|

They say that change doesn’t happen overnight – but all rules go out the window when a pandemic hits the world stage. In mid-March, the stock market experienced its worst day since 1987’s “Black Monday” crash, half of American employees stopped showing up to the office from one day to the next, and companies across the nation (and the world) shuttered their doors to foot traffic at the drop of a hat.

Pandemic or not, breaking onto the scene has always been a challenge for new businesses: Approximately 20% fail during the first two years, 45% go under during the first five years, and 65% don’t make it past the 10-year mark. So, with these exceptionally difficult economic challenges on our doorstep due to COVID-19, what’s an entrepreneur to do?

We surveyed more than 500 Americans who had either recently started a business or were looking to kick off a new venture with the goal of finding out how the pandemic had affected their plans – not to mention their outlook for the future.

Nearly every industry worldwide was impacted by the pandemic in one way or another. How many businesses suffered setbacks, and how many got lucky?

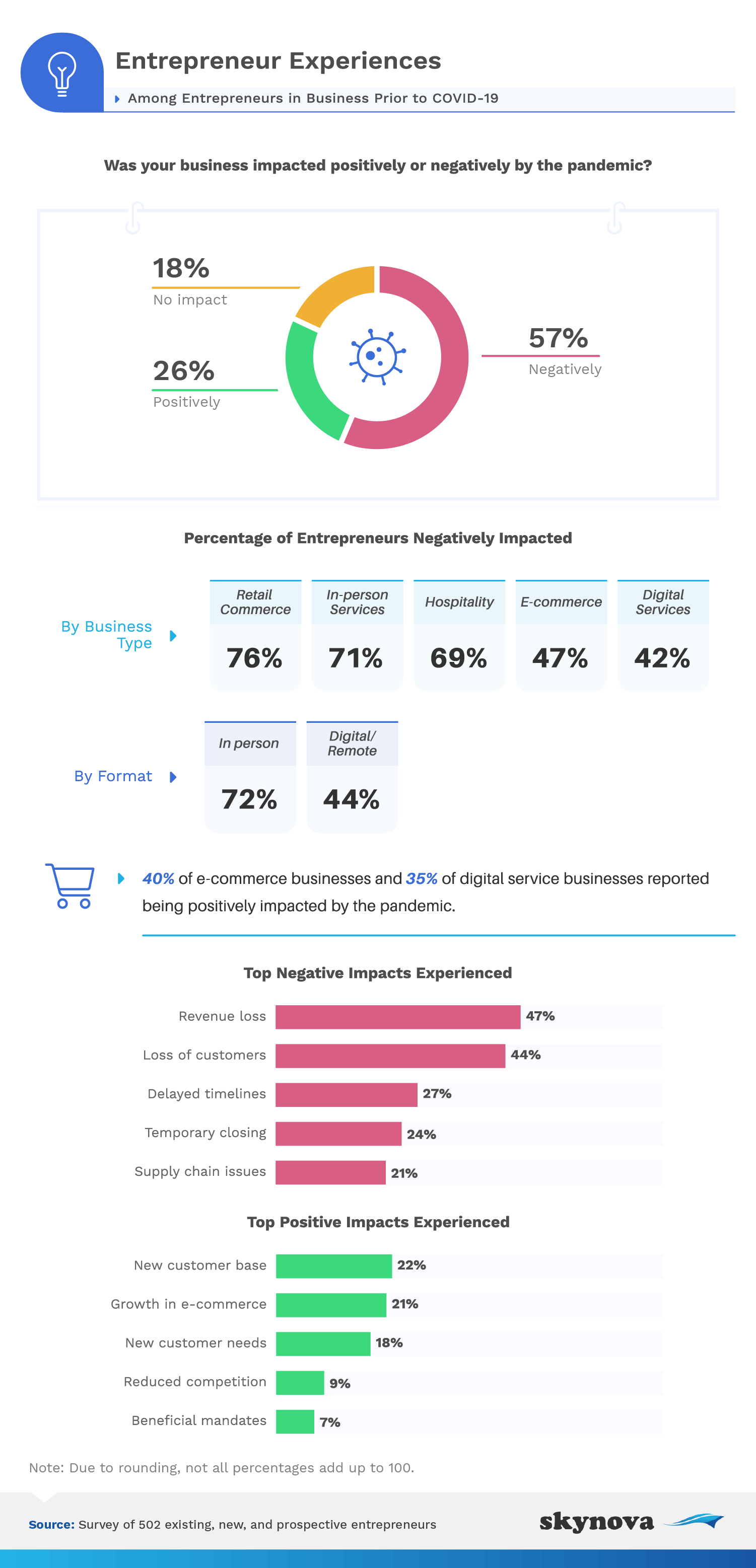

While some businesses (26%) had the ability to make lemons into lemonade, most (57%) were negatively affected by the pandemic – though some industries experienced an outsized blow, compared to others. Just over three-quarters of retail commerce companies said they suffered greatly due to COVID-19: Following sweeping brick-and-mortar shutdowns across the United States, retail sales dropped by 8.7%, marking the deepest plunge since records began in 1992.

In-person services were also negatively affected at a rate of 70%, followed by hospitality at 69% – two sectors that rely entirely on face-to-face interaction. The two most commonly experienced pitfalls were revenue loss (47%) and customer loss (44%), but many companies also experienced delayed timelines (27%), temporary closures (24%), and supply chain issues (21%).

There was, however, a flip-side to this coin: the 26% of businesses that saw an uptick in business due to the pandemic. Twenty-two percent of this segment saw an influx of customers, and 21% grew their e-commerce market share. Videoconferencing platform Zoom has become the poster child for explosive success during the pandemic, after they experienced a 30-fold increase in usership between March and April alone.

Running a business requires elaborate planning and a sensible strategy. But what happens to those plans when a pandemic sweeps the globe?

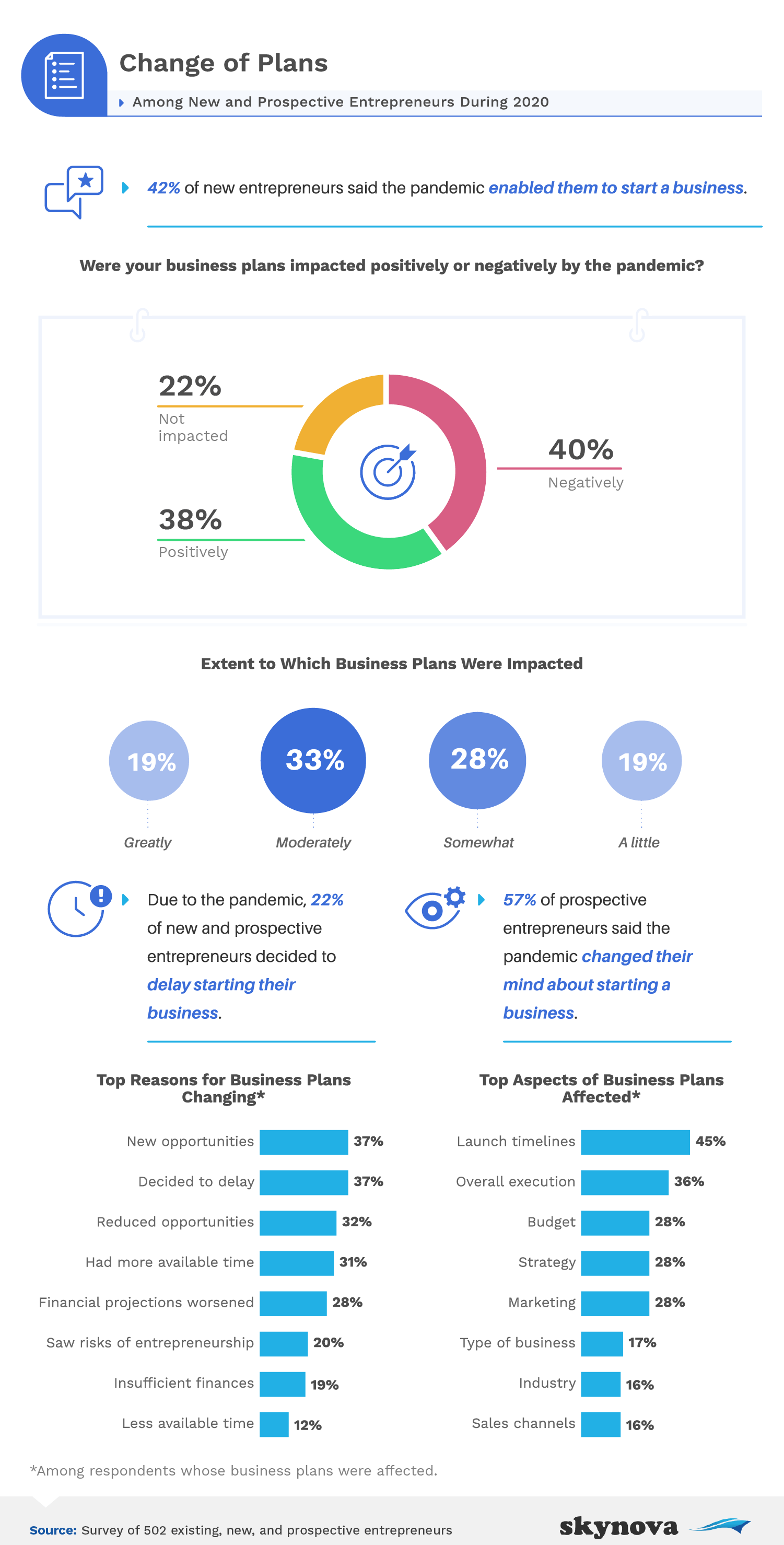

Entrepreneurs understand that changing their plans on a dime comes with the territory, but nobody could have prepared for an event like COVID-19. Still, that’s not necessarily a bad thing: While 40% of entrepreneurs said the pandemic had a negative impact on their business plans, 38% said that it actually helped move their plans along. One-third said they were affected “moderately,” while 28% were somewhat affected.

Given how financially fragile new companies tend to be, it’s understandable that 22% of new and prospective entrepreneurs decided to put their plans on hold. One study conducted in the context of COVID-19 found that the median business with more than $10,000 in monthly expenses only had two weeks of cash on hand. In a time of immense uncertainty, another 57% of people who were considering starting a business said the pandemic had soured them to the idea.

For the majority of people, a “change of plans” came in the form of altering their timeline. This meant delaying the opening of a business for 37% of entrepreneurs – but the exact same share had their business plans change for the better, in the form of new opportunities. Starting a new business is a risk no matter when you decide to roll the dice, but the pandemic proved to be a “make or break” scenario unlike any other.

The face of work has changed. Here are the industries that have emerged victorious and the employee structures that will likely define our future.

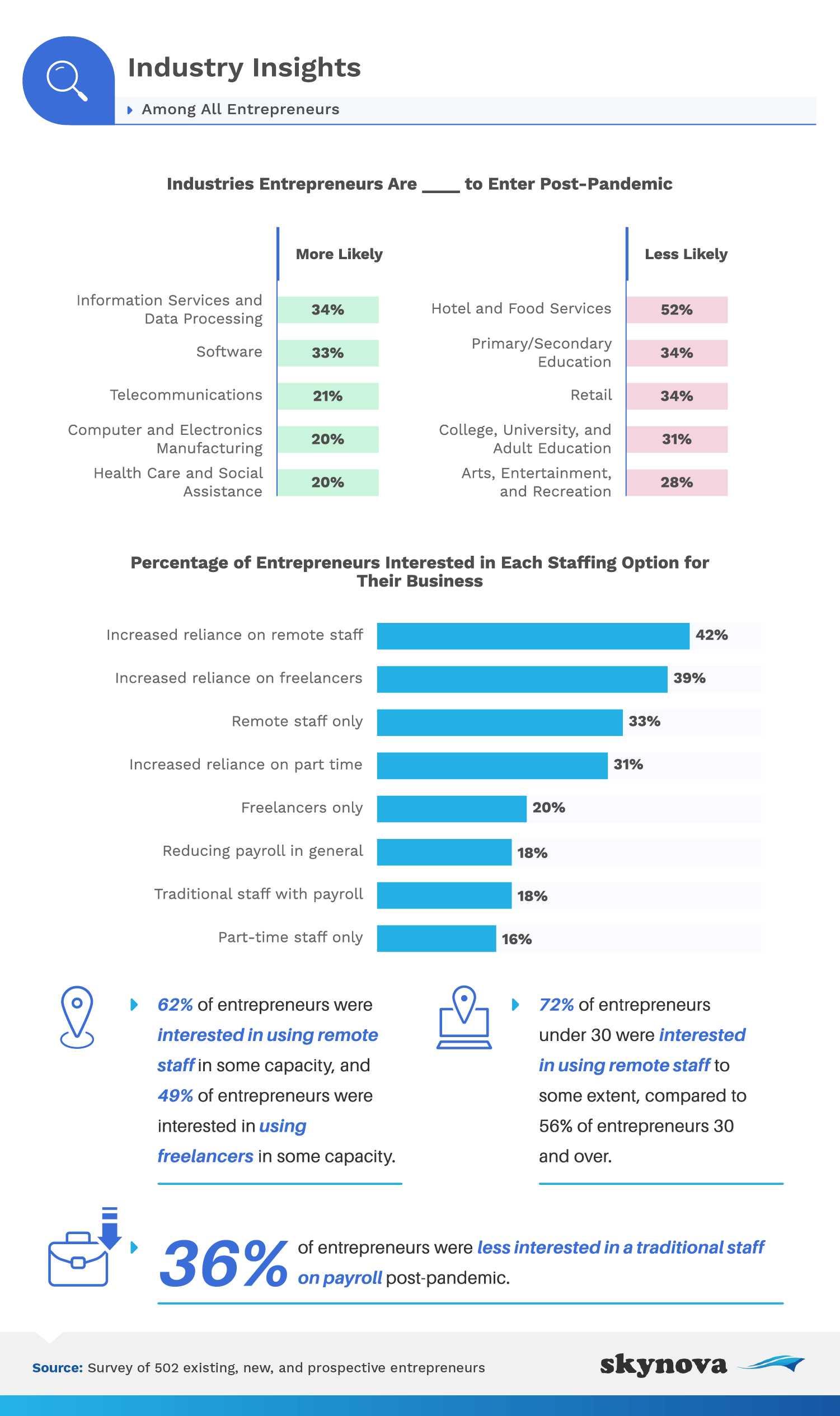

Now that major parts of our life – from work to retail – are taking place almost exclusively online, it’s no surprise that 4 out of the 5 most popular post-pandemic industries were related to digital services. IT, software, telecommunications, and electronics were the sectors entrepreneurs were most likely to pursue after the pandemic, with health care taking fifth place. On the opposite end of the spectrum, entrepreneurs are likely to avoid hospitality, education-related jobs, retail, and the arts.

As reported by McKinsey & Company, “companies have accelerated the digitization of their customer and supply-chain interactions and of their internal operations by three to four years.” Rapid tech adoption has spread to even the most laggard of industries, making IT and software one of the safest bets as the service industry continues to weather lockdowns almost one year after the pandemic began.

Entrepreneurs also expressed great interest in remote and freelance staffing options, which are innately tied to the explosive popularity of software and telecom solutions. As of October 2020, one-third of the American workforce was still working from home on a daily basis, and 25% were doing so on an occasional basis. While that number is much lower than the peak of the pandemic, it does illustrate the staying power of remote work.

What is the overall outlook for small businesses moving forward? Are people optimistic about their role in the economy, or are they doubting their ability to thrive?

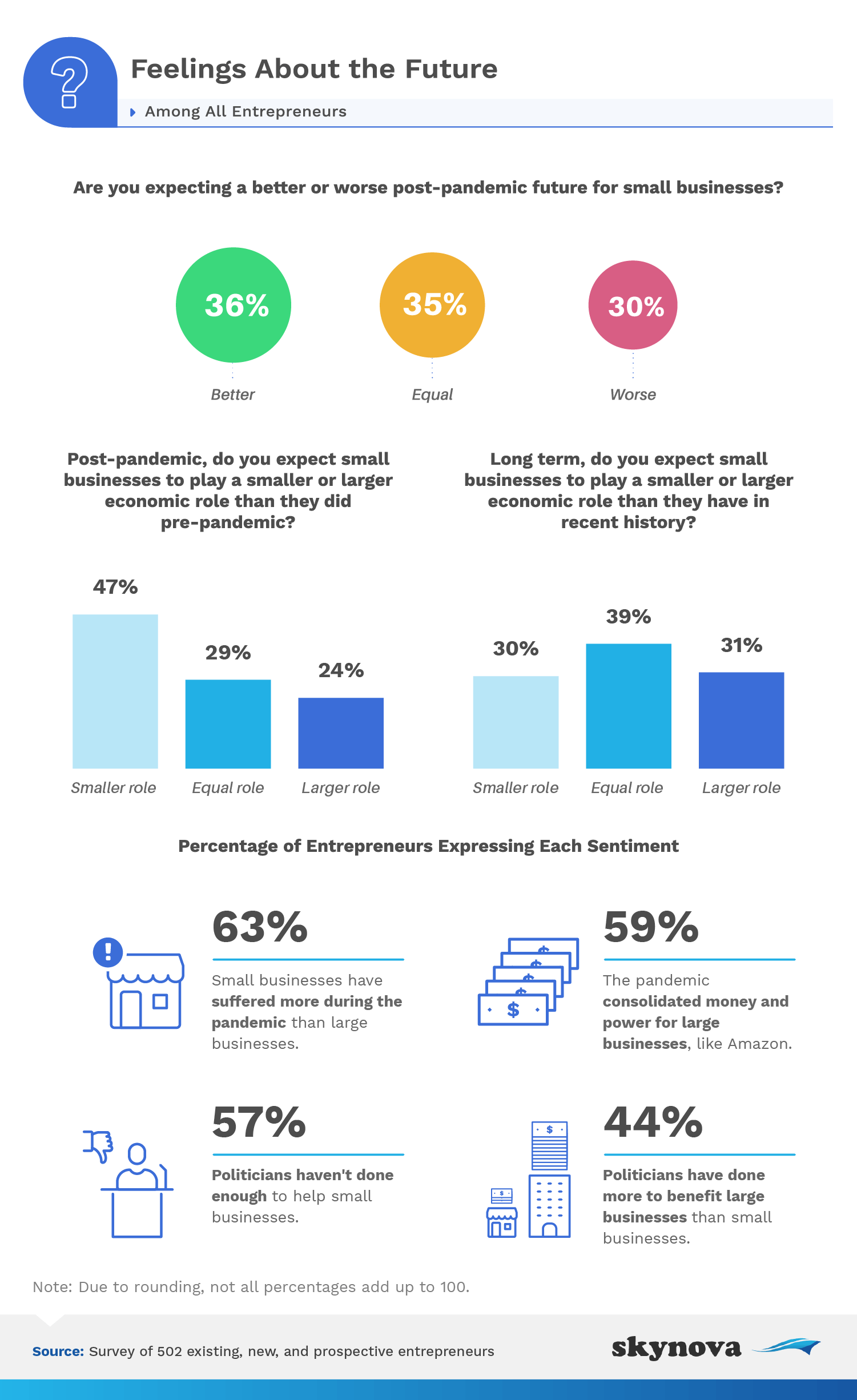

The jury was divided three ways on whether a post-pandemic world will be a better or worse climate for small businesses. While a small majority (36%) said the future was bright, 30% had a more pessimistic outlook, and the remaining cohort felt things would remain largely the same. However, a majority agreed that small businesses would play a more minor role in the economic landscape immediately following COVID-19 (47%, compared to 24% who believed they would play a larger role).

In the longer term, though, respondents had a more positive outlook for small businesses. Thirty-one percent believed they would grow to play a larger role in the economy, and the “smaller role” camp shrunk to 30%. Another 39% thought small businesses would end up playing the same role as before the pandemic.

To hear entrepreneurs tell it, 63% believed small businesses suffered far more than large companies during COVID-19. Most also thought it consolidated money and power for huge players, like Amazon: Indeed, the e-commerce giant’s market cap grew by $570 billion in 2020, and the value of its stock has increased by more than 60%.

The impact of COVID-19 on businesses was largely dependent on the industry. While hospitality, retail, and entertainment suffered, sectors like software and IT boomed as employees flocked to their home offices. A large number of entrepreneurs reported that they had to pivot their business plans in the form of delays and reevaluations, but just as many people were able to play the pandemic to their advantage.

Looking forward, entrepreneurs are setting their sights on industries that were able to ride the COVID wave – namely those in the digital and tech sectors. And while some respondents believed small businesses would take a back seat in the near future, their longer-term vision was more positive regarding the role they might play in the economic landscape.

Skynova is an online invoicing solution designed for small businesses to help them maintain consistent and professional invoicing, process billings faster, invoice from anywhere at any time of day, and stay organized. With 37 unique software modules that can be used together or separately, Skynova offers better control of invoicing, accounting, retainers, work orders, and more. To better serve small businesses and entrepreneurs, Skynova also produces reports like this one to help explore and expose growing business trends that entrepreneurs need to know about.

We surveyed 502 respondents who owned a business, started a business during the pandemic, or abandoned plans to start a business during the pandemic. Among our respondents, 288 were male, 209 were female, and 5 did not identify their gender as male or female. Our margin of error is 4% with a 95% confidence interval.

To help gather accurate responses, all respondents were required to identify and correctly respond to a decoyed attention-check question. In some cases, questions and answers have been rephrased for clarity or brevity. These data rely on self-reporting. Potential issues with self-reported data include, but are not limited to, telescoping, selective memory, and attribution errors.

In the spirit of helping businesses succeed, we have one simple ask: Please only share this piece for noncommercial purposes, and when you do, always link back to the full article so the reader can get the whole story.