|

As 2020 launches us into a dramatic shift in the workforce, the trend of freelance work is bound to see another drastic increase. Freedom, flexibility, and the potential to earn more may attract people to the world of freelance, but the extra earnings often come at a price. Despite freelancers making more than 70% of workers in the overall U.S. economy, the freedom of being your own boss can mean weeks, sometimes months, of waiting for payday.

With varying processes for handling invoices, contractual wait periods for payment, and personal responsibility for bookkeeping, what are the biggest obstacles freelancers face? What is the longest wait time between invoice and payment, and how has the pandemic affected this? We surveyed 1,000 freelancers to understand their invoicing woes better. Keep reading to see what we found.

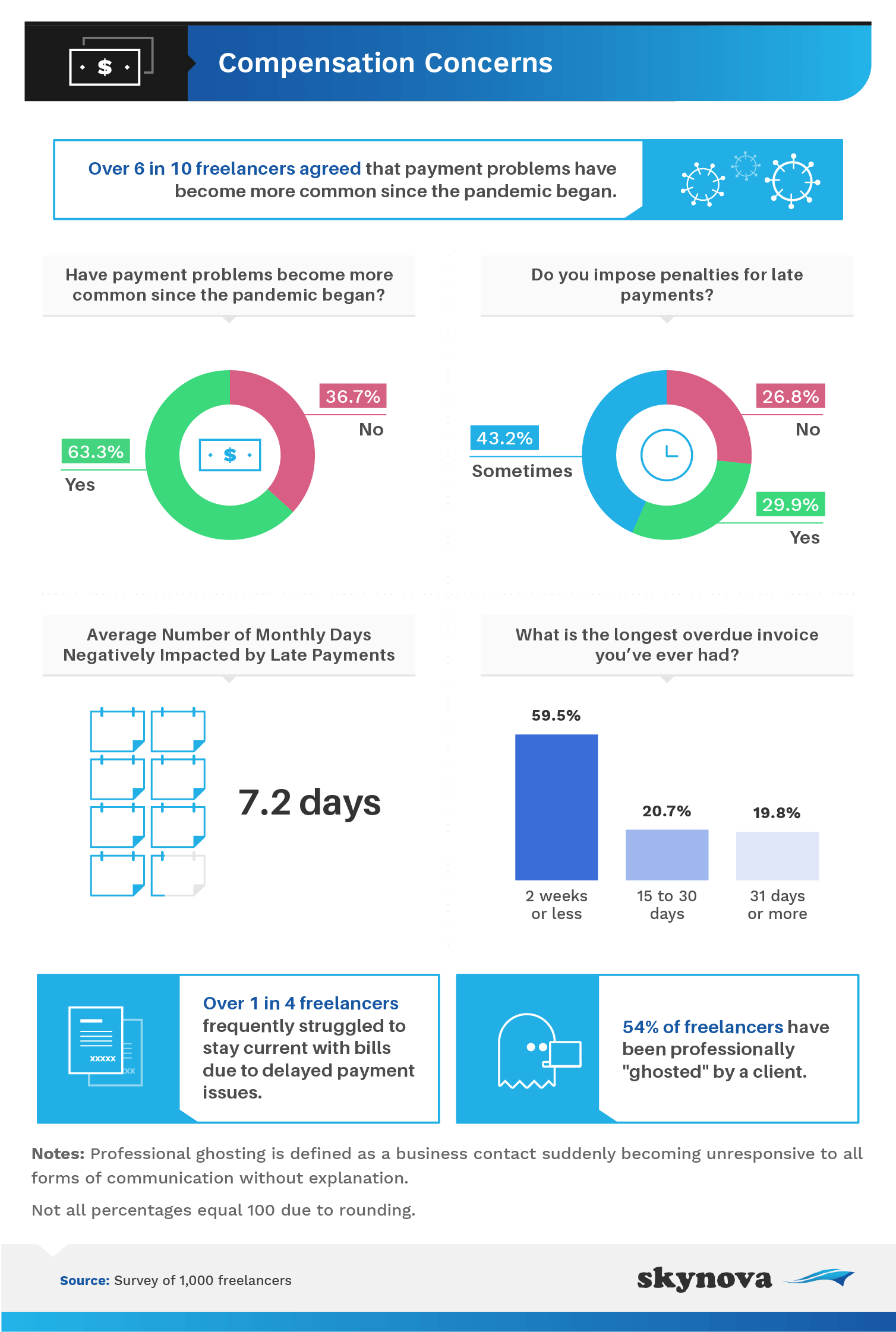

The coronavirus pandemic left millions of Americans furloughed or laid off, while many still holding jobs have been forced to accept pay cuts. Freelance workers may not be in the exact same boat as full-time workers, but the pandemic has exacerbated payment problems for over 6 in 10 freelancers.

While the average number of days from invoice submission to payment is just 7.2 days, nearly 60% of freelancers have had to wait up to two weeks. Similarly, almost 20% of freelancers said the longest overdue invoice they've ever had was 31 days or more. Fortunately for them, 30% of freelancers always imposed penalties for late payments, while 43.2% sometimes did.

Penalties or not, late payments of just a few days can severely impact freelancers. Over 1 in 4 frequently struggled to stay current with bills due to delayed payment issues. At the same time, late payments are better than no payments. A whopping 54% of freelancers said they had been professionally "ghosted" by a client.

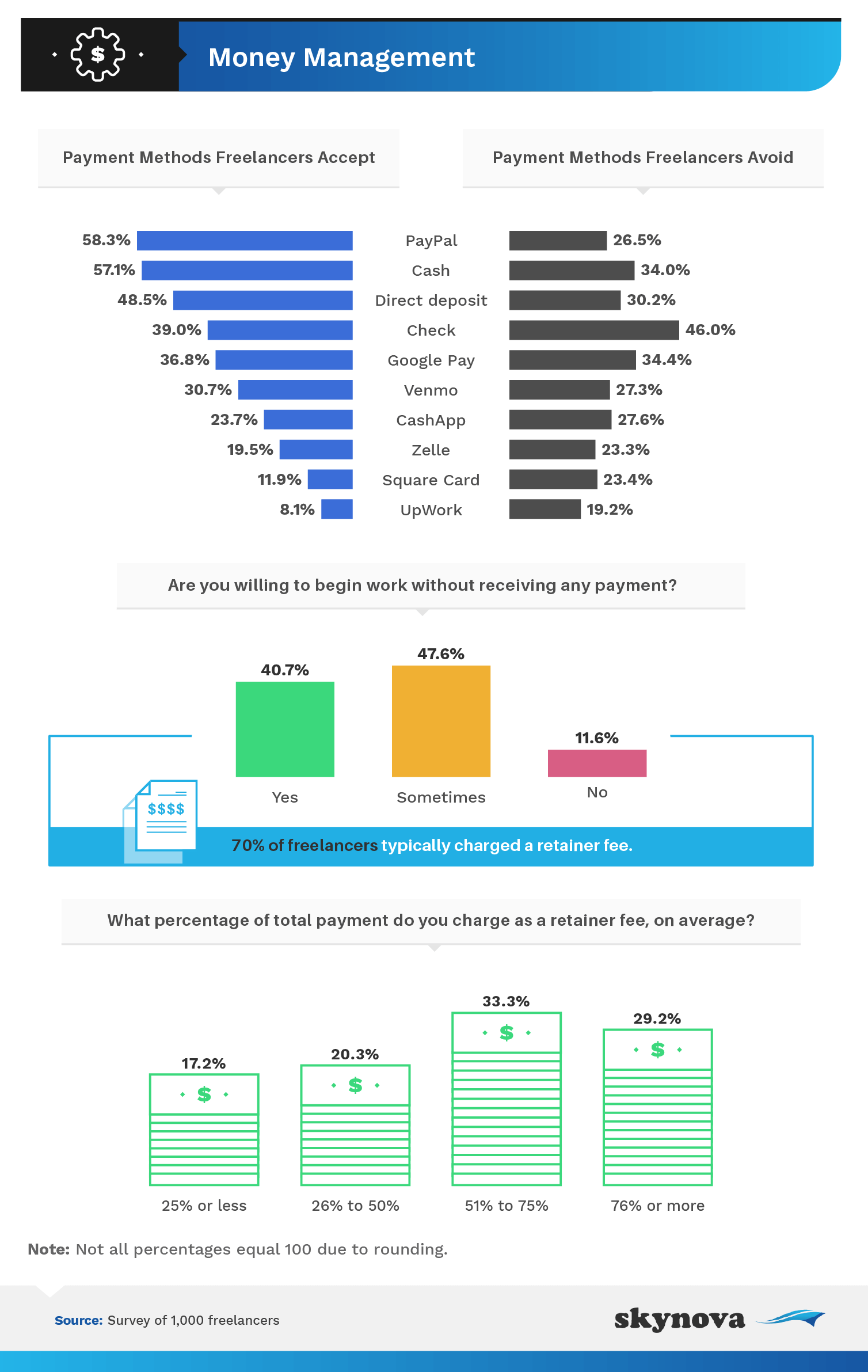

There are plenty of reasons clients are late fulfilling invoices, but freelancers can help cut down on the wait by merely being picky with their accepted payment method.

Checks may be one of the easiest ways to receive payment and avoid fees upon deposit, but the waiting period for checks to clear can add more time to an already late payment. That's likely why checks are the number one payment method freelancers avoided. Instead, PayPal was the most commonly accepted payment (58.3%), followed by cash (57.1%) and direct deposit (48.5%).

Another common way for freelancers to make up for an extended waiting time is to receive full or partial payment upfront. Seventy percent of freelancers said they typically charged a retainer fee, with one-third charging 51% to 75%, on average. However, 40.7% of freelancers said they are always willing to begin work without receiving any payment, while 47.6% said they were willing to do so sometimes. Only 11.6% of freelancers said they refuse to start work without some form of payment upfront.

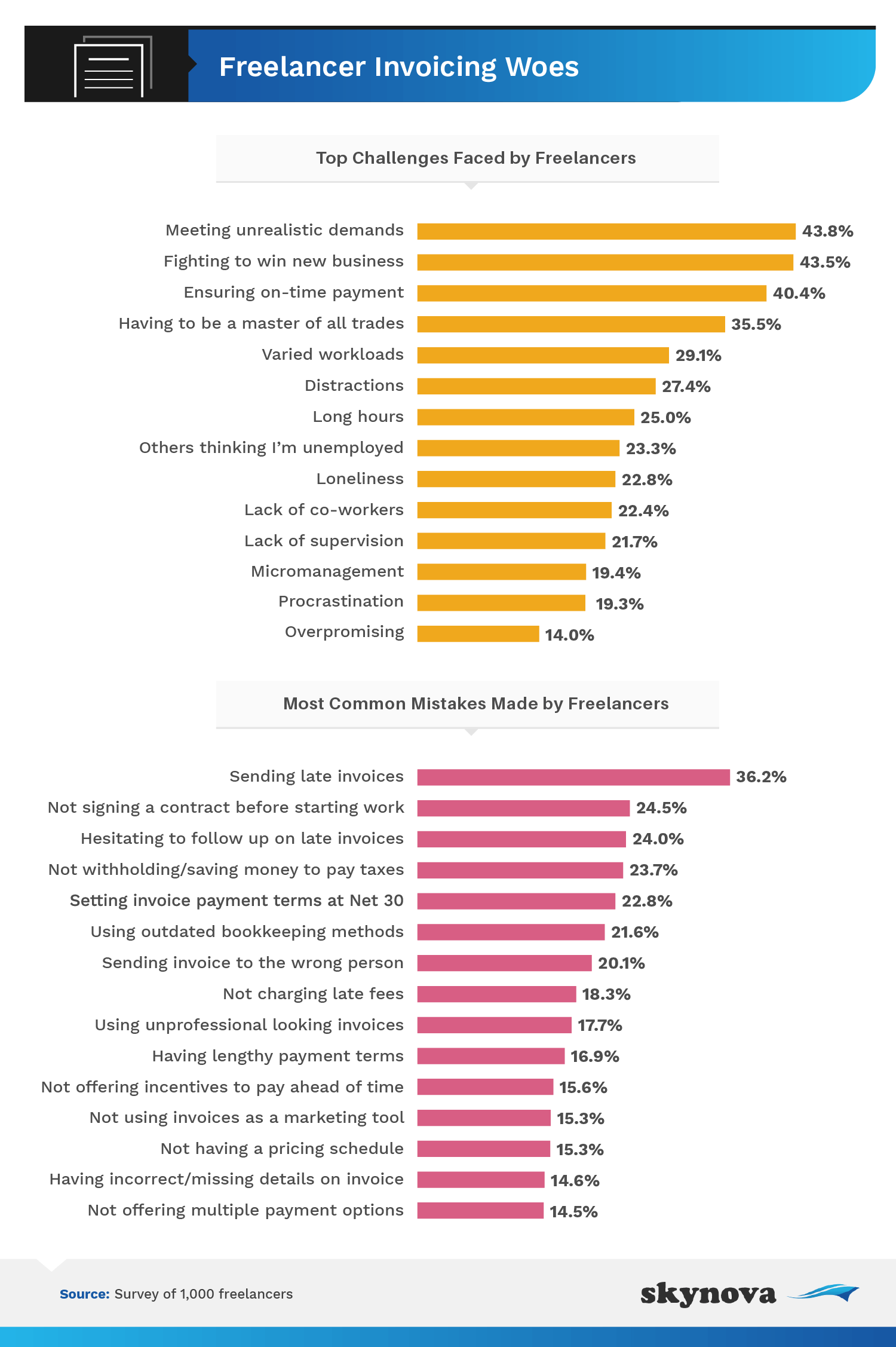

Delays in payment are just one of the issues freelancers face. Slightly over 40% of freelancers named ensuring on-time payment as the top challenge they faced, but fighting to win new business and meeting unrealistic demands were even more common. However, the top two challenges are simply a part of freelance work, and little can be done to avoid it. Late payments, however, can be prevented, and considering the top mistake made by freelancers was sending invoices late, staying on top of bookkeeping is one way to help ensure payment is made on time.

Similarly, signing a contract that includes payment requirements and late payment penalties can also push clients to make on-time payments or, at the very least, hold them accountable. And if late payments occur, it is vital to follow up and request that invoices be brought up to date. Surprisingly, though, 24.5% of freelancers said they'd made the mistake of not signing a contract before starting work, while 24% have hesitated to speak up about late invoices.

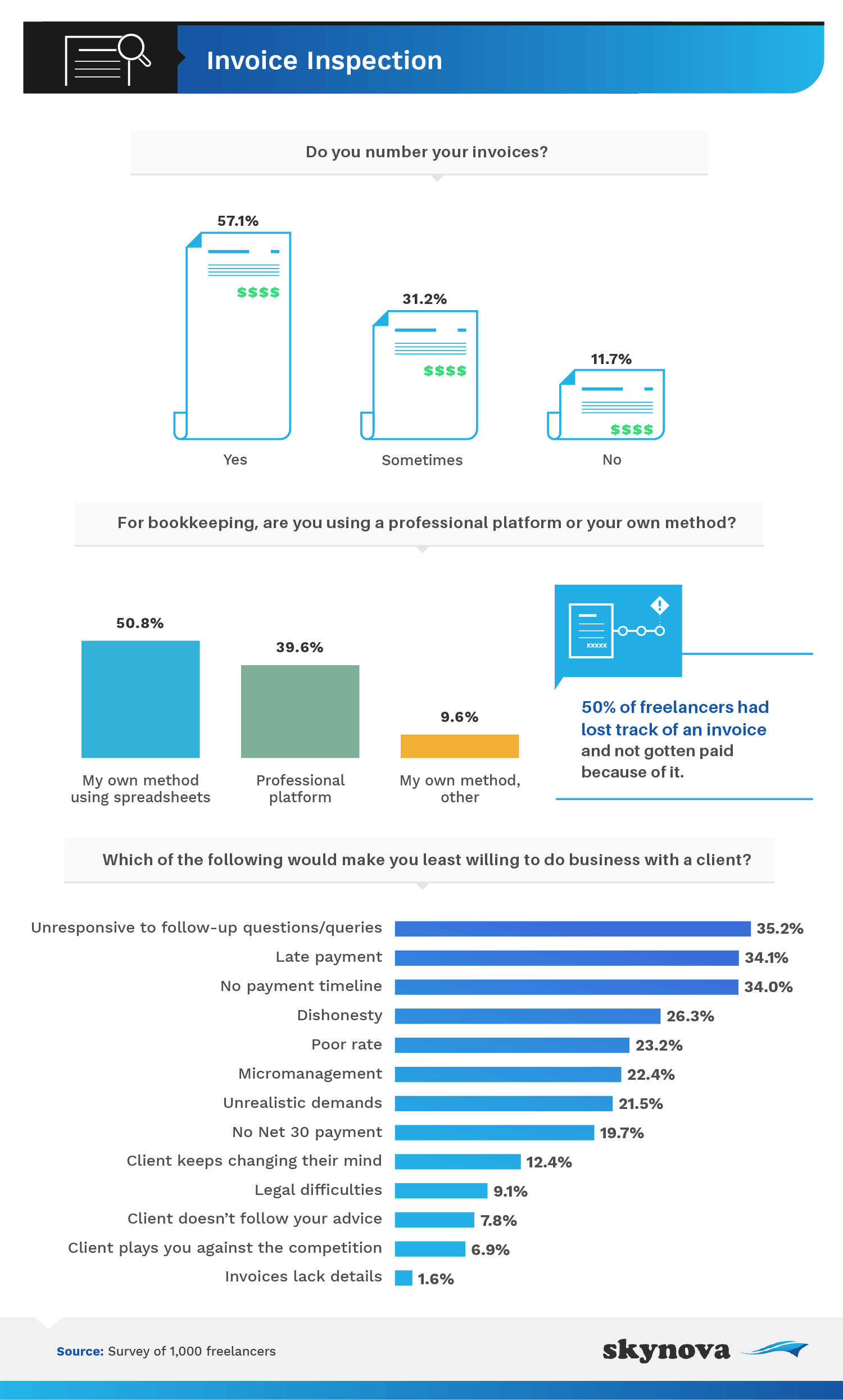

Freelancing means being your own boss and your own employee, leaving bookkeeping and accounting up to the freelancer themselves. Keeping proper records can mean the difference between getting every penny earned and missing out on payment due to lack of organization. Just over 57% of freelancers said they always number their invoices, while 31.2% sometimes did. Shockingly, 11.7% never numbered their invoices, which can make payments incredibly difficult to keep track of.

Fortunately, there are plenty of platforms and software options out there to help freelancers keep track of their invoices and payments. Nearly 40% admit to using a professional platform, but 50.8% do it all themselves using spreadsheets. However, regardless of the method used, half of the freelancers reported having lost track of an invoice and not being paid because of it.

While some clients may be hesitant to work with freelancers who are disorganized with their bookkeeping, some freelancers are also picky about the clients they choose to work with. Late payments and lack of payment timelines were among the top three reasons for avoiding getting into business with a client, but unresponsiveness to follow-up questions or queries was the most common deterrent. Whatever the reason, freelancers should be picky about their clients and the projects they pick up. Being selective means putting you and your business first, and it's bound to lead to more happiness and success.

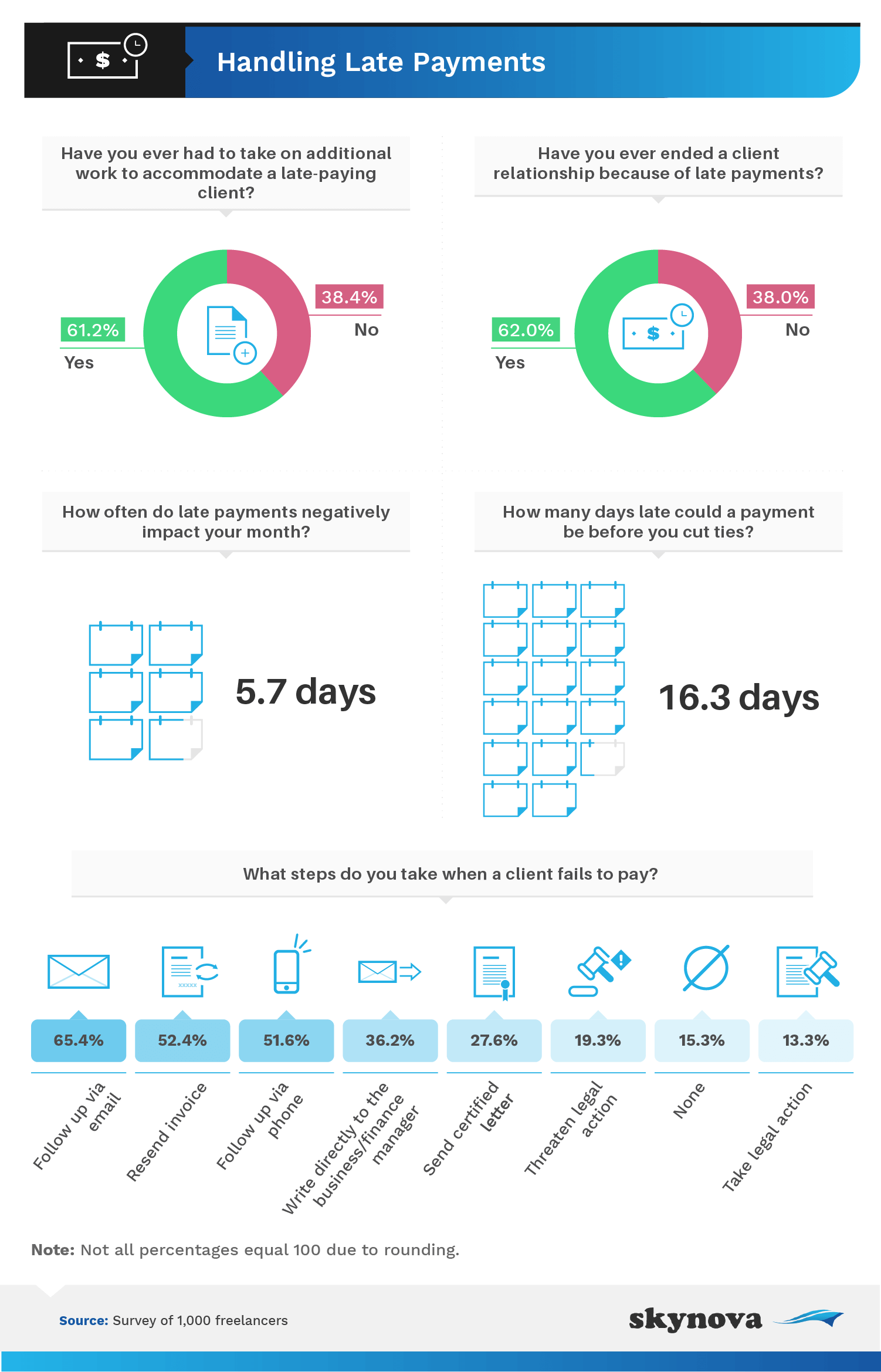

Sixty-two percent of freelancers have ended a client relationship because of late payments - and for a good reason.

Choosing to not work with clients who have a history of paying late may fall under the "picky" umbrella, but it is also beneficial to the freelancer's business and peace of mind. Over 61% of freelancers have had to take on additional work simply to accommodate a late-paying client, and the typical freelancer experienced an average of 5.7 negative days per month due to late payments.

Despite the negative impacts, freelancers reported only cutting ties with a client when a payment is late by an average of 16.3 days. Instead of jumping to cut ties, freelancers seem to follow standard protocol. Faced with a late payment, 65.4% said they follow up with an email, while 52.4% resend the invoice. Over half of freelancers follow up with a phone call, and more than a third write directly to the business or finance manager. Taking legal action should always be a last resort, but 13.3% of freelancers were willing to go that route.

There are plenty of benefits to freelance work, and the pandemic has only highlighted them more. But being your own boss comes with challenges, and a prominent one freelancers face is late payments. While freelance work often comes with a lengthy period between invoice delivery and payment, failure to keep proper records or set payment requirements in a contract can only exacerbate the issue.

Skynova provides simplified online access for customers to create and submit invoices, keep track of accounting, and create accurate timesheets. At the core, we help small businesses get paid faster. We also write articles that cover business and workplace topics with intersections of technology, politics, sports, health, and more. These articles stem from surveys backed by statistics and research conducted by us, so we can provide readers with new insights and perspectives.

For this study, we surveyed 1,000 professional freelance workers via Amazon Mechanical Turk. To qualify for this survey, respondents had to be employed either freelance, part time, or full time.

Of the 1,000 professionals surveyed, 38.8% were female, 60.7% were male, and less than 1% identified as nonbinary. The average age of respondents was 37, with a standard deviation of nine years. An attention-check question was used to identify and disqualify respondents who failed to read questions and answers in their entirety.

This study's main limitation is the reliance on self-report, which is faced with several issues such as, but not limited to, attribution, exaggeration, recency bias, and telescoping. This survey ran during September 2020.

To best manage clients who fail to pay on time, freelancers need to heed others' advice. If you know someone who could benefit from this study's findings, feel free to share it with them for noncommercial purposes. All we ask is that you include a link back to this page so readers can see the projects in its entirety and our creators receive proper credit.