|

Invoicing is an essential process in any business. It's how you pay for what you need to run your business and how you get paid for your products or services. Establishing accurate and efficient invoicing processes keeps your cash flow moving and ensures no penny is wasted.

This guide explains the latest in invoice processing by exploring 39 invoicing statistics, including how invoices are processed, the insights of accounts payable and receivable teams, and the impacts of invoice automation.

This first section covers some of the most pertinent invoicing statistics. We'll break down how many invoices businesses process per month, the average processing time, the percentage of paper and electronic invoices, data entry methods, and more.

Running a business requires numerous paid transactions daily, each requiring a separate invoice. Those individual invoices add up quickly; almost half of all businesses (48%) handle up to 500 invoices each month.

With so many invoices coming in and out, most businesses spend at least five days processing invoices each month.

Despite the large number of invoices, only just over half are received electronically. The rest are paper invoices that need to be physically sorted, entered, and filed, adding additional steps to the project management process.

Along with invoices, 37% of businesses also use paper invoice receipts, adding to the paperwork load of accounts receivable and accounts payable teams — and the mail costs for businesses.

Paper invoices are often entered into accounting software, but even the best software requires a significant amount of manual entry. On average, 57% of invoice data has to be entered manually.

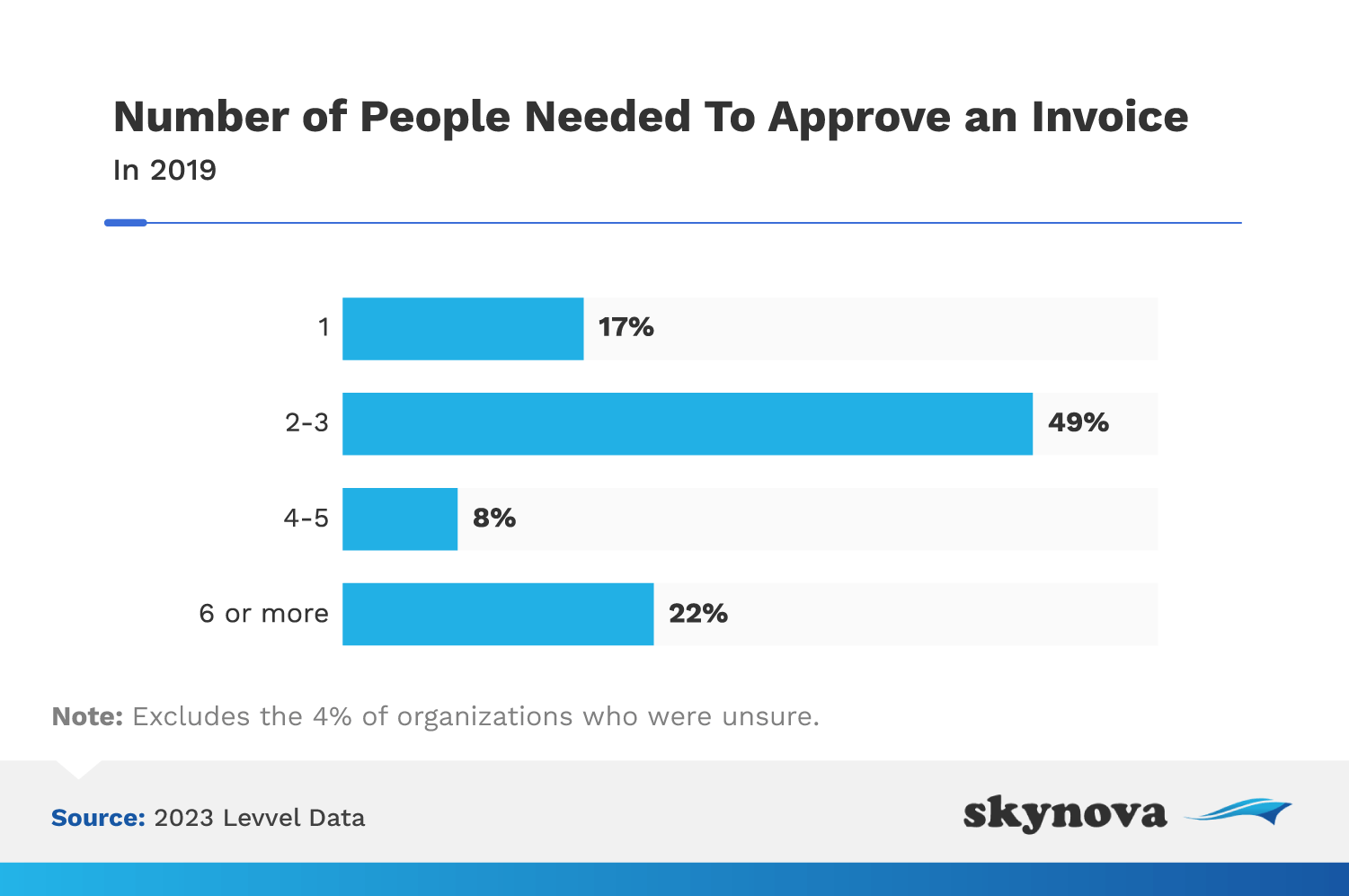

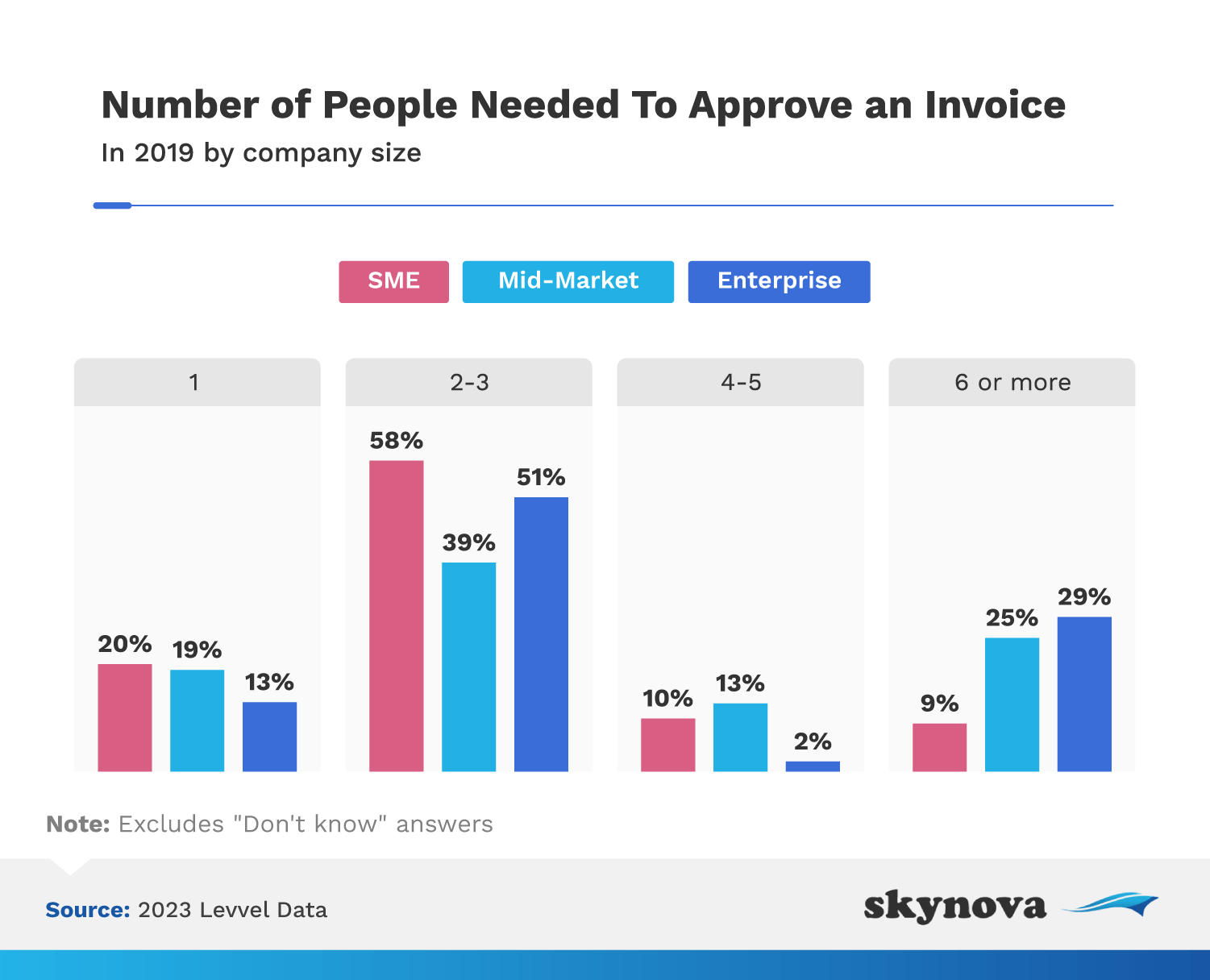

After data entry, waiting for invoice approval is often one of the slowest steps in invoice processing. For most businesses, the wait is prolonged by the need for multi-level approval: 49% of businesses require two to three people to approve an invoice. A surprising 22% require six or more.

Despite the best efforts of accounting departments, such a large volume of invoices is inevitably difficult to keep up with. On average, 11% of customers never receive their invoices. Not only does this slow the payment process, but it also requires more work and money to follow up with customers and re-process invoices.

As the business world embraces digitization and artificial intelligence, accounts payable and accounts receivable are eager to improve functionality through automation. This section will look at statistics related to invoicing automation and automated accounting systems.

Automation is slowly making its way into every aspect of business, and 71% of people believe invoice automation will be the biggest invoicing trend of 2023. Electronic Data Interchange (EDI), which upgrades manual paper invoicing to automated transactions, is one example of how businesses can save time and avoid errors.

While automation can streamline workflow, only 5% of accounts payable teams have fully automated invoice and payment processing. Teams could significantly cut their labor costs if they used software to automate these tasks.

For example, Enterprise Resource Planning (ERP) platforms can help businesses integrate aspects like purchasing, sales, and finance into a single system, streamlining these processes to save time and money.

Though just a handful of businesses have fully-automated systems, 26% are working toward fully automated invoice processing. Most businesses hope to reach full automation by 2024.

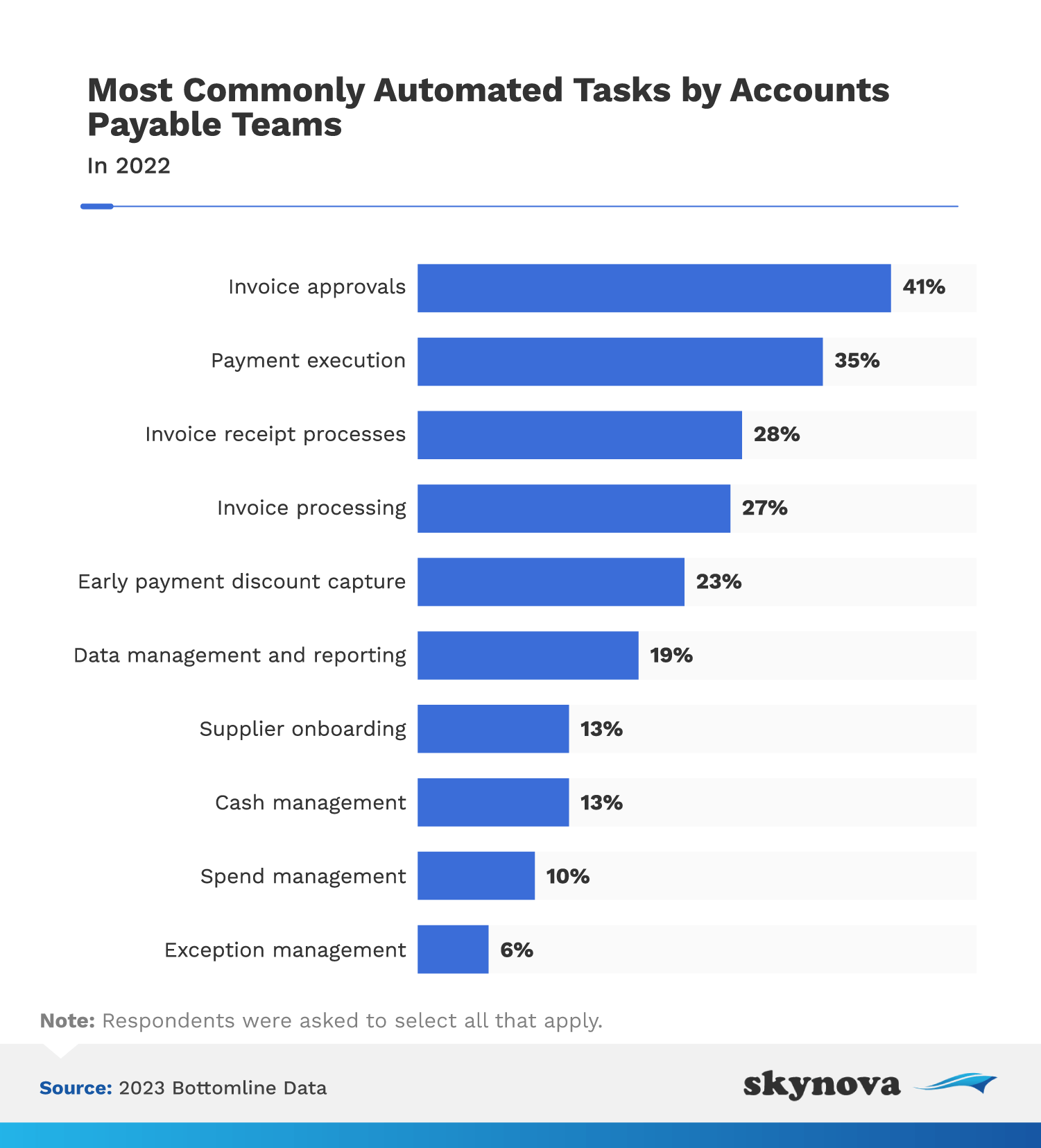

Many businesses have partially automated invoicing systems. Among them, 41% have automated invoice approvals, the most common automated task for accounts payable.

The size of a business can have a significant impact on business processes. Small-business owners and employees often fulfill many roles within a company, from bookkeeper to CFO, while larger businesses can keep departments more defined and focused. In this section, we'll look at invoice statistics by business size. For these statistics, business size is defined as follows:

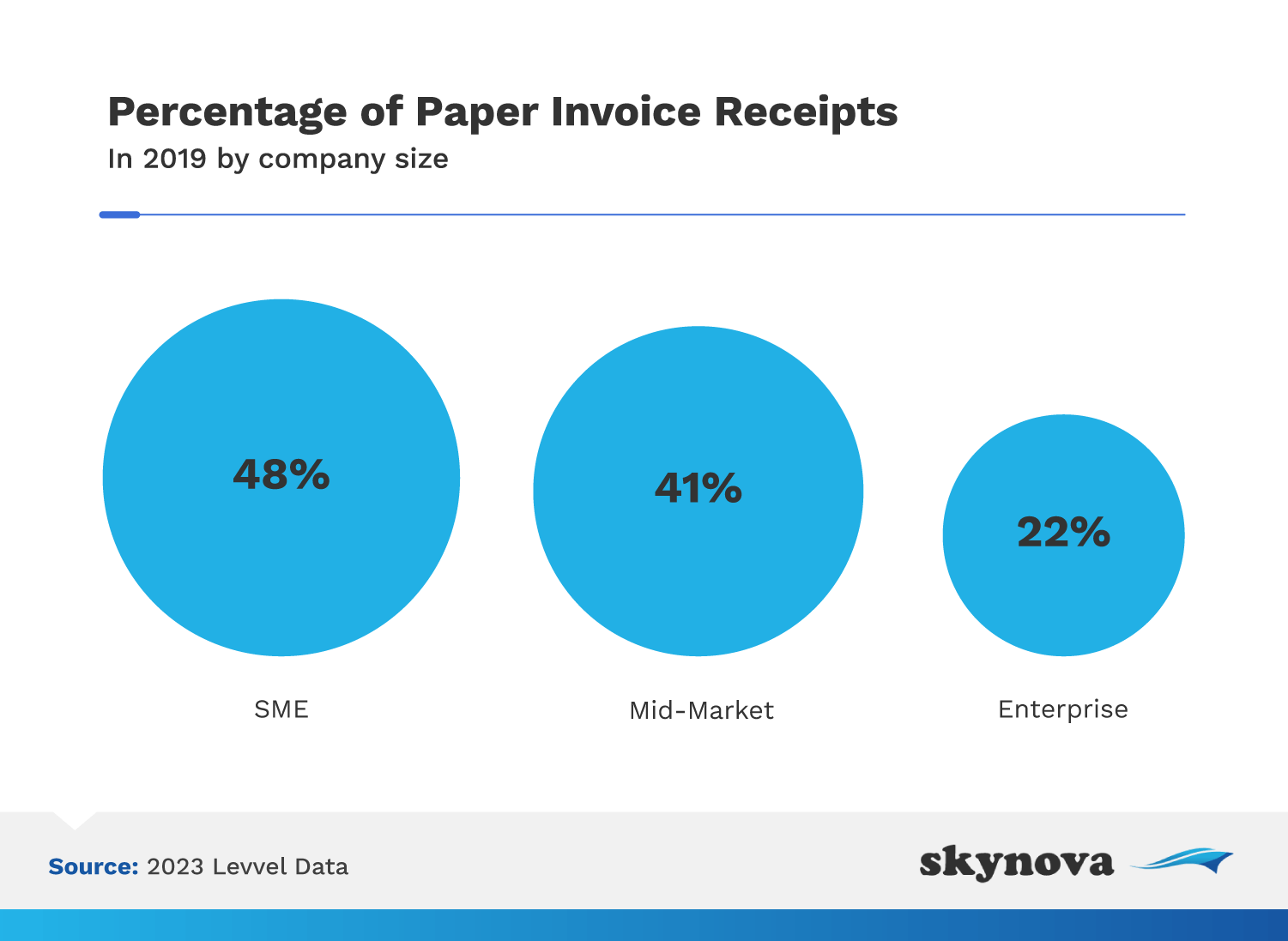

Forty-eight percent of SMEs use paper invoice receipts, the highest percentage of any company size. Only 22% of enterprise businesses use paper receipts.

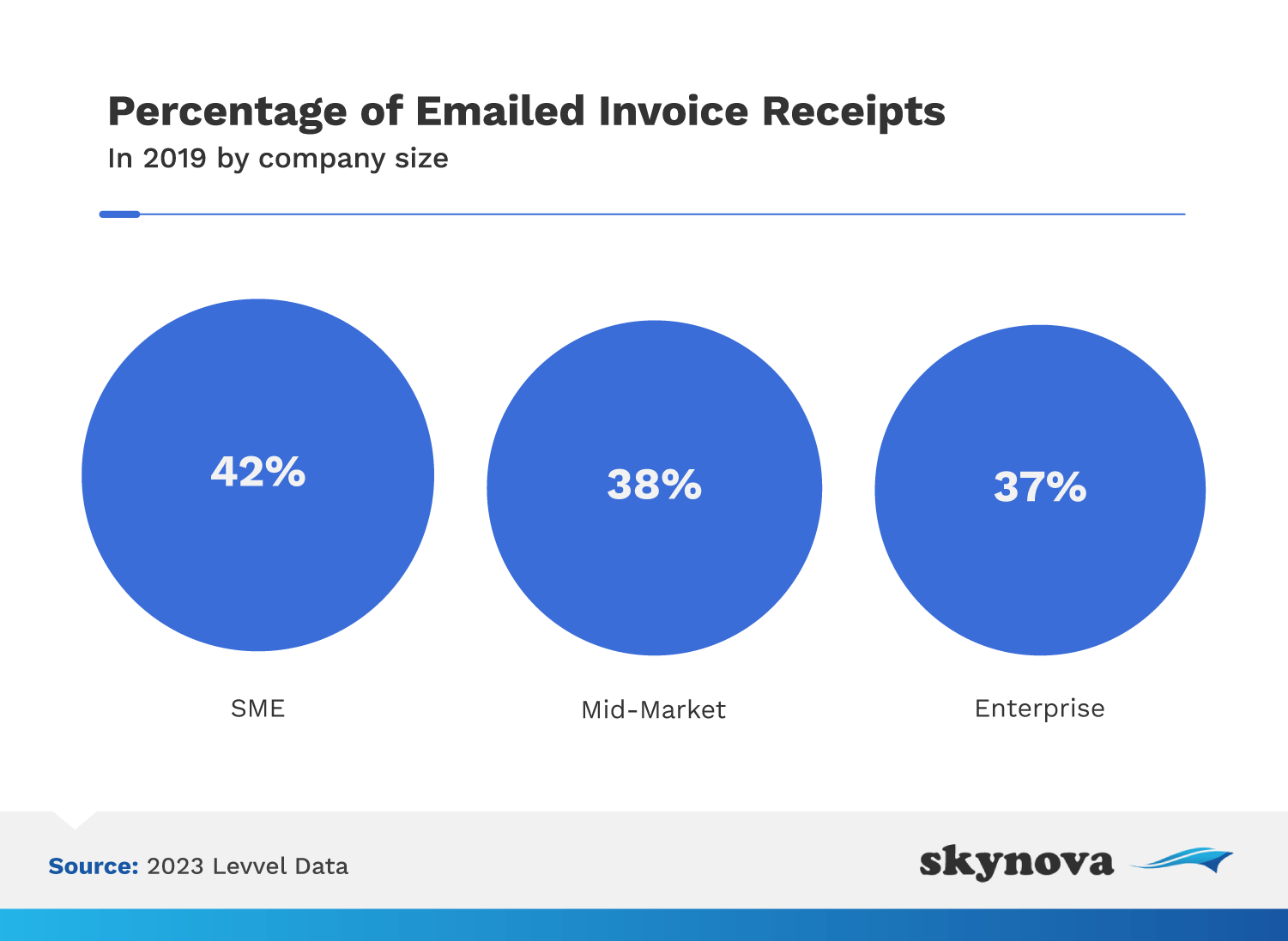

Another 42% of SMEs use email for invoice receipts, again the highest percentage of any company size. Mid-market (38%) and enterprise (37%) businesses also use email receipts regularly.

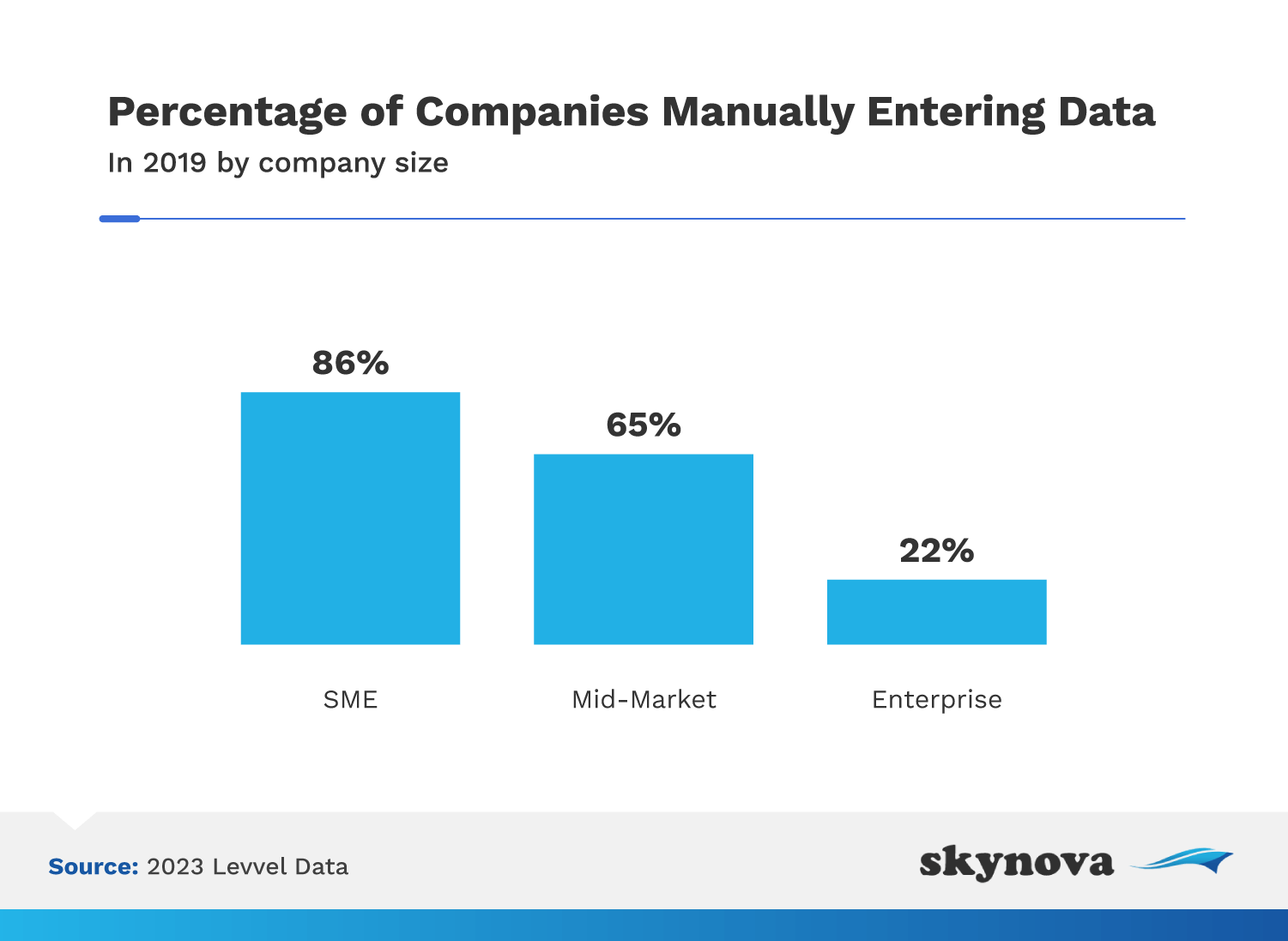

While nearly half of SMEs use email invoices, almost all rely heavily on manual entry: 86% manually enter invoice data. Many mid-market businesses do as well (65%), as do 22% of enterprise businesses.

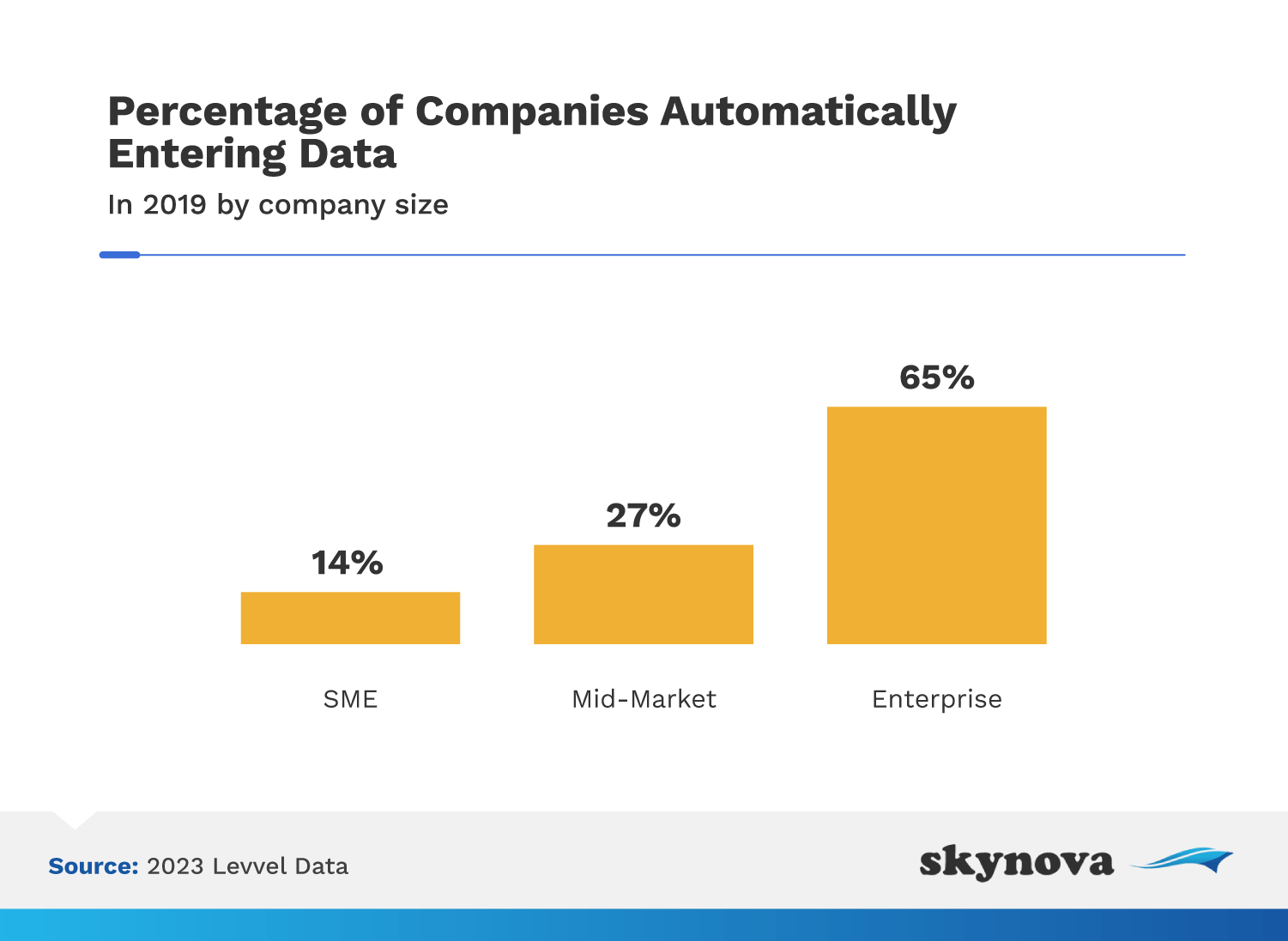

Manual entry is the standard for SMEs, but automatic entry is the standard for enterprises. Over half of all enterprises (65%) have automated invoice data entry. Only 27% of mid-market and 14% of SMEs have automated entry.

Most businesses require just two to three people to approve an invoice, but enterprise businesses can require many more. More than a quarter of businesses that need six or more invoice approvers (29%) are enterprises.

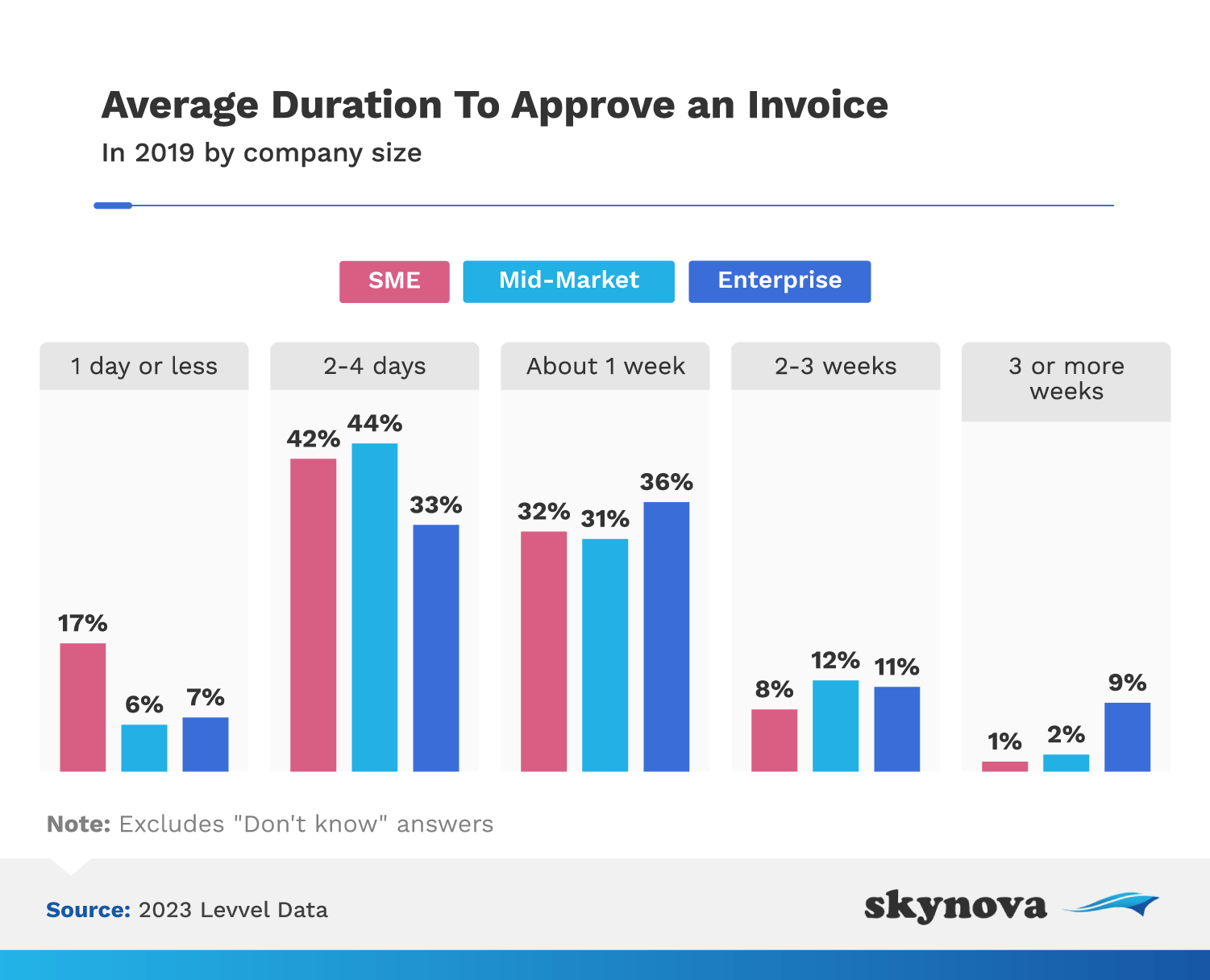

It takes most businesses two to seven days to approve an invoice, but 9% of enterprise businesses take three weeks or more. This length of time could be due to the large number of enterprises that require six or more people to approve an invoice.

Accounts payable is one of the busiest departments in any business. This section looks at statistics regarding accounts payable teams and their insights into the invoicing process.

As crucial components to both growing and large businesses, over 378,750 accounts payable specialists are employed in the United States.

Women dominate the invoicing industry: 79% of accounts payable associates are women, while just 21% are men.

Accounts payable associates have a fairly high median age, averaging 51 years old.

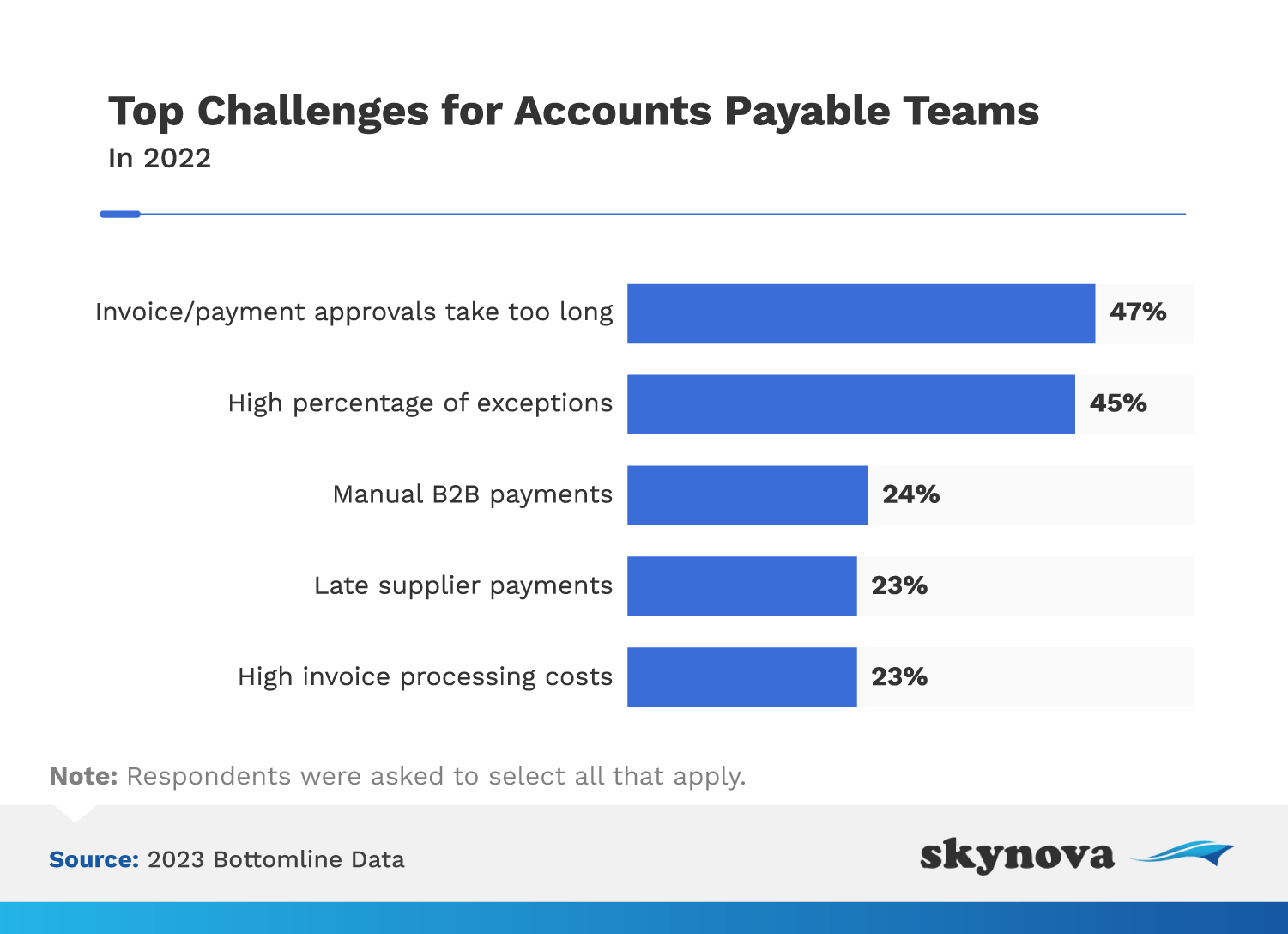

Accounts payable teams face many challenges during the invoicing process. The two biggest issues are slow invoice approvals (47%) and the high number of exceptions to invoicing standards (45%).

A slow invoice process creates considerable stress for accounts payable teams. It also damages supplier relationships and delays the delivery of much-needed goods and services.

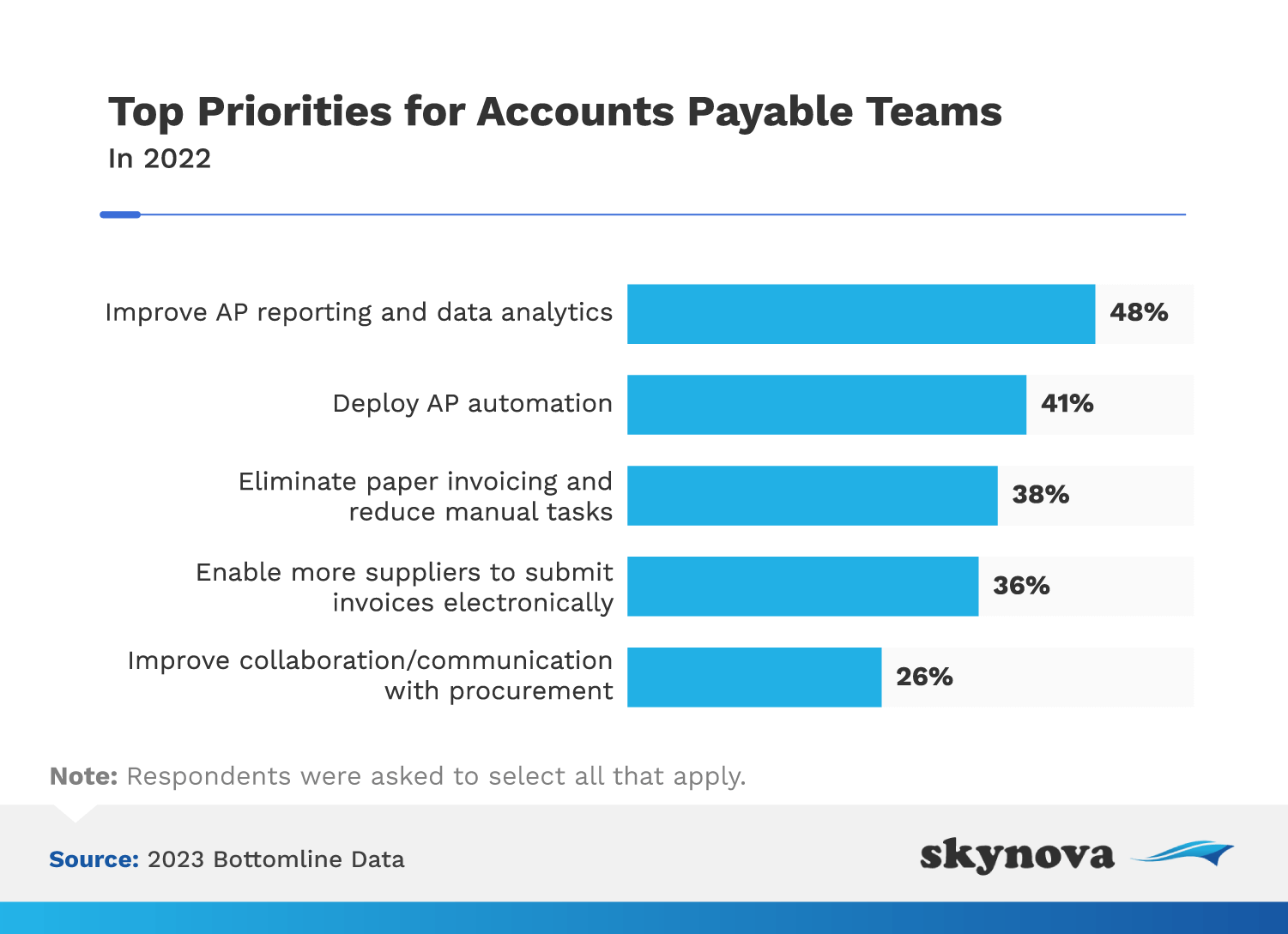

To reduce stress, 48% of accounts payable teams want improved reporting and data analytics. Another 41% want to launch invoice automation, which would allow them to send invoice notifications automatically.

Businesses process dozens to hundreds of invoices per month, but just over half of all accounts payable teams use digital payments like credit cards.

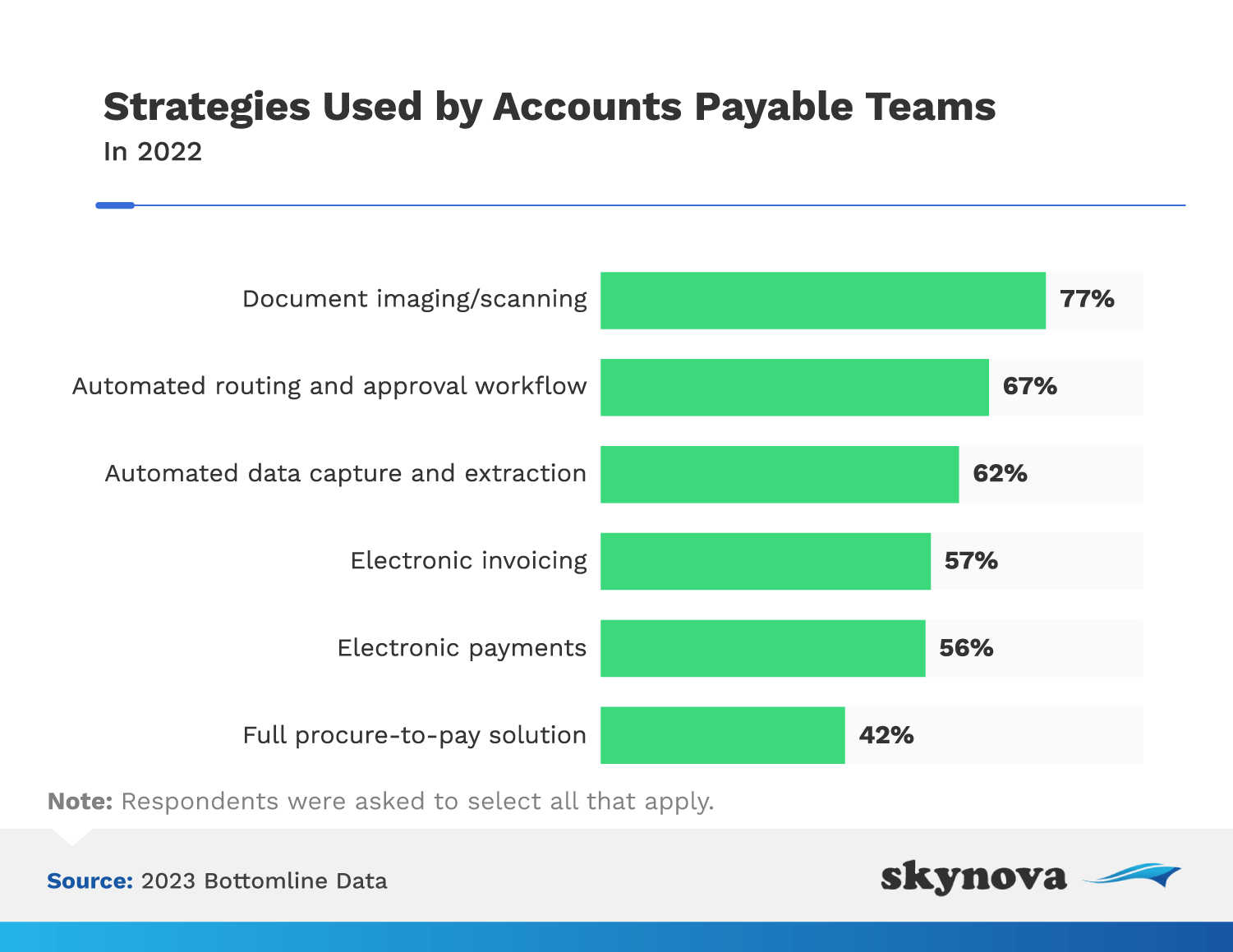

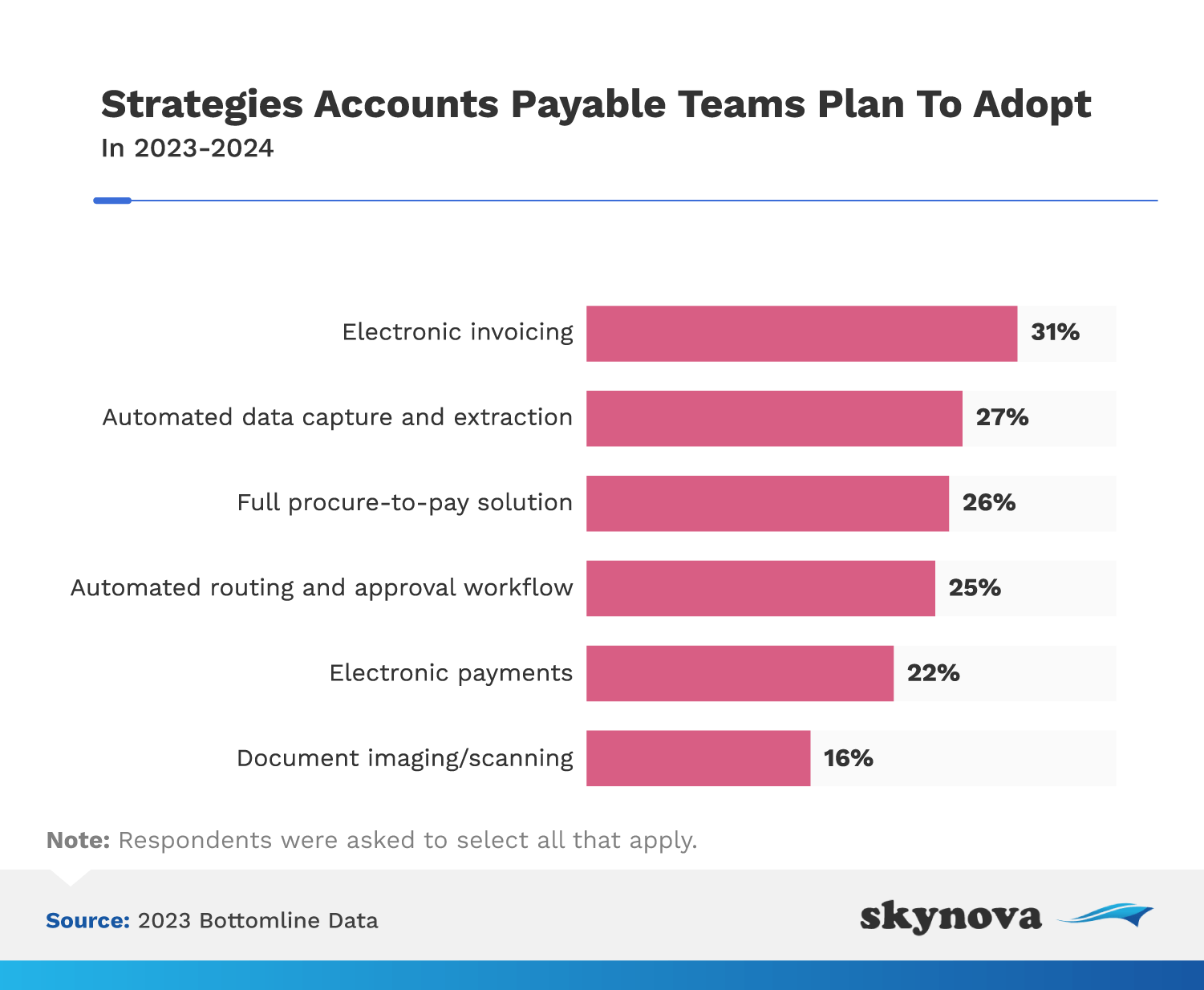

Many accounts payable teams currently rely on paper. In fact, 77% of teams still rely on document scanning as a standard practice. However, one-third plan to adopt e-invoicing within the next one to two years.

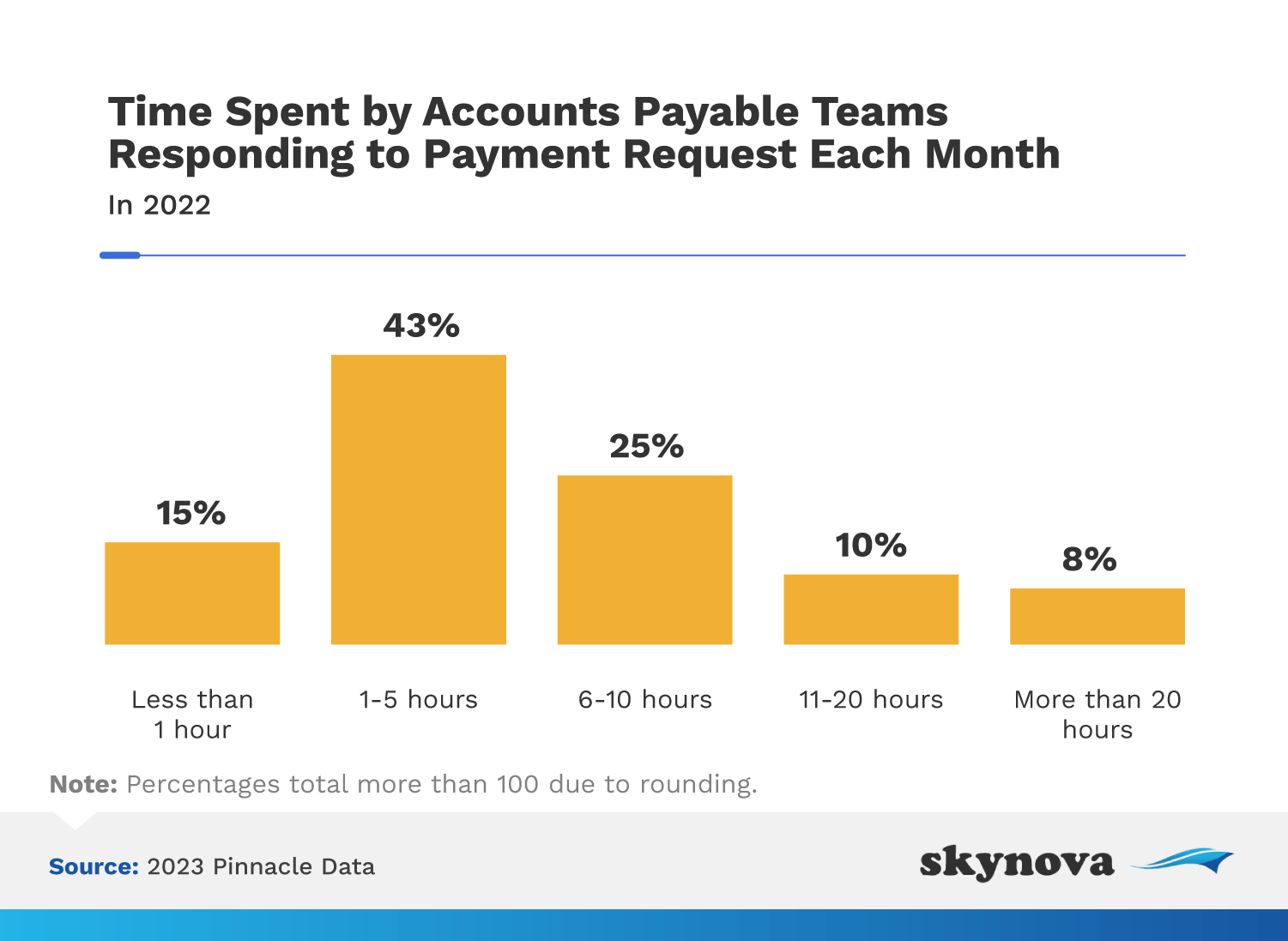

Clear and effective communication is important for any accounts payable team, as they often help facilitate the relationship between a business and its suppliers. Almost half of all teams spend one to five hours per month responding to invoice requests. Another 25% spend six to 10 hours, and 8% spend more than 20.

Accounts payable teams spend the vast majority of their time on data entry. It takes one clerk an average of 12 minutes to manually process a single invoice.

Accounts receivable is the department that deposits a business's hard-earned money into the bank. This section will take a quick look at accounts receivable teams.

Responsible for collecting money owed to a business, 515,368 accounts receivable specialists work in the U.S. They coordinate with accounts payable specialists and clients, making sure that payments are received and correct.

As in accounts payable, women far outnumber men on accounts receivable teams: 82% are women, compared to just 18% who are men.

Accounts receivable specialists have an average age of 45 — a bit younger than their accounts payable counterparts, who average 51 years old.

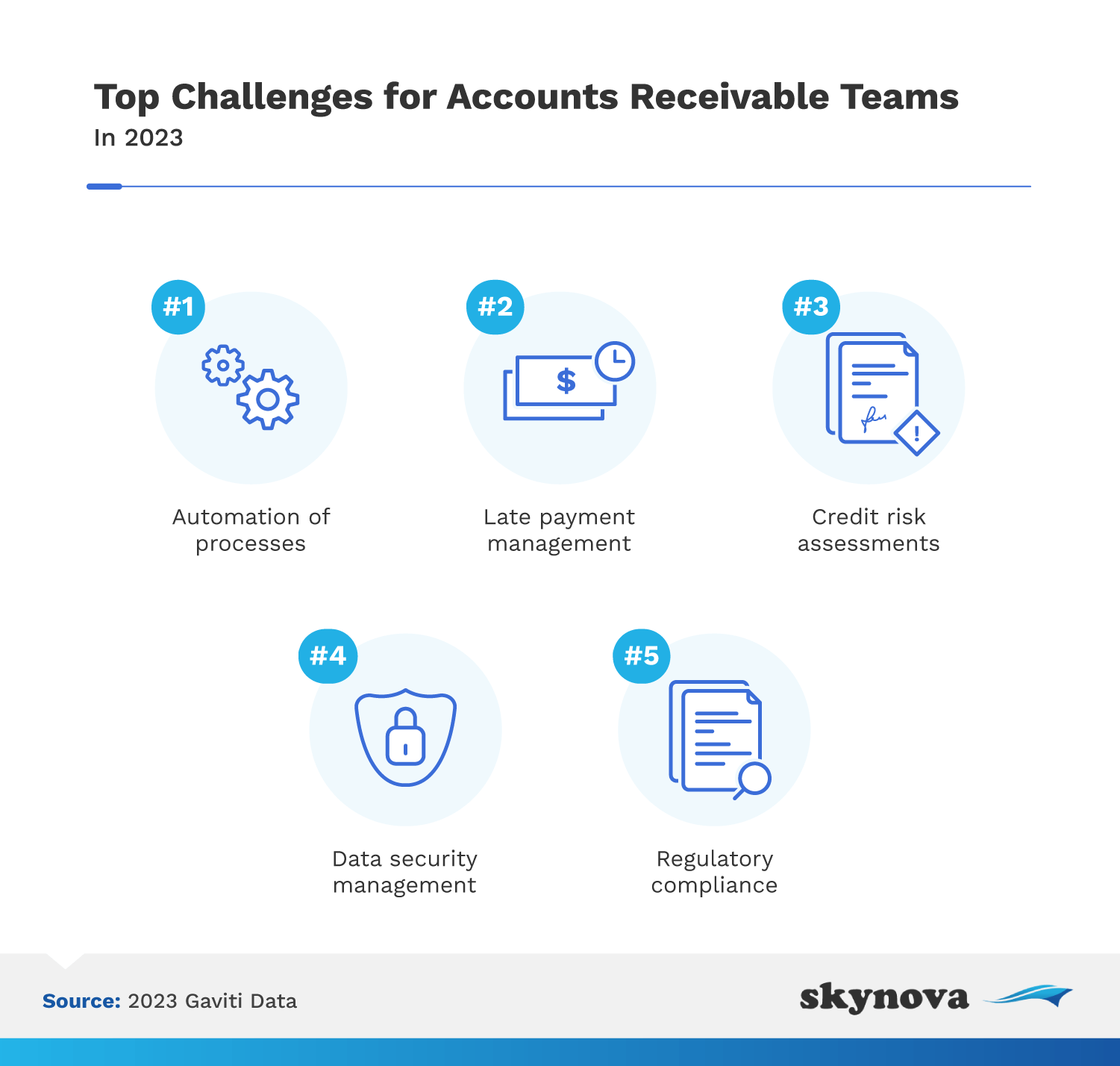

As businesses turn to artificial intelligence to streamline their invoicing processes, accounts receivable teams' two primary struggles are process automation and late payment management. This involves balancing customer relations with ensuring on-time payments, which might include effective communication about payment terms.

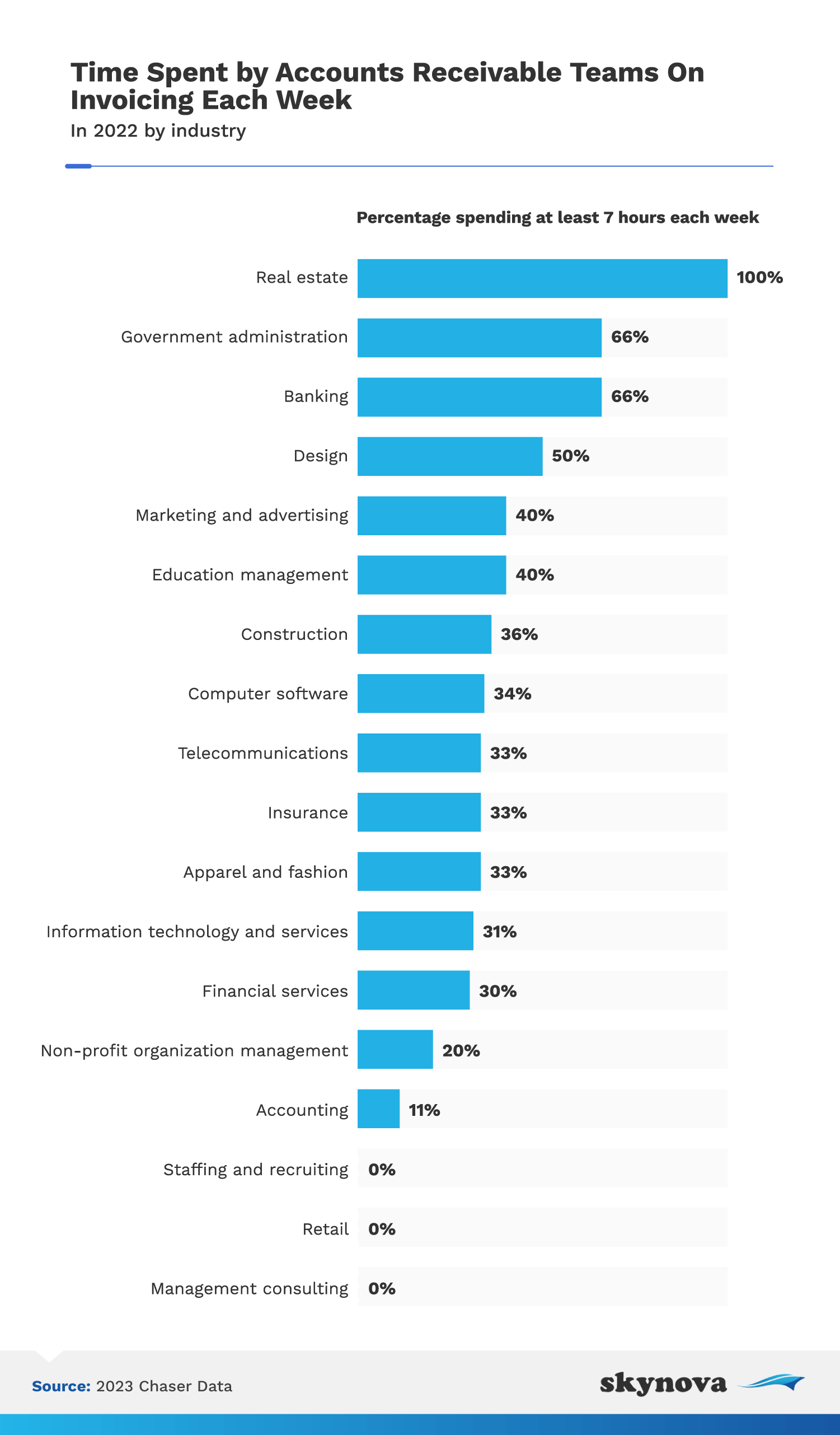

Accounts receivable professionals working in real estate all tend to spend at least seven hours a week on invoicing. Meanwhile, those working in staffing and recruiting, retail, and management consulting all spent less than seven hours per week.

One of the biggest challenges for accounting departments is managing late invoice payments. This section looks at statistics relating to late invoices and overdue payments.

As businesses struggle to keep up with invoices, delays often bleed over into payment processing. In the U.S., 39% of invoices are paid late.

The delay of payments is most often caused by invoice errors, which need to be corrected and rebilled before payment can be rendered. Incorrect invoices account for 61% of late payments.

On-time payment seems rare for businesses these days. Delays and errors are so prevalent in the invoicing process that 87% of businesses receive their invoice payments after the due date.

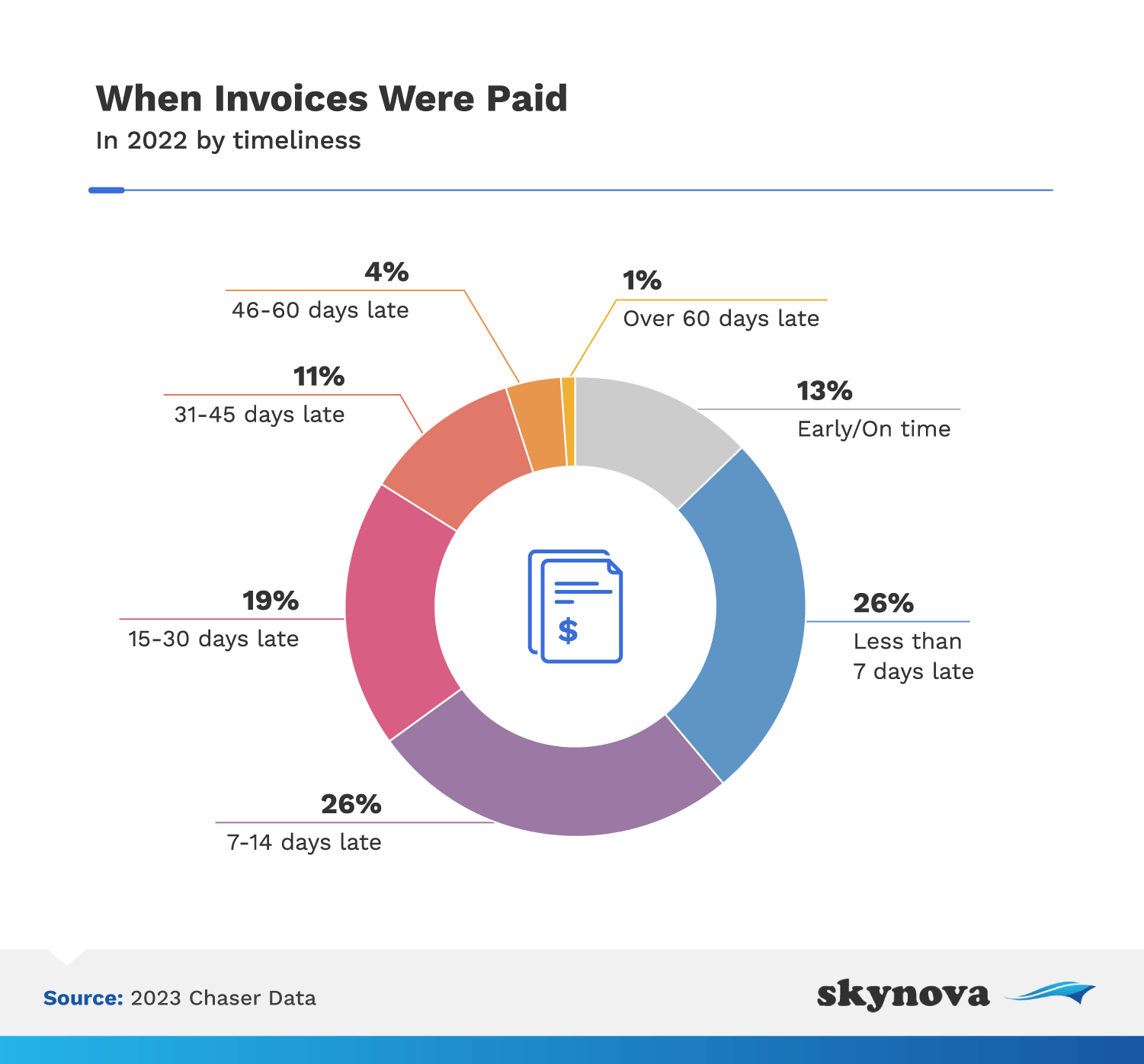

Just how late are most late payments? While 52% are only two weeks late or less, 35% are more than 30 days past due.

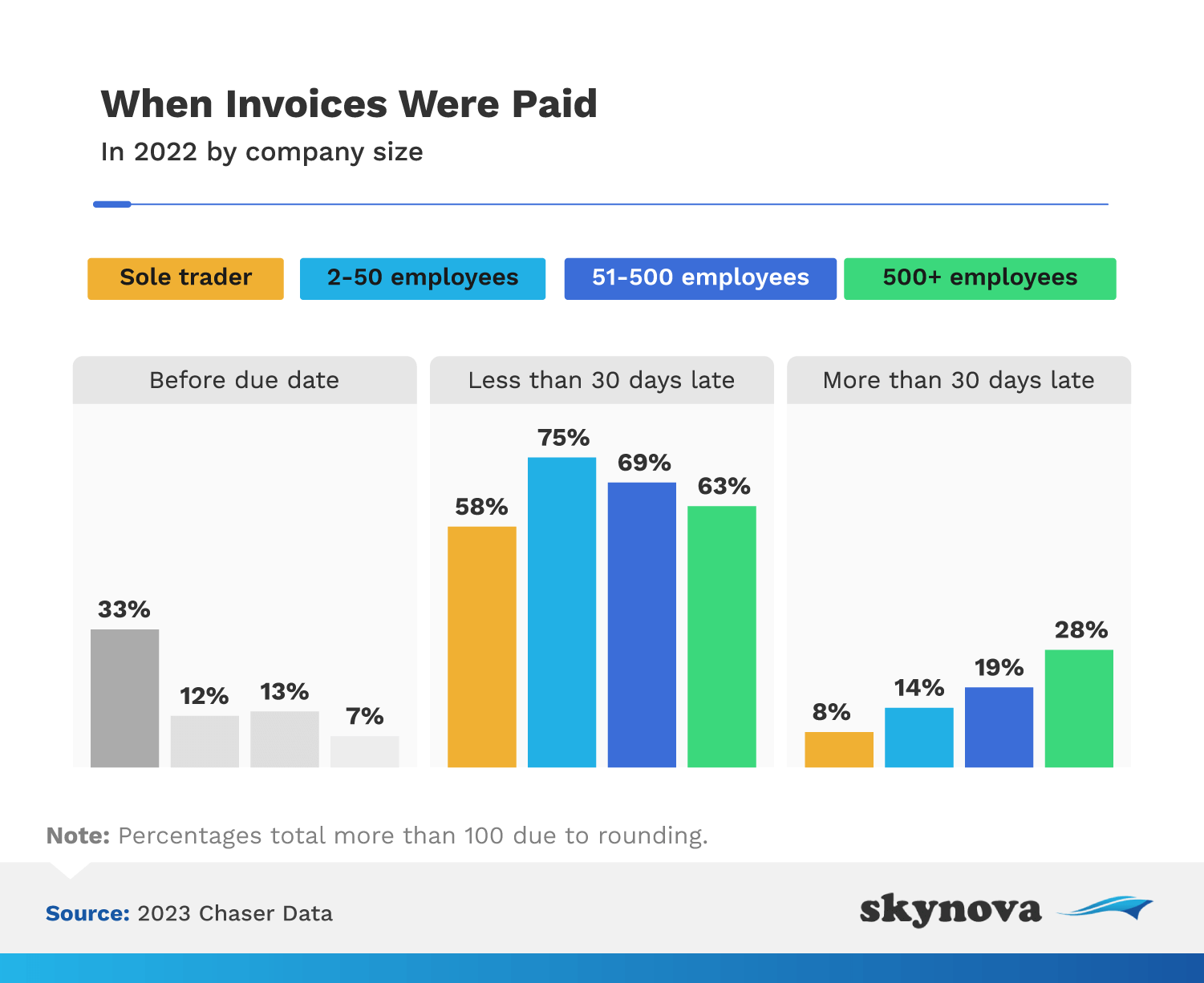

Late invoice payments are especially problematic for larger companies with more than 500 employees: 28% of invoice payments received by large companies are more than 30 days late, compared to just 8-19% for small to medium-sized businesses.

Invoicing is an essential, time-sensitive process for every business. Accounting teams handle up to 500 invoices per month, half of which are paper invoices that need to be physically sorted, entered, and filed. The large volume of paperwork leads to a high rate of invoice errors, lost invoices, and late payments.

The good news is that digitization and automation are finally reaching accounts payable and receivable departments. Skynova can help streamline your business's invoicing process with free e-invoice templates that help save processing time and reduce errors. Our industry-tailored online templates enable you to deliver invoices in seconds. Try Skynova's online invoice template today and get digital payments faster.

Working to improve the functionality of your invoicing process? We encourage you to share these invoicing statistics for any noncommercial use. Please include a link to this page so readers can access our complete findings and methodology.