|

Managing a small business is simple – you, along with a handful of employees, run a tight ship in whatever industry you're operating – they get paid, and your business prospers … right? Wrong. Not only is the likelihood of your small business surviving in the long run low, but there are also hidden costs of employment that can create financial and operational headaches for employers down the line.

We've surveyed 266 small-business owners to learn more about their operating costs once additional expenditures, like taxes and benefits, have been factored in. What perks are employers most likely to offer to their employees, and which ones would they prefer to forgo paying for?

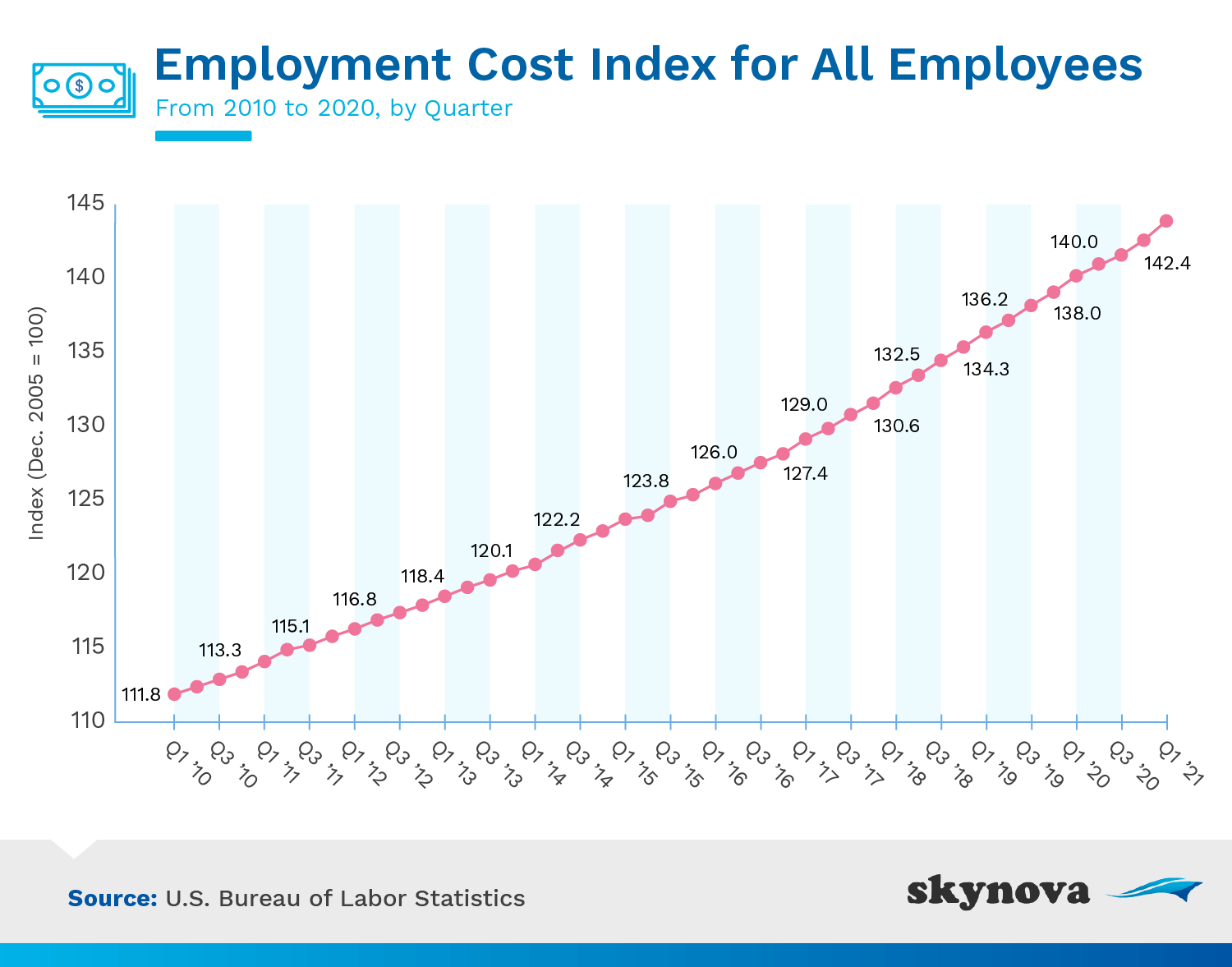

To better understand the macroenvironment of work-related expenses, it's important to mention how employee compensation has changed over time. The Employment Cost Index (ECI) shows the change in labor cost in each fiscal quarter. As shown in the image below, there has been an increase in employment costs every quarter from 2010 to 2021. These findings are based on a survey conducted by the U.S. Bureau of Labor Statistics in the last month of each quarter.

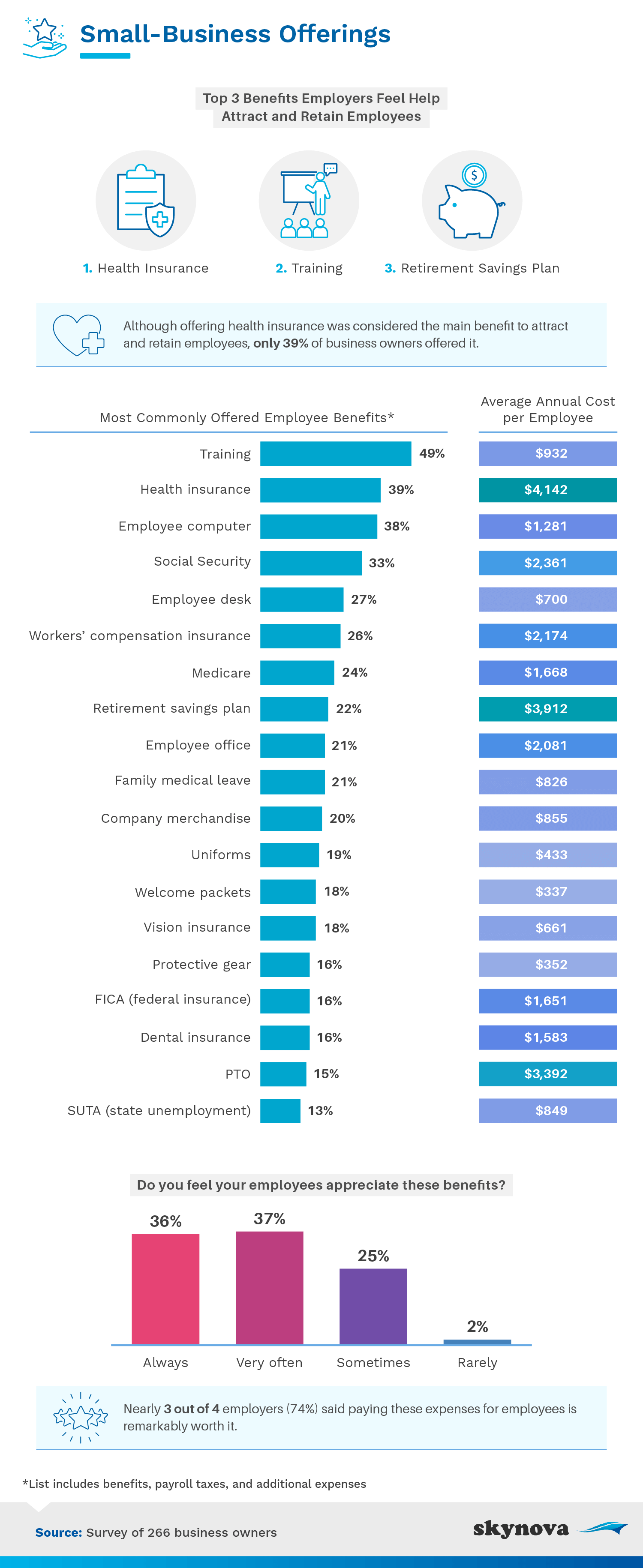

Keeping an employee around isn't always easy, but small-business owners have had the most success retaining their workers if they presented them with health benefits, training, and retirement savings plans. By a margin of 10 percentage points, the most offered benefit was training, with an average annual cost of $932 per employee. Health insurance was the second-most offered benefit, but was much more expensive, as employers needed to shell out $4,142 yearly per employee, on average. Only 22% of employers offered retirement savings plans, and it was the second-most expensive benefit, costing an average of $3,912 per year. Paid time off was the third costliest benefit, and only 15% of small-business owners offered it as a perk.

Nearly three-quarters of employers felt that their employees either often or always appreciated their work benefits and said that offering them was worth it – regardless of the expense. Offering benefits to employees increases the likelihood of them staying long term, boosts morale, allows for productivity, and generally sets the foundation for your business to grow (due to the positive culture being instilled).

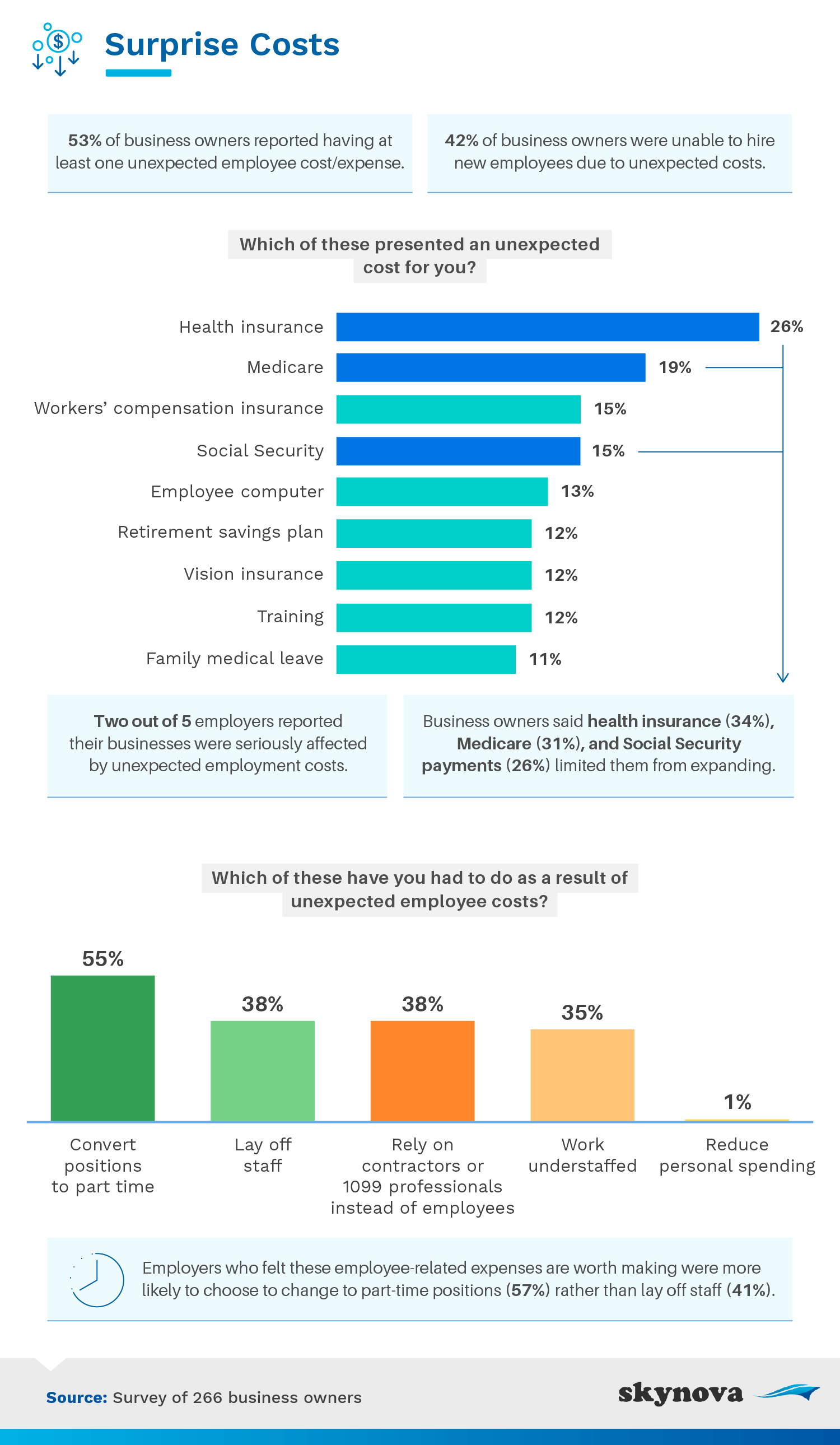

Over half of small-business owners had encountered an unexpected cost at some point, and 42% couldn't onboard new employees because of them. Just over a quarter said health insurance was most likely to present an unexpected cost to them – remember, this was also the most expensive yearly average cost per employee. This, Medicare, and Social Security payments were the three biggest hurdles preventing small-business owners from expanding. Forty percent of them said whatever unexpected costs they encountered did serious damage to their business.

Consequently, 55% of employers had to convert some full-time positions into part-time ones, whereas 38% were forced to lay off staff or rely on contractors to get work done. Thirty-five percent needed to bite the bullet and work understaffed, and just 1% decided to reduce their personal spending. Employers who still felt that the unexpected costs were worth the benefits were more likely to convert positions to part time than fire staff. One way small-business owners can brace themselves for unexpected costs is to create an emergency fund. It will reduce the risk of suffering serious financial woes, lessen the need to use personal funds to cover the costs, and help avoid credit and/or late fee headaches.

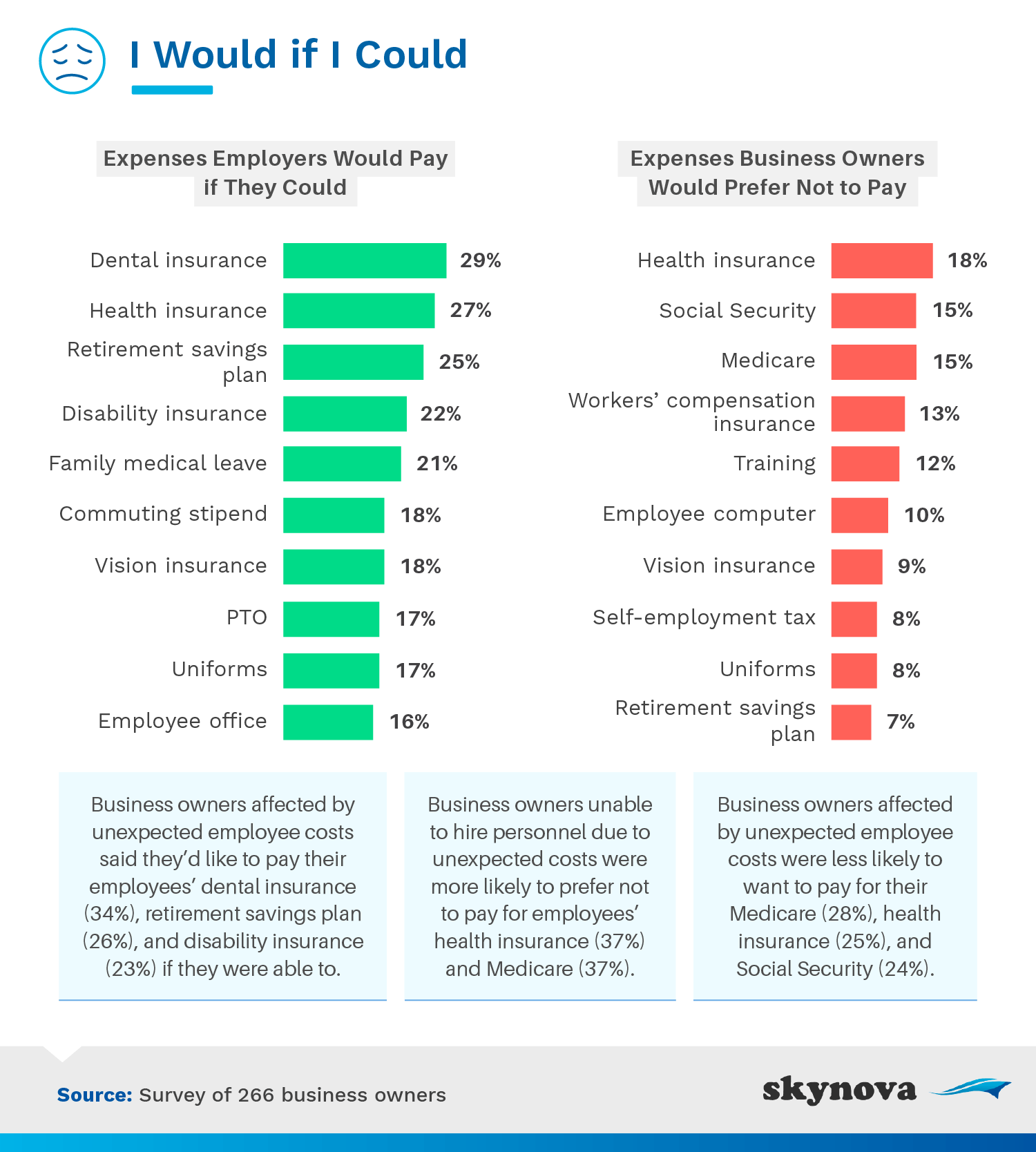

The top three benefits that many employers would like to give their employees, but were unable to were dental insurance, health insurance, and retirement savings plans. Those affected by unexpected costs agreed that they would've liked to offer dental and retirement savings plans as well as disability insurance. As described above, these are some of the most expensive employee benefits, making it difficult for many small-business owners to provide them.

On the other hand, the three benefits that some employers would rather avoid paying were health insurance, Social Security, and Medicare. Business owners that were tied down with unexpected business costs, including those who couldn't afford to hire additional personnel, would've especially preferred not to accommodate their employees with these perks. The COVID-19 pandemic has hit many small businesses hard – a recent survey of 885,000 small businesses across the U.S. determined that over 70% either felt a moderate or large negative effect because of it. Dishing out perks to employees simply isn't an option for many employers right now.

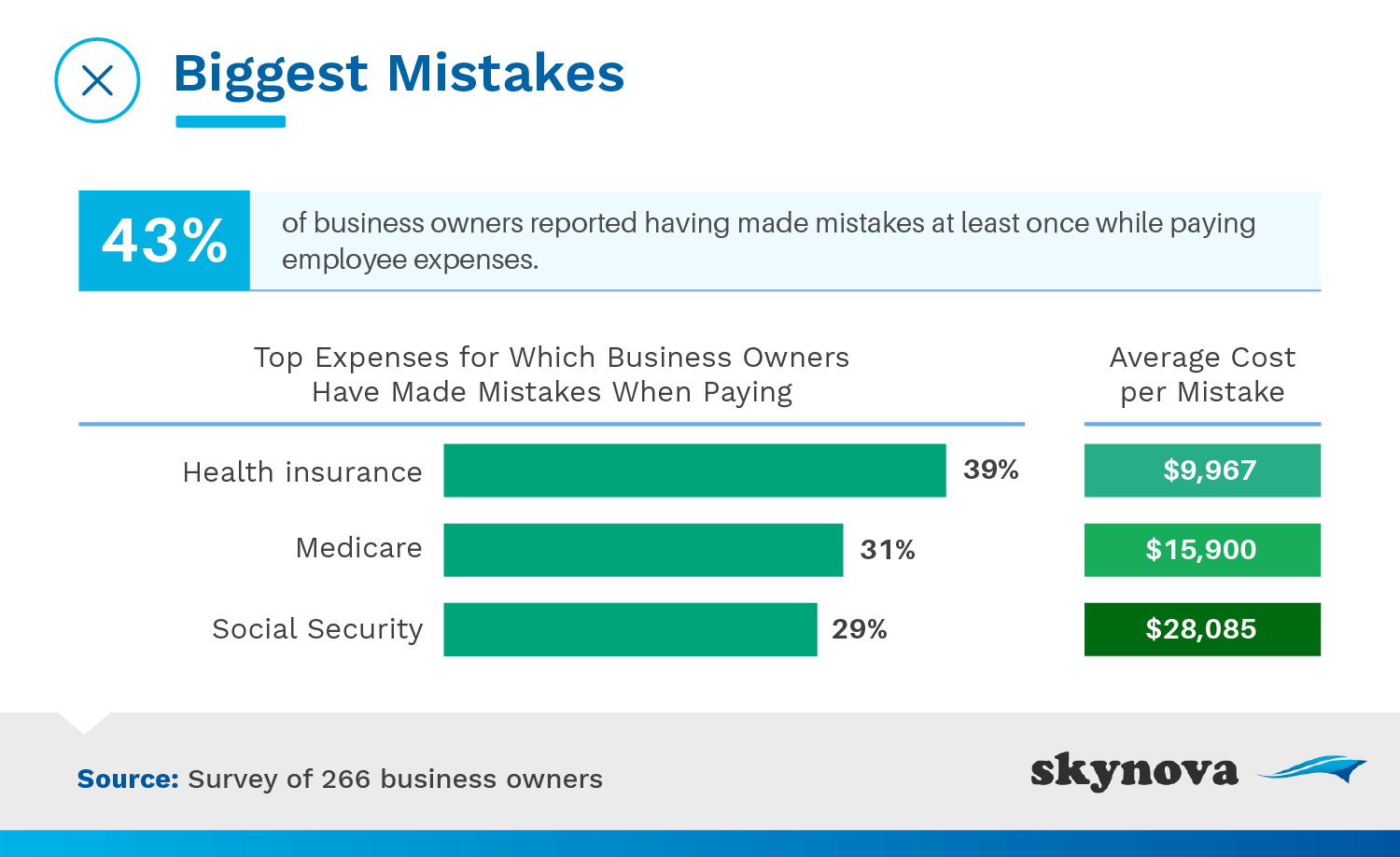

It can be hard to keep track of business payments, and 43% of business owners have made an error when dealing with employee expenses. The most likely expenses to be mishandled were those pertaining to health insurance, Medicare, and Social Security. While all were costly mistakes, the most expensive one was an error involving Social Security payments, with an average cost of $28,085 per mistake.

What are some penalties that employers can incur if they make a mistake? Here are some examples that can be costly:

Unfortunately, the odds are already stacked against the survival of small businesses – 20% of them fail within the first year, 30% by the end of the second, half are long gone by the end of their fifth year, and 70% will have disappeared by the ten-year mark. For the best chance at survival, small business employers need to diligently track their expenses – every penny counts.

Although costly, offering benefits to employees, especially healthcare, was worth it in order to cultivate a more positive and productive workspace. Sometimes, these benefits presented themselves in the form of unexpected costs, which hindered the financial capabilities of employers - for example, they weren't able to onboard new staff, and had to change some positions from full-time to part-time. On top of that, employers were susceptible to making mistakes when paying employee expenses, enlarging the financial burden of their business operations.

Also, the Employment Cost Index has shown us that, over the last decade, labor costs have risen. Also, state and local government employees had higher wages and more benefits than people working in private industries or the civilian sector. With costs rising, business owners, especially those running small companies, need to be on the ball when it comes to their finances.

To look professional, stay organized and accelerate your payment processes, Skynova's online invoicing platform has you covered. We also enjoy writing articles about topics that we are passionate about. Usually, they'll take on a business or workplace angle, while mixing in another aspect of society. In order to produce high-quality content, we use both primary and secondary research to back up and flesh out our findings. We hope you've enjoyed the read!

We surveyed 266 business owners. Among them, 67% were men, and 33% were women. Respondent's age ranged from 24 to 53 years old with an average age of 40.

For short, open-ended questions, outliers were removed. To help ensure that all respondents took our survey seriously, they were required to identify and correctly answer an attention-check question.

These data rely on self-reporting by respondents and are only exploratory. Issues with self-reported responses include but aren't limited to exaggeration, selective memory, telescoping, attribution, and bias. All values are based on estimation.

Paying your employees isn't as simple as one might think. If you know someone who might be interested in reading about the hidden costs of employment, feel free to share this study with them for noncommercial use only. We also kindly ask that you provide a link back to this original page for access to our full findings and methodology.