|

For many small businesses, late invoices are a nightmare to deal with. Unlike large corporations, which tend to have more resources to track down late payments, local and small businesses often have to write-off thousands of dollars every year from unpaid invoices. According to a recent press release, late payments are disproportionately affecting small business owners – making barriers for growth and profits even higher.

To further explore the implications late payments have on small businesses, we conducted a study of nearly 300 business owners to understand how companies deal with clients who refuse to pay, how it affects their bottom line, and the right time to put their foot down. Read on to see how business owners are faring in today’s unpredictable world.

From the perspective of these business owners, how often do they have to deal with late invoices?

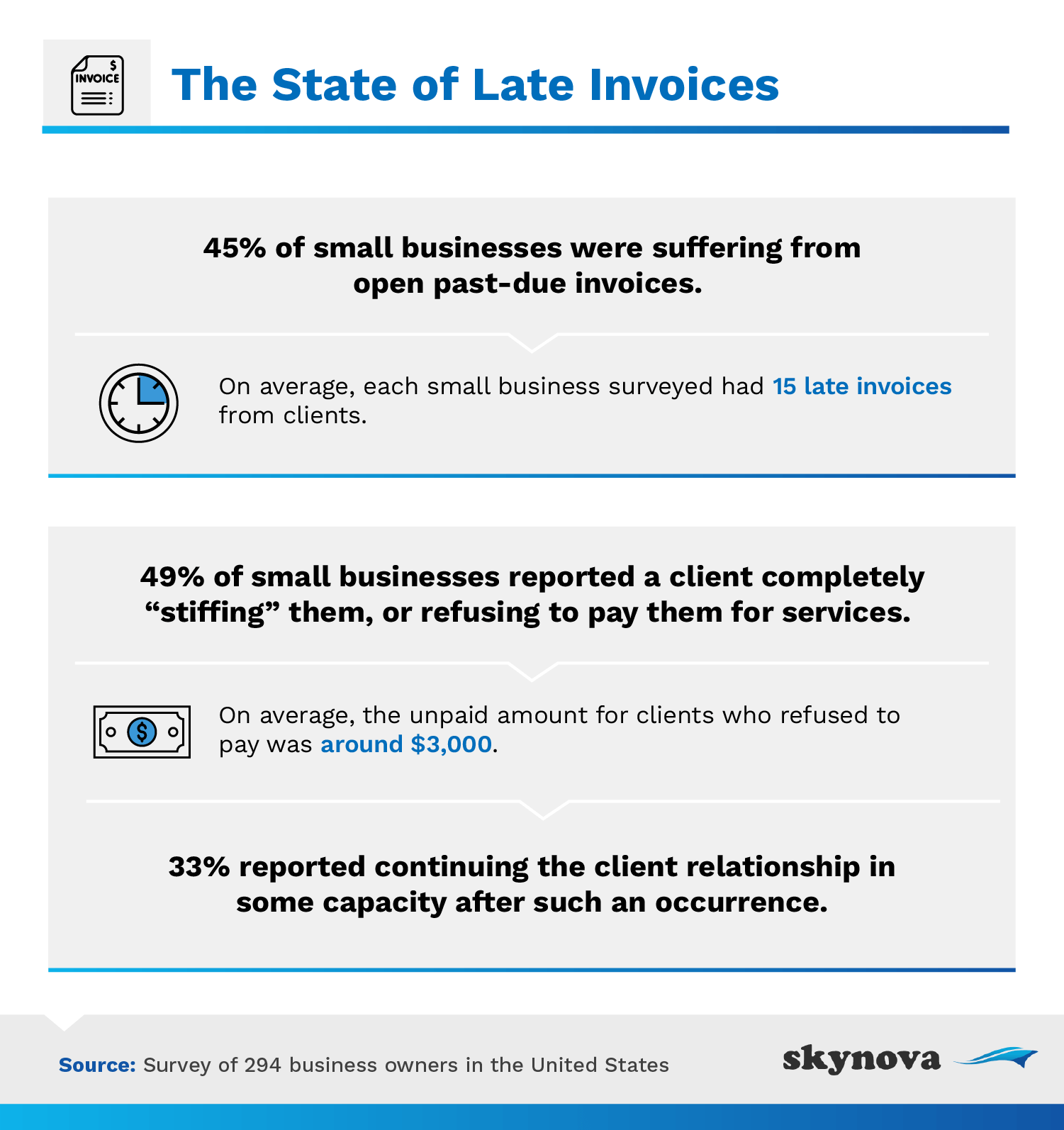

According to our survey of 294 business owners, nearly 5 in 10 were suffering from open past-due invoices. In fact, on average, each had 15 late invoices from clients. When figuring out how to pay their expenses, these owners have to assume their invoices will get paid on time. But, the survey’s responses indicate owners should always prepare for a flaky client.

While late-paying clients can still fulfill their obligations, what about those that never pay? Unfortunately, 5 in 10 business owners have had to grapple with a client refusing to pay them for their services. With business owners losing out on an average of $3,000 from these incidents, invoices can be a source of stress and uncertainty.

Yet small businesses, particularly newer ones, often have no choice when it comes to clients. One in 3 reported continuing a relationship with a nonpaying client in some capacity. But, this will seldom solve the problem at hand. By refusing to hold these clients accountable, small businesses are opening themselves up to even more risk. Being candid with customers and having plenty of backup strategies are key for business owners to reduce invoice disasters and keep their cash flow steady. That, however, is easier said than done.

Unsurprisingly, late and unpaid invoices have a substantial impact on small businesses.

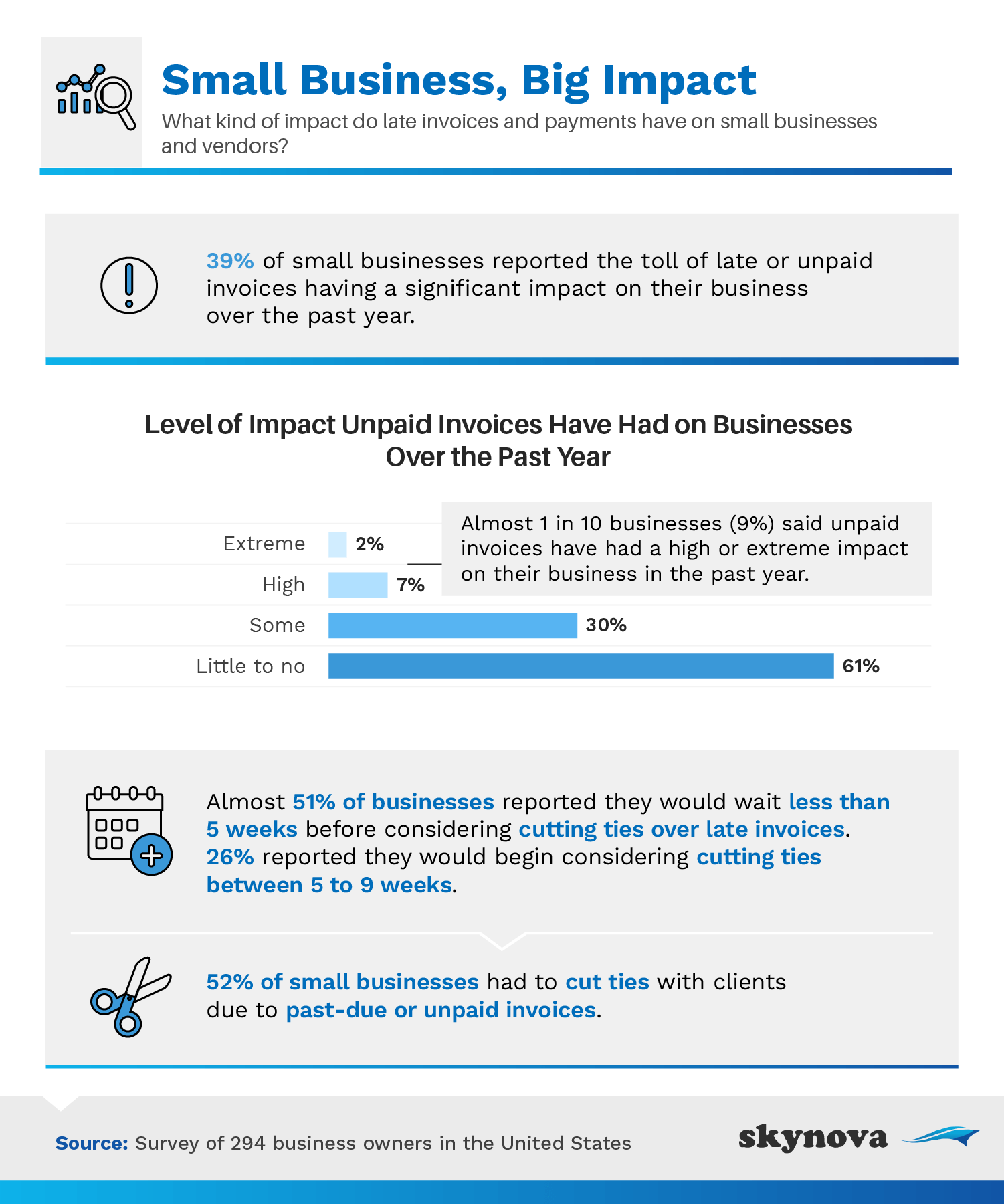

According to the survey, 1 in 10 stated late invoices had a high or extreme impact on their business in the past year. Almost 4 in 10 reported these payment issues having at least some impact on their ability to operate.

Not all business owners could tolerate their client’s late payments: More than 52% of respondents have had to completely cut ties with clients due to late or unpaid invoices. Yet the question remains: Why aren’t more business owners putting their foot down?

This phenomenon has a lot to do with how businesses view themselves. In their eyes, clients – particularly long-term ones – represent stability and money. After all, it takes time and effort to find new prospects, so if one misses a payment or two, business owners sometimes just move on. They hope the client will pay on the next due date – but this mentality will only hurt these businesses’ bottom lines. Find respectful clients and avoid working with bad ones.

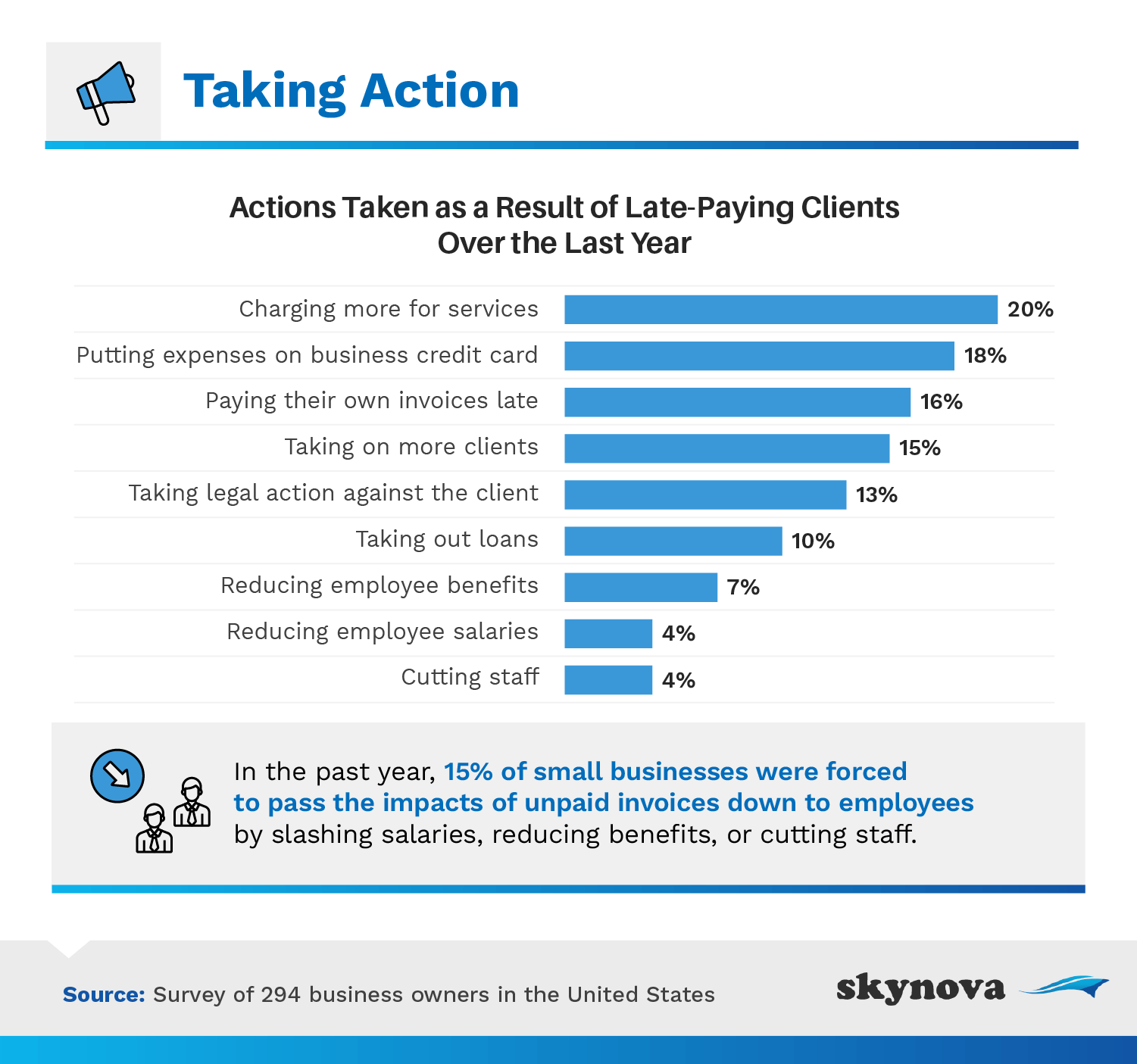

When trying to accommodate for this lost income, business owners varied in their responses. But 15% passed down the costs of these late payments onto their employees through decreased salaries, reduced benefits, and layoffs. Delayed invoices have the potential to not only hurt small businesses but their employees and families as well.

As established previously in our study, small business owners often give clients significant flexibility. Why? Often, owners themselves rely on these invoices to make up their personal income. Moreover, small businesses do not have the same power as larger ones – and shady clients can take advantage of this dynamic.

Since late invoices are clearly an issue, what are business owners doing about it? Do they send gentle reminders? Meet clients in person? Work with a collections agency?

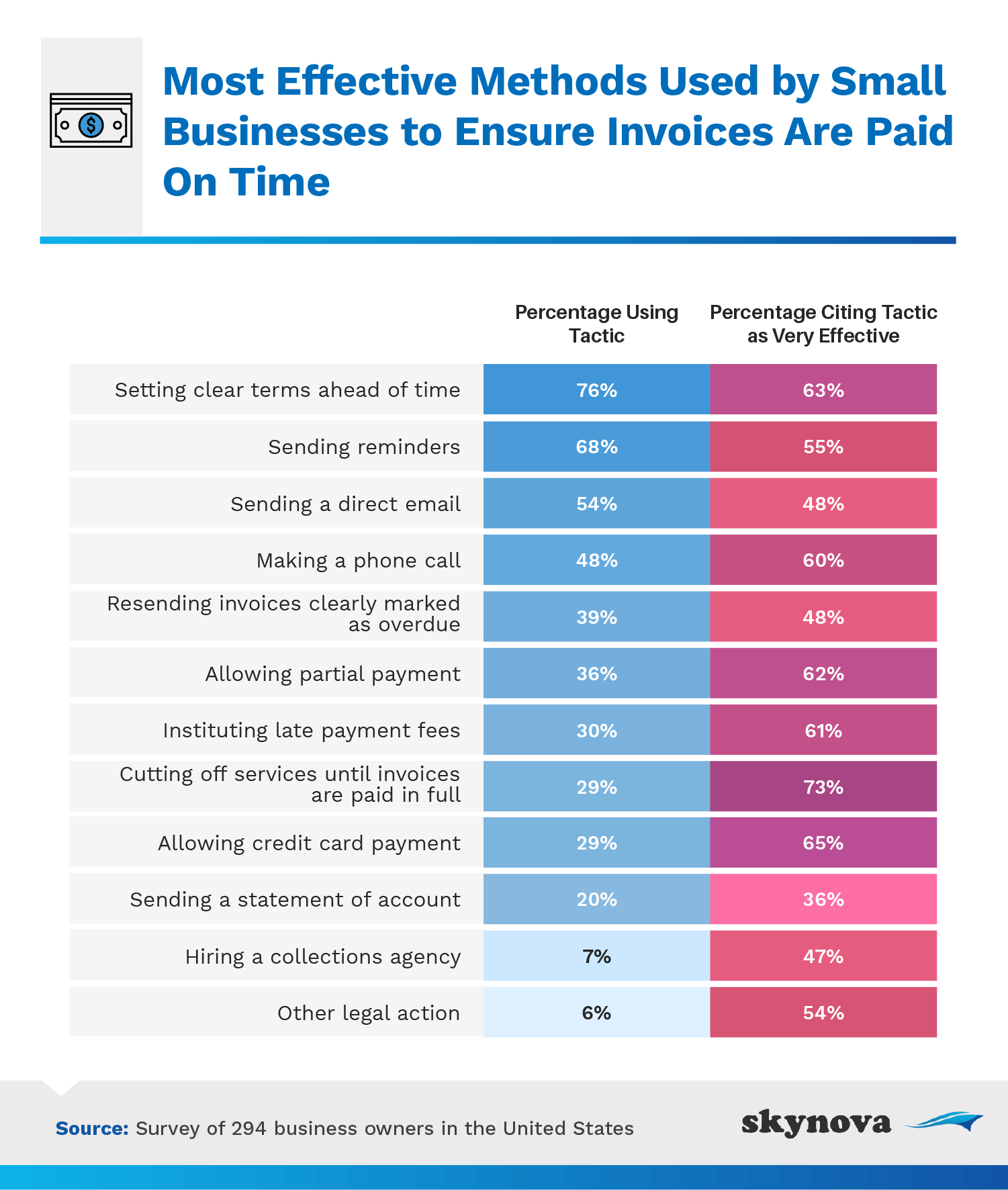

While there are many options business owners can pursue, cutting off services until a client pays their invoice has proven most effective. According to the survey, nearly 3 in 10 respondents have tried this method – with 73% ranking it as very effective. This works especially well if the business has a critical role in their client’s work.

However, many owners attempted other less effective methods. Nearly 8 in 10 set clear terms ahead of time, with 63% reporting this strategy as very effective. In fact, the most popular methods centered on sending reminders, writing emails, and making phone calls – perhaps last-ditch efforts by the owners to get their invoices paid. Importantly, however, these were not the most effective methods.

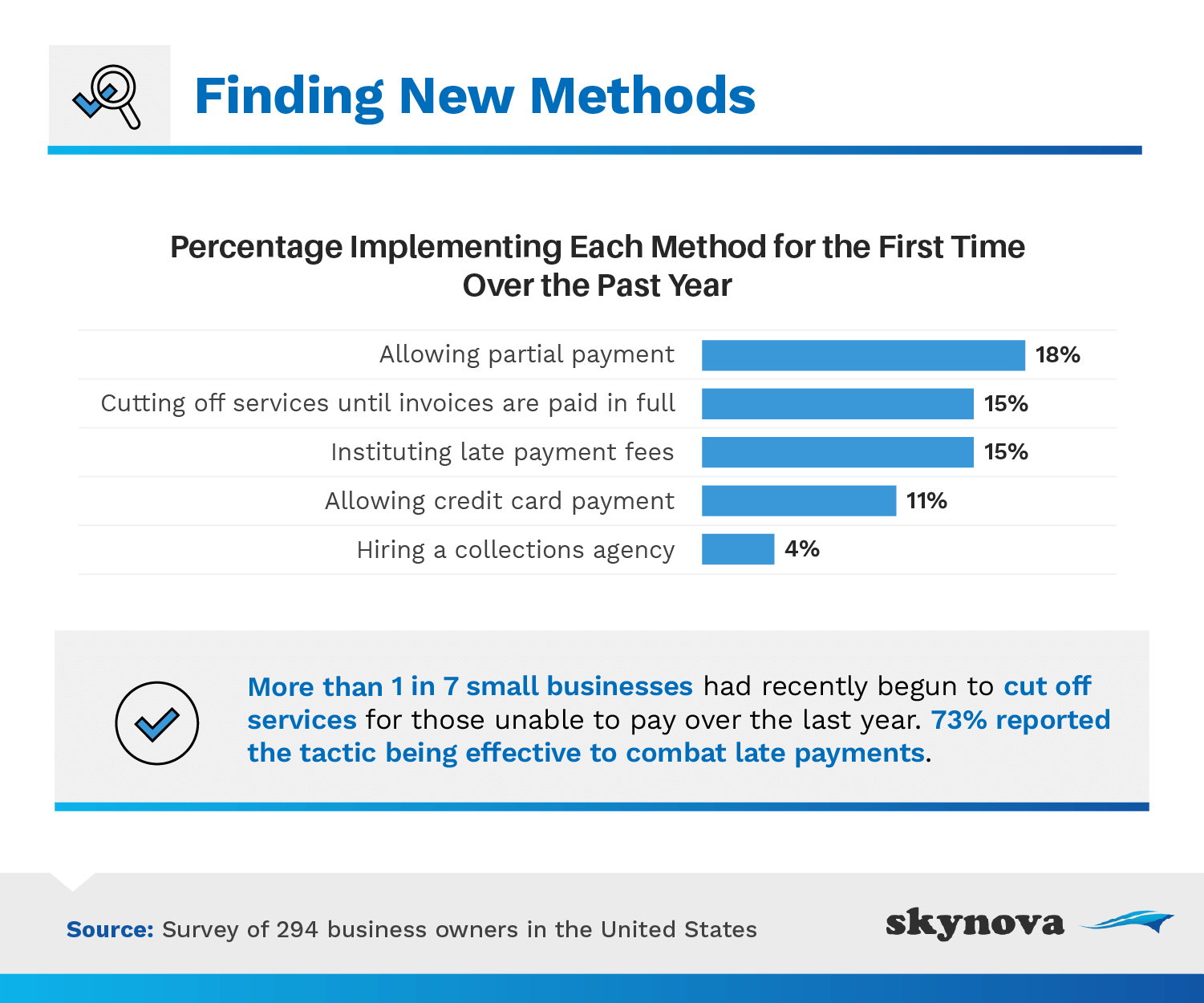

Given the world-shifting events of this past year, we were curious to see how businesses were adjusting their strategies for receiving payments from customers.

The most popular new method business owners turned to was allowing their customers to make a partial payment. Eighteen percent of the businesses we surveyed said this past year was the first time they tried implementing this method.

The method we identified as being the most effective was also one of the most popular new methods for business owners. Out of the 29% of businesses who reported cutting off services until invoices were paid in full, 15% tried this method for the very first time this past year.

Ultimately, the survey reveals business owners have power – and they can use this to get their clients to pay them. After all, clients come to small businesses because they need a product or service. While businesses do need clients to make money, they need to exercise selectivity to avoid these invoice nightmares.

Before entering into an agreement with a client, conduct your due diligence. Do they have notable reviews online? Are they a newer company? Where do they fit into your current set of clients? If they pay late, can your business survive?

While the idea of a new client sounds exciting, there are substantial risks you need to consider. Given that 5 in 10 business owners deal with late invoices, do what you can to avoid these situations – otherwise, it may end up hurting you.

Though every business has their own set of procedures and challenges when it comes to invoicing, there is one constant across the board, businesses want to get paid! Companies from virtually every region – at some point or another – have had to deal with clients who either do not submit payments on time or fail to submit them at all. And while a majority of businesses want to give their clients the benefit of the doubt, the reality is cutting off services until a client pays their invoice has proven a most effective method in obtaining payment and may be the key to ensuring that a company, its bottom line, and the employees who work there are not negatively impacted in the process. As a small-business owner, it is imperative to set clear invoicing parameters and to hold clients accountable, so your company and employees do not suffer.

Skynova provides online invoice templates and software for small businesses in virtually every area of from accounting to time management needs. By aiming to provide insightful perspectives on industry trends and other areas of society, Skynova educates and entertains those who engage with their content. The information gathered is primarily based on surveys, statistics, and research conducted by ourselves put together with the intention of bringing content to life.

We surveyed 294 business owners about their experiences with late invoices and the effects they have on their businesses. Respondents were 53.4% men and 45.9% women. One respondent was nonbinary, and one respondent chose not to disclose their gender. The average age of respondents was 40.3.

The data on the actions businesses have taken as a result of late-paying clients; methods business owners have used to ensure on-time payment and their respective effectiveness; as well as new methods businesses have tried within the past year were all collected using select-all-that-apply questions. Therefore, percentages won’t add to 100.

The data we are presenting rely on self-report. There are many issues with self-reported data. These issues include, but are not limited to, the following: selective memory, telescoping, attribution, and exaggeration.

While the cost of doing business may not be free, sharing this article is. If you feel this content is worth sharing and important for small businesses to read, you are welcome to disperse this study online for any noncommercial purpose. All we ask is that you include a link to this page so our contributors receive proper credit.