|

The gig economy is alive and well in the U.S., with more than 70 million Americans freelancing as of 2022. As more companies take advantage of freelancers' skills, many are also encountering an uptick in freelance service invoices.

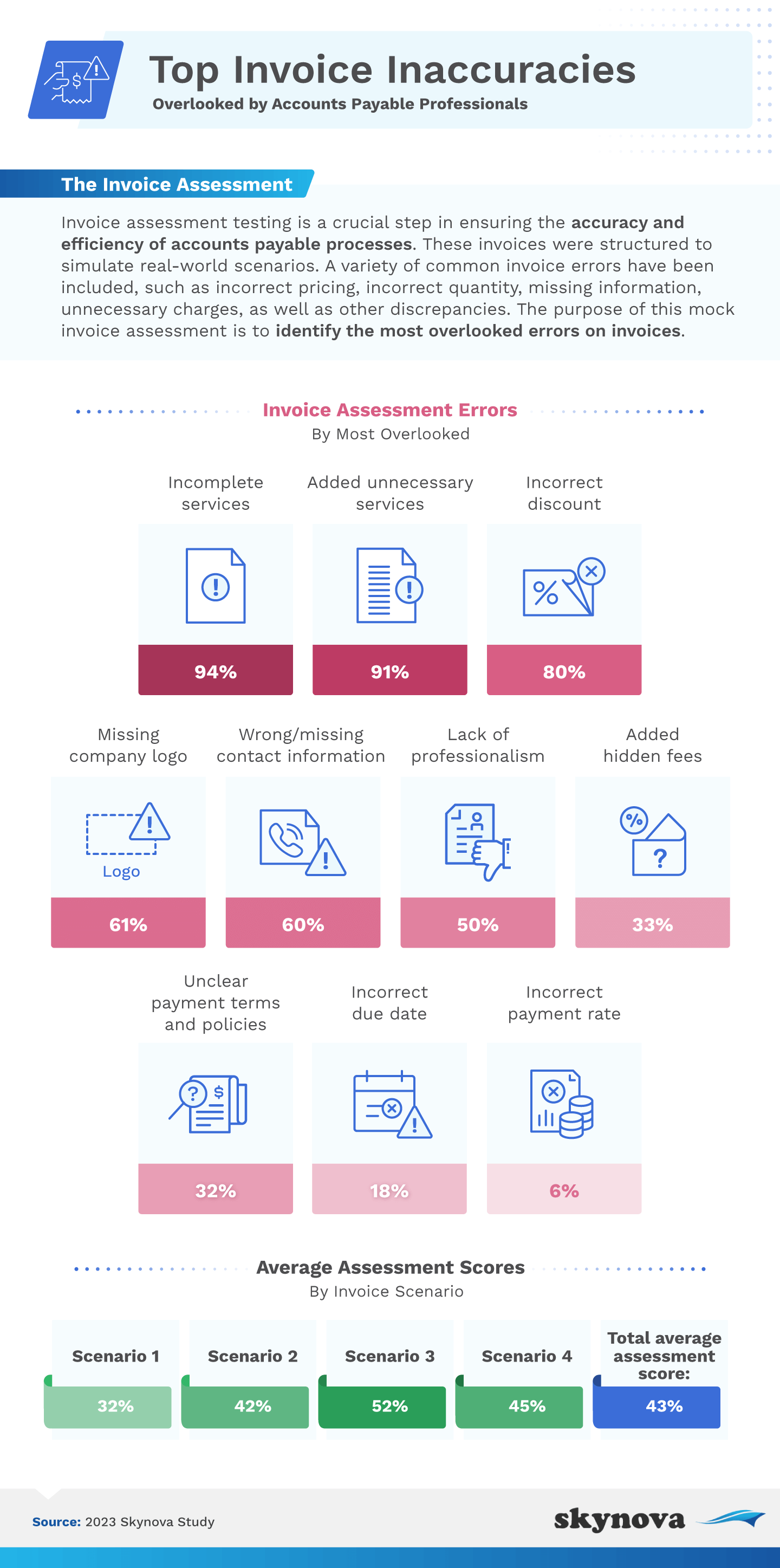

But how many invoice mistakes go unnoticed? We decided to find out by presenting 200 accounts payable professionals with four different invoices, each riddled with errors, and asked them to spot the inaccuracies. We'll show you how they fared and the common consequences of these mistakes.

For a freelancer perspective, we also surveyed 800 gig workers about their experiences with invoicing and how it affects their client relationships. Explore the insights we gleaned from both groups and discover how invoicing mishaps may affect your business.

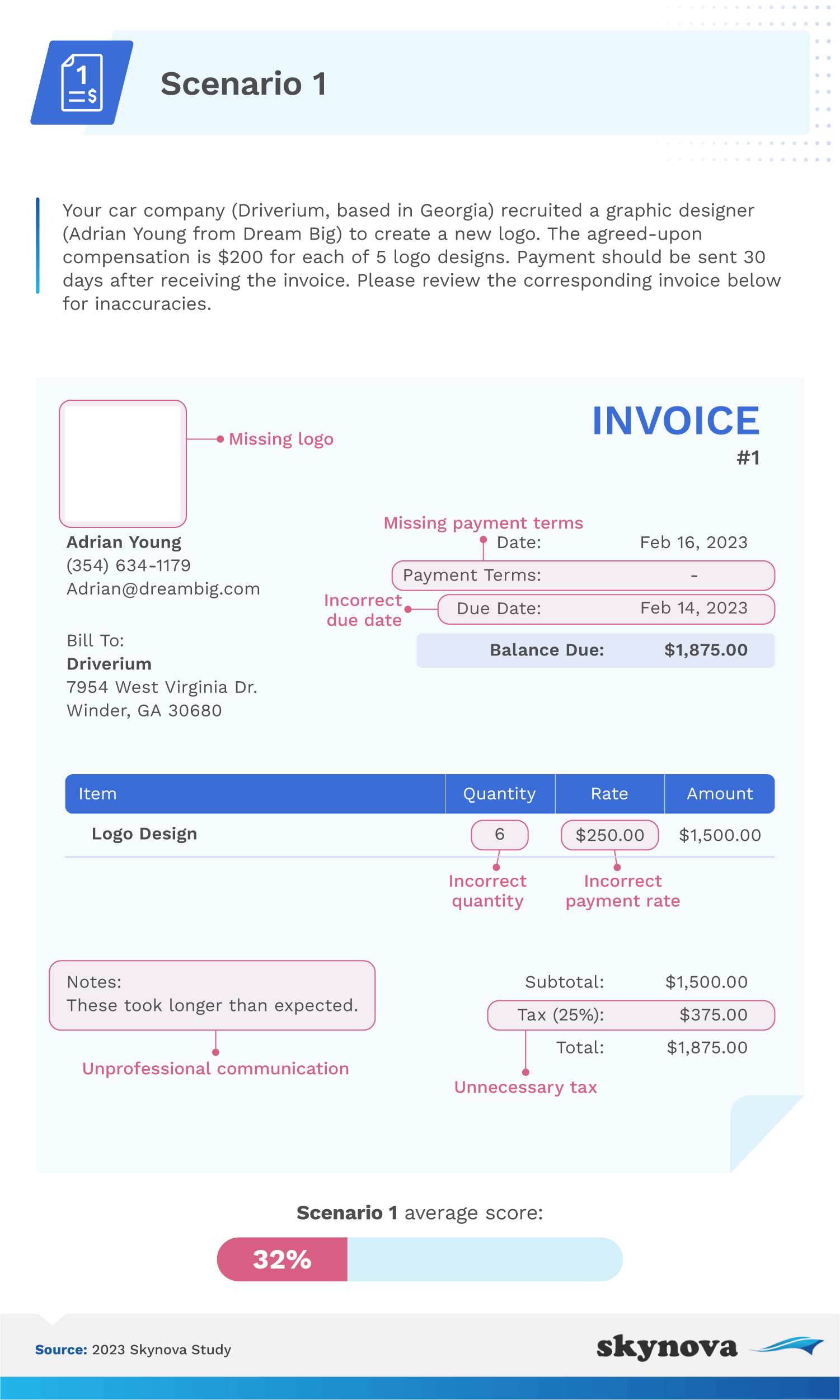

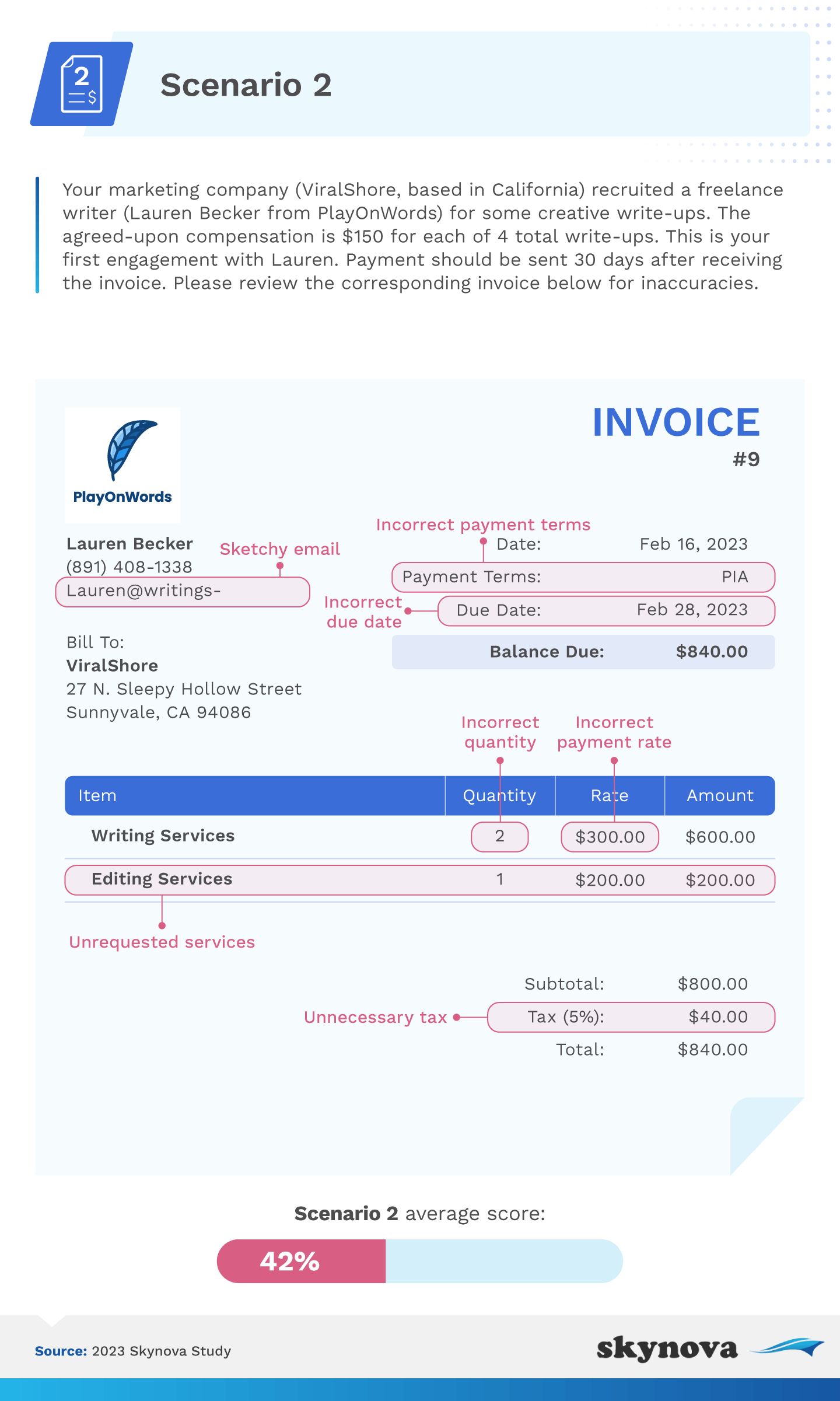

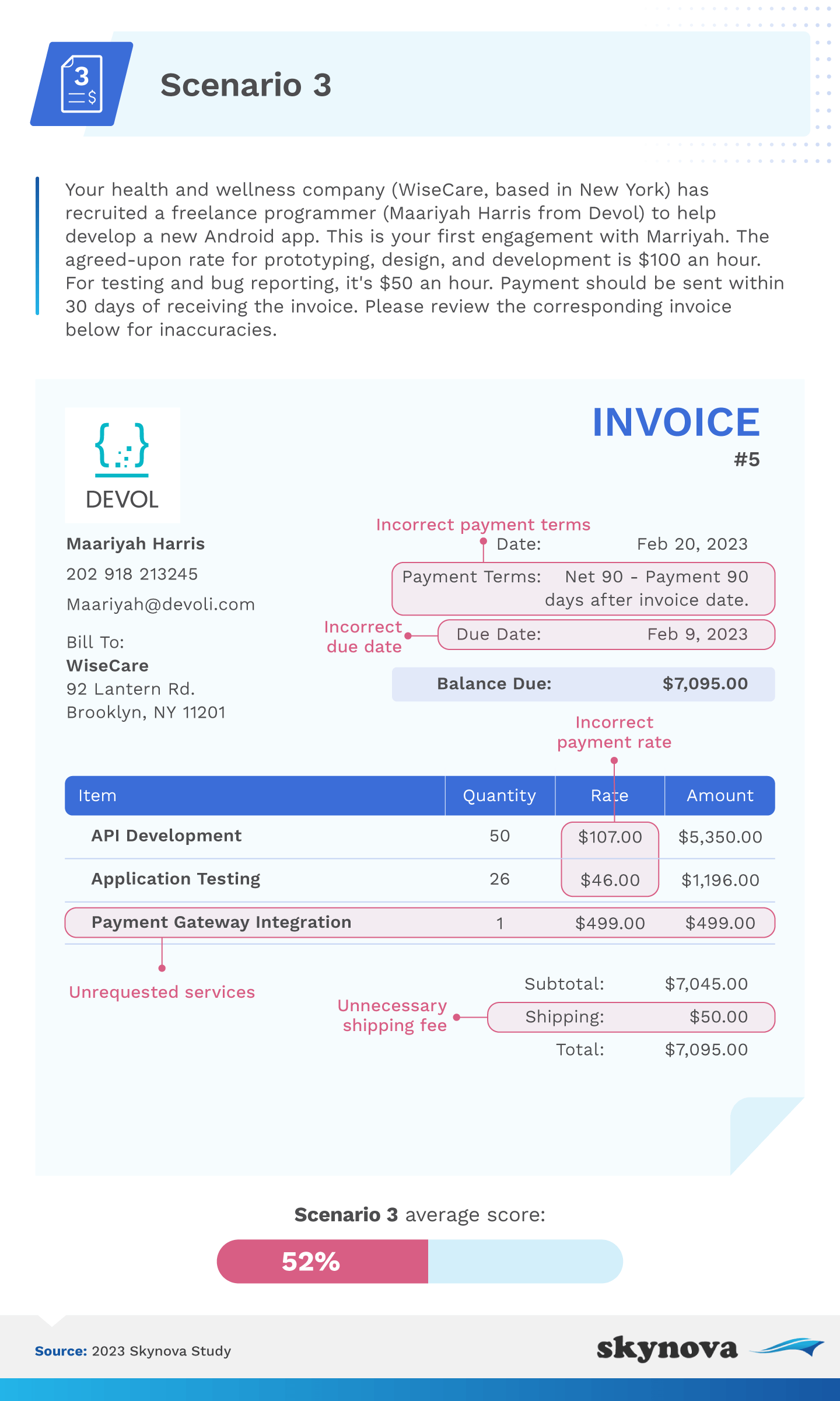

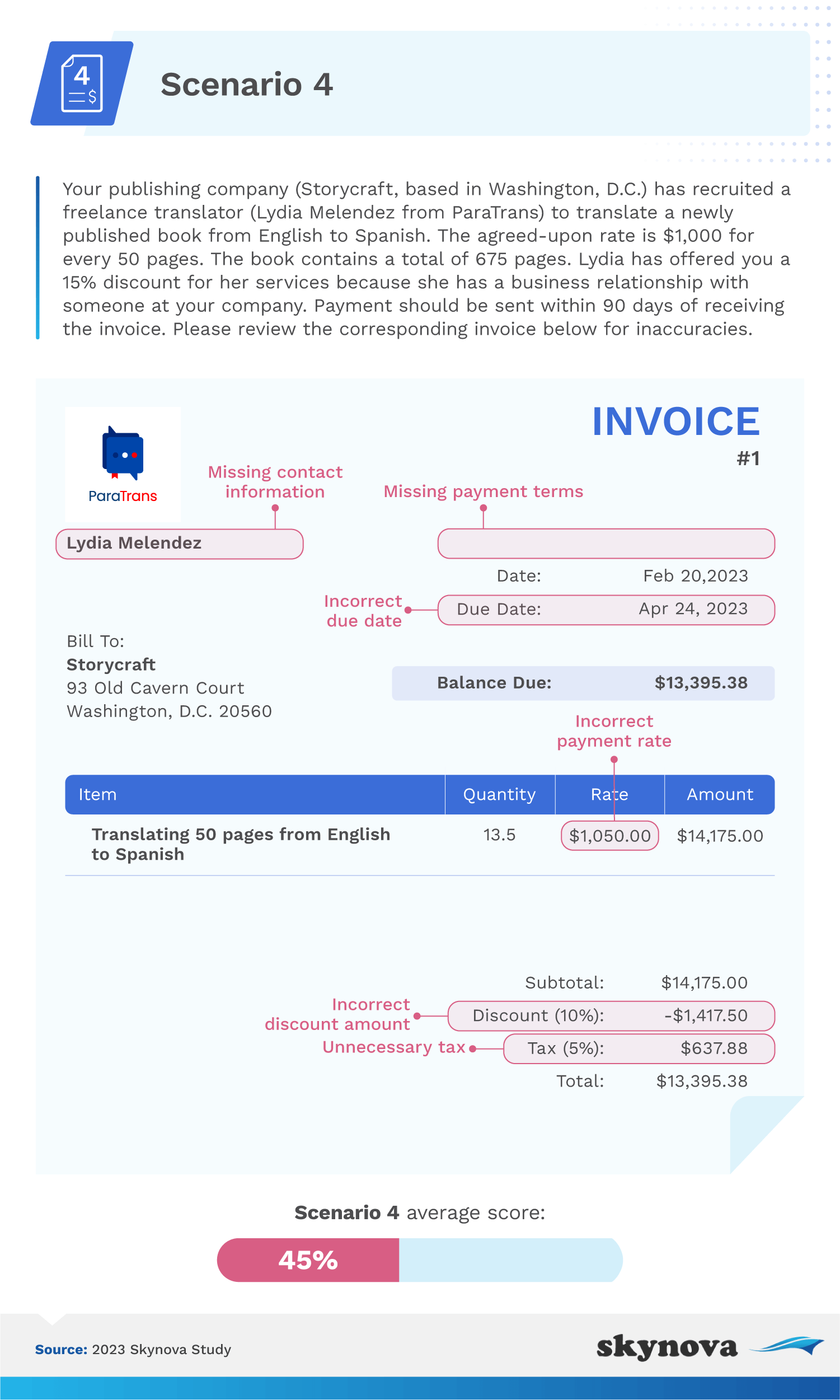

Below, you'll find the inaccurate invoices we presented to our accounts payable participants. We've also highlighted each error to show you what we hoped they would spot.

From missing or incorrect payment terms to hidden fees, plenty of errors managed to slip through the cracks. The majority of accounts payable professionals failed the invoice accuracy assessment, only spotting an average of 39% of the invoice errors. Unfortunately, the cost of failing to track expenses and payments properly can add up quickly.

So, why do so many invoicing oversights happen? It may come down to another statistic we uncovered. When asked how long they spent assessing invoices for inaccuracies, 70% of our respondents said they only dedicated 1-2 minutes to the task. Spending more time reviewing these invoices could have saved these companies hundreds of dollars in overpayments.

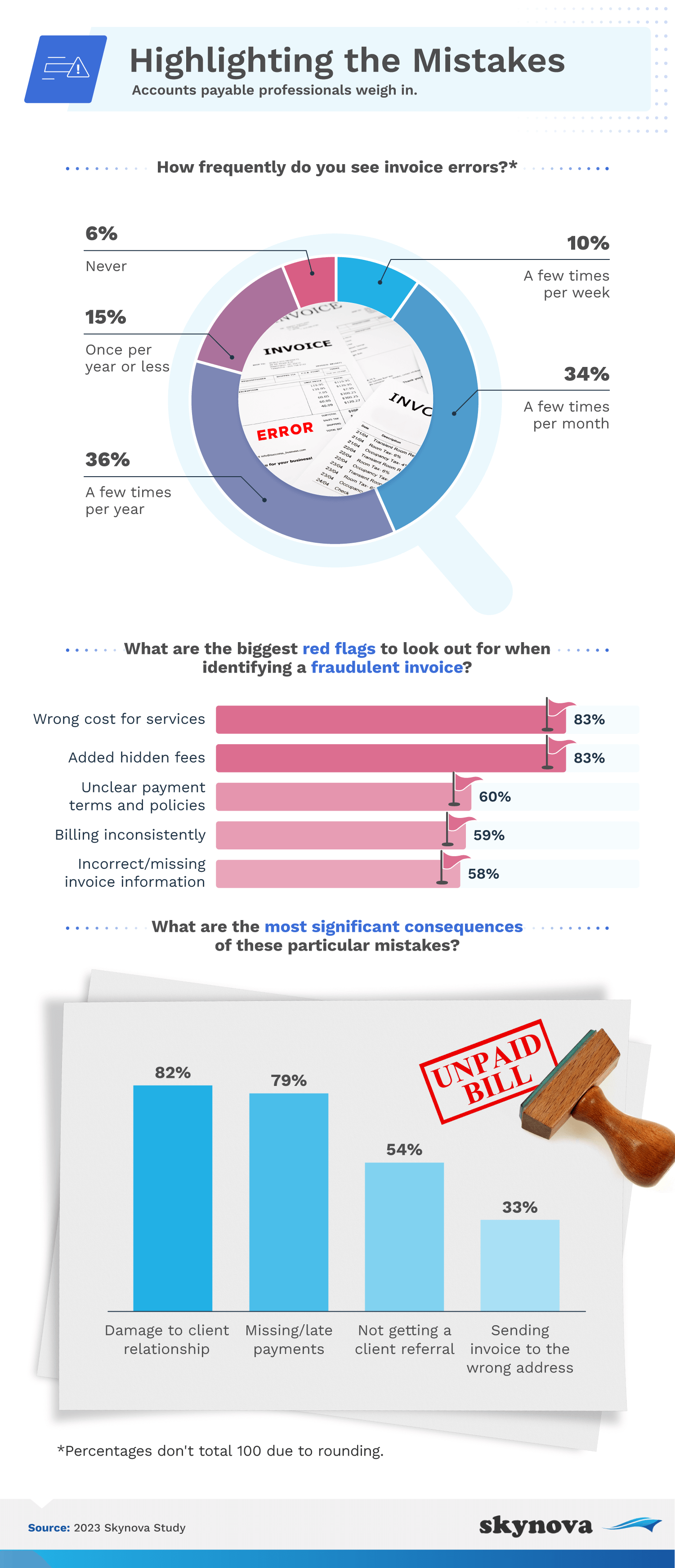

Next, we asked the accounts payable professionals about common red flags of fraudulent invoices and how often they encounter each. We also asked them about the ramifications of invoicing errors.

Many accounts payable professionals look straight to the numbers for clues pointing to inflated or fraudulent invoices. They scan for things like incorrect service prices, hidden fees, and unclear terms or policies. More than a third of respondents said they see these things a few times per year (36%) or even as often as a few times per month (34%).

Most of them (82%) also said the top consequence of these errors was damaging their relationship with the client. Incorrect invoicing also led to a high risk of missing or late payments (79%) and the strong possibility of missing out on a client referral (54%). But what are freelancers' experiences with invoicing errors?

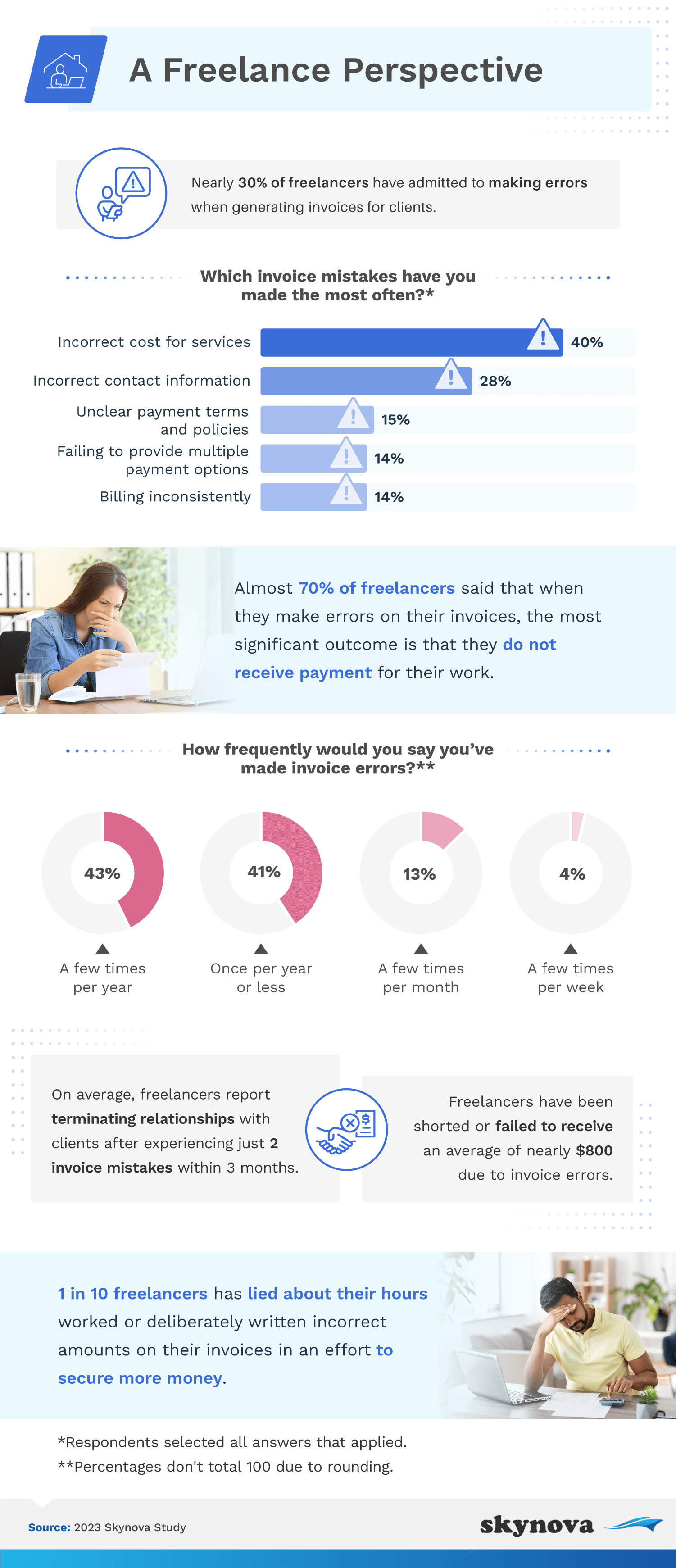

We all make mistakes, but how do they affect the workers asking to be paid? And how many freelancers knowingly submit incorrect invoices?

While nearly 30% of freelancers admitted to having made invoice mistakes, 10% did so deliberately in order to overcharge their clients. However, most freelancers count on the business of long-term and recurring clients, illustrating the importance of maintaining positive working relationships. So, it's likely that most of their invoicing mistakes are honest ones.

These oversights can cost freelancers as well. Those we surveyed came up short by an average of nearly $800 due to invoice mistakes. This is another reason for both freelancers and accounts payable professionals to double-check for service costs, incorrect or missing information, added fees, and other common errors.

A little extra diligence with invoices can go a long way for both freelancers and their clients. Honest mistakes will happen on both ends, but freelancers who constantly submit inflated invoices may send clients in search of a better fit. Whichever side you fall on, a reliable invoice template can be a great way to keep everyone on the same page and avoid mistakes, surprises, or damaged relationships.

Skynova is a user-friendly web application that simplifies common business tasks such as invoicing and expense tracking. With customizable modules, Skynova offers business solutions for companies of any size.

We surveyed 200 accounts payable professionals regarding their perspectives on invoices and assessed their ability to identify invoice inaccuracies by creating mock invoices simulating real-world scenarios. The mean age of respondents was 37 years old. Among them, 51% were male, and 49% were female. Respondents comprised the following generational breakdown: 9% Gen Z, 59% millennials, 28% Gen X, and 4% baby boomers.

Additionally, we surveyed 800 gig workers regarding their experience with invoices. The mean age of respondents was 41 years old. Among them, 47% were male, 51% were female, and 2% were nonbinary. Respondents comprised the following generational breakdown: 9% Gen Z, 25% Gen X, 57% millennials, and 9% baby boomers.

If you found this information useful, feel free to share it for any non-commercial purposes. We just ask that you please provide a link to this original page in return.