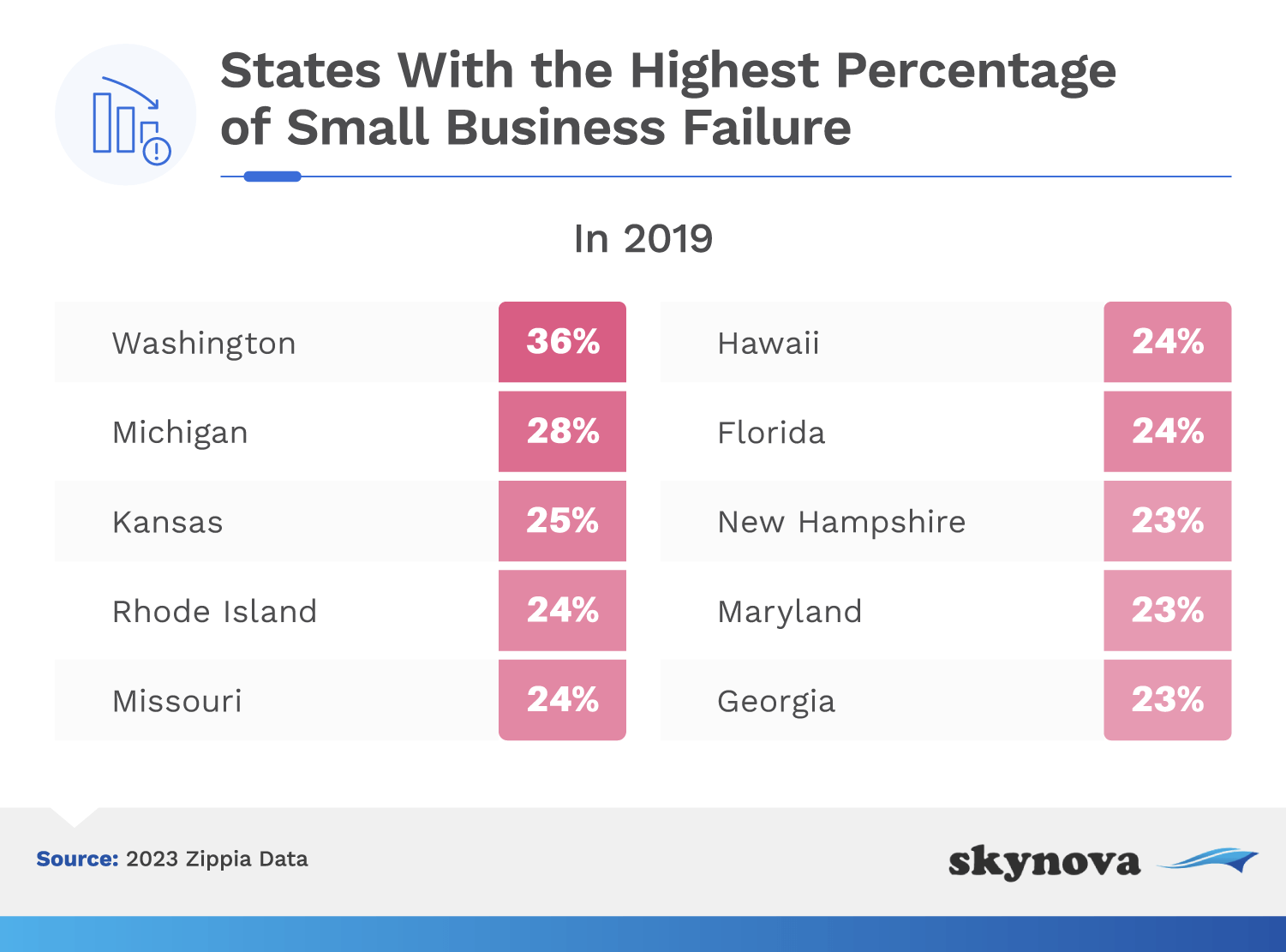

Over one-third of Washington's small companies may struggle to get off the ground. Michigan is a distant second on the list, with 28% of new small businesses having failed in 2019.

Small businesses make up a significant portion of the global economy, so it's important to understand how small enterprises grow and develop worldwide. These statistics shed light on the current international landscape of small businesses.

Small and medium enterprises (SMEs) play a vital role in the global economy, especially in developing countries. Small, medium, and micro businesses may contribute as much as 40% of the national GDP in these economies.

That number climbs even higher if you include informal SMEs. By 2030, another 600 million jobs will be needed to keep up with population increases.

Although most jobs come from SMEs, many of these businesses need help acquiring proper funding and must rely on internal cash reserves or personal loans.

According to the International Finance Corporation, 65 million firms in developing countries have a combined total of $5.2 trillion in unmet business financing needs.

Small-business owners come from a variety of backgrounds, demographics, and interests. While studies may identify some common characteristics, no two small-business owners are exactly alike.

More than 1.7 million veterans are small-business owners, and veterans make up 5% of the American workforce.

Over 70% of small-business owners report feeling some degree of happiness. Only 5% reported feeling very unhappy, and less than 15% of small-business owners expressed some degree of unhappiness.

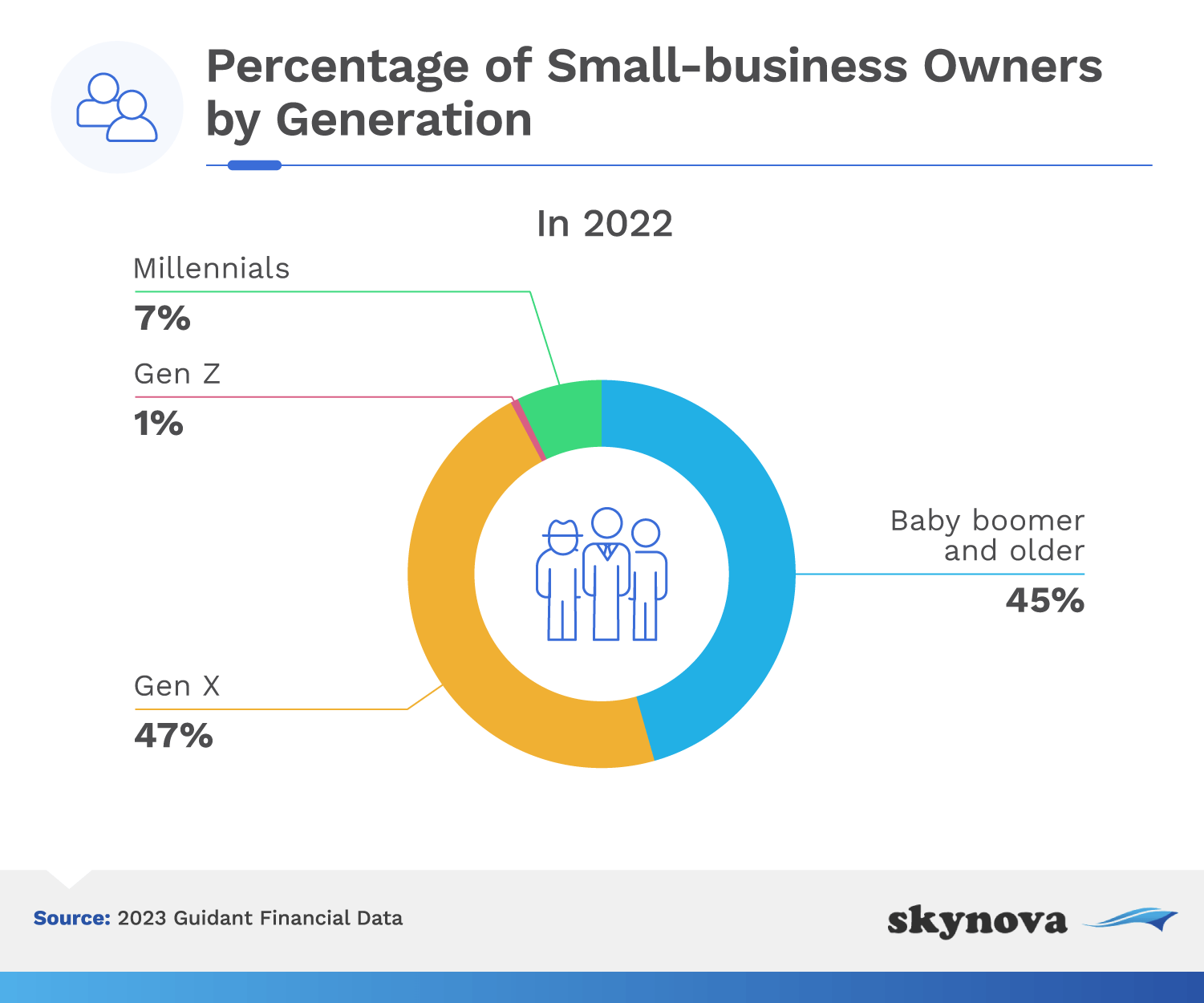

Among current and aspiring small business owners, only 7% are millennials. The majority are GenX (45.5%) and Baby Boomers (46.5%).

Pay can increase steadily as small-business owners spend more time in the industry. New small-business owners make an average of $35,000 annually, and most can expect to top $60,000 after 5-9 years of operation.

This number represents a record high, as many small-business owners continue to express uncertainty about the future state of the U.S. economy. The percentage has jumped 30% in the last year.

Although average salaries are similar, high and low numbers can vary drastically. Some small-business owners make less than $30,000 annually, but the highest earners may bring home close to $130,000 each year.

While the average age to start a business is 35, the average small-business owner is 44 years old.

Around 74,000 small-business owners are members of the LGBTQ community.

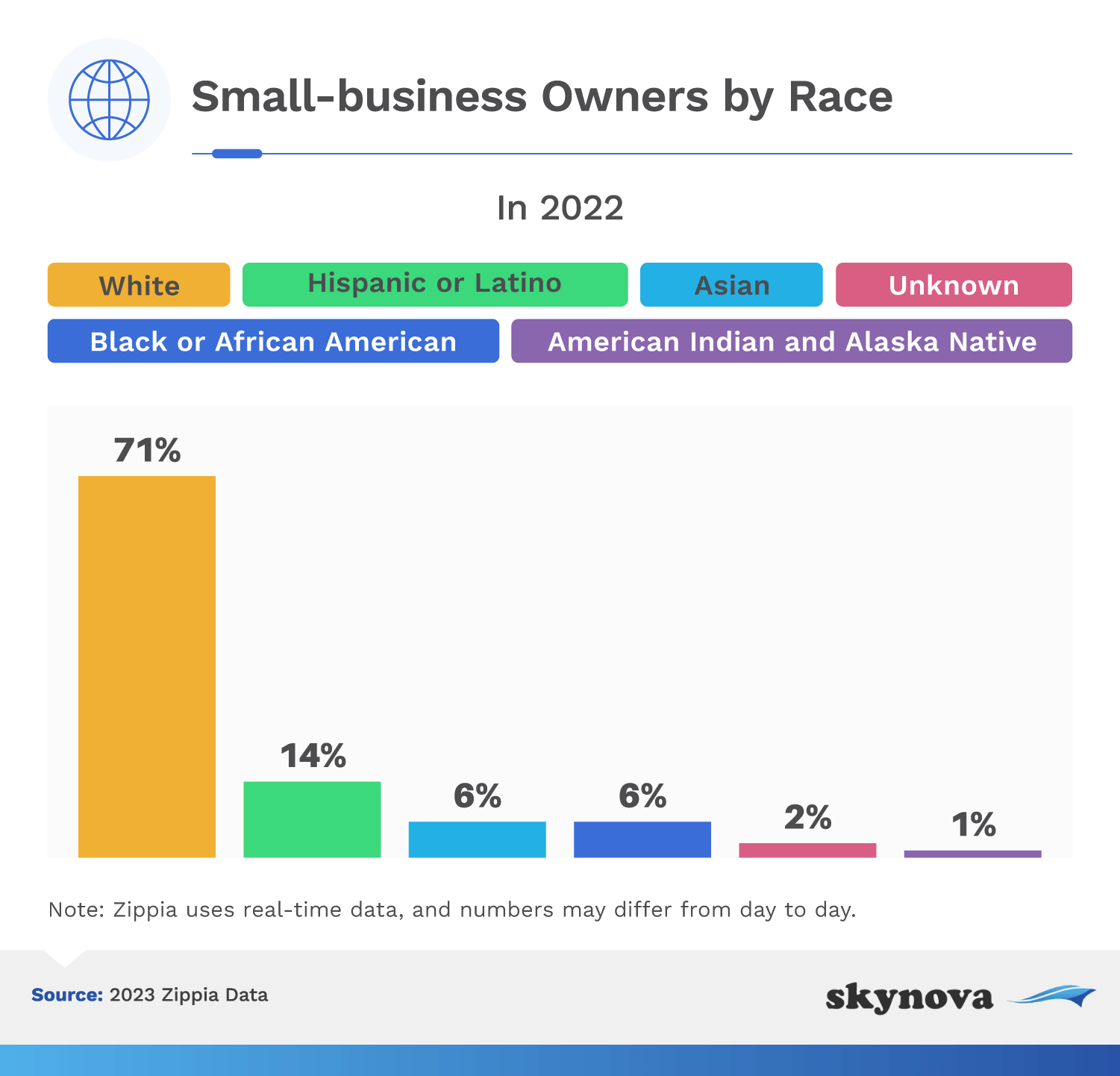

Over 100,000 small-business owners are Hispanic or Latino. Another 50,000 are African-American owned, and Asian Americans own a similar number of small businesses.

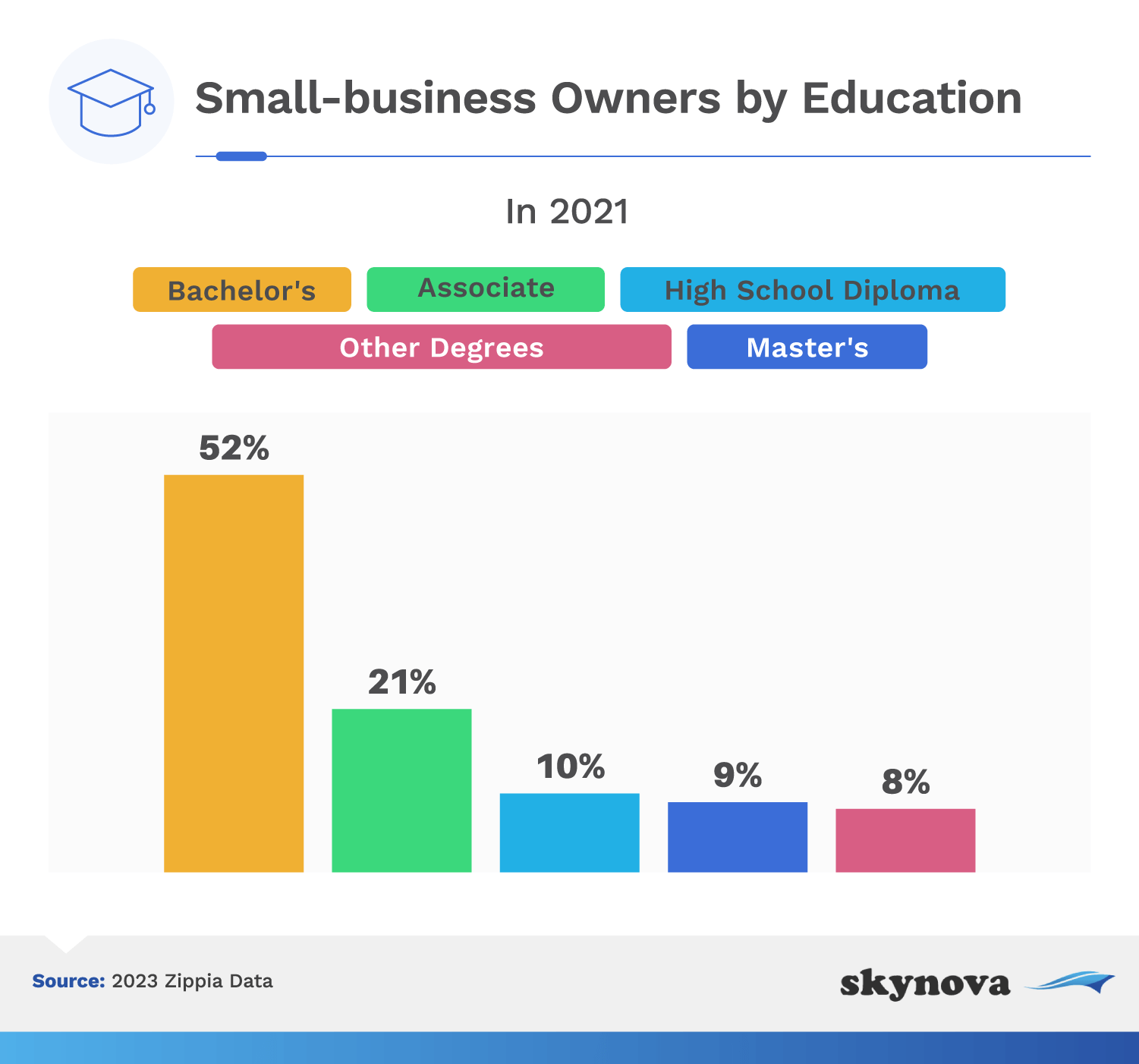

Some small-business owners (around 20%) have an associate degree as their highest level of education, and even fewer (10%) have only a high school diploma.

23.5% of Americans have a Bachelor's degree, while more than half of American business owners also have a four-year degree.

Most new business owners spend about 11-12 years working in their industry before venturing out on their own.

A large number of small businesses are also female-owned businesses. Below, you'll learn about several small business trends among them.

Nearly 70% of female small-business owners are Gen Xers. Another 19% are baby boomers, and 11% are millennials.

If that figure seems lower than expected, understand that nearly half of female-owned businesses (49%) are five years or younger, and businesses tend to become more profitable over time.

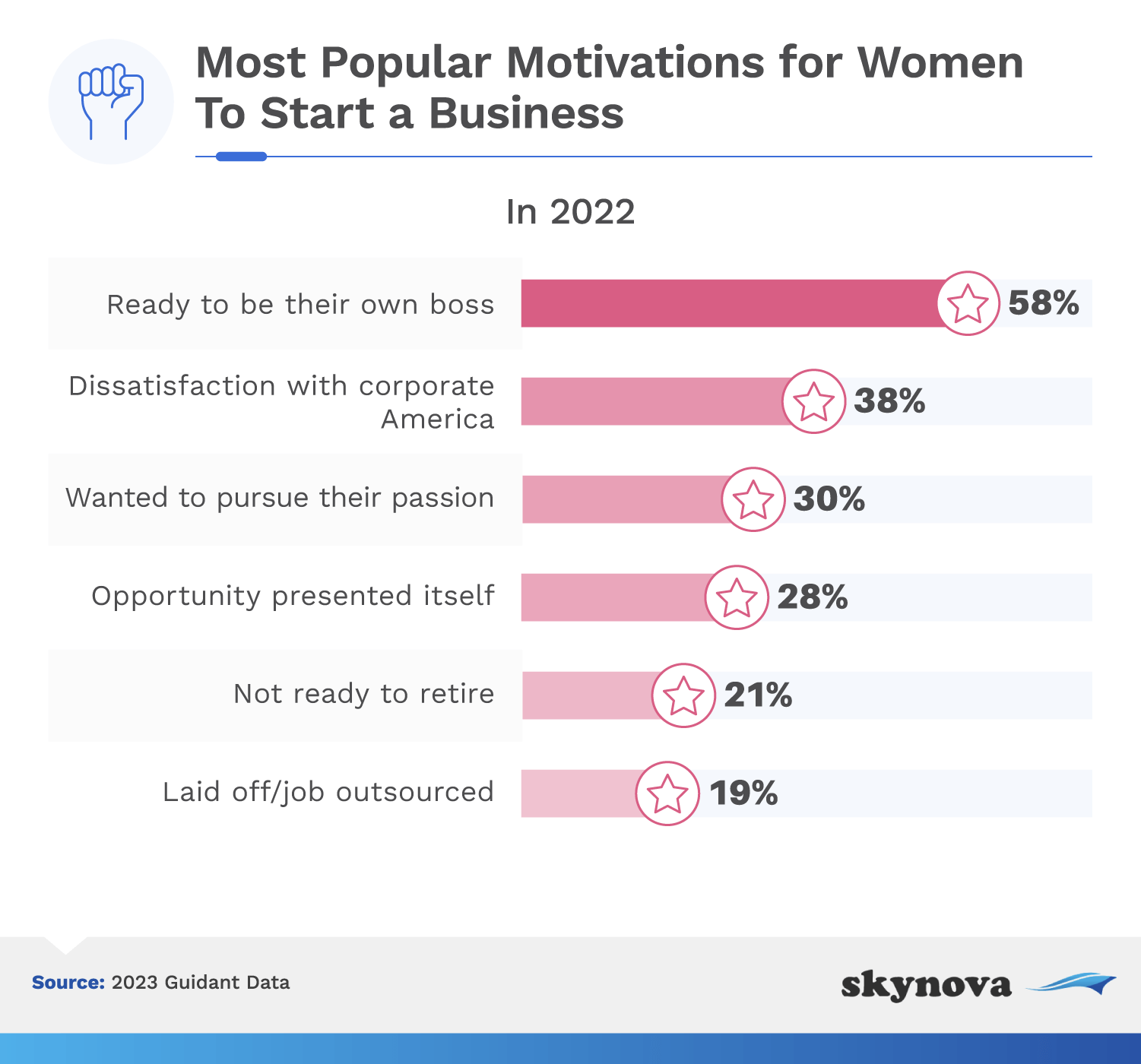

A desire to be their own boss is the most common reason why women start their own business. Another 38% felt frustration with corporate America, and 30% decided it was time to pursue their passion.

Most female small-business owners (around 70%) feel some level of happiness in their business, while less than 18% express some level of unhappiness.

Most small businesses require some level of outside funding in their early days. Many different options exist for businesses looking for funding, and the statistics below will reveal how most businesses pursue their initial startup capital.

This amount represents more than 62,000 traditional small-business loans and another 1,200 investments via Small Business Investment Companies (SBICs).

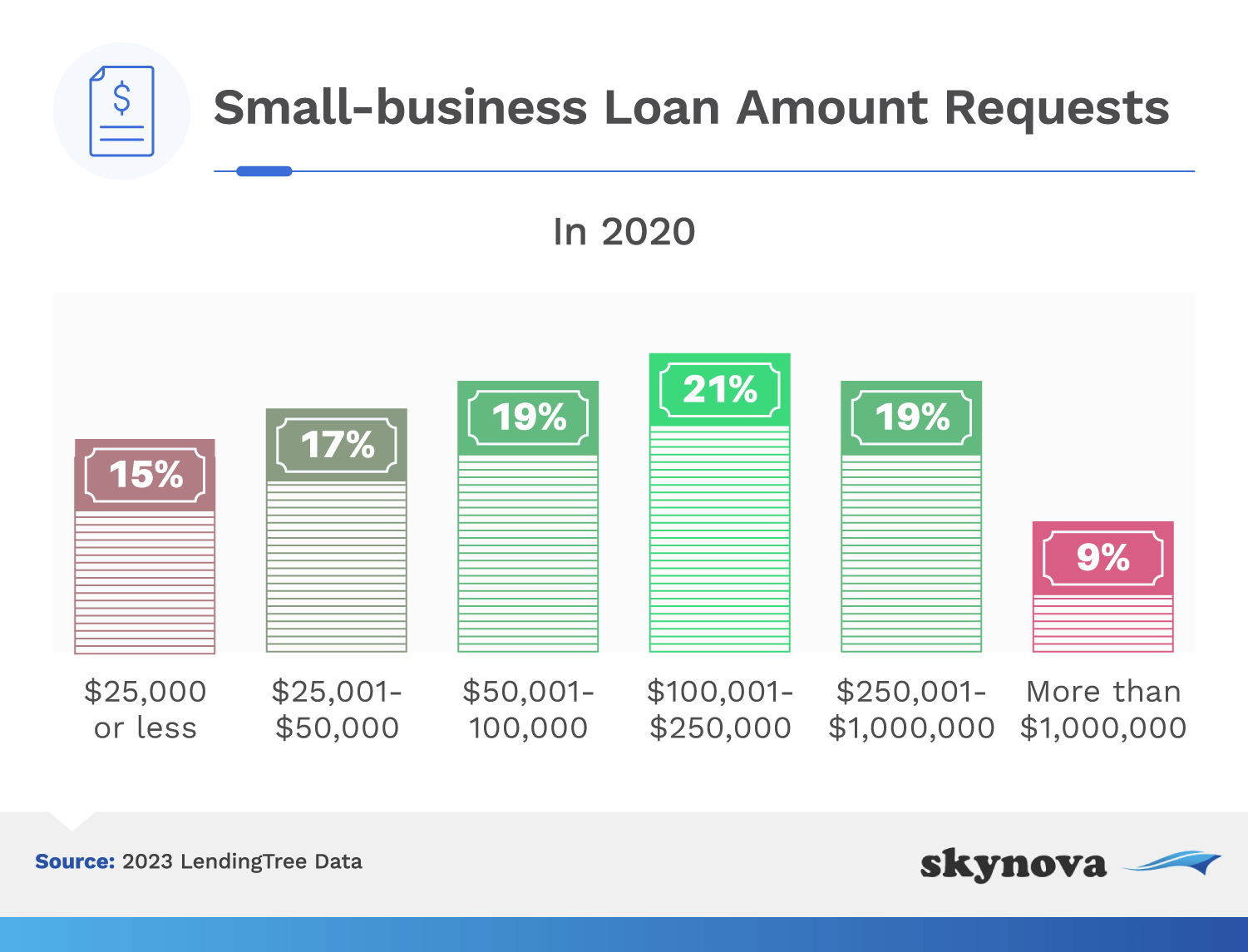

Another 19% of small-business owners sought loans between $250,001 and $1,000,000, and only 9% asked for loans greater than $1 million.

This 2021 number increased drastically from the year prior, when the average loan amount was only $533,076.

This average has increased every year since 2014, with the largest hike happening between 2020 and 2021.

However, 49% of entrepreneurs start with more than $10,000 in cash reserves leaving only a small percentage in the middle starting with between $5,000 and $10,000 worth of cash reserves.

Over a quarter of small-business owners have between one and five paying customers after the end of their first year. Slightly fewer (less than 18%) have at least 100 customers.

More than one-quarter of small-business owners who used personal funds for their startups had less than $5,000 in the bank. Only slightly more than 10% had more than $50,000.

Many mentors recommend that entrepreneurs have enough cash in the bank to live for six months after starting their business, since bringing in paying customers can take some time.

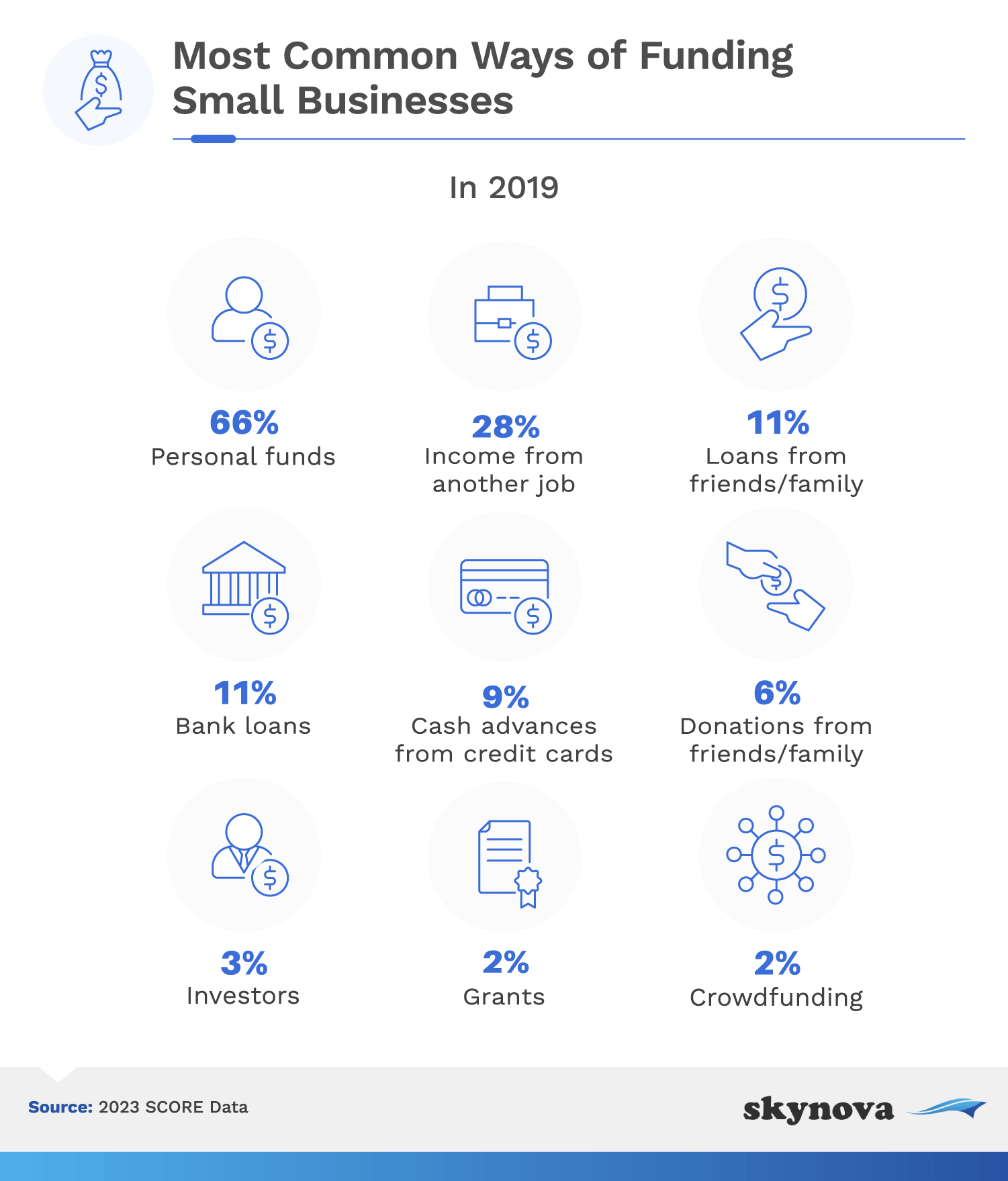

Some new business owners (8%) pursue bank loans, and 5% seek funding from friends and family. Another 9% use cash advances from credit cards.

Many Americans work as employees for small businesses. The jobs these businesses create are essential for the continued prosperity of the national economy. The stats below review how many Americans work for small businesses and how many small businesses hire additional employees beyond the owner.

Professional, scientific, and technical service small businesses employ the greatest number of individuals.

Although only 20% of small businesses have employees, over 29 million Americans work for a small business. In 2022, small businesses employed almost 62 million people.

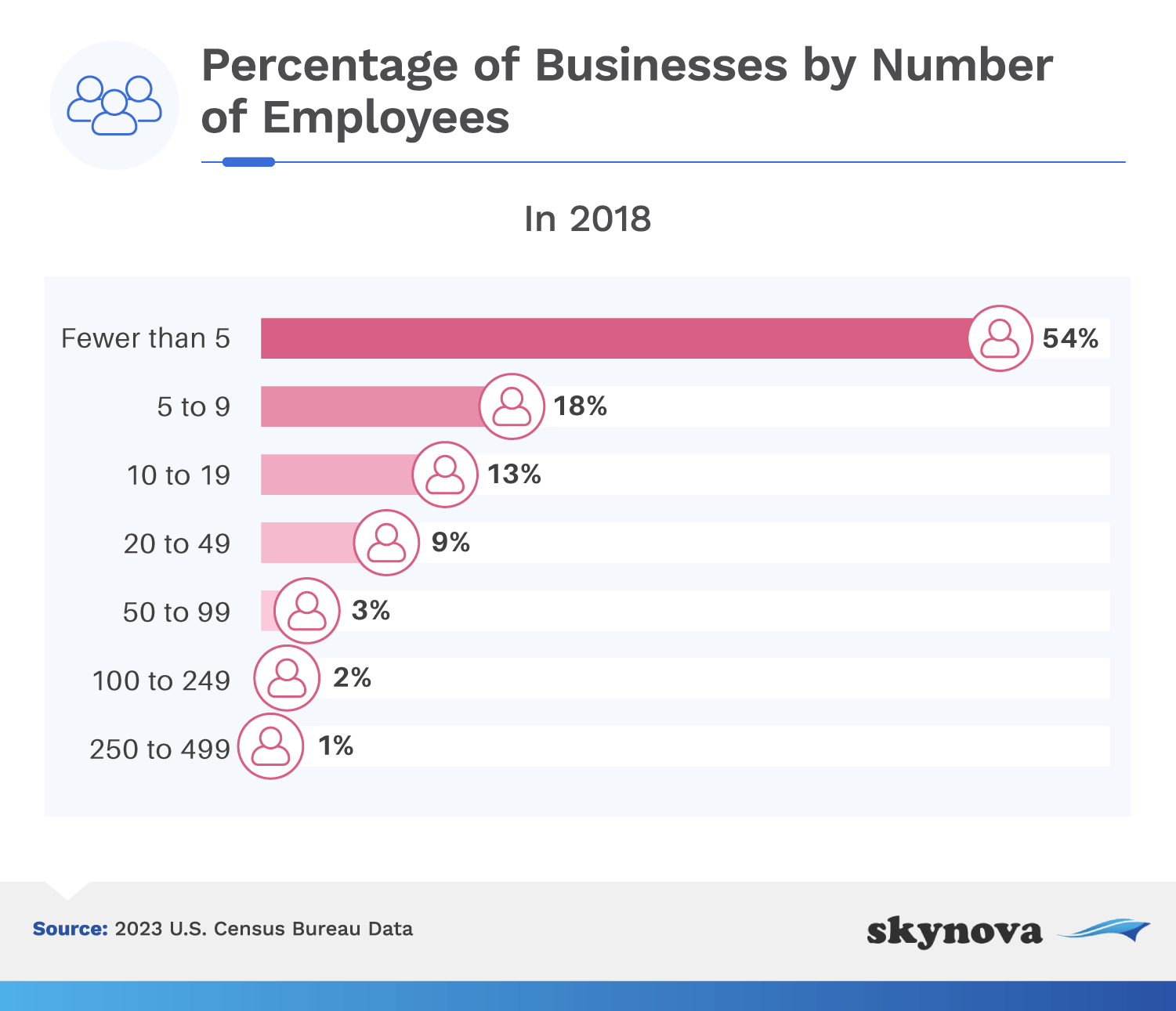

The next most common range was 5-9 employees (18%), followed by 10-19 (13%).

Over half of small-business owners consider the hiring process to be at least somewhat challenging, and only 7% view the process as easy.

Over 24 million family-owned businesses exist in the United States, making up 64% of the total GDP.

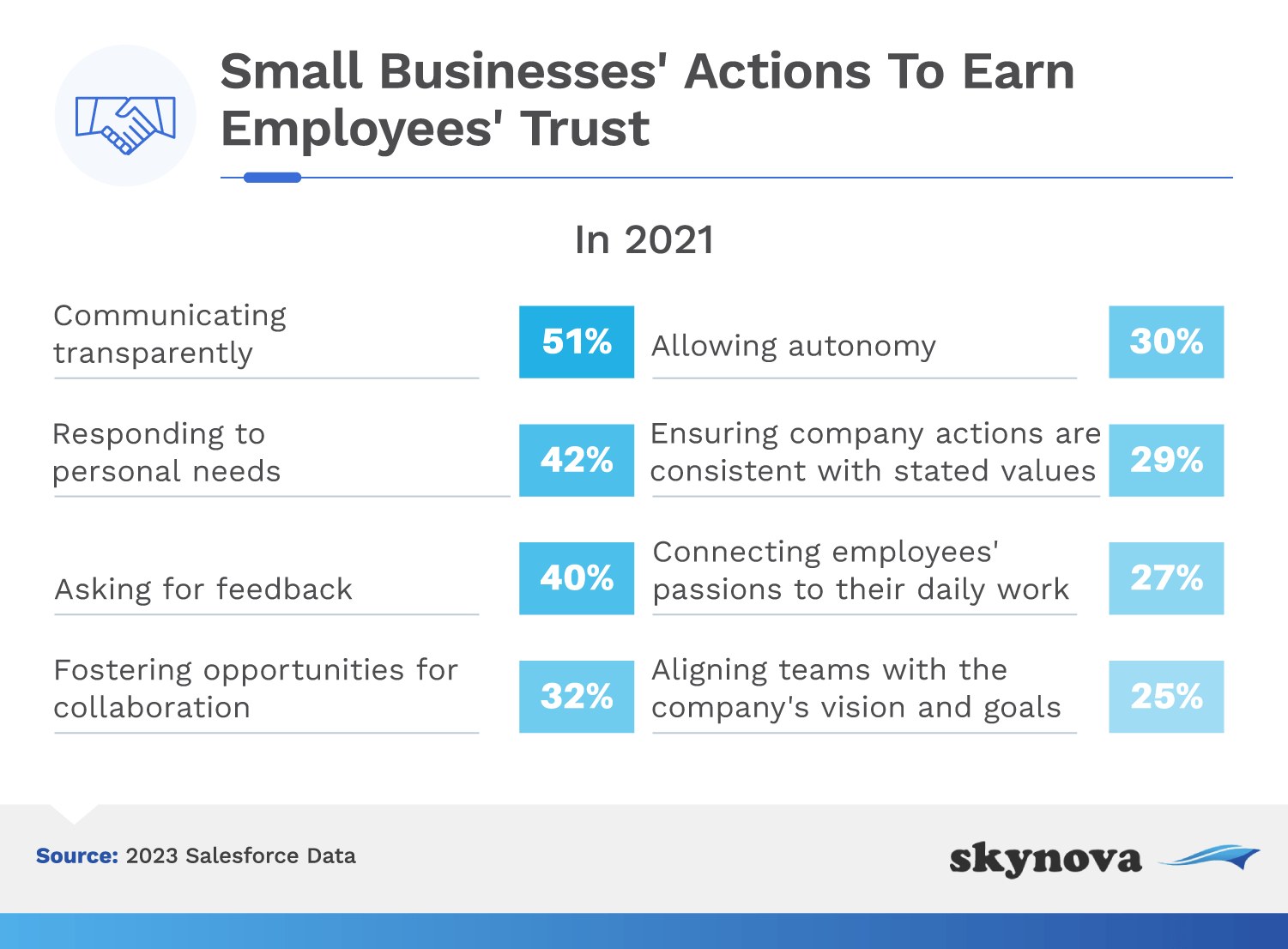

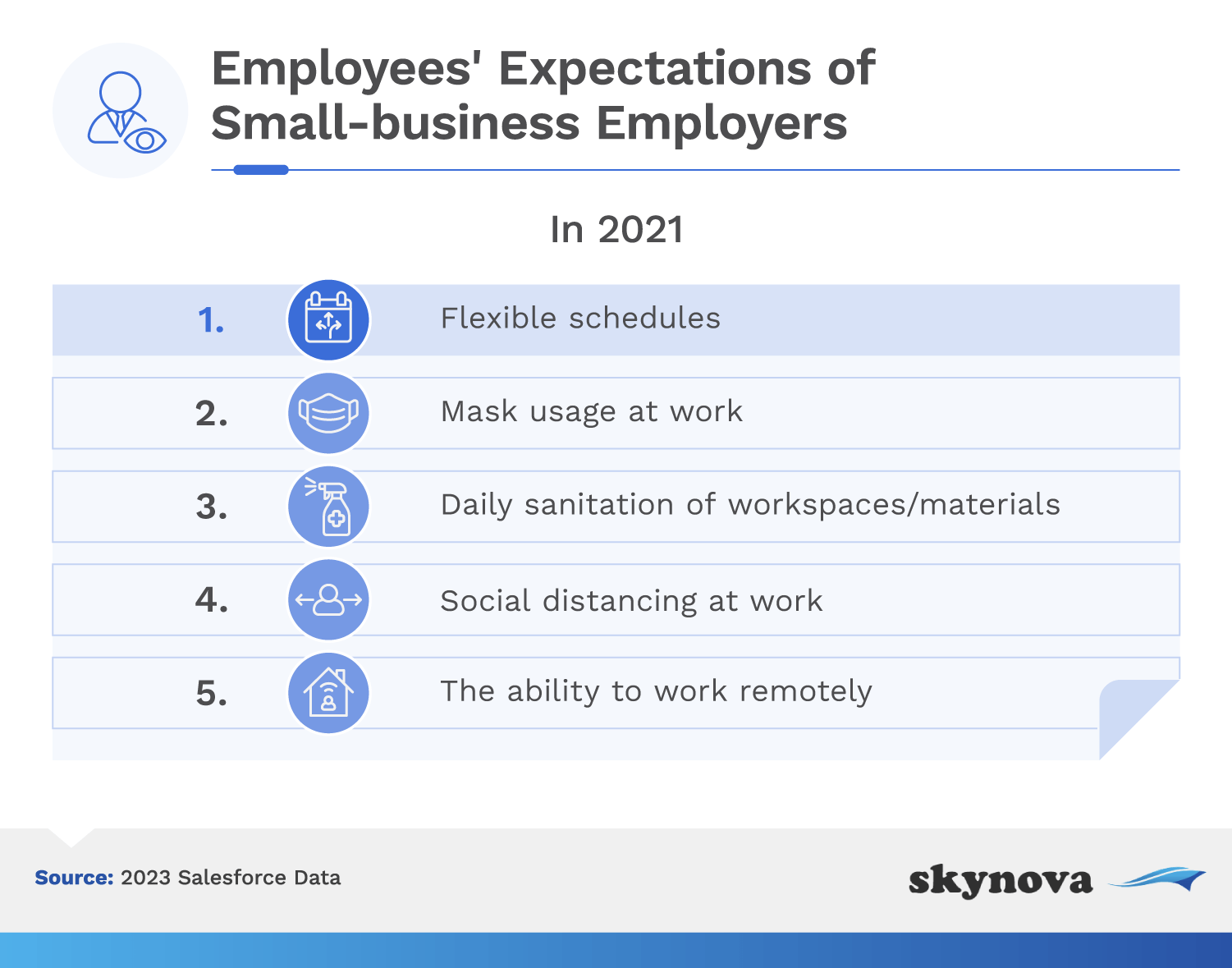

More than half of small businesses practice transparent communication to gain employees' trust. Another 42% look for ways to respond to personal needs, and 40% ask employees for feedback.

Nearly 40% of small businesses offer flexible working arrangements to their employees. Of the small businesses that reported growth, half have implemented this change.

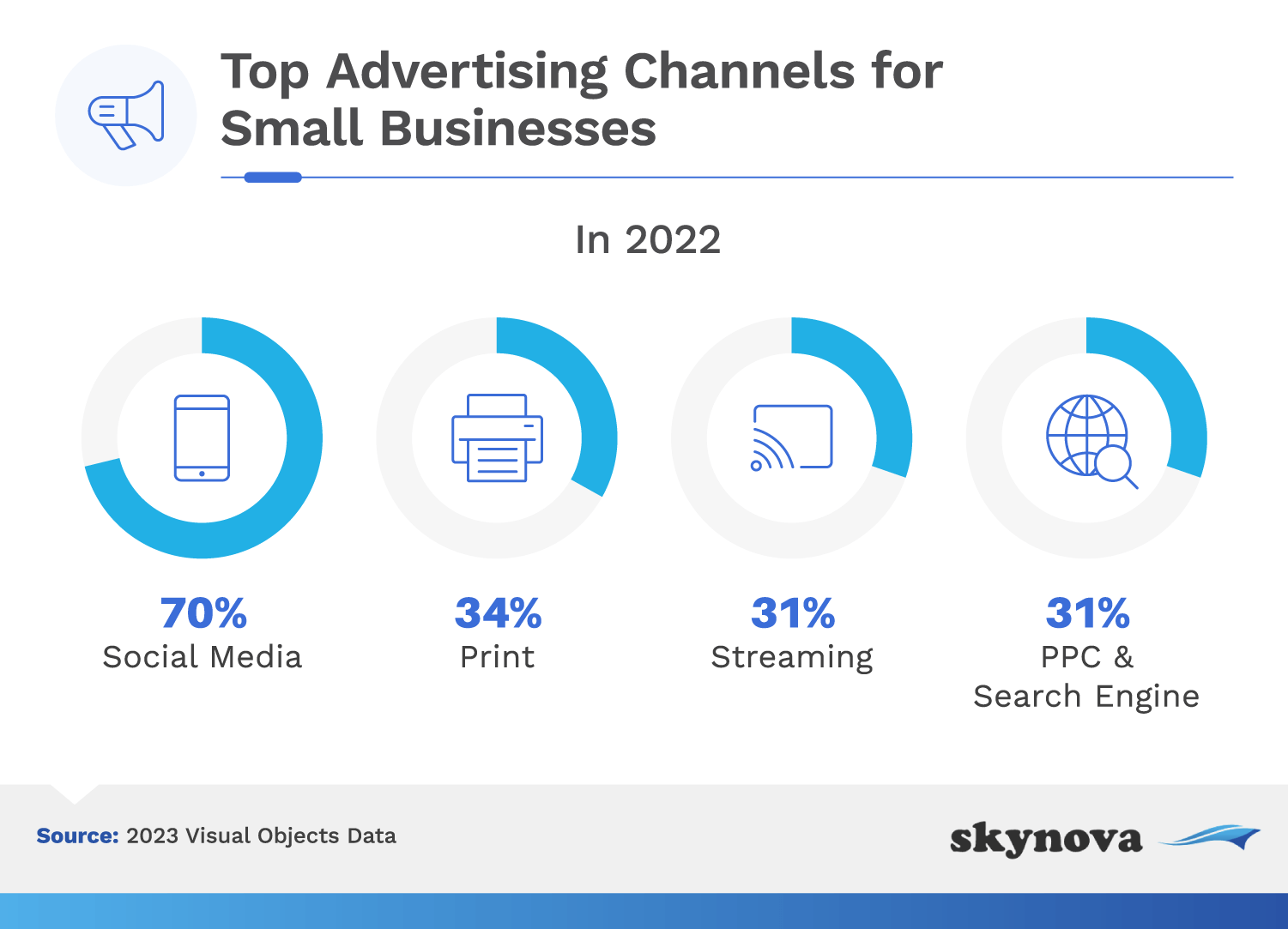

To have a successful small business, business owners must determine how to let potential customers know about their products and the value they can provide. Each small business owner has a marketing strategy, and you'll learn more about different tools and tactics in the sections below.

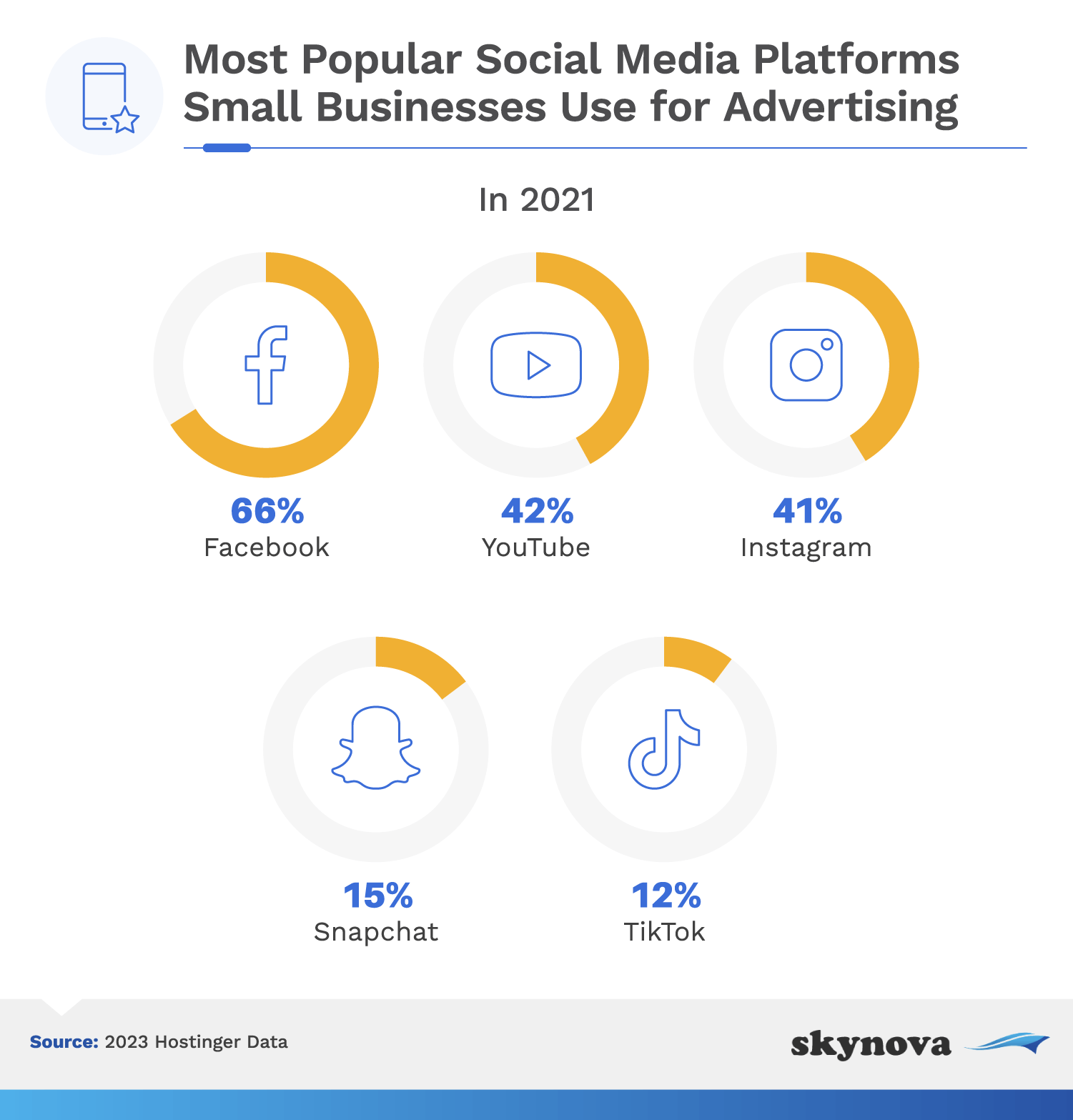

Over half of small-business owners use social media marketing for advertising their goods and services, and two in three post about them on Facebook.

Many businesses have observed social media's rise in popularity in recent years, and one in four small-business owners invested at least 10% of their marketing budget into social media advertising.

Nearly half of small-business owners report a slight increase in online presence over the past year, and another 27% consider their increase in digital marketing significant.

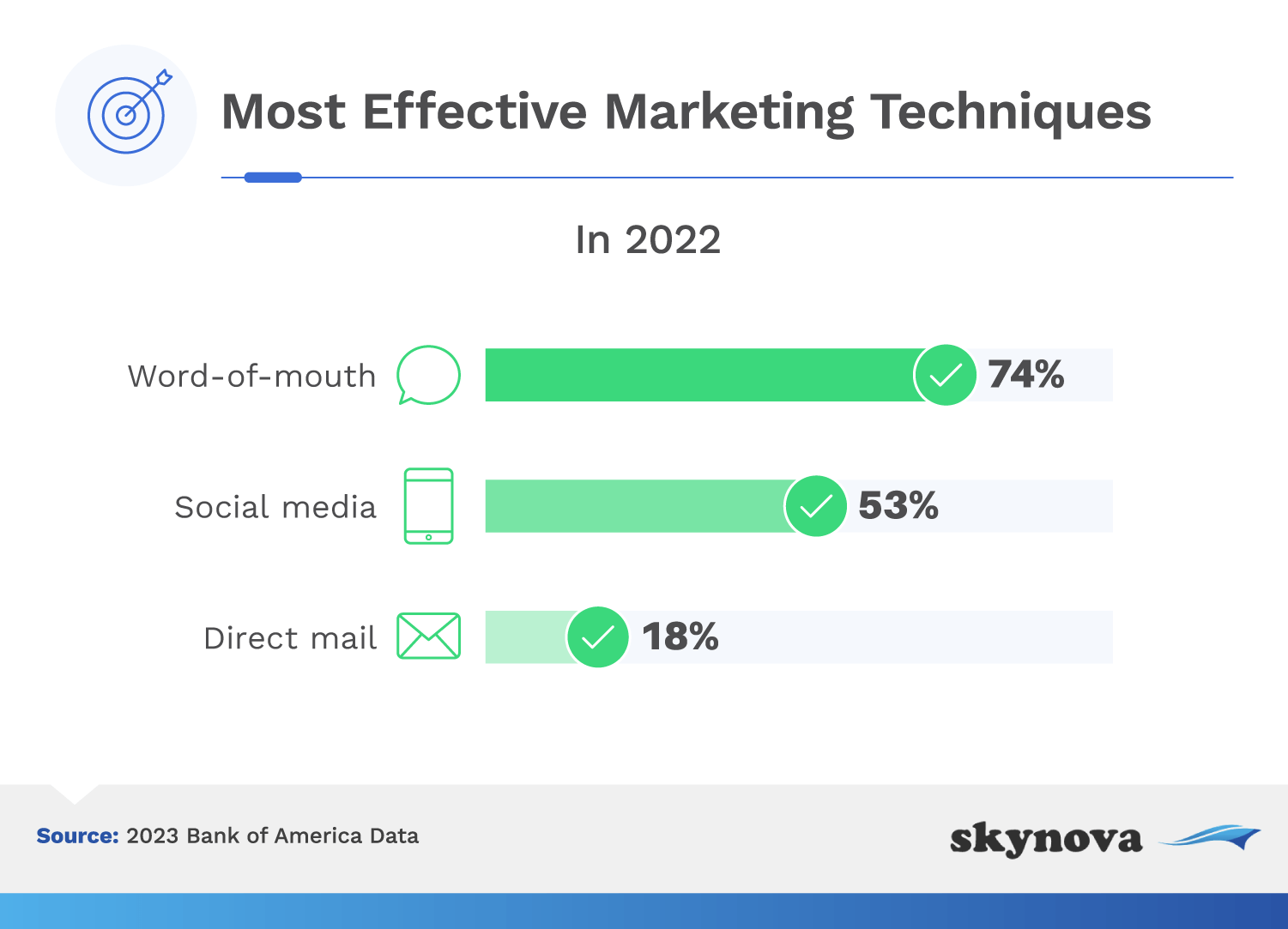

Although 74% of business owners believe word of mouth is the best way to market their services, the number is less than it was in 2012 (87%). Since then, the number of business owners who believe in social media as an effective marketing tool has risen significantly from 32% to 53%.

Small businesses can receive customer payments in many different ways, and invoicing volume and methods vary just as much.

Around half of small-business owners send out less than 50 invoices each month, and roughly one in three send between 1-25.

In addition, 46% of small-business owners struggle with receiving payment on time.

These SMB owners know that when it comes to invoicing, you get what you pay for. Some (12%) even spend as much as $100 per month on solutions like invoicing software and apps.

Many small-business owners face unique struggles, but some challenges are shared across industries. Learning about the specific issues small-business owners face can help current and future small-business owners anticipate obstacles and take steps to prevent problems.

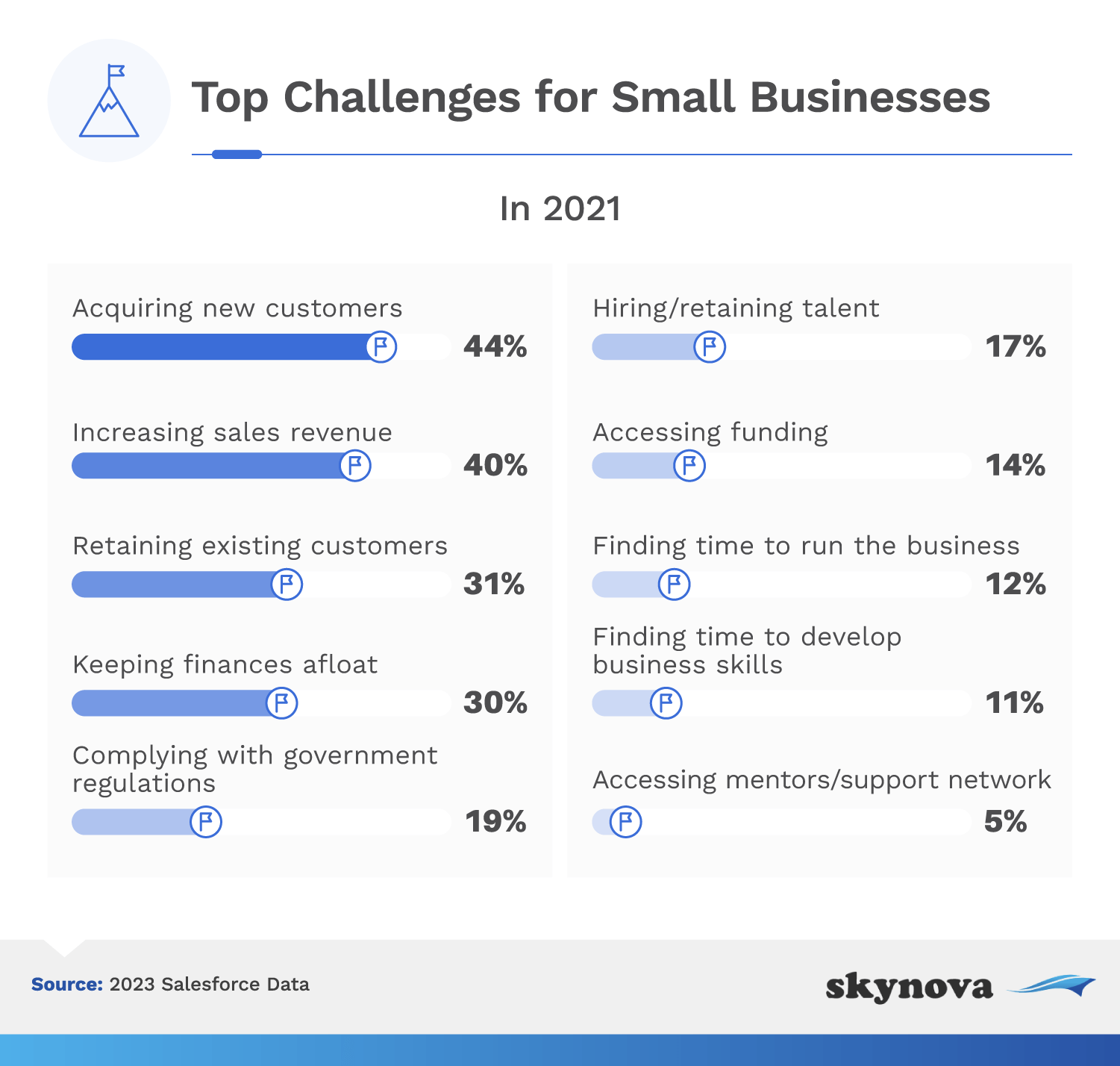

Getting new customers was the biggest challenge for 44% of small-business owners. Another 40% struggled to increase sales revenue, and nearly one-third needed help retaining customers.

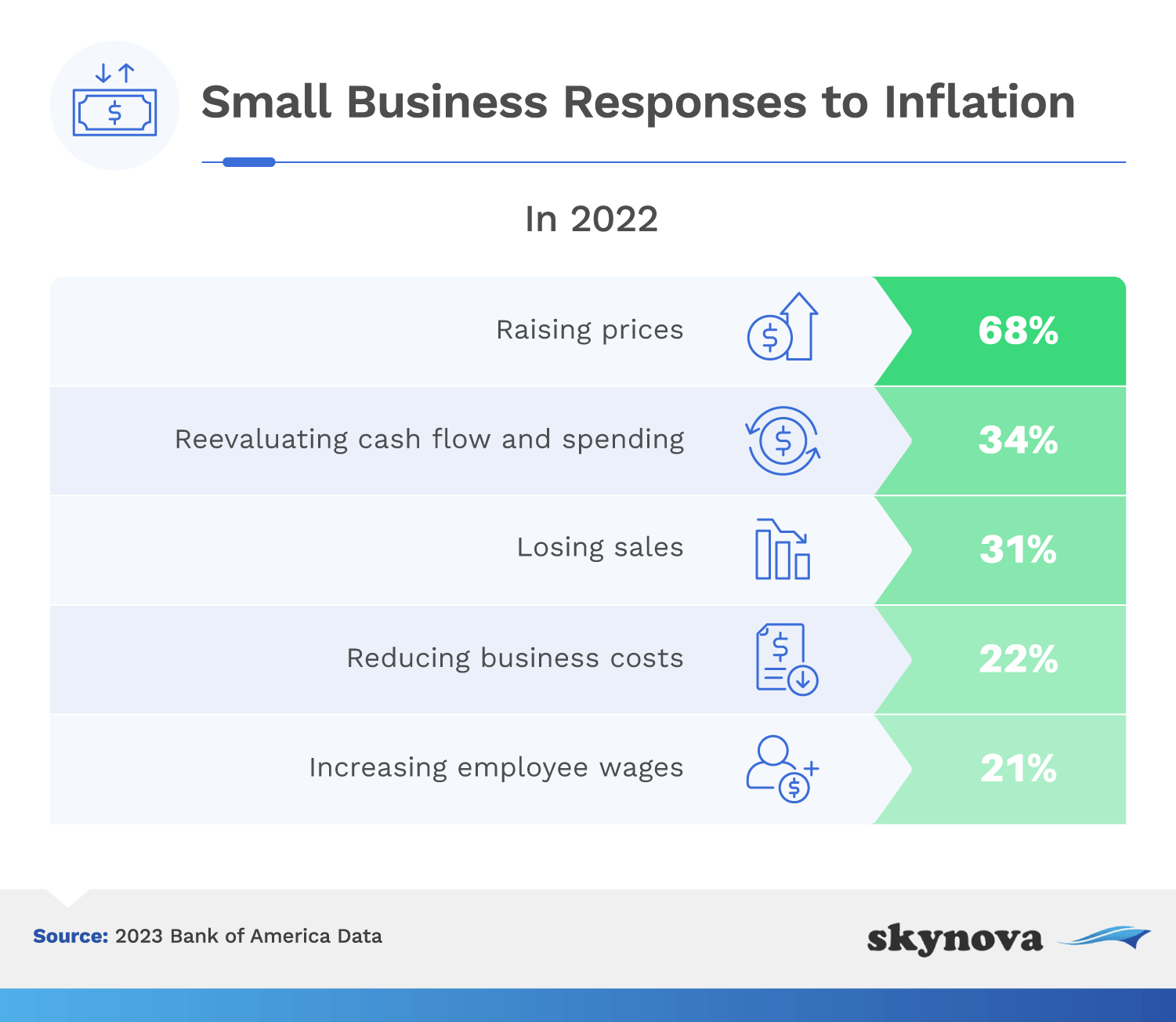

In addition, 34% of small-business owners are taking a closer look at their spending and cash flow. Nearly as many (31%) are losing sales because of inflation.

Supply chain issues have also forced 58% of them to increase their prices.

The majority of small-business owners (83%) are increasing their efforts to retain and attract employees as a result.

Entrepreneurship has its share of challenges but remains a popular endeavor for millions of Americans. With the number of new business owners growing each year, many people will be searching for additional help with common tasks such as invoicing. Skynova offers tools to assist small-business owners with important day-to-day tasks. Check out our free invoicing template today.

The following sources were consulted in the creation of this page: Bureau of Labor Statistics, U.S. Census Bureau, U.S. Small Business Administration, U.S. Small Business Administration Office of Advocacy, Guidant Financial, U.S. Chamber of Commerce, Salesforce, Bank of America, Zippia, Worldbank, Payscale, Forbes, SCORE, Hubspot, LendingTree, Familybusiness.org, Hostinger, and Visual Objects.

You are welcome to share this information for non-commercial purposes only, and a link back to this page must be included.