|

Competition is tough these days. Small-business owners face a multitude of hurdles inherent to the business life and now even more so in the general landscape of life. In an effort to rise to the top or simply stay afloat, entrepreneurs are facing competition from seemingly every angle. But do they really know who they're up against?

Small-business owners are often unclear on exactly who, what, and where their competition is. To both better understand and help rectify this situation, we did a little digging. Speaking directly to 536 business owners, we navigated their thinking in terms of how they identify their own niche and competition, how they target and market toward certain audiences, and how well those efforts are going. If you're a small-business owner, dreaming of becoming one, or know someone who runs an enterprise, keep scrolling - you may just help yourself or an acquaintance avoid the newly understood pitfalls of entrepreneurship.

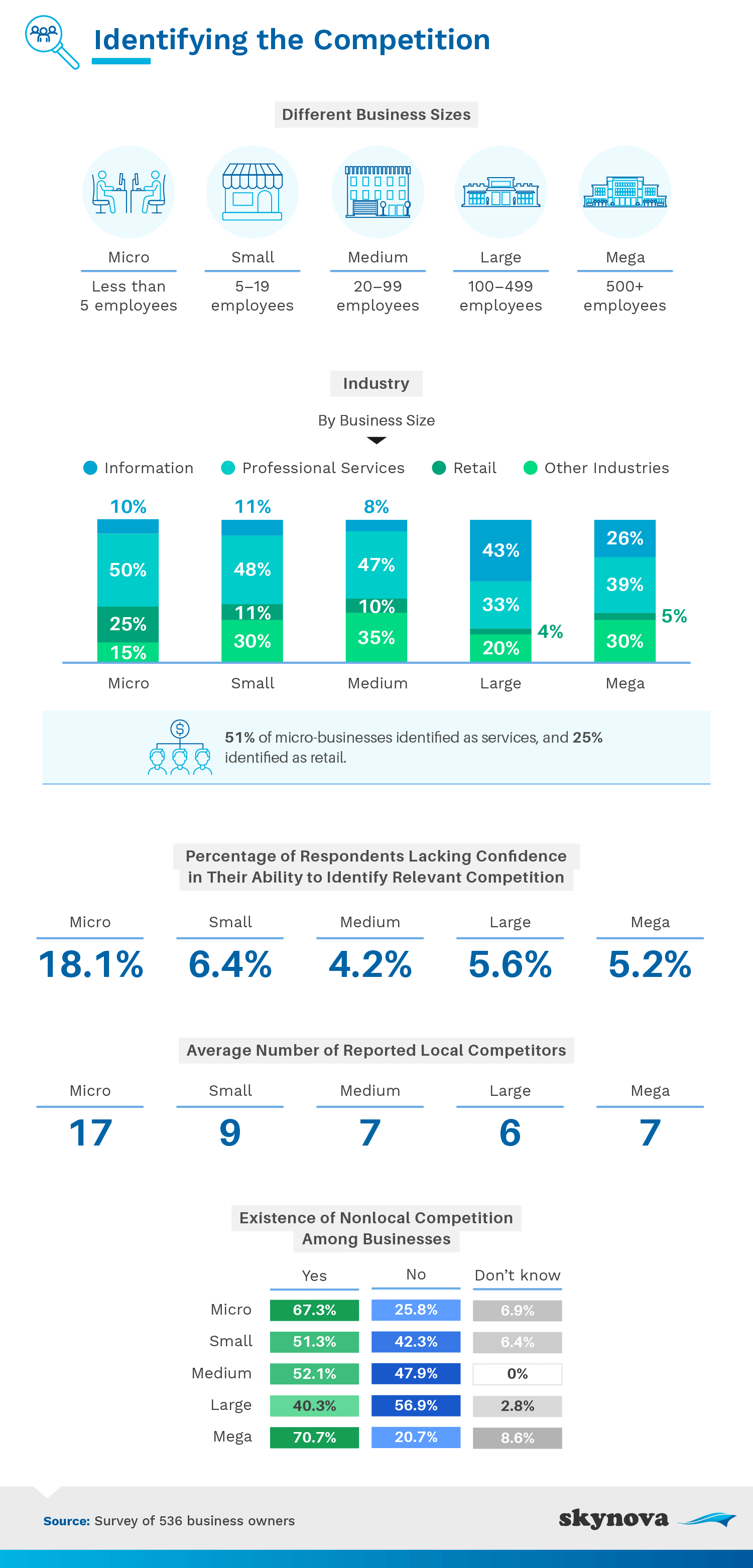

Much of study breaks business ownership into distinct sizes: micro, small, medium, large, and megastores. After breaking down the sizes and industries to which our respondents belonged, we dug into how confident each felt in their ability to identify competition and how many local competitors they estimated having.

Microsized businesses, or those with less than five employees, were having the hardest time confidently identifying their competition. Unfortunately, they're also feeling the weight from the most competitors. While everybody from small to megastore owners felt they had fewer than ten local competitors, micro-owners felt an average of 17 different competitors in their immediate area. They just couldn't always acutely envision what that competition was.

When asked to cast a wider net, micro-business owners felt a sense of nonlocal competition, sharing a similar perception as megastores. About 67% of micro business owners and 70% of megastores felt they had significant nonlocal competition, though possibly for different reasons. Micro business' less-confident assessments may have contributed to an overestimation of their local and nonlocal competition.

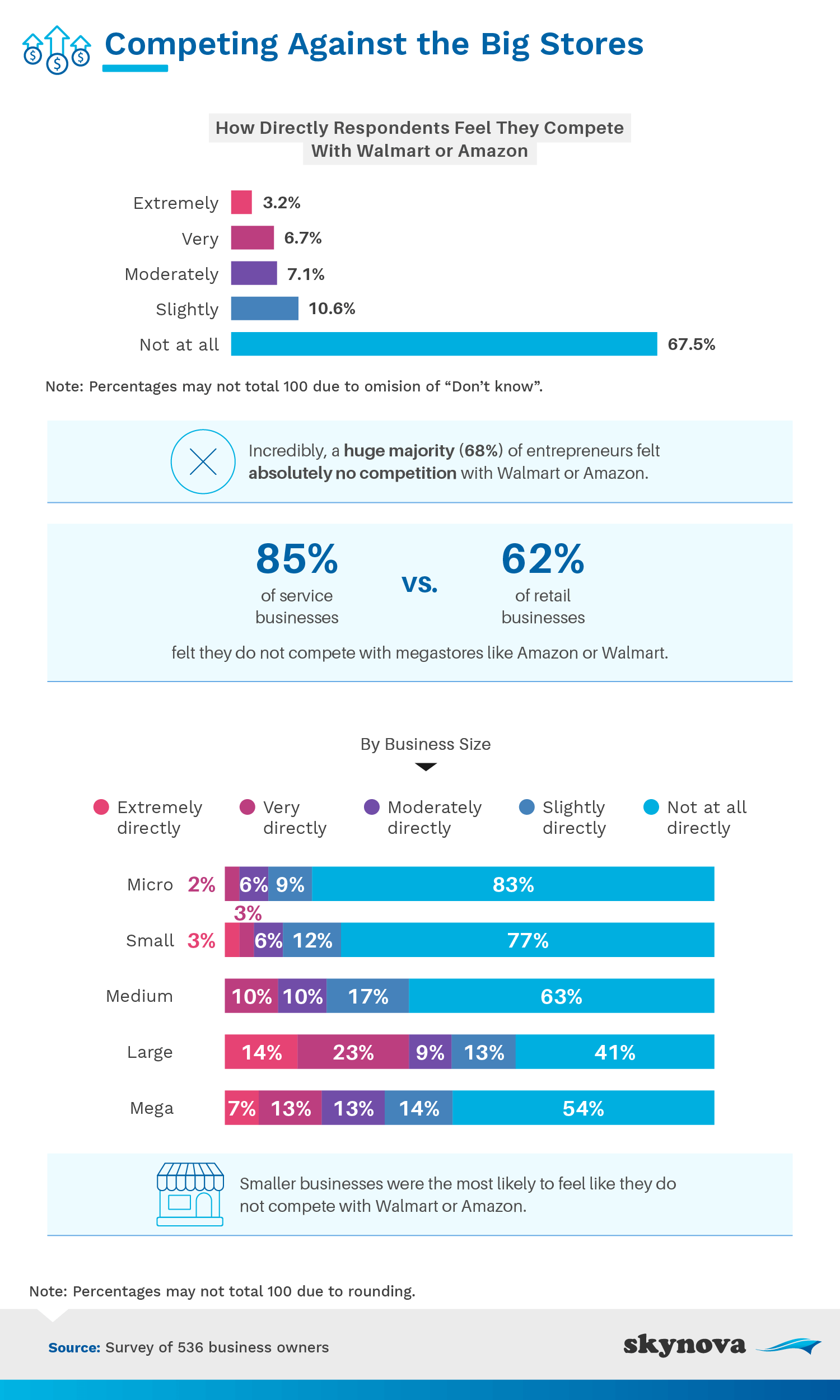

Whether a small-business owner's dreams are humble or massive, it's still appropriate to think of big-box retailers as competition. The next part of our study queried business owners on how directly they're competing against industry giants Walmart and Amazon.

A huge majority of business owners - 68% - thought they are not at all directly in competition with Walmart or Amazon. Even 62% of explicitly retail businesses felt this way. Herein lies the first misunderstanding of the small-business owners' competition. Regardless of which business you are in, Amazon is your competition.

Amazon dominates the digital marketspace in an era when most customers are digital. Because all digital marketplaces exist on the same screen, today's customers are comparing your digital performance against all other digital performances, not just those in your industry or niche. Now, a customer can easily switch from your store to the next. Often, that store is Amazon.

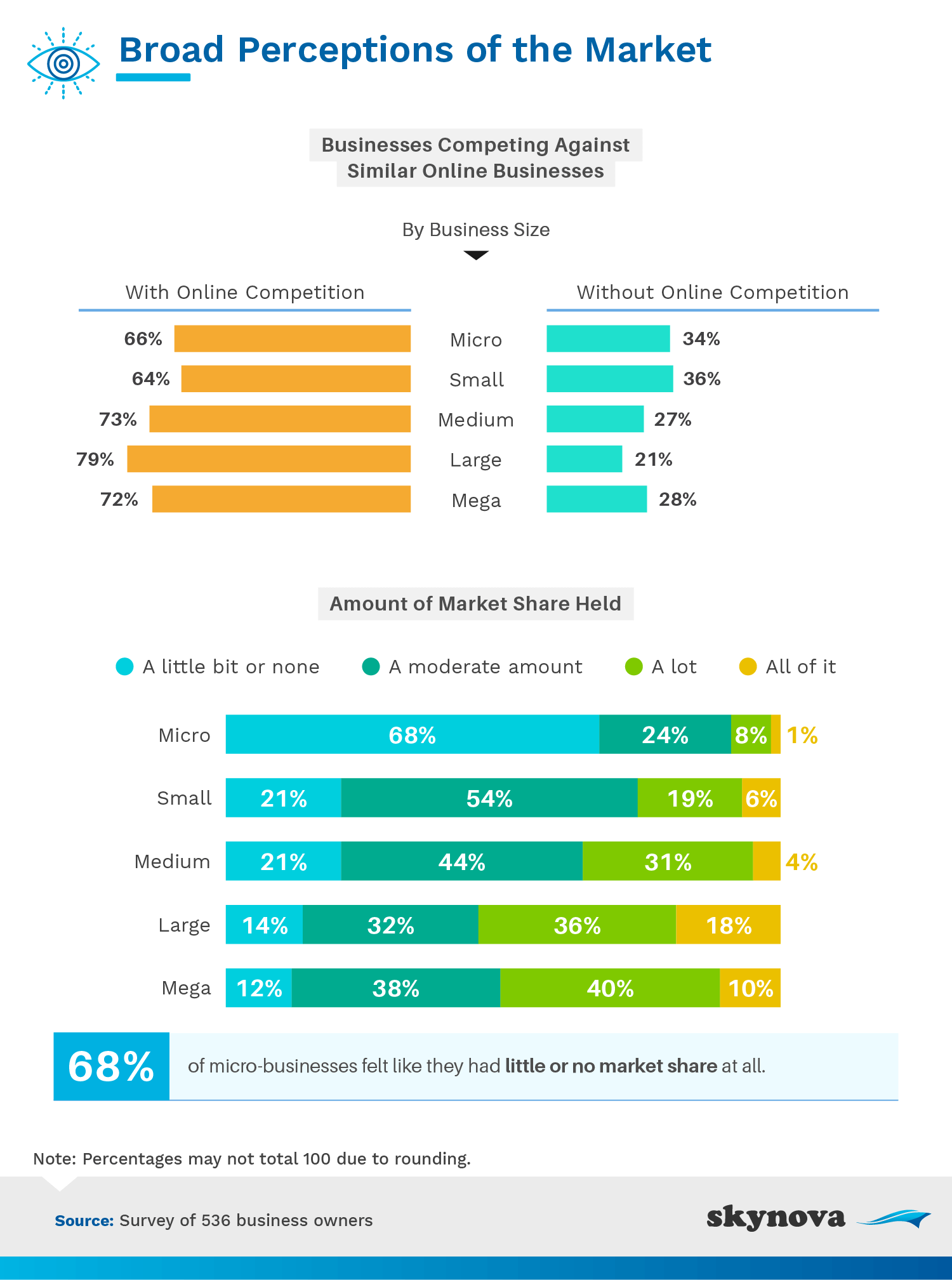

As we now understand the digital force behind Amazon's universally competitive presence, we wanted to know what percentage of business owners felt competition online. We also asked what percentage of market share our entrepreneurs felt they owned.

Most business owners agreed to the same extent that they faced competition online, regardless of company size. Even many of those who identified as being more than solely an online business agreed that they too felt competition from the digital landscape. That said, the online competition was still grossly underestimated, especially if you consider Amazon to be a true competitor for everyone.

When we asked about market share, we found that 68% of micro-businesses felt they had absolutely no market share at all. Perhaps just making those next few hires was the key to gaining some: Just a small increase in the number of employees caused business owners to feel that they had captured at least a moderate amount of market share. This is no small feat, considering how competitive the market truly is today.

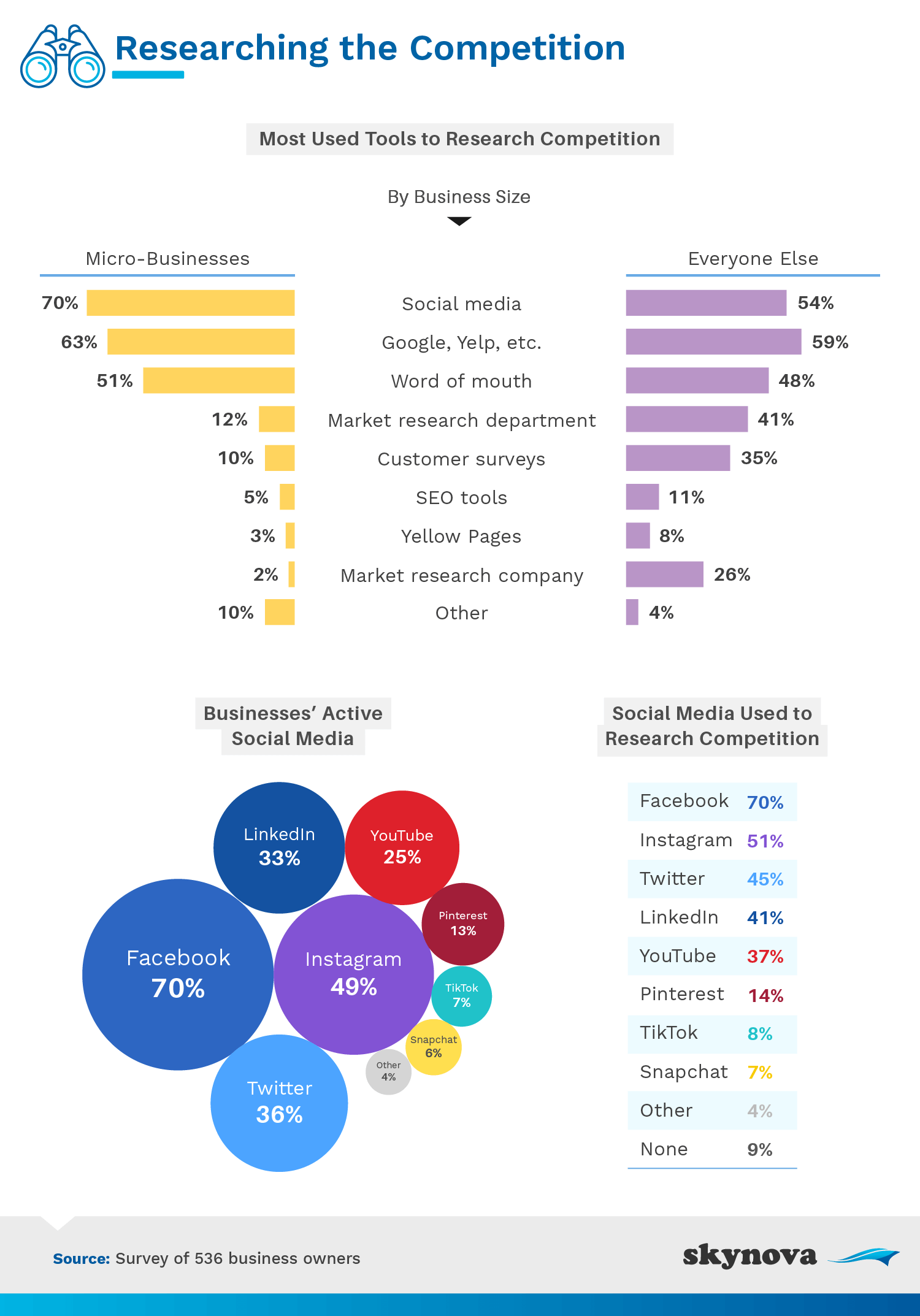

With their admittedly limited understanding of competition, small-business owners next shared the tools they were using to research their competitors. Responses were compared between micro-business owners and all others.

Free research tools, like Google and social media platforms, were the most common ways to conduct competitive research, for small businesses and corporate moguls alike. Conducting a comprehensive competitive analysis on social media is almost inherently built into the system. Users are encouraged to use hashtags that essentially provide keywords or phrases directly related to their niche. From social media alone, a company can identify their competitors, understand how their strategy operates, and fill in gaps in their own social media strategy. Google also provides plenty of free competitive tools, like Google Trends, which enable businesses to see how popular search search terms are by time and location.

More expensive research tools like surveys and outsourcing were highly popular as well but more often reserved for larger businesses. Fewer than 10% of micro-businesses used these tools. Perhaps their inherently small size prevented them from taking advantage of getting direct feedback from customers. Customer service, which is truly the name of the game in today's digital workplace, is often strategized well through surveys, while outsourcing obviously provides much freedom and flexibility as well.

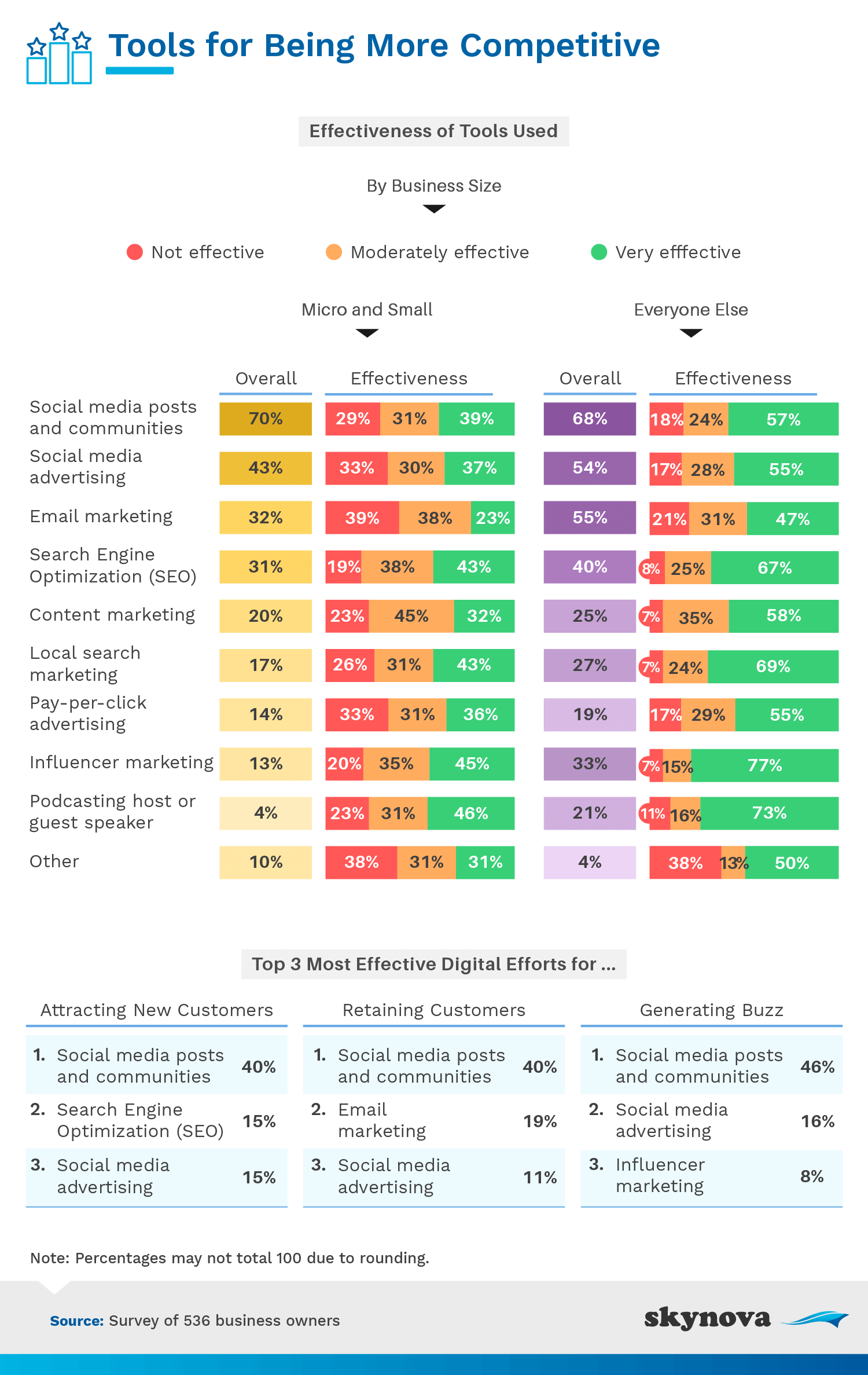

After you've done your competitive research, you can start putting your competitive marketing tools to work. But what marketing tools are small-business owners using, and how effective are they? The graphs below break down the answers.

Not only was social media an effective and free way to conduct market research, but it also dominated the landscape for competitive marketing as well. It was the top way small and large businesses marketed themselves and one of their most effective methods. In fact, it was the top method for businesses to attract new customers, to retain existing customers, and to generate more buzz. Most people with social media spend more than two hours every day on the platforms, and this number is expected to continue growing. Meeting your customers here is key for sharing your message in a way that's convenient and digestible for them.

Influencer marketing, however, was one particularly effective type of social media marketing that appeared inaccessible to micro-business owners. While larger businesses often employed this practice and cited it as highly effective, just 13% of micro-business owners were able to use this tool. Influencer marketers can make anywhere from $1,000 to $1,000,000 per post. Even on the low end of the spectrum, this may be too expensive and out of reach for a business with only a few employees.

Like everything else, the pandemic had its hands in the world of business competition. Our study wraps up with a look at how business owners have embraced remote workers as well as whether they had changed marketing strategies since COVID-19's onset.

In spite of remote workers now constituting 41.8% of the post-pandemic American workforce, over half of respondents had not yet embraced remote workers. Only 18.7% considered them extremely advantageous. Remote workers are studied as being more productive, more engaged, and to generally outperform the standard office worker - all things we'd consider "extremely advantageous." That said, small and large businesses alike were unlikely to see things this way … yet.

The pandemic did cause a perception shift in marketing strategies, however. Nearly three-quarters of all respondents said they changed their strategy since the pandemic struck. With the pandemic being so pervasive, many likely didn't have a choice. Only 26.5% were able to stick with their original plans, though adapting could easily have been a better option.

Evidence suggests micro-business owners to be at a few disadvantages - sometimes self-imposed. While they suffer from possibly overestimating the quantity of their competition, they also were most likely to grossly underestimate one major competitor: Amazon. That said, they were utilizing the same free research tools, like Google and social media, that even the big-box stores still lean on. While their needed resources may come in the form of additional labor, many respondents still appeared averse to incorporating remote workers to their roster.

Always on the side of the small-business owner, Skynova seeks to share this type of information and help even micro-businesses see success. Skynova offers easy-to-use, professional invoicing so that small businesses can get paid faster, bill anytime and anywhere, and stay organized.

We collected 536 responses of entrepreneurs from Prolific. 48% of our participants identified as men, 45% identified as women, 6% declined to provide gender information, and less than 1% identified as nonbinary or nonconforming. Participants ranged in age from 19 to 79 with a mean of 39 and a standard deviation of 12.2. Those who failed an attention-check question were disqualified.

The data we are presenting rely on self-report. There are many issues with self-reported data. These issues include, but are not limited to, the following: selective memory, telescoping, attribution, and exaggeration.

Feeling inspired to support a small business owner? You're welcome to share the data in this study, just be sure your purposes are noncommercial and that you link back to this page.