|

The not-so-small world of small business has been rattled to its core. In 2016, small businesses accounted for 99.7% of all businesses in the U.S. If we could figure out that percentage today, it would likely change as quickly as the COVID-19 outbreak chart itself. What can reliably indicate the future of small businesses, however, are peeks into the mindsets of the business owners. Their level of optimism or pessimism, the amount of help they've received, and what they personally envision may just help us know what to expect for the small businessman in America.

What follows is an in-depth analysis of reporting from the Small Business Pulse Survey. State-by-state analyses reveal the visions small business owners across the country have for their livelihoods. We've broken down their responses and compared them by optimism as well as political party lines. If you're curious about the future of America's small businessman, keep reading.

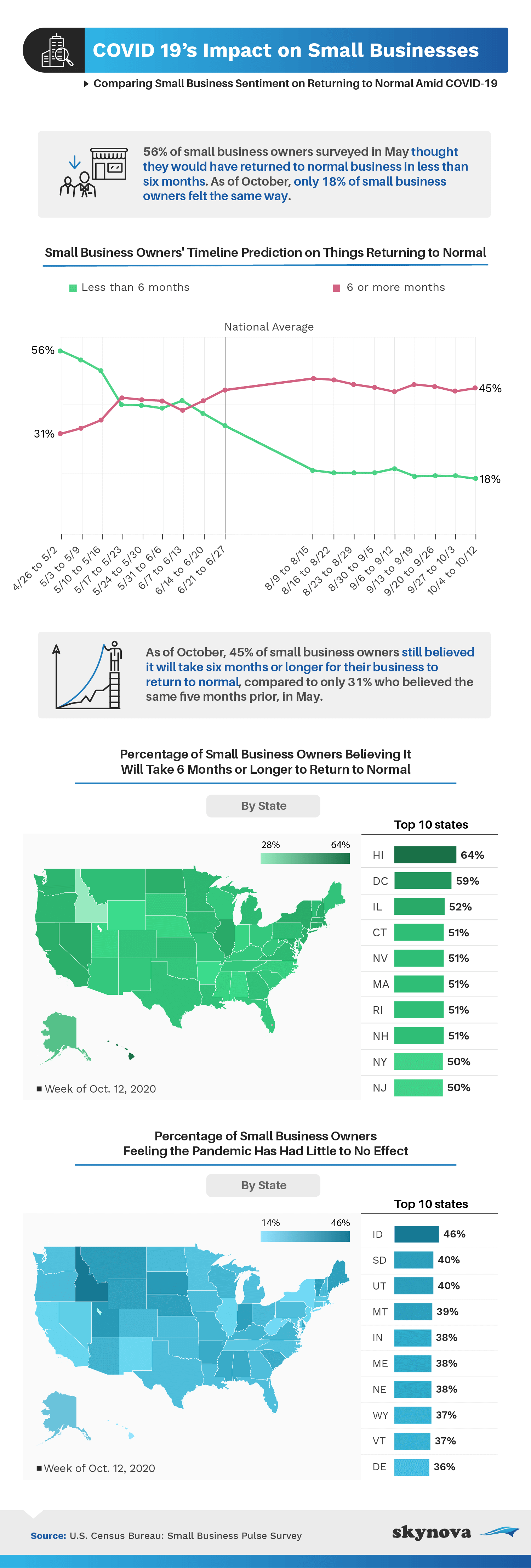

The first part of our study looks at small business opinions on how the next six months may unfold, beginning with the overall national average as well as state-by-state results.

Over the course of the next six months, small business owners aren't necessarily expecting any miracles. At the end of April and into the beginning of May of 2020, even as COVID cases raged on, more than half of business owners felt things would return to normal within less than six months. That figure plummeted to just 19% in January. In other words, fewer than 1 in 5 business owners still held the belief that normality would return in less than half a year. As the line chart above starkly reveals, August appeared to be a particular shifting point for this belief, which also happened to correspond with an intense COVID-19 spike throughout the country. At only 17% of small business owners, the second week in November was when sentiments toward a quick COVID-19 turnaround were at their lowest.

On a state level, the less than six-month timeline feels most unrealistic in Hawaii and Washington, D.C. Ironically, the small businesses in these locations are also the country's top two earners of export value. Moreover, Hawaii also has the country's highest unemployment, while one could argue that D.C. may have the most insight into what's going on with COVID-19. All of this is to say that their lack of optimism over the next six months is concerning.

On the other hand, other states were feeling much more optimistic. Places like Wyoming, Idaho, and Nebraska all felt that the pandemic has had little to no effect on their businesses. Though these states don't hold the largest amounts of COVID cases, their numbers are on the rise, without exception. So their optimism may soon be dropping off as well.

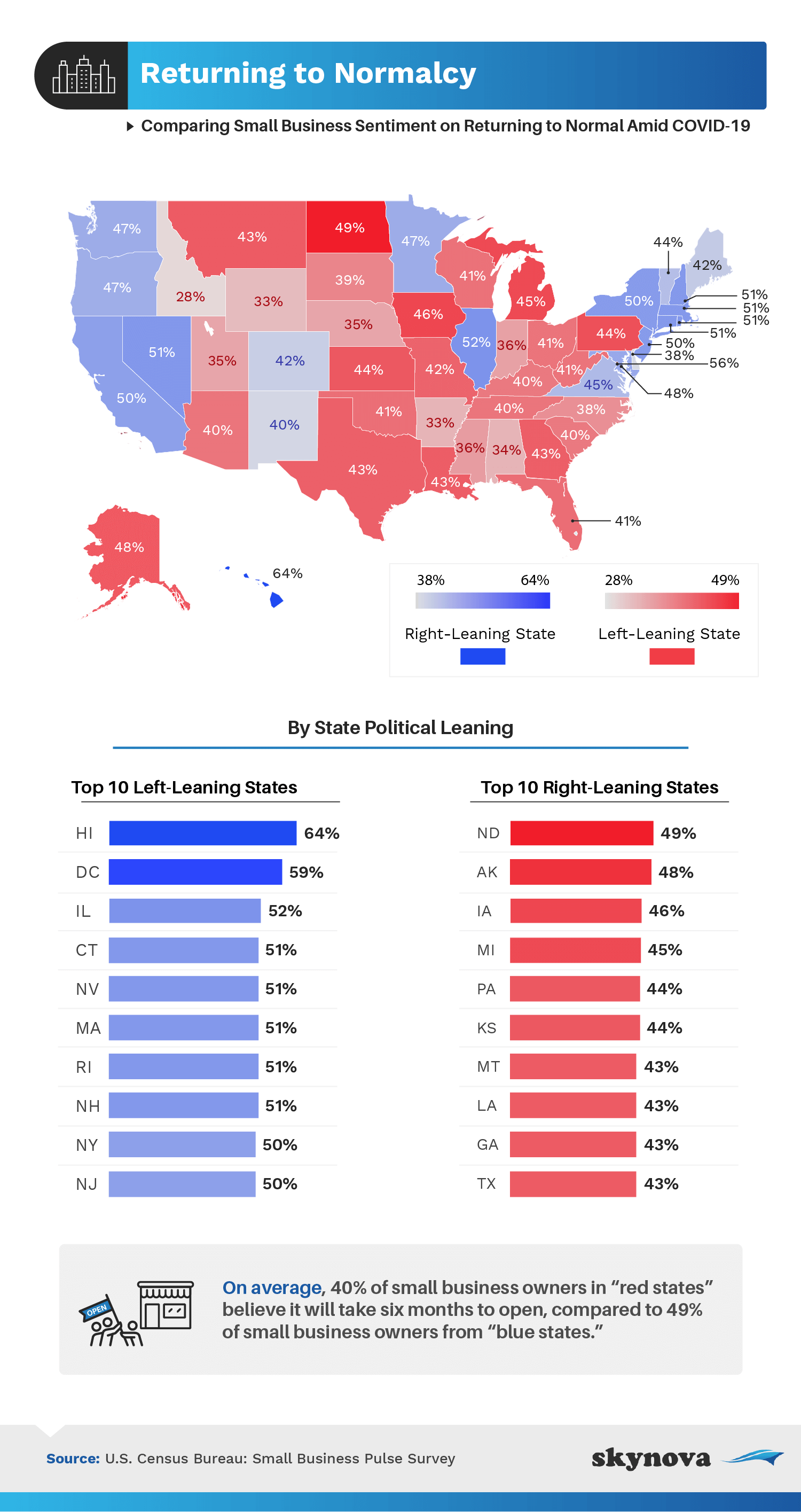

Since COVID-19 has become so politicized, we thought it would be helpful to next compare six-month optimism by political lines. The two charts below contrast right wing and left wing states with regards to their opinions as to whether or not it will take longer than six months to return to normal.

Traditionally red states were overall more optimistic about things returning to normal before six months. Blue states, like Hawaii and New York, had more than half of small business owners thinking it would take longer than six months for their operations to feel normal again, while red states, like Wyoming and Idaho, were much less likely to be in agreement, instead assuming things wouldn't have to take so long.

Looking at the graph of COVID-19 cases, it's easy to see that this sense of optimism actually has less to do with the number of cases and more to do with the rhetoric of each party's prominent leaders. While Trump and Pence remain insistent that COVID is under control, blue leaders like Andrew Cuomo have repeated the instructions to “be afraid,” of this disease. This stark contrast is clearly being reflected among small business owners.

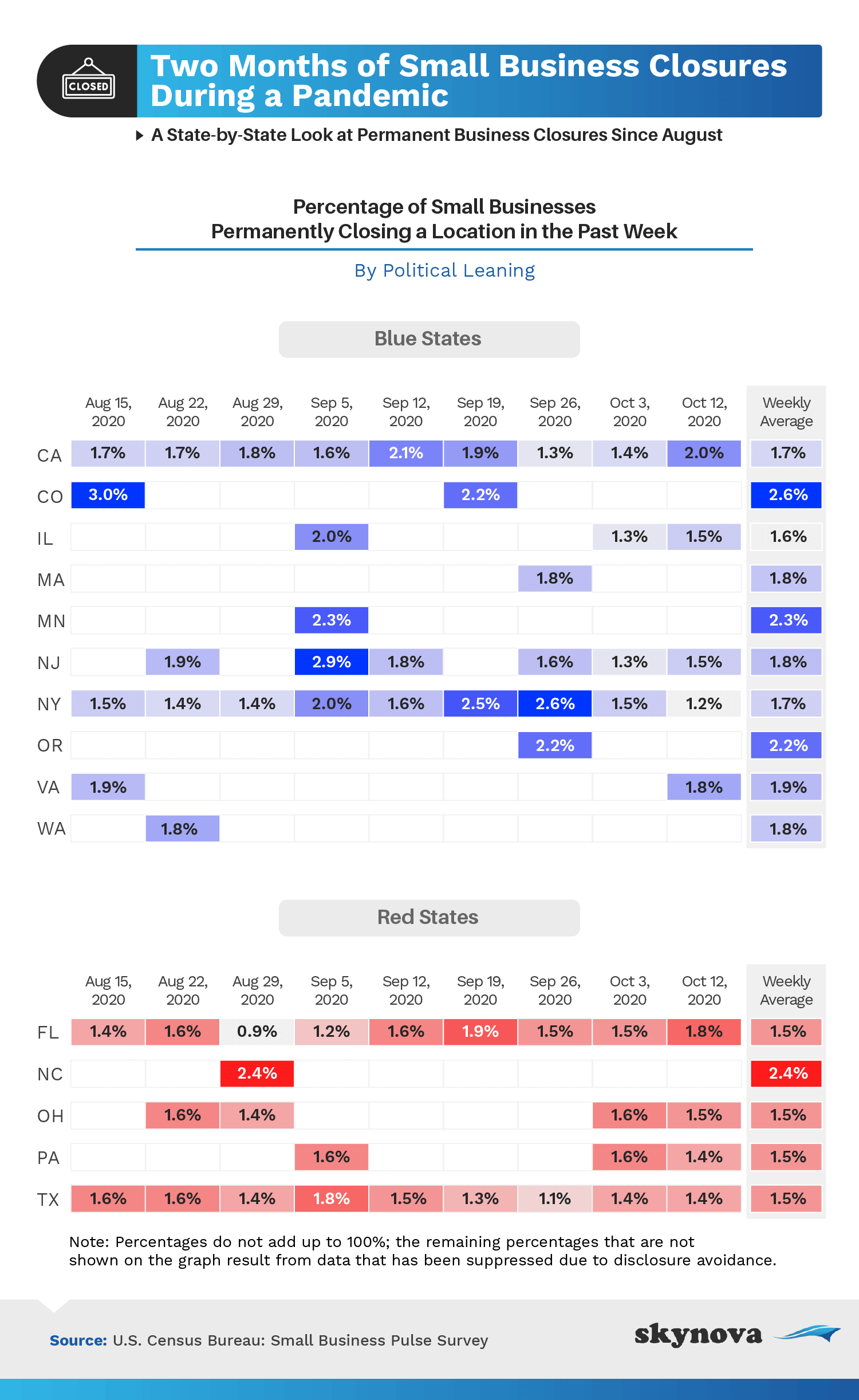

Businesses have been closing so quickly across the country that Yelp actually added a feature to allow business accounts to temporarily or permanently close their profiles. Since March of 2020, Yelp estimates that nearly 165,000 businesses have already done so. Other experts estimate that 60% of these businesses will never return.

The chart above, however, looks exclusively at permanent closures. By comparing party lines, we can see just how impactful the optimism and pessimism can be. While fear of the disease and corresponding restrictions demonstrated disproportionately by blue states may be warranted and accurate, blue states are seeing higher numbers of business closures than red states. In one week of November alone, Colorado saw 3.4% of its small businesses permanently close their doors, while California and New York saw 2.5% and nearly 2% of the same in the same week, respectively. Meanwhile, across the aisle, Texas saw 2.6% of its small businesses permanently close shop in the beginning of January; It was the only red state to get close to 3%. For the most part, other red states typically saw under 2% of small business doors close permanently, at least as far as a single week was concerned.

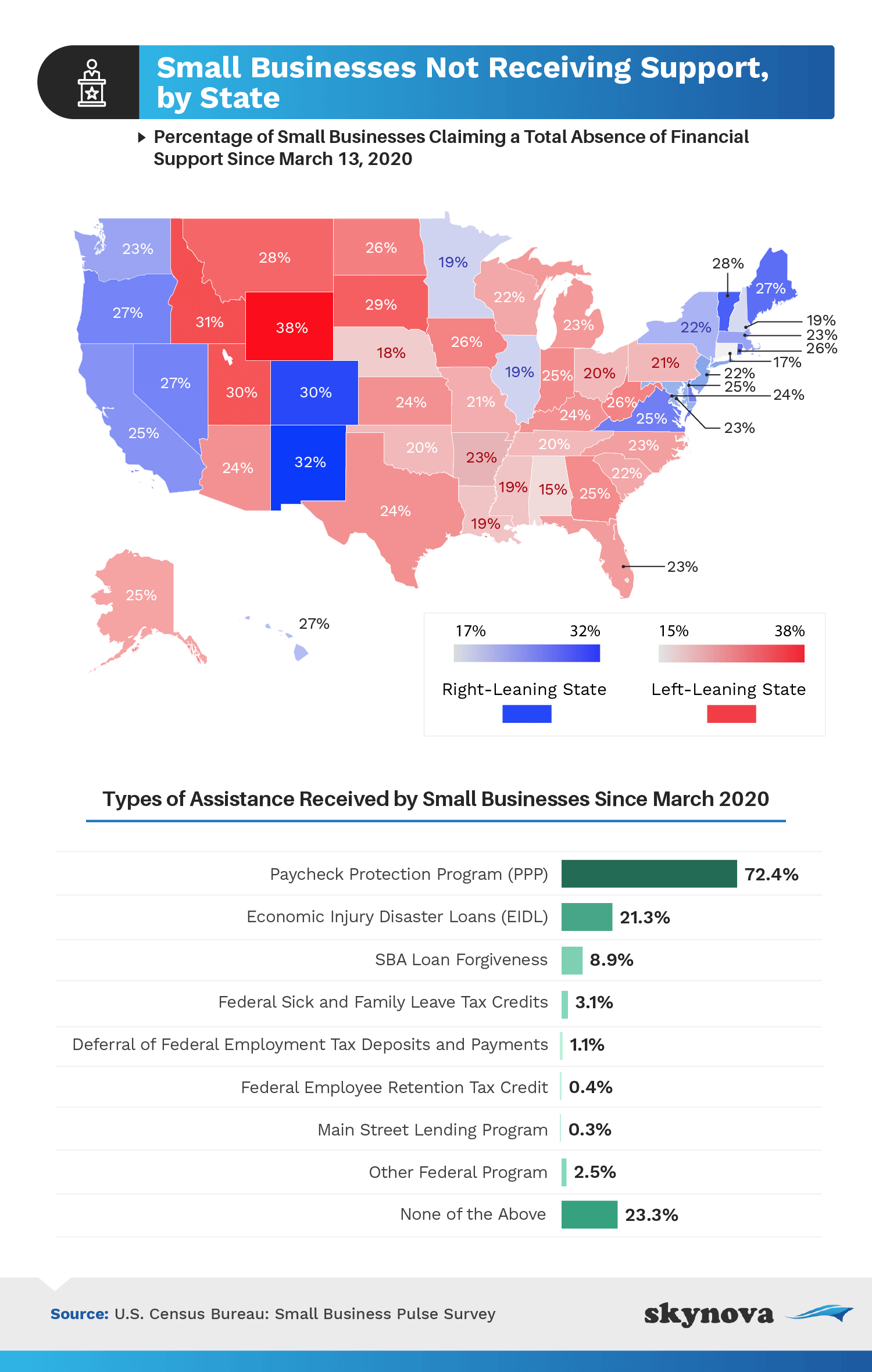

Of course, we cannot assume that optimism alone carries small businesses through pandemic restrictions. A small business' success may easily depend on the amount of support they are able to receive during a time when typical operations become impossible. The next part of our study looks at the percent of small businesses claiming they have not received financial support of any kind during the pandemic.

In spite of their higher number of closures, blue states in general did appear more likely to receive financial support. States like New Mexico, Maine, and Delaware maxed out at 35% of businesses who were unable to receive support of any kind, while the cap remained at 37% for red states. Small businesses from New Hampshire were the most likely to receive support for blue states, however, Alabama, a red state, was the most likely of all the states to receive support - with only 13% claiming they did not obtain any financial support. Researchers are claiming that Alababam's economy is recovering from COVID-19 faster than other states, which could be due to this financial support for small businesses.

Alabama Governor Kay Ivey recently announced a $100 million grant program to help employers from the state recover, and it's evidently being utilized. That said, the most common form of financial assistance received across all states was PPP, or the Paycheck Protection Program. Nearly three-quarters of small businesses that received aid received it in this form.

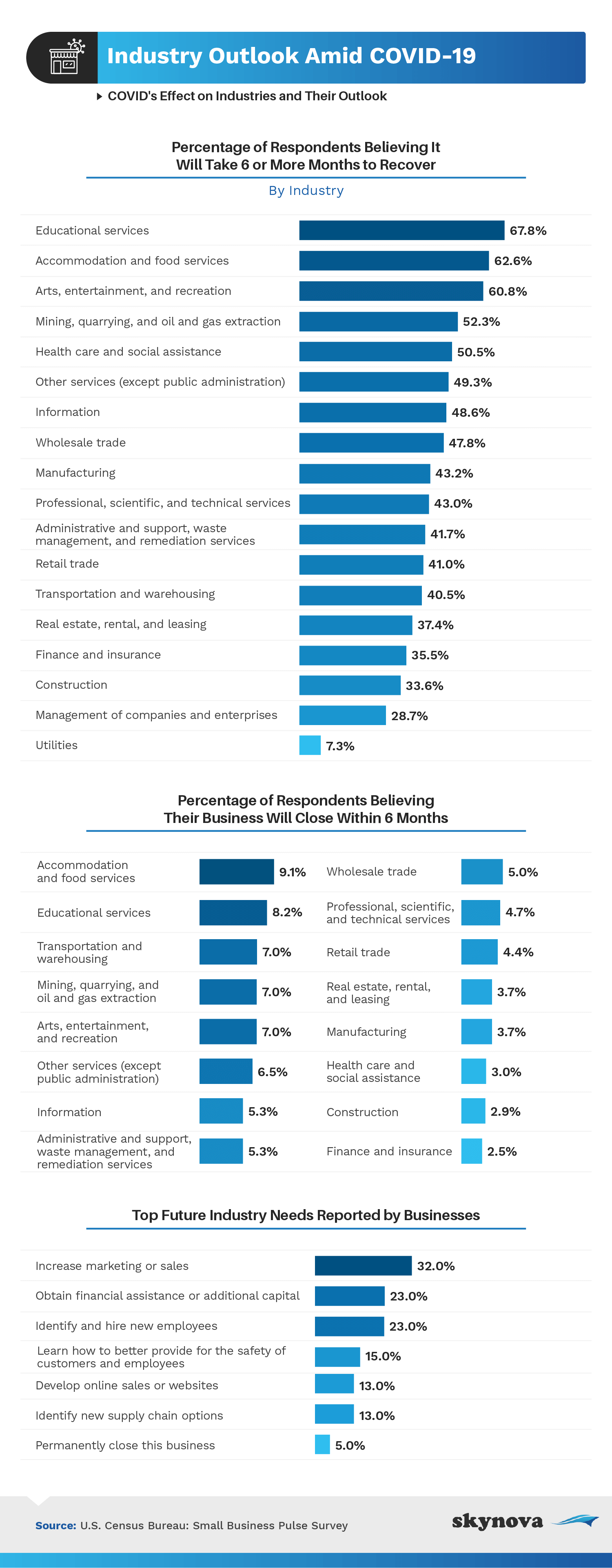

So how do businesses move on from the financial burden of the pandemic? To find out, we asked small business owners what their future needs would be to recoup their losses. Their responses demonstrate the diversity of problems and necessary solutions brought about by the financial consequences of a global virus outbreak.

The top future need reported by small businesses - at 34% - was to obtain financial assistance or additional capital. As seen previously in our study, there are those out there who have not yet received any type of financial support, which is concerning given this clear need. However, the newly-inducted Biden administration seems to be aware of this need, offering support and tax relief in the stimulus programs of the American Rescue Act signed for this upcoming year.

Other business owners signaled that their future needs required more than just financial assistance; These entrepreneurs reported that they'd need a change in the way they conduct their businesses. Thirty-two percent of small business owners noted that they'd need to increase their marketing or sales, followed by 24% who said they'd need to find and hire new employees. For a small number of businesses (5%), the only solution left seems to be closing their doors for good.

As small businesses across the country attempt to rebound against all odds, their spirits unfortunately appear increasingly pessimistic. As time has gone on, they more often estimate the need for more than six months for their livelihoods to return to normal, while they also bear witness to increasing amounts of small business closures in many states.

Skynova is a premier small business resource that makes all accounting and invoicing easy and professional. Everything from expense tracking to financial reporting to ledger creation and sales tax computing can be done in a simple, easy-to-understand format. Skynova created 37 different software templates to make small businesses run as efficiently and professionally as possible.

For this project we used the Small Business Pulse Survey conducted by the United States Census Bureau. The purpose of the survey was to understand the effect of COVID-19 on businesses since the declaration of a pandemic in mid-March of 2020. For more information on the survey, please visit https://portal.census.gov/pulse/data/#data where you can find detailed information on collection methods, questions, and more data. Please note that the survey was not conducted in July.

State political leanings were based on the 2016 election results as per http://www.politico.com/2016-election/results/map/president/.

Small business owners and even their patrons need help and support at this time. Sometimes support can be as simple as sharing helpful information. If you would like to share this article with anyone, just be sure your purposes are noncommercial and that you link back to this page.