|

Accounting is a massive industry, responsible for a tremendous amount of annual revenue and a large number of employed Americans. In this guide, we'll examine several accounting trends from the past few years and provide insight into what the future of accounting could look like.

Below, we've gathered an in-depth analysis of several relevant accounting trends. How much revenue did the accounting industry earn in 2022, and what could it mean for accounting professionals in the future?

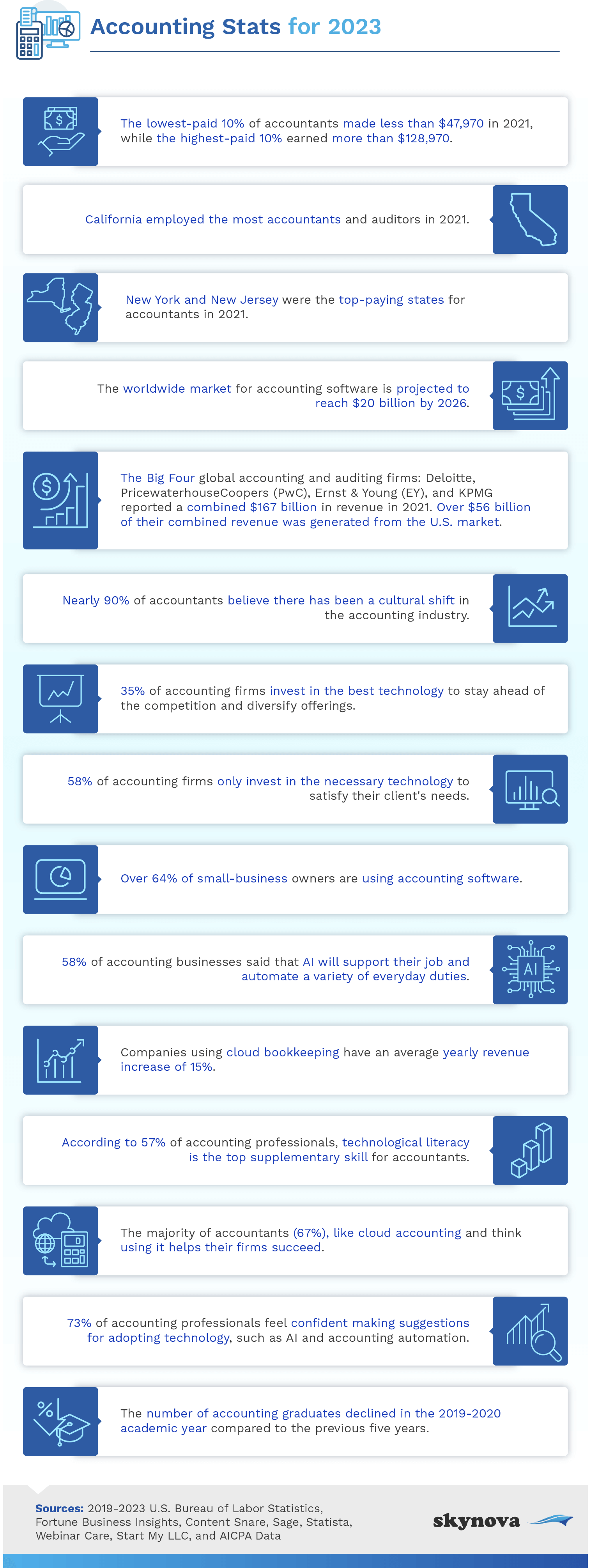

The accounting industry in the U.S. is forecasted to have produced over $141 billion in revenue in 2022.

Revenue from accounting services has risen in each of the past ten years, with the exception of 2020. Even though this was the first year of the pandemic, revenue was only down by $1 billion (or less than one percent).

It's estimated that U.S. accounting firms brought in a combined $141 billion in 2022, more money than any year prior. The Big four — Deloitte, Ernst & Young, PricewaterhouseCoopers, and KPMG — are the leading firms in the U.S., earning billions in revenue annually and employing over 1 million people worldwide.

The job outlook for accounting is expected to increase by 6% by 2031, roughly the same growth rate as the overall job market.

As of 2021, over 1.4 million Americans were employed in the accounting profession. Many jobs in accounting and auditing will open up before the year 2031 as workers retire or leave to pursue jobs in other career fields. The Bureau of Labor Statistics (BLS) estimated about 136,000 job openings each year over the next ten years. The BLS also projected that over 80,000 new accountants and CPAs will be employed throughout the nation by 2031.

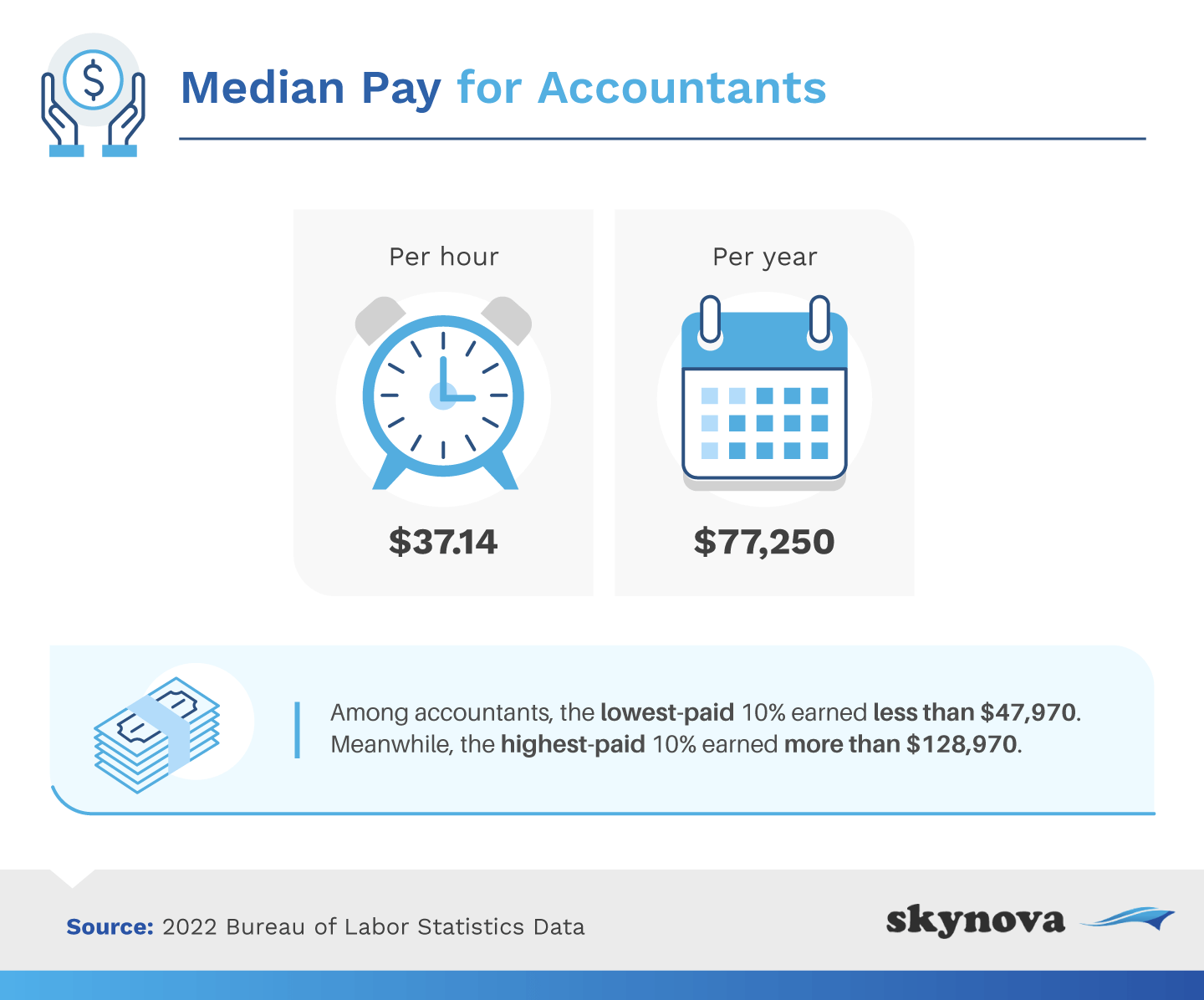

The median hourly wage for accountants was $37.14 in 2021.

According to the BLS, the average American accountant makes $40.37/hour. The median hourly wage (earned by 50% of accountants in 2021) was $37.14/hour. Accountants who made over $62/hour ranked in the 90th percentile, while workers making less than $23/hour landed in the bottom 10% of earners.

California employs more accountants than any other state. Over 150,000 Californians work in accounting, making an average hourly wage of $44.63. In second place, New York also employs a significant number of accountants but has a higher mean hourly wage of $50.86. Other top-paying states include New Jersey ($47.09) and Massachusetts ($44.38). The best pay was found in Washington, D.C., where accountants earn $53/hour on average.

Depending on the location and job type, accountants salaries vary; the median annual wage for an accountant was $77,250 in 2021.

The median annual wage in 2021 was $77,250 in the U.S., but accountants' salaries vary depending on location, industry, and job title. For example, accountants who provide tax preparation and payroll services made an average annual salary of $86,650. Managers and senior-level accountants typically earn more, as do those in crude oil and computer manufacturing industries. We'll dive further into top-paying industries and roles like these later in this guide.

The median annual wage for an accountant is significantly higher than the national median annual wage for all occupations.

The average accountant makes nearly 70% more than the average worker in the U.S. The median annual salary for all occupations is just under $46,000, and even accountants in the bottom tenth percentile made an average annual salary of almost $48,000. But what these figures don't take into account is the number of hours an accountant works throughout the year. Many certified public accountants will work longer hours during tax season or when preparing quarterly audits.

Here are some more statistics to help you understand the current state of the accounting industry and where it's projected to go in the future.

Cloud-based accounting software is similar to traditional accounting software in terms of the functions that it can perform. The main difference is that real-time data is stored in the cloud rather than on a remote server. This method allows everyone in the company to easily perform cloud computing tasks on their devices without having to establish a connection with the server.

Accountants can also take advantage of accounting automation, allowing them to automate simple, repetitive tasks. This also improves the accuracy of the data produced while streamlining workflows, Usually, this happens through robotic process automation (RPA): an advanced form of automation that records a user's computer tasks.

Next, we'll look at accountants' wages. How do they vary between different job titles and specific industries?

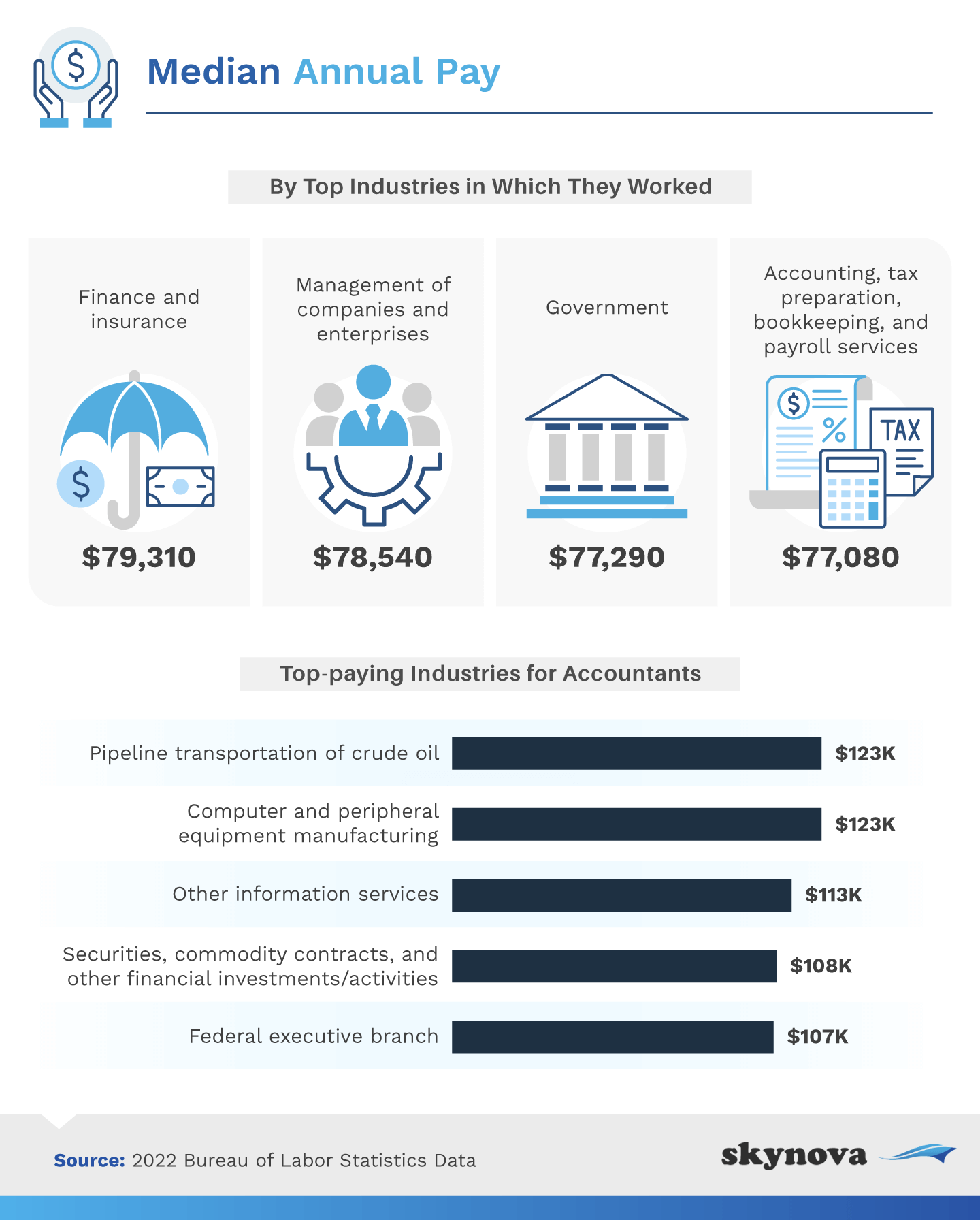

While the average accountant makes around $37 per hour ($77,000 per year), pay varies widely based on their industry or sector. The BLS determined that the top-paying industries for accountants in the U.S. were those facilitating pipeline transportation of crude oil and manufacturing computers and related equipment. On average, accounting professionals in these sectors bring in over $120,000 per year.

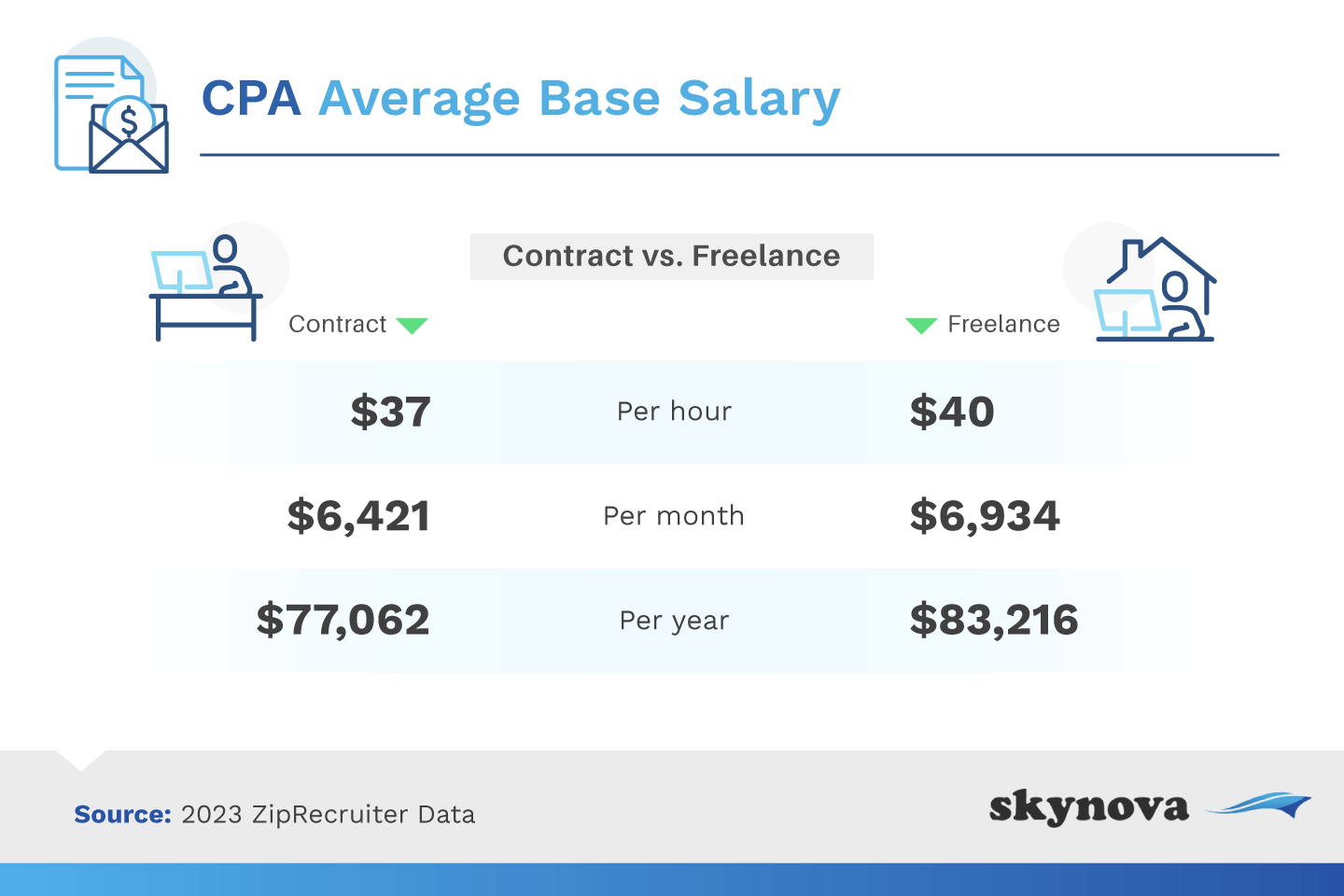

Large companies with more than $250 million in annual revenue typically pay their accountants a higher wage than medium and small businesses. According to the CPA Accounting Institute for Success, entry-level accountants for large businesses make between $50,000 to $60,000 per year, while senior-level or managing accountants can earn closer to $100,000 or more. CPAs also frequently command higher salaries than non-certified accountants, with freelancing CPAs earning more than contractors.

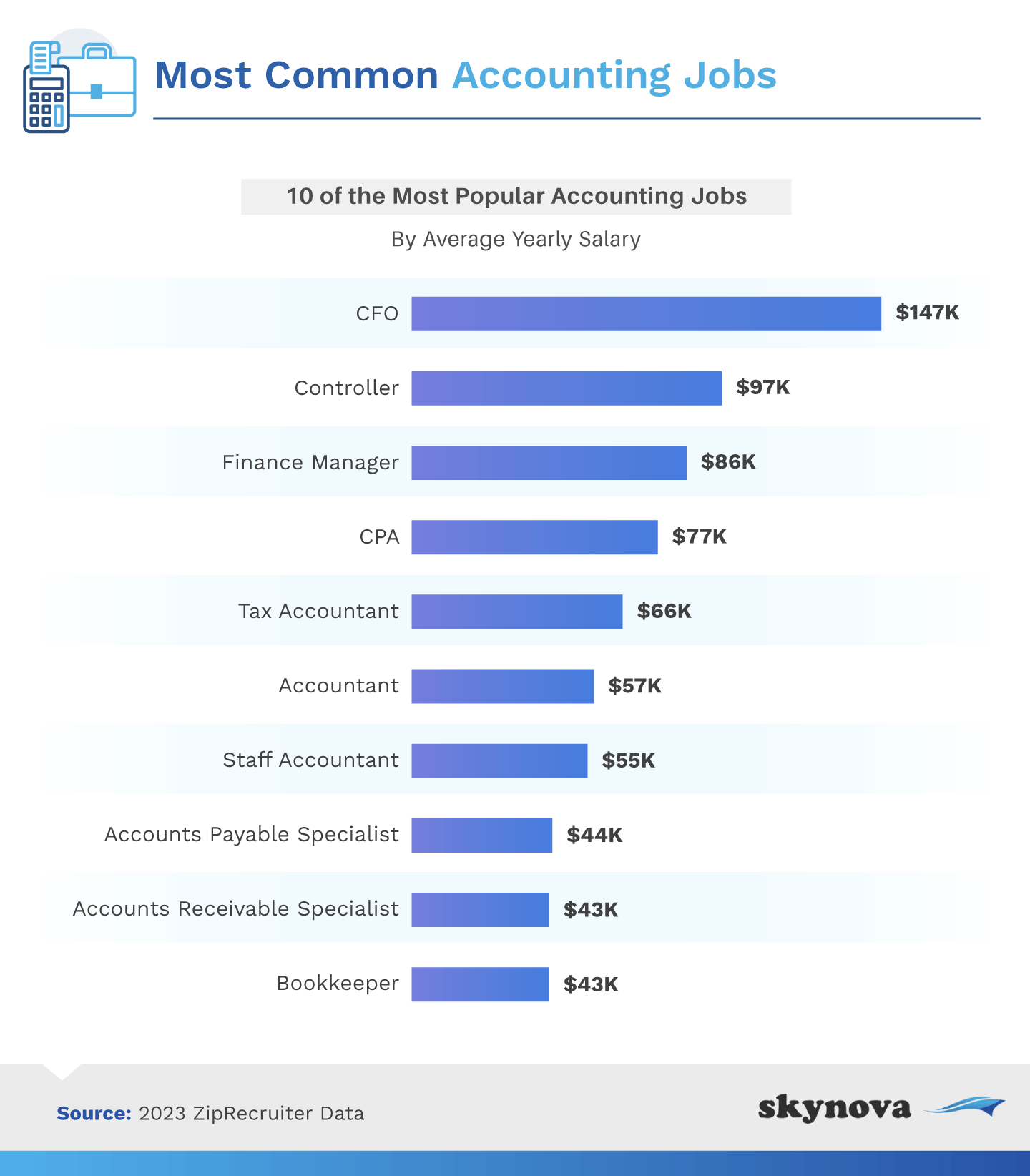

The field of accounting is broad and diverse, so accountants can specialize in a number of different roles and industries. ZipRecruiter recently collected yearly salary data for the 10 most popular accounting jobs in the U.S., revealing that accountants serving as Chief Financial Officers (CFOs) make close to $150,000 per year, on average.

Controllers and finance managers also hold lucrative positions, earning around $90,000 annually. Meanwhile, bookkeepers and accounts receivable specialists are on the lower end of the salary range, making an average of $43,000 annually.

Accountants are typically satisfied with their job and work environment. Despite above-average stress levels, they enjoy some flexibility and have plenty of opportunities to move up in their careers.

Beyond salary ranges, what does the future of the accounting profession look like in terms of job availability? To see how prospective and current accountants might fare in the job market, we've examined job growth projections and which accounting functions companies are outsourcing.

With over 136,000 jobs expected to open up in accounting over the next 10 years, aspiring accountants will have plenty of options to choose from as they pursue a career in the field.

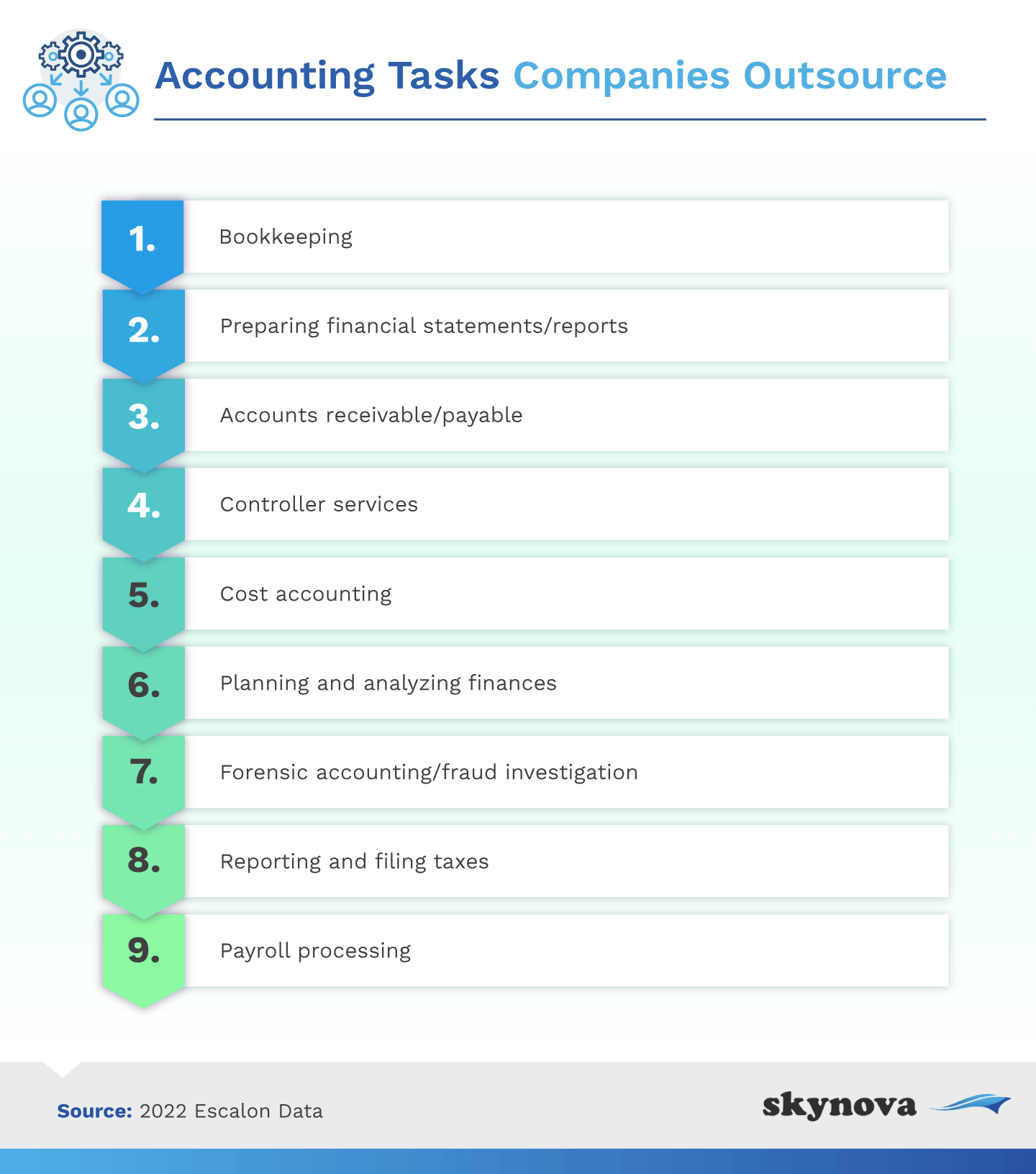

Companies commonly outsource accounting tasks such as bookkeeping and preparing financial reports instead of completing them in-house. Some rely on software systems and platforms to handle these tasks, while others assign them to independent or self-employed accountants on a contract basis.

Like most industries, the accounting industry is likely to face some challenges over the next several years. However, it holds a strong position overall thanks to anticipated job growth, higher-than-average salaries, and the job satisfaction most accountants enjoy.

As technology improves, software continues to have a greater impact in the field of professional accounting. Let's explore how these tools are changing the way businesses track their income and expenses.

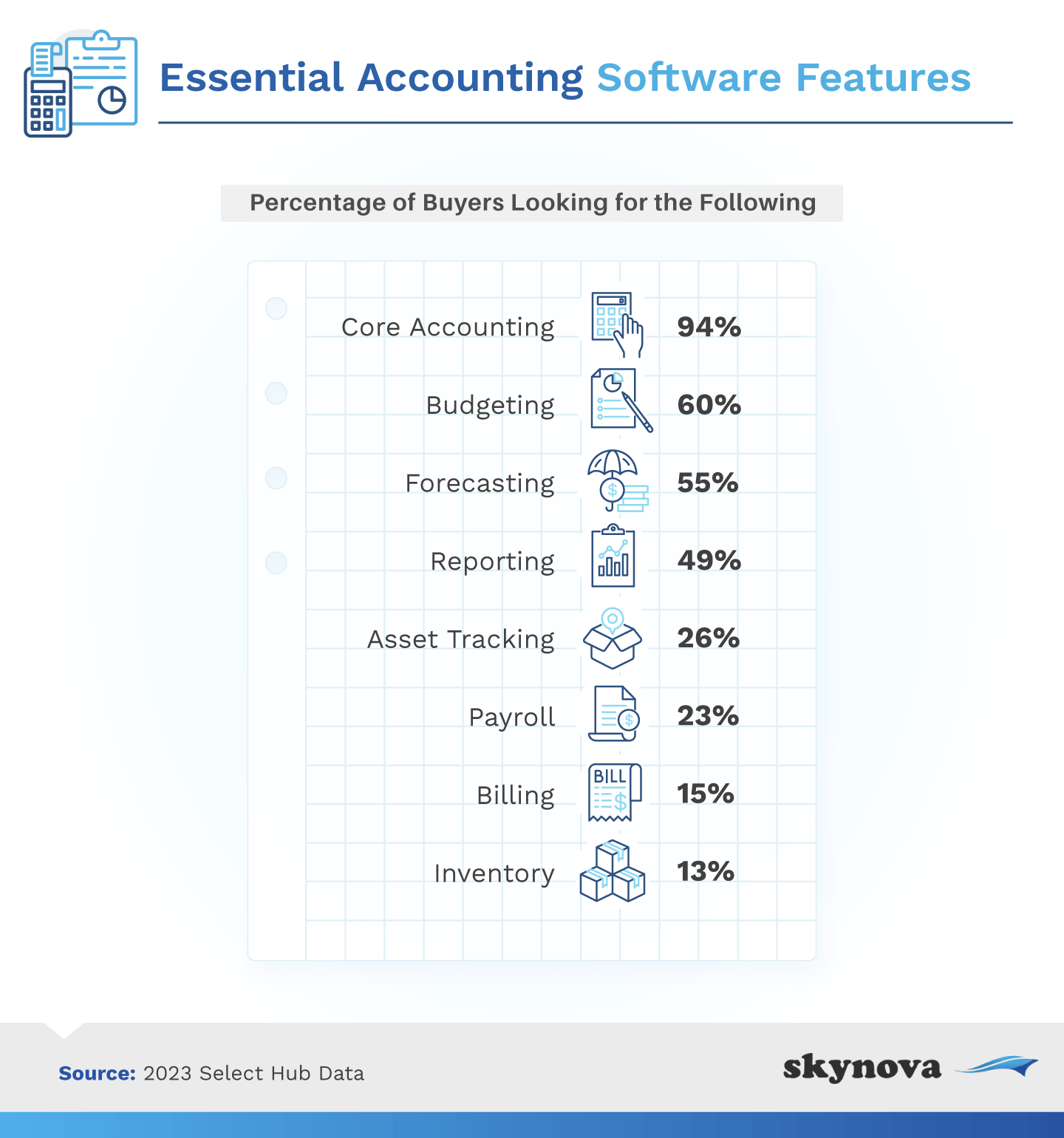

The following chart identifies the key features and functions of accounting software.

As AI continues to develop and rise in popularity, we'll likely see frequent groundbreaking technological advancements in accounting software.

Whether large or small, every business could use increased accuracy and productivity in managing their money. So, accounting software can be helpful for businesses of any size.

Small businesses often have a unique approach to accounting and bookkeeping. Let's look at the accounting trends specific to small businesses.

Most small businesses outsource their tax preparation, and some outsource payroll, auditing, tax planning, personal finances, and bookkeeping.

Small businesses handle their finances in different ways, but many are outsourcing tasks to accountants. Small-business owners most often rely on CPAs to prepare their business taxes (71%), and half of them outsource their payroll needs (50%). Nearly the same portion outsource auditing to external accounting professionals (48%), and some also outsource tax planning (30%), managing personal finances (16%), and bookkeeping (14%).

About 42% of small-business owners expect their accountants to offer business advice.

Many small-business owners who need help with their finances hire an accountant to handle things. But over 40% also expect their accountants to offer business advice from their accountants.

Since this is not always an accountant's area of expertise, this expectation could be why some business owners are left feeling dissatisfied. Over a quarter of small-business owners think their accountant doesn't provide enough advice (27%), and another 23% believe their accountant doesn't educate them properly. Specifying whether or not an accountant offers advisory services could be a way to increase client satisfaction.

90% of small businesses are turning to technology this year to help them have a better tax season.

Filing taxes can be complicated, especially for small businesses without dedicated accountants on staff. That's likely why 90% of small businesses plan to use technology this year to optimize the process of filing their tax returns.

Small-business accounting will see a significant increase in automation in 2023.

Automated accounting systems are the future of accounting. This accounting technology could replace 94% of accountants and auditors, but most experts believe that some level of human judgment and discernment will always be necessary.

Next, we'll examine the most common issues professionals in the accounting sector can expect to face in the near future.

51% of firms said their biggest challenge is keeping up with regulatory change.

As tax laws and regulations change, it can be a challenge for accountants to stay up to date with current policies. Over half of the accounting firms that participated in a 2022 Accounting Today survey expressed that they struggle with this to some degree.

Nationwide, many are concerned about the direction of the economy. It's easy to see why, after a year when interest rates approached 7% and inflation was higher than it had been in 40 years. Even while managing their own fears about the economy, accountants must also prepare to field questions from clients about these issues.

Reporting policies become more complex every year. The Financial Accounting Standards Board (FASB) takes steps to simplify things, but it's not always easy to keep up with the changes and implement new standards as they emerge.

Every industry has questions about the future of the labor market, and the same is true for finance professionals. Many firms and businesses experience difficulty finding qualified individuals who understand current tax laws and have the right skills.

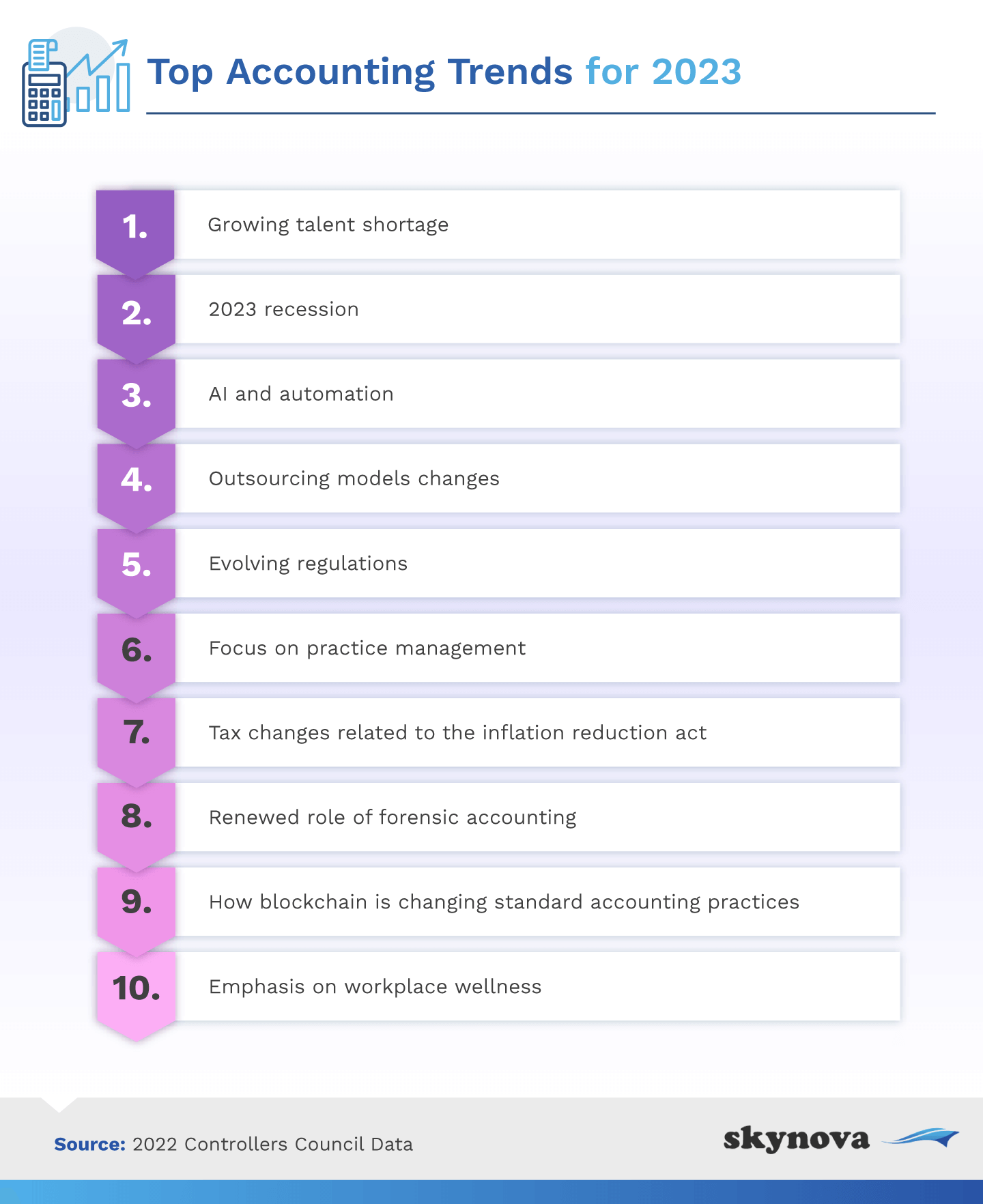

Now that we've examined past accounting trends, we can begin to see where the industry might be headed in the next year. Let's go over some potential upcoming trends and discuss how they might impact the accounting industry overall.

As automation increases and the performance of cloud-based systems improves, existing accounting firms may have to reexamine their agreements with their existing clients. There's a chance that 60% of these contracts won't be renewed before 2025.

The world of professional accounting continues to grow, allowing big data to provide new opportunities for financial data analysis and insight. As accounting statistics become available from a wider range of sources, accountants can better identify various trends and patterns that will inform business decisions and improve performance.

Many companies are already incorporating digital tools into their accounting processes. While these systems will improve with time, the need for human decision-making is unlikely to go away, which is good news for accounting professionals. They may need to do some research to discern how to best incorporate these new technologies into their current practices.

Better data analytics will improve accountants' ability to make stronger, more well-informed decisions. They can increase the accuracy of financial forecasting and as well as increase data security. There's also a chance that more precise data science could also help to automate and streamline current accounting practices and systems.

Remote work allows accountants greater cost savings and flexibility. It can also benefit businesses, allowing them to access a larger talent pool when looking to hire accountants on a contract or freelance basis.

As the world adapts to new technologies and returns to normal after the global pandemic, it remains to be seen how exactly accounting trends might shift. But for now, the future looks promising. Accountants who want to know where their industry is headed can rest assured that it's expected to grow over the next 10 years. It's currently a lucrative industry to work in, and since business owners will always have questions about how to best keep their books or process payroll, the need for these services is sure to continue — especially true for freelance bookkeepers.

Publishers and readers are welcome to share these findings for non-commercial purposes only. However, they must provide a link referring back to this page.