|

No one said starting up a business was easy, but if it works out, people have the opportunity to do what they love the way they want to. America quite literally runs on small businesses, and there are constantly new, aspiring entrepreneurs trying to take a stab at their own. We’ve surveyed 1,003 current and hopeful entrepreneurs to learn more about what helps or harms their business aspirations.

Of those who are still on the fence, what hurdles are preventing them from taking the leap of faith? How many respondents know about government aid programs that could help them get over these fears? What are the top industries where people would like to dip their toes? Read on to learn more about the road to entrepreneurial success.

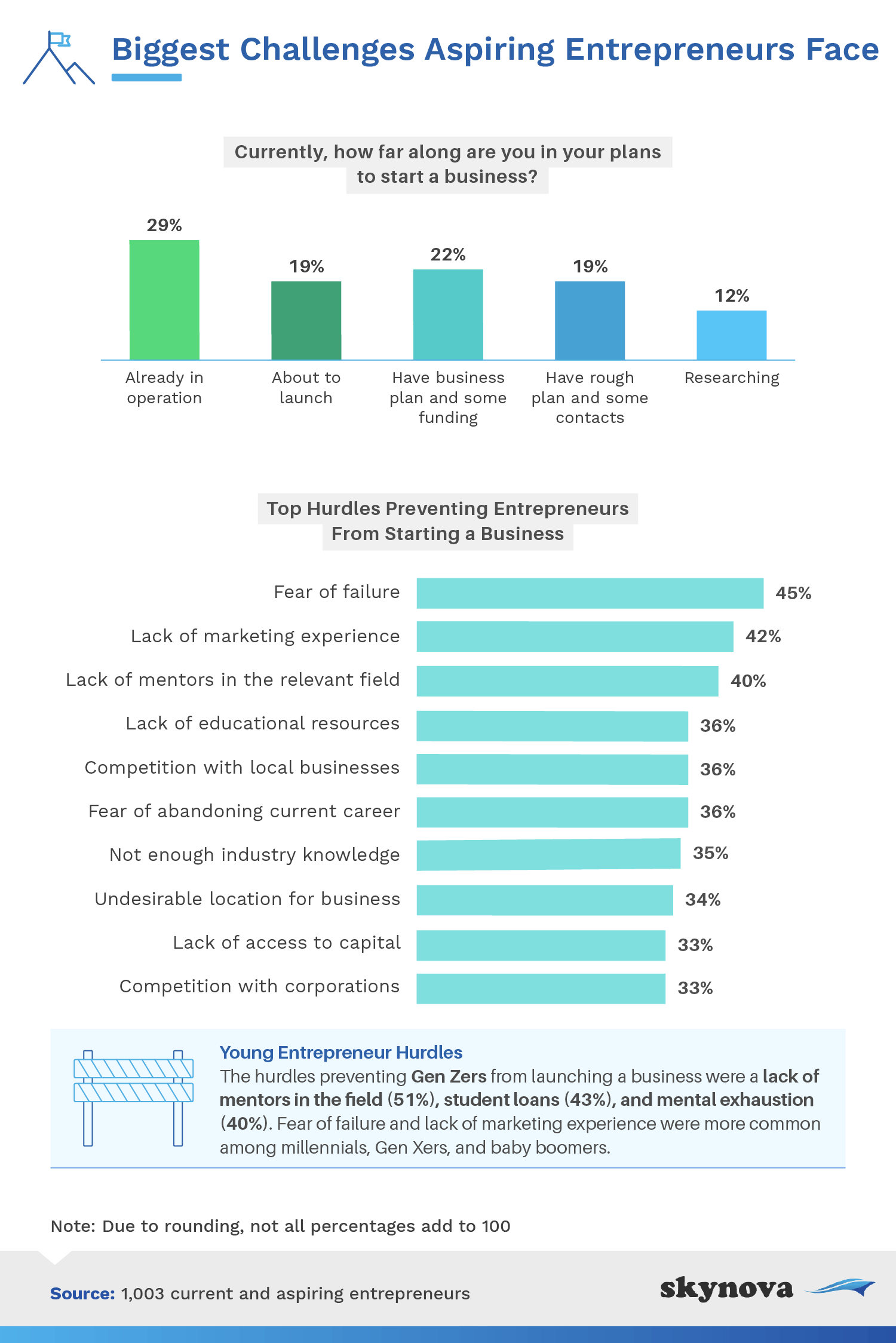

When asked how far along they were in their plans to start their own business, just under a fifth of respondents were approaching their official launch. Additionally, 22% had most of the pieces in place, 19% had started making some headway, and 12% were in the midst of their preliminary research. Twenty-nine percent even said they’re already running their own business! Of baby boomer entrepreneurs surveyed, 30% already operated their own business, followed by Gen Zers (28%), millennials (27%), and Gen Xers (24%).

While it’s nice to see that many are making lots of headway in their plans to start their own business, others were more hesitant to get the ball rolling. The most common setback that people dealt with was a fear of failure. The reality is, after 10 years, only around a third of new businesses will have survived. Although this might be a demotivating statistic, small businesses account for 99.9% of all businesses in America, meaning that anyone – with a good business model and some elbow grease – can successfully grow their own too.

Additional hurdles, especially for young entrepreneurs, included a lack of mentorship, the financial burden of outstanding student loans, and mental exhaustion. A general fear of failure and lack of marketing experience was a more common worry for older generations.

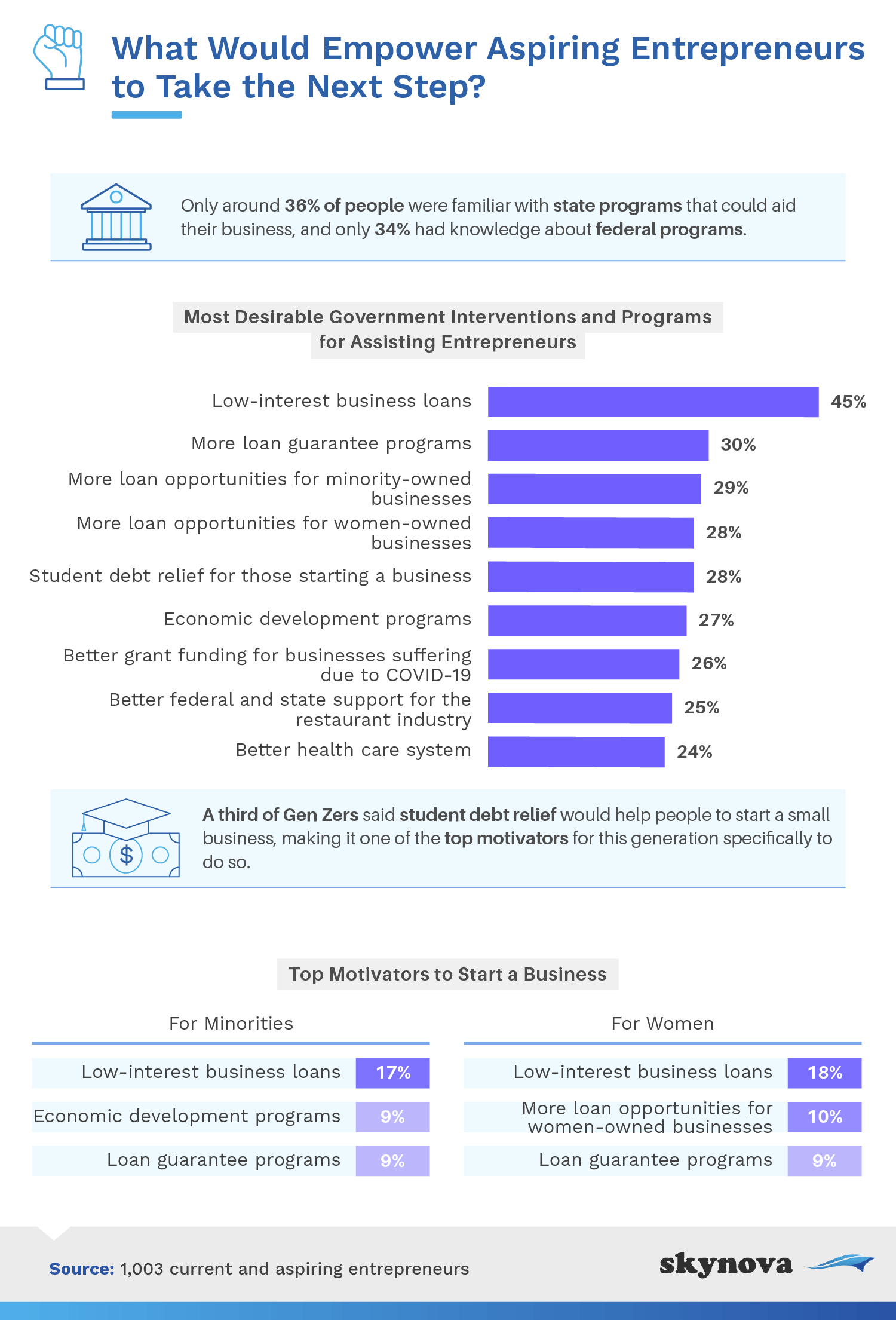

If more people knew about the availability of state and federal programs that could help their startups, many who were originally dissuaded might consider taking that initial leap. According to our respondents, the most favorable government intervention or program that could aid small businesses was the option of low-interest loans. Locking in a low rate means the loan will cost you less in the long run, helping stabilize your debt as your company grows. Most of the popular programs were loan-related, including loan guarantee programs and more loan opportunities for minority- and women-owned businesses. The U.S. Small Business Association already provides some government funding assistance for entrepreneurs through loans, grants, and bonds.

According to Gen Zers, student debt relief is one of the best ways the government could support small businesses, with 33% of respondents believing it would give them the encouragement and inspiration to start their own. Meanwhile, both minority and female entrepreneurs agreed that low-interest business loans and more loan guarantee programs would be primary motivators to starting their own businesses.

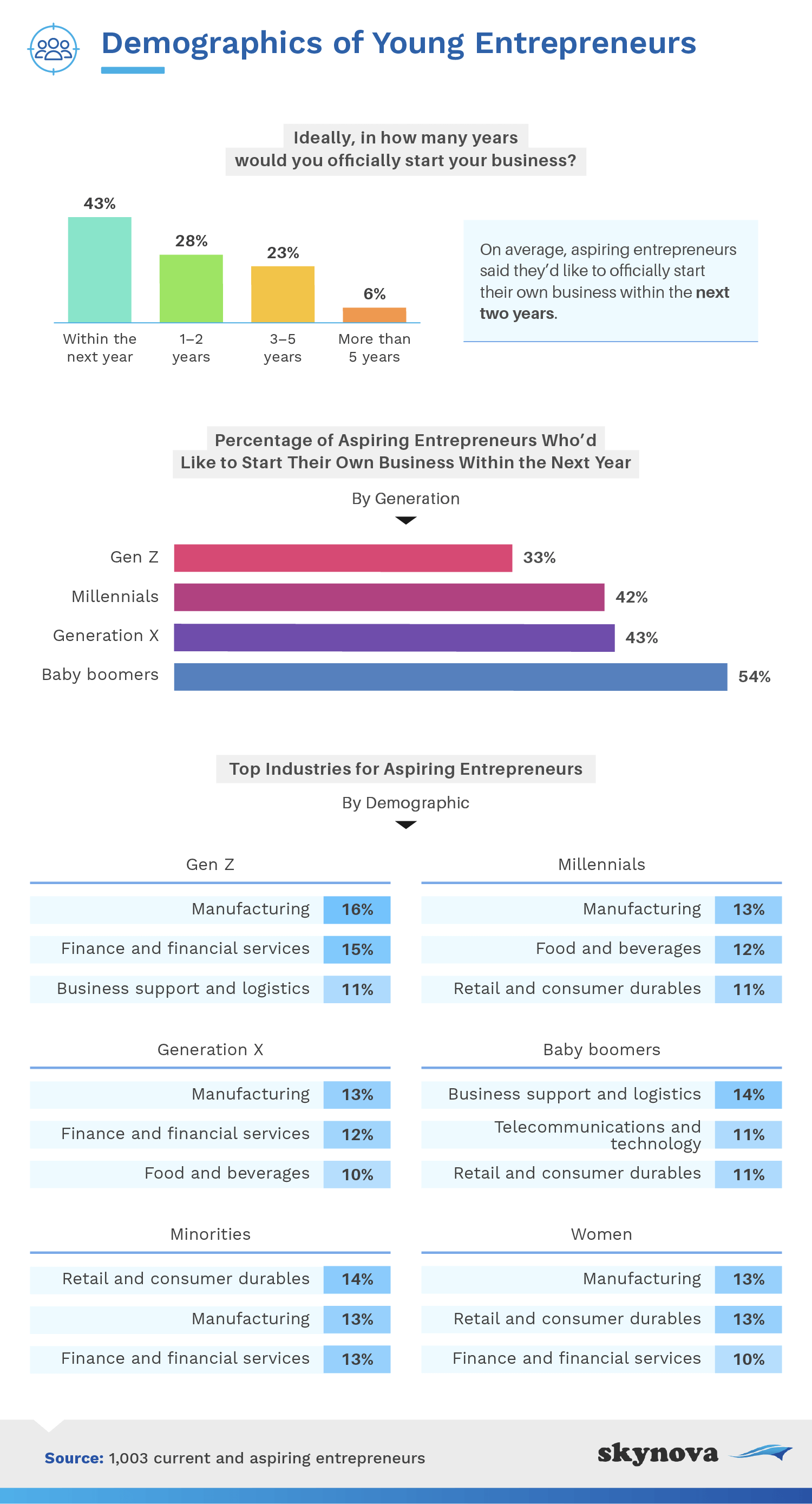

Aspiring entrepreneurs were quite eager to get the show on the road – on average, they wanted to start their businesses within two years of answering our survey. Of them, 43% (and over half of baby boomer respondents) were even looking to hit the ground running within the next year.

When analyzing the most attractive industries to enter, by generation, the top choice among Gen Zers, millennials, and Gen Xers was the manufacturing industry. Working in this particular sector can entice people for a number of reasons. First of all, it helps support the economy on both small and large scales, which is something to be proud of. Manufacturing also involves the development of cutting-edge technology, something that many people might be interested in. Another great benefit is that you get to see the tangible outcome of your work, which can be a key motivator for people who like to point at their work and say: "I made that!"

Other popular industries that aspiring entrepreneurs were keen on entering included finance and financial services, food and beverages, business support and logistics, and retail and consumer durables.

Of the surveyed entrepreneurs, some already had their small businesses up and running, and many more were making headway in their plans to eventually launch. While these people were confidently spearheading their efforts, others were hesitant to go all in. Fear of failure, among other worries, prevented them from totally investing into the idea of running their own business.

Unbeknownst to many, government programs and interventions are available specifically to help small businesses flourish. The most sought-after ones were low-interest business loans, allowing entrepreneurs to build the foundation for their business without drowning in debt.

For those that were eager to launch, a big chunk wanted to get things going within the next year. It wouldn’t be surprising if many entered the manufacturing industry, which seemed to be the consensus top choice among respondents. Regardless of sector, though, starting your own business allows for total independence and control, two things that many people clearly value greatly.

Skynova’s many online software modules help small businesses tackle their invoicing and other needs with pinpoint accuracy and efficiency. We also like to write articles about topics we feel passionate about, usually taking on a business or workplace angle. We use both primary and secondary research to build our articles, pulling in information from a range of sources to highlight the analysis that has been conducted.

We surveyed 1,003 respondents ranging in age from 18 to 72 in order to explore the challenges that prospective entrepreneurs face. The mean age was 38 with a standard deviation of 12 years. For generational breakdowns, 16% were baby boomers, 30% were Generation X, 38% were millennials, and Gen Z were 16%. 43% of our respondents identified as women, and 57% identified as men.

Survey data has certain limitations related to self-reporting. These limitations include, but aren’t limited to, telescoping, exaggeration, and selective memory. We didn’t weight our data or statistically test our hypotheses. This was a purely exploratory project that examines the challenges facing prospective entrepreneurs.

If you know someone who’s been on the fence about starting their own business, this article could provide them with some clarity. We encourage you to share our study with them, but we ask that you do so for noncommercial use only. Also, please include a link back to this page for access to our full findings and methodology.